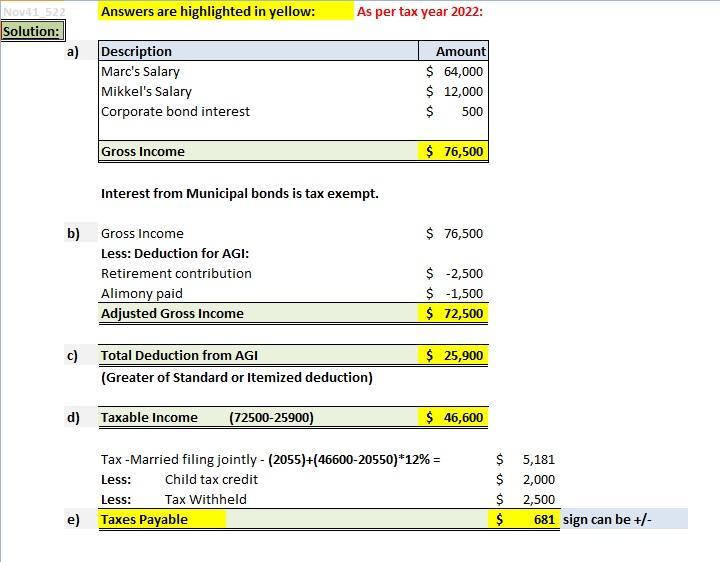

Marc And Mikkel Are Married And Earned Salaries This Year Of Marc and Mikkel earned salaries this year of 64 000 and 12 000 respectively In addition to their salaries they received interest of 350 from municipal bonds and 500 from corporate bonds Marc contributed 2 500 to a traditional individual retirement account and Marc paid alimony to a prior

