Md State Payroll POSC Payroll Online Service Center This application provides employees with the following online payroll related services View of current pay stubs View of prior year end pay stubs View print of up to 3 years of W 2s Update your address information

Welcome to the Central Payroll Bureau CPB site Established in 1953 we handle and provide payment of salaries and wages for all state employees whose salaries are paid from funds appropriated by the General Assembly We serve over 100 000 state workers every two weeks CPB strives to provide quality payroll services in the issuance of State Payroll Services Employees Employees Important News effective July 1 2023 Fiscal Year 2024 Thank You Federal W 4 instructions Federal Withholding Employee Address Update MD MW507 2024 MD MW507 Instructions Withholding Exemption Certificate Employee Address Update MD MW507M 2024 Exemption from Maryland Withholding Tax for

Md State Payroll

Md State Payroll

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Publication-15-T-1.png

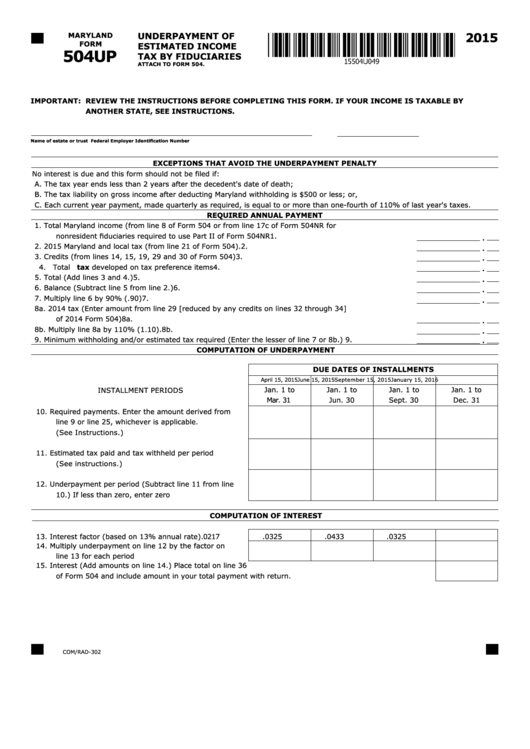

Income Tax Forms 2015 Printable Trinidad Form Mo 8453 Individual

https://data.formsbank.com/pdf_docs_html/312/3126/312607/page_1_thumb_big.png

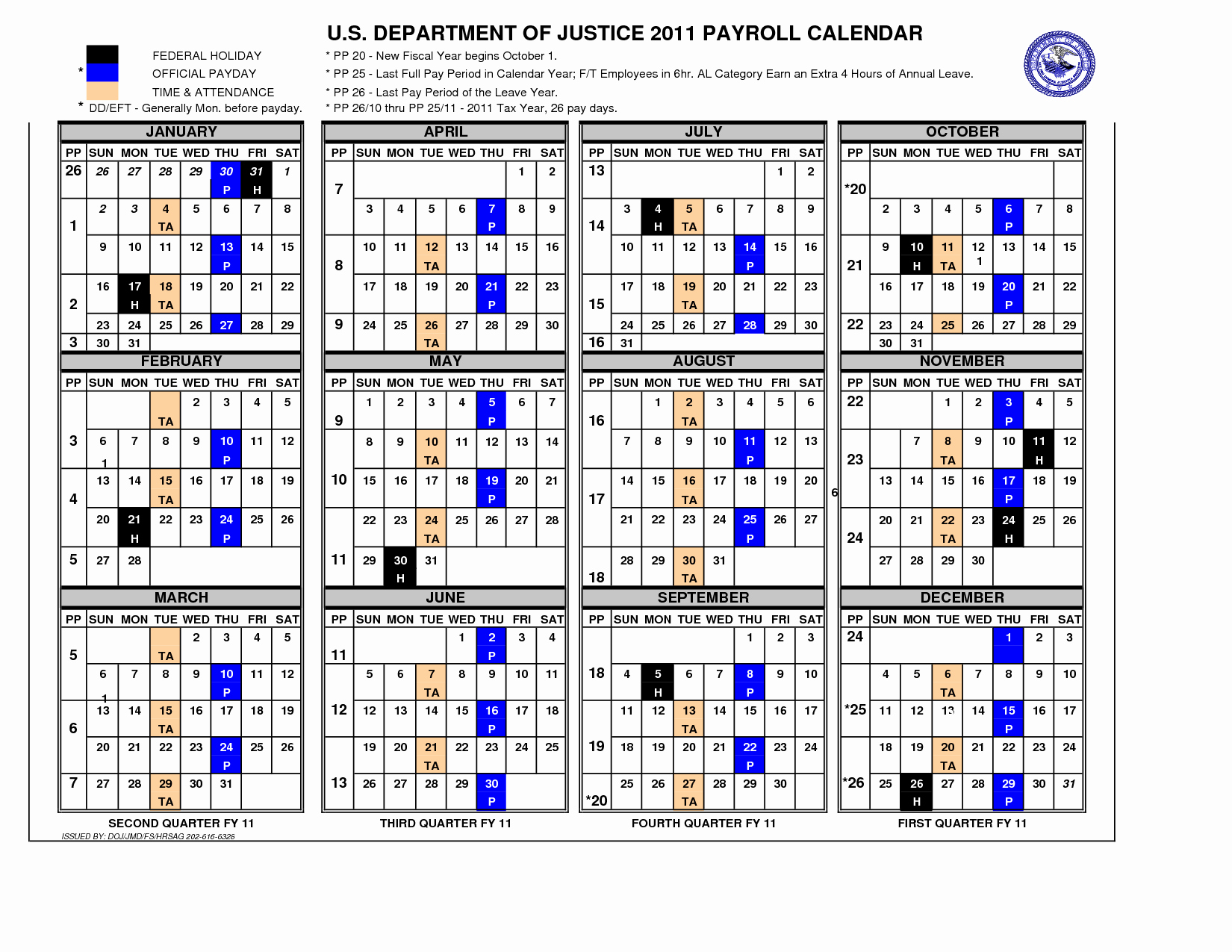

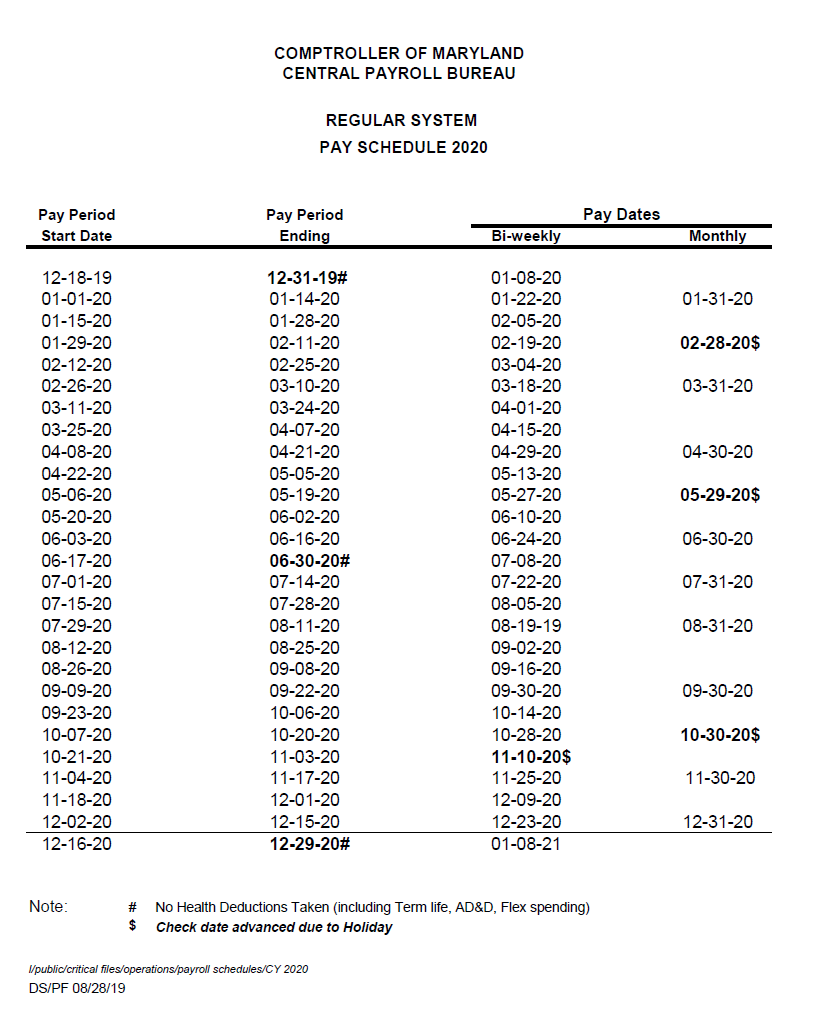

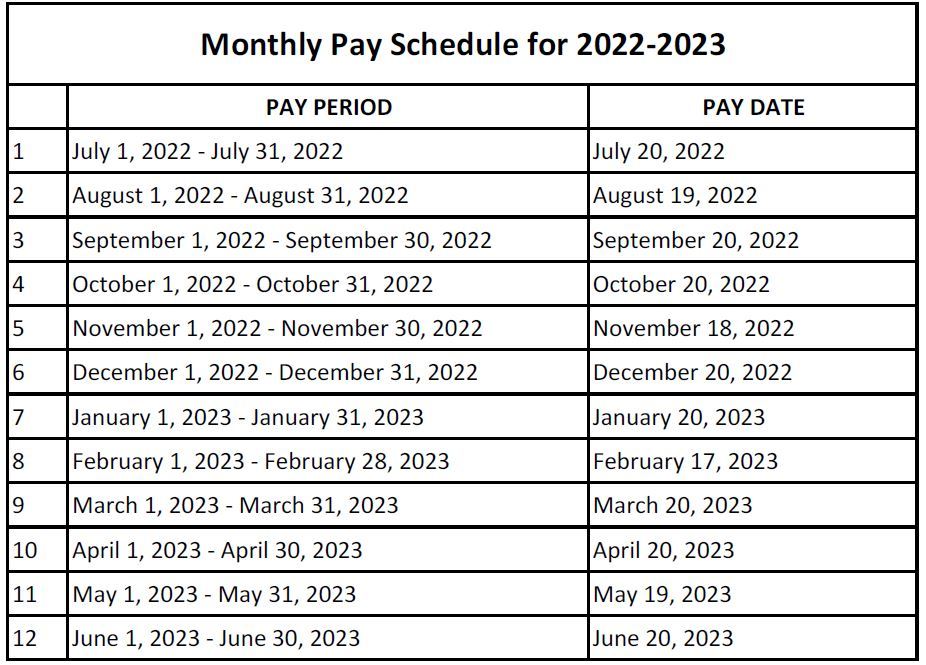

Pay Period Cycle Pay Period Calendars

https://calendarinspiration.com/wp-content/uploads/2021/05/federal-employee-pay-period-calendar-2020-free-printable.png

Payroll Retirement State Holidays Statewide Phone Directory Online Services Payroll Online Service Center POSC The State of Maryland pledges to provide constituents businesses customers and stakeholders with friendly and courteous timely and responsive accurate and consistent accessible and convenient and truthful and State Payroll Services Payroll Services for State Agencies Important News effective July 1 2023 Fiscal Year 2024 Thank You Dhiren Shah Director Links for State Payroll Services Employees Payroll Officers Salary Scales Online Services Vendor Deductions State Agency Deductions Internal Contact List FAQ Forms

