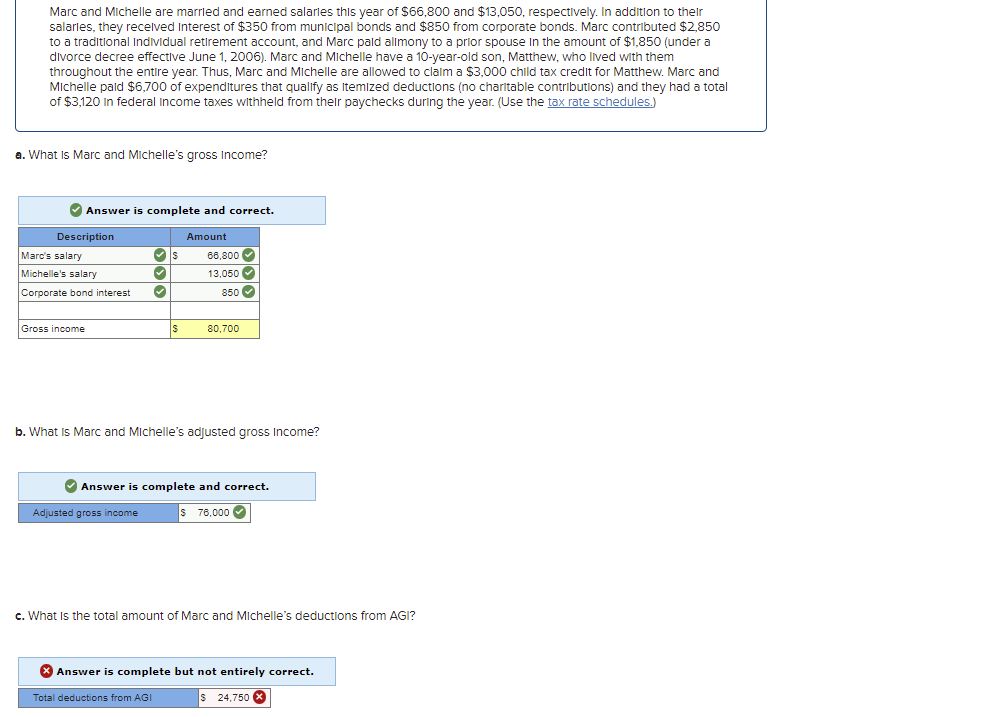

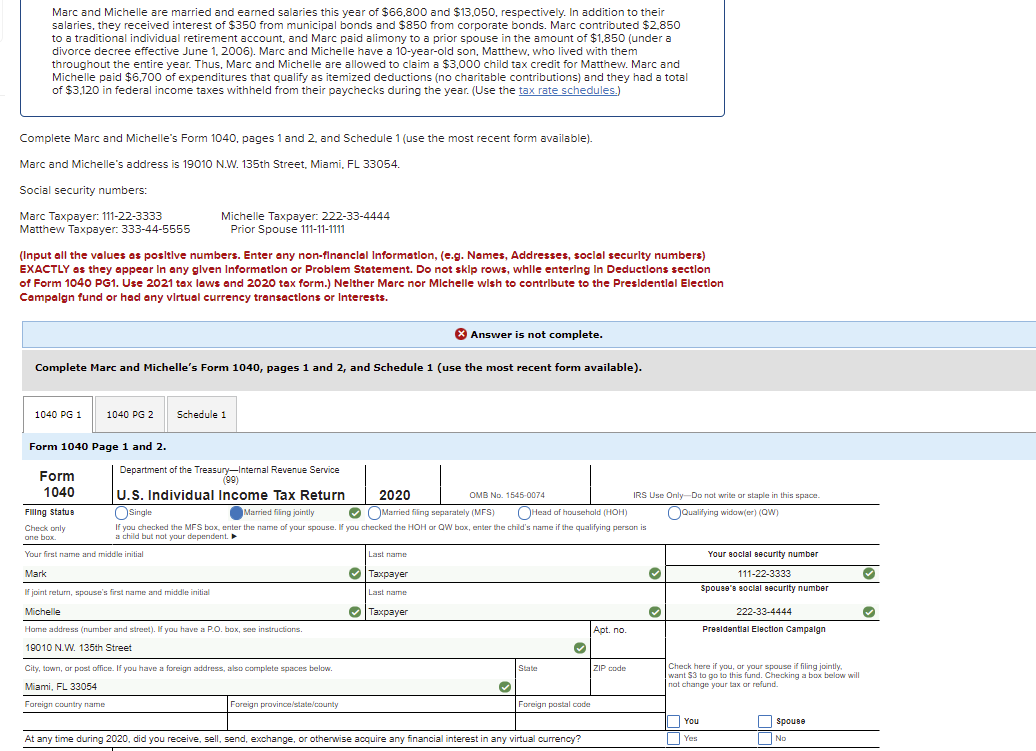

Marc And Michelle Are Married And Earned Salaries Law Civil Law Tax Accounting Chapter 4 4 3 4 reviews Get a hint Jeremy earned 100 000 in salary and 6 000 in interest income during the year Jeremy s employer withheld 11 000 of federal income taxes from Jeremy s paychecks during the year Jeremy has one qualifying dependent child who lives with him

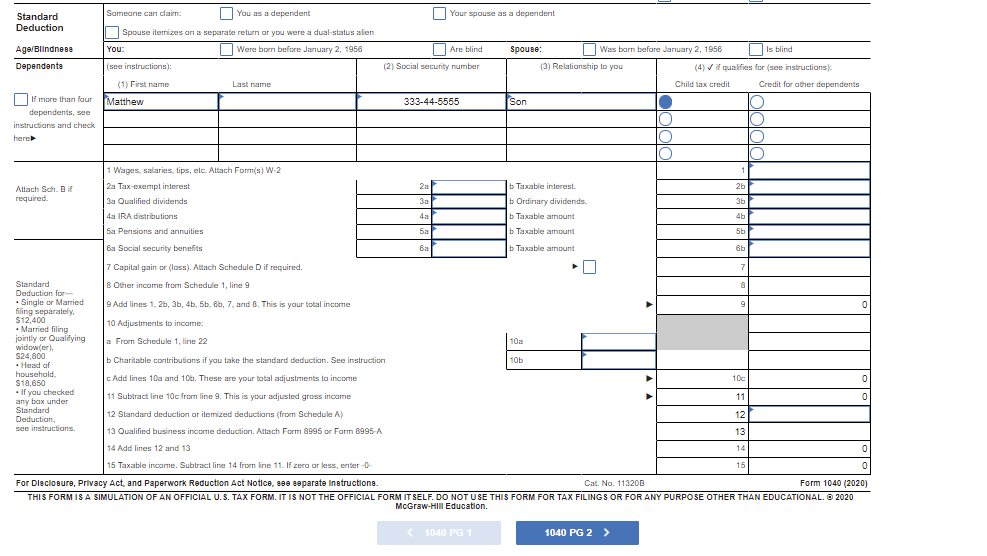