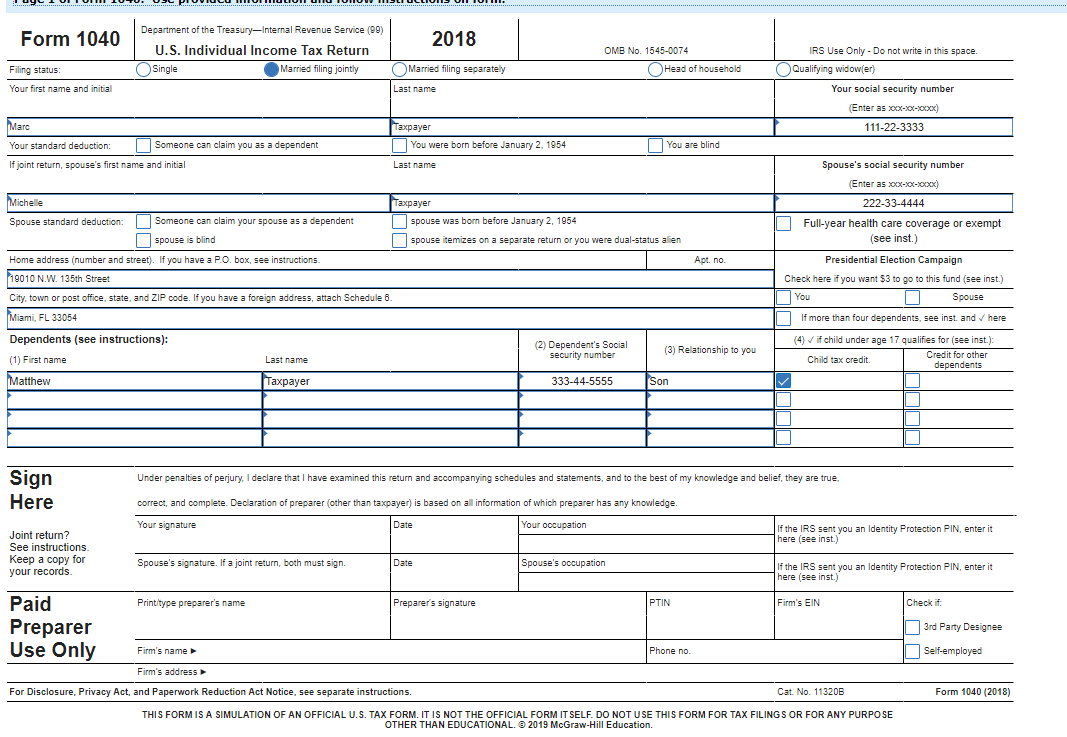

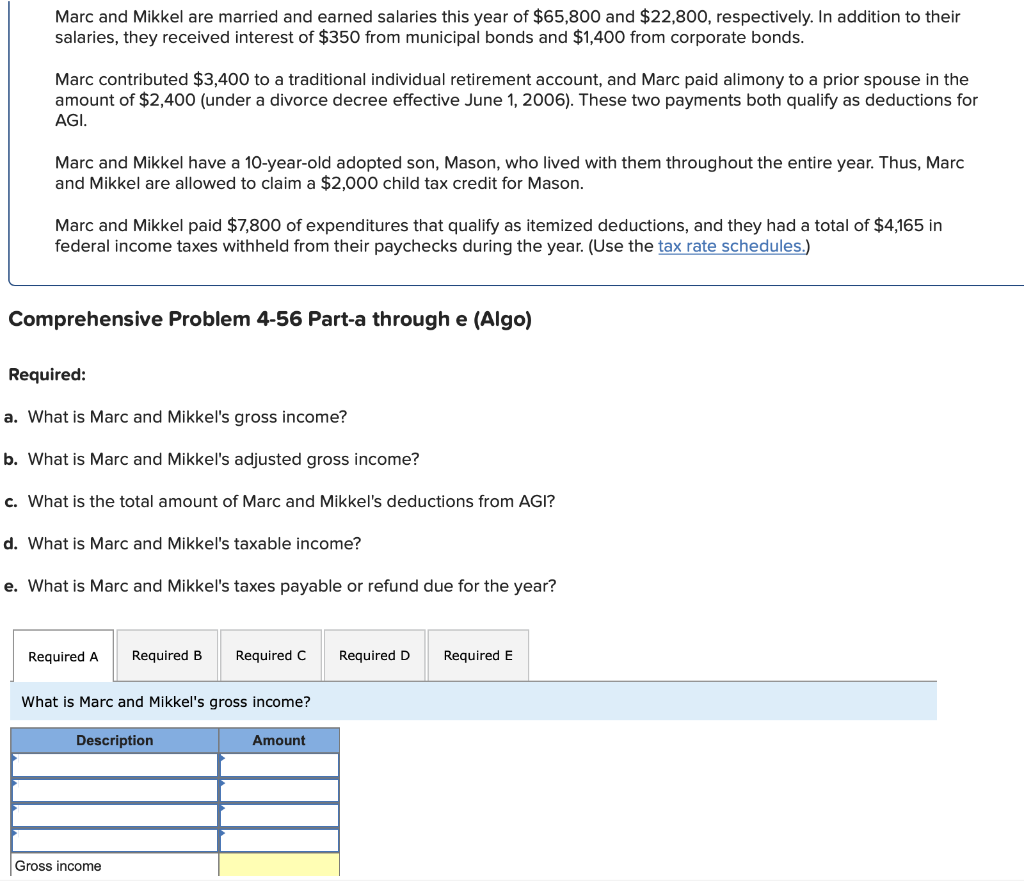

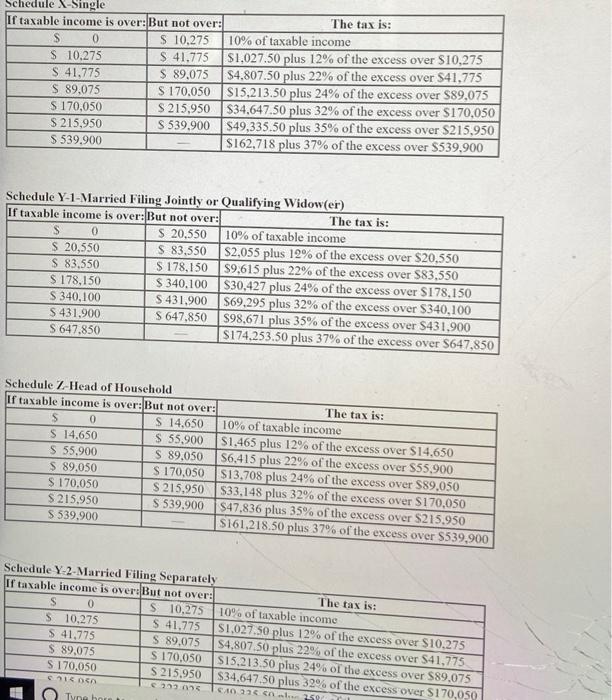

1 Gross Income 106 000 2 For AGI deductions 0 3 Adjusted Gross Income 106 000 4 Standard deduction 18 350 5 Itemized deductions 23 000 6 Greater of standard deduction or itemized deductions 23 000 7 Taxable Income 83 000 8 Income Tax Liability 12 698 9 Child Tax Credit 2 000 10 Tax WIthholding 11 000 Tax refund 302 Tax Return 1 Marc and Mikkel are married and earned salaries this year of 64 900 and 17 400 respectively In addition to their salaries they received interest of 350 from municipal bonds and 950 from corporate bonds