The State of Maryland pledges to provide constituents businesses customers and stakeholders with friendly and courteous timely and responsive accurate and consistent accessible and convenient and truthful and transparent services Employees that do not submit a withholding certificate are defaulted to the highest rate of local tax which for the year 2021 will be 3 20 For most employees who are not residents of Maryland the Nonresident rate 7 0 is used which includes no local tax but does include the Special 2 25 Nonresident rate Employees who meet this income

More picture related to Md State Payroll

State Of Maryland Payroll Calendar 2021 Payroll Calendar

https://payrollcalendar.net/wp-content/uploads/2020/09/state-of-maryland-payroll-2020.png

Monthly Pay Schedule

https://www.bgsu.edu/content/dam/BGSU/payroll/Images/STRS-2022-2023-monthly-pay-calendar.jpg

Former Maryland State Fair President General Mgr Howard Max Mosner

https://i.pinimg.com/originals/c2/af/2e/c2af2e97c0d24ec59788b5294971988f.jpg

Therefore payroll processing schedules will be advance for the Pay Period Ending June 27 2023 ETR s will be updated and available for posting on Wednesday June 21 2023 after 9 00 a m All ETR s must be approved no later than 3 00 p m on Wednesday June 28 2023 If you have further questions you may call any of the payroll operations As a State Employee you have the ability to view your own information in Workday The SPS provides Human Resources Time and Payroll and Employee Benefits services to State employees Depending on your agency institution or type of employment you will use the SPS for certain services As you explore Workday you should familiarize

This process will help you generate a Logon ID and Password that will be used each subsequent time you access the POSC Online view and print of 12 rolling months of most recent pay stub information Online view and print of year end Prior Year pay stub information Ability to eliminate the Central Payroll Bureau printed copy of your pay STATE OF MARYLAND REGULAR PAYROLL SCHEDULE FISCAL YEAR 2021 PAY DATE Author Data Processing Division Created Date 6 2 2020 12 53 56 PM

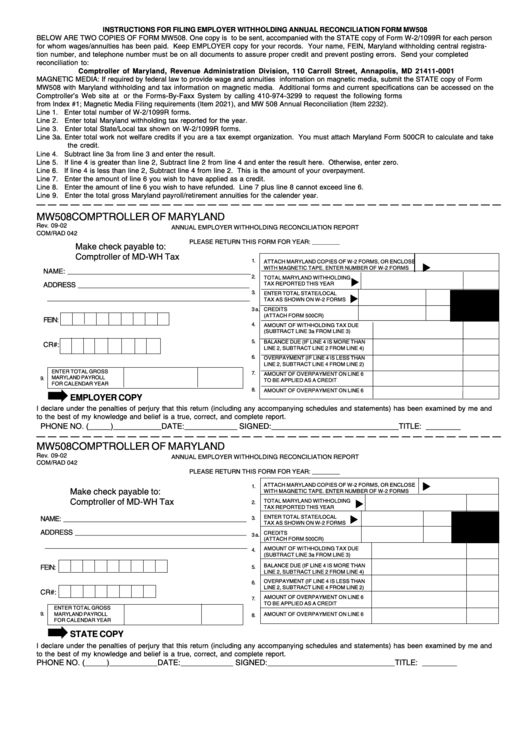

Maryland Withholding Form 2021 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2021/07/form-mw508-annual-employer-withholding-reconciliation-2.png

