Net Asset Value Of A Company What is Net Asset Value Net asset value NAV is defined as the value of a fund s assets minus the value of its liabilities The term net asset value is commonly used in relation to mutual funds and is used to determine the value of the assets held According to the SEC mutual funds and Unit Investment Trusts UITs are required to calculate their NAV at least once every business day

NAV Net Asset Value refers to the total equity of a business While NAV can be applied to any entity it is mostly used to reference investment funds Net asset value calculator is used as part of fund accounting also referred to as securities accounting investment accounting and portfolio accounting For a business the difference between its total assets and liabilities results in its net asset or net worth

Net Asset Value Of A Company

Net Asset Value Of A Company

https://www.wikihow.com/images/thumb/3/32/1394384-4.jpg/aid1394384-v4-728px-1394384-4.jpg

Net Asset Value

https://1.bp.blogspot.com/-qFcglcIQEm0/WySPUjT483I/AAAAAAABLnY/tVHjrxMEYUoacRo5b5hEu25OdbCpIj9TACK4BGAYYCw/s1600/picture-741370.jpg

Net Asset Value NAV And Its Importance Finvestfox

https://finvestfox.com/wp-content/uploads/2020/10/Net-Asset-Value.jpg

Net asset value NAV is the value of an entity s assets minus the value of its liabilities often in relation to open end mutual funds hedge funds and venture capital funds The net asset value formula is calculated by adding up what a fund owns and subtracting what it owes For example if a fund holds investments valued at 100 million and has liabilities of 10

Net Asset Value is the net value of a company s assets minus liabilities It helps assess the value of companies and is often close to the book value NAV is calculated by dividing Value of Assets Value of Liabilities by Total Shares Outstanding It is used in mutual funds UITs real estate oil and reserve companies Net Asset Value commonly referred to as NAV is a crucial term in the financial market particularly in the realm of mutual funds exchange traded funds ETFs and closed end funds It

More picture related to Net Asset Value Of A Company

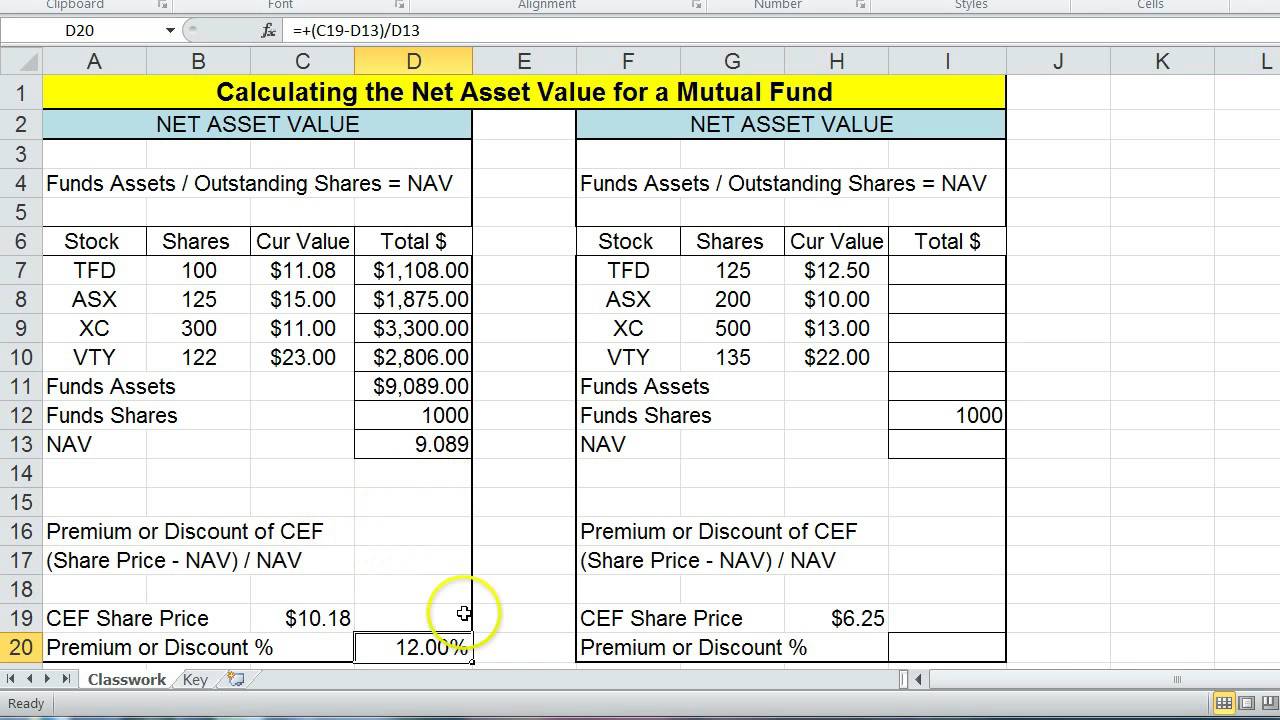

Net Asset Value Of A Mutual Fund YouTube

https://i.ytimg.com/vi/B4aOj6EUD3E/maxresdefault.jpg

Intrinsic Value Of A Company Net Asset Value Market Capitalisation

https://static.wixstatic.com/media/606bcb_a1633d3886c04ed8a0df0dd3a42cecf9~mv2.png/v1/fill/w_980,h_693,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/606bcb_a1633d3886c04ed8a0df0dd3a42cecf9~mv2.png

Net Asset Value NAV What Is The Definition And How To Calculate In

https://paisahealth.in/wp-content/uploads/2020/01/Investment-1.png

Asset Based Approach An asset based approach is a type of business valuation that focuses on a company s net asset value NAV or the fair market value of its total assets minus its total What is net asset value Net Asset Value NAV is the complete value of an investment after expensing its liabilities from its assets Morningstar uses NAV to reference the per share price of a fund

Net asset value or NAV represents the value of an investment fund NAV most simply is calculated by adding up what a fund owns the assets and subtracting what it owes the liabilities NAV is typically used to represent the value of the fund per share however so the total above is usually divided by the number of outstanding shares A Net Asset Value is one of the organization s monetary stability indicators It s calculated as the total value of the company s assets minus the total value of its liabilities Net Asset Value Value of assets Value of liabilities If it s represented on a per share basis the difference is then divided by the number of shares

In Open ended Schemes You Can Get Your Money Back At Any Point In Time

https://i.pinimg.com/originals/8a/2f/0f/8a2f0f5a31061d511e08049d44f00d48.jpg

Unit Trust Calculation Formula A Titration Calculation Is A Simple

https://i.ytimg.com/vi/apT3XPYFlAs/maxresdefault.jpg

Net Asset Value Of A Company - The net asset value formula is calculated by adding up what a fund owns and subtracting what it owes For example if a fund holds investments valued at 100 million and has liabilities of 10