Marc And Mikkel Are Married And Earned Salaries This Year Of

Marc And Mikkel Are Married And Earned Salaries This Year Of

https://media.cheggcdn.com/media/974/9742e044-aa70-4bcc-9a20-22c5d52b6cff/phpZna13h

Marc And Mikkel Are Married And Earned Salaries This Year Of 65 400 A docx

https://image.slidesharecdn.com/marcandmikkelaremarriedandearnedsalariesthisyearof65-400a-230223063834-302f7da9/85/marc-and-mikkel-are-married-and-earned-salaries-this-year-of-65400-adocx-1-638.jpg?cb=1677135631

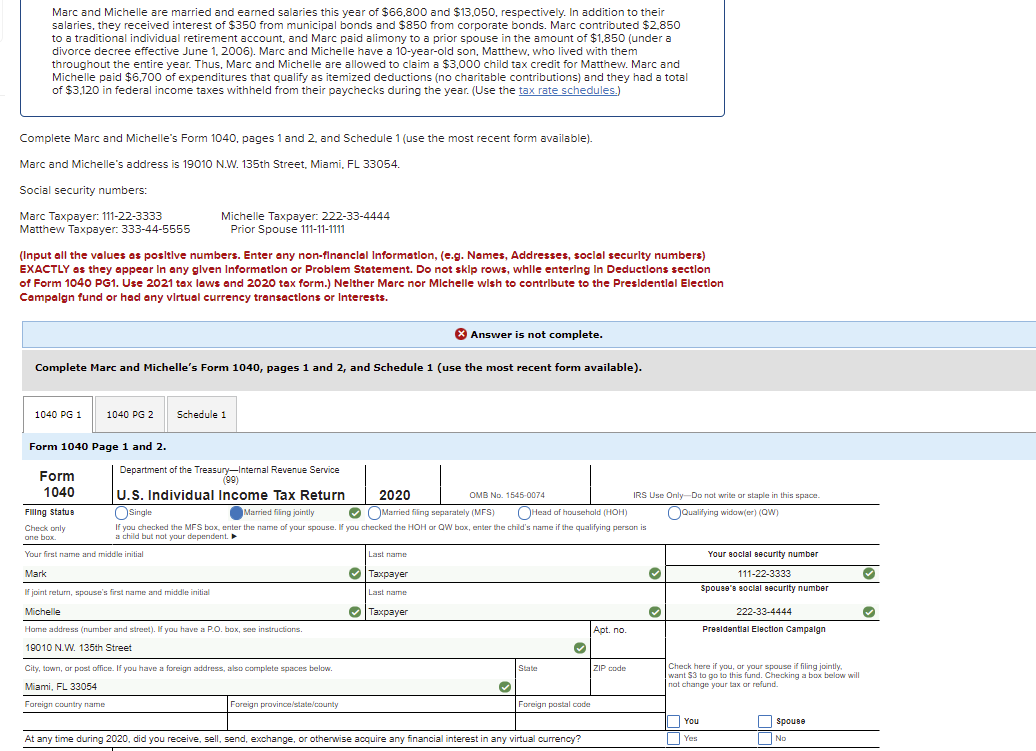

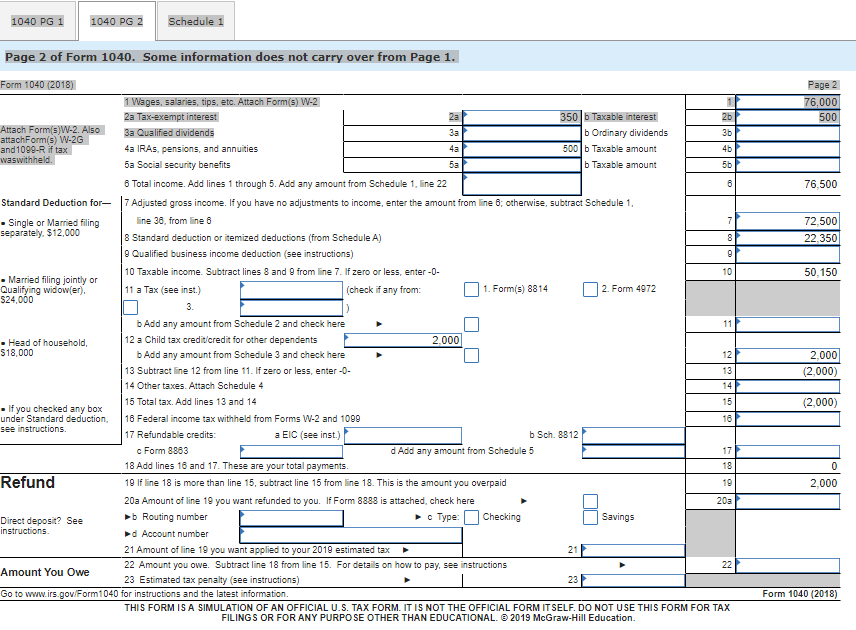

Marc And Michelle Are Married And Earned Salaries Chegg

https://media.cheggcdn.com/media/9f0/9f007d89-2ed3-48b2-8208-c84a740171cb/phpsK5UuB

Business Accounting Marc and Mikkel are married and file a joint tax return Marc and Mikel earned salaries this year of 65 000 and 18 000 respectively In addition to their salaries they received interest of 370 from municipal bonds and 1000 from corporate bonds Marc and Mikkel are married and file a joint tax return Marc and Mikkel earned salaries this year of 64 000 and 12 000 respectively In addition to their salaries they received interest of 350 from municipal bonds and 500 from corporate bonds Marc contributed 2 500 to a traditional individual retirement account and Marc

Marc and Mikkel are married and earned salaries this year of 64 000 and 12 000 respectively In addition to their salaries they received interest of 350 from municipal bonds and 500 from corporate bonds Marc and Mikkel have a 10 year old adopted son Mason who lived with them throughout the entire year Thus Marc and Mikkel are 1 Marc and Mikkel s gross Income 76 500 2 Marc and Mikkel s adjusted gross income AGI 72 500 3 Marc and Mikkel s deductions from AGI 25 900 4 Marc and Mikkel s taxable income 46 600 5 Marc and Mikkel s taxes payable or refund 681 Step by step explanation Requirement 1

More picture related to Marc And Mikkel Are Married And Earned Salaries This Year Of

Solved Marc And Michelle Are Married And Earned Salaries Chegg

http://d2vlcm61l7u1fs.cloudfront.net/media%2F1cb%2F1cba5adf-4273-4ba9-8ba6-7e249e54d667%2FphpkyxUVL.png

Solved Marc And Michelle Are Married And Earned Salaries Chegg

https://media.cheggcdn.com/media/1a0/1a0141b8-a451-492a-befa-9db60d74dc8e/phpv58FFY.png

Solved Marc And Michelle Are Married And Earned Salaries Chegg

https://media.cheggcdn.com/media/ad3/ad3c3a61-d3fe-4393-bdf8-da45b799ea3f/phpYhWbLv.png

Marc and Mikkel are married and earned salaries this year of 64 000 and 12 000 respectively In addition to their salaries they received interest of 350 from municipal bonds and 500 from corporate bonds Transcribed Image Text Marc and Mikkel are married and earned salaries this year of 66 500 and 27 000 respectively In addition to their salaries they received interest of 350 from municipal bonds and 1 750 from corporate bonds Marc contributed 3 750 to a traditional individual retirement account and Marc paid alimony to a prior spouse in the amount of 2 750 under a divorce decree

Marc and Michelle s gross income is 77 850 Their adjusted gross income AGI is 68 950 The total amount of deductions from AGI is 6 000 Their taxable income is 62 950 They have a refund due of 59 450 for the year A Gross Income Marc s salary 64 000 Michelle s salary 12 000 Interest from municipal bonds 350 Answered Marc and Mikkel are married and earned salaries this year of 64 000 and 12 000 respectively In addition to their salaries they received interest of 350 from municipal bonds and 500 from corporate bonds

Solved Marc And Mikkel Are Married And Earned Salaries This Chegg

https://media.cheggcdn.com/media/805/805fad0a-710f-4c02-9006-41a86af843cb/phpGRkWsP

Solved Marc And Mikkel Are Married And Earned Salaries This Chegg

https://media.cheggcdn.com/study/6ae/6ae38898-0239-43da-a85f-6215d2c81f3f/image

Marc And Mikkel Are Married And Earned Salaries This Year Of - Marc and Mikkel are married and earned salaries this year of 64 000 and 12 000 respectively In addition to their salaries they received interest of 350 from municipal bonds and 500 from corporate bonds Marc and Mikkel have a 10 year old adopted son Mason who lived with them throughout the entire year Thus Marc and Mikkel are