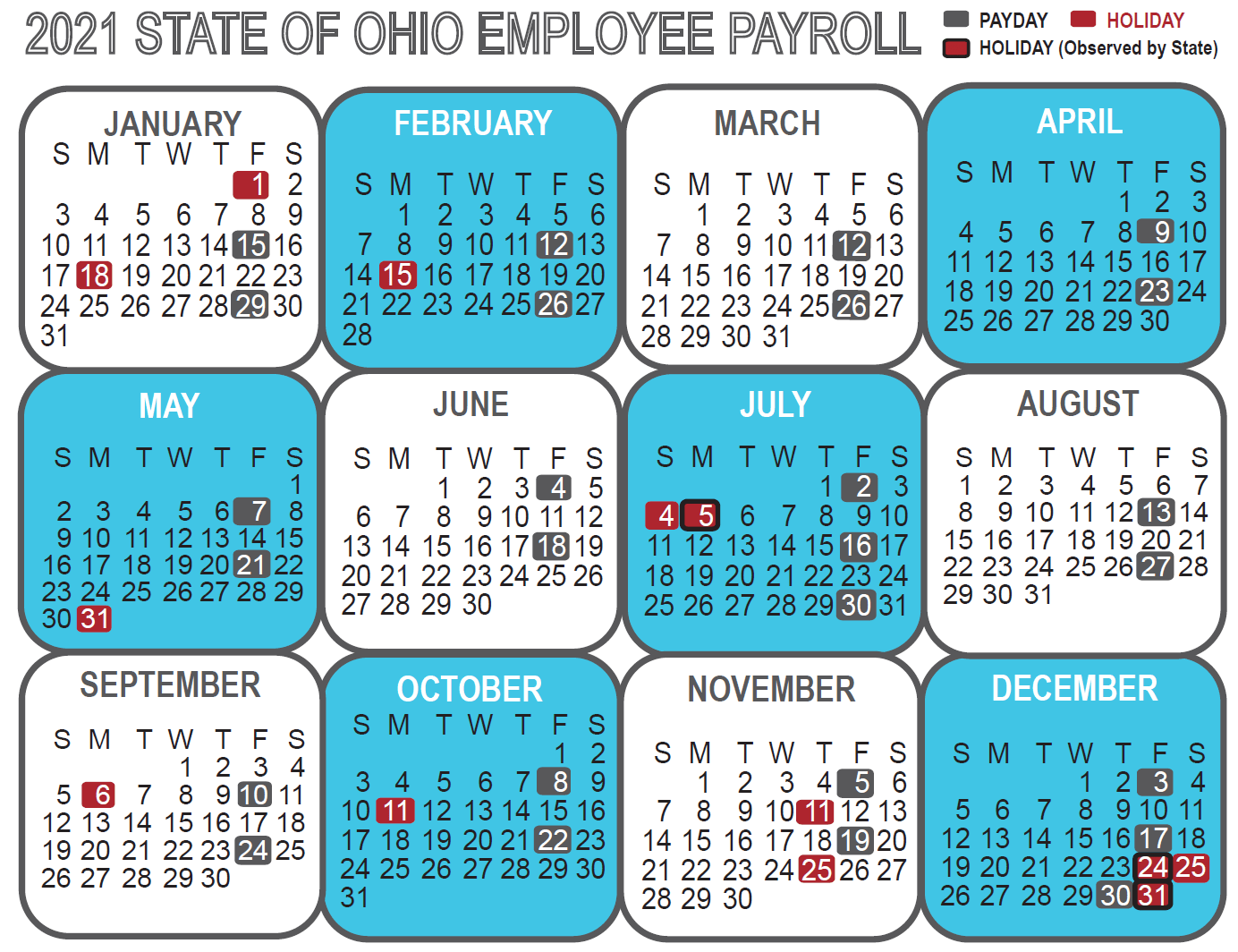

Ohio State Payroll Calendar 2022 2022 Payroll Calendar

https://payrollcalendar.net/wp-content/uploads/2020/08/Ohio-State-Payroll-Calendar-2021.png

Md State Payroll - Employees that do not submit a withholding certificate are defaulted to the highest rate of local tax which for the year 2021 will be 3 20 For most employees who are not residents of Maryland the Nonresident rate 7 0 is used which includes no local tax but does include the Special 2 25 Nonresident rate Employees who meet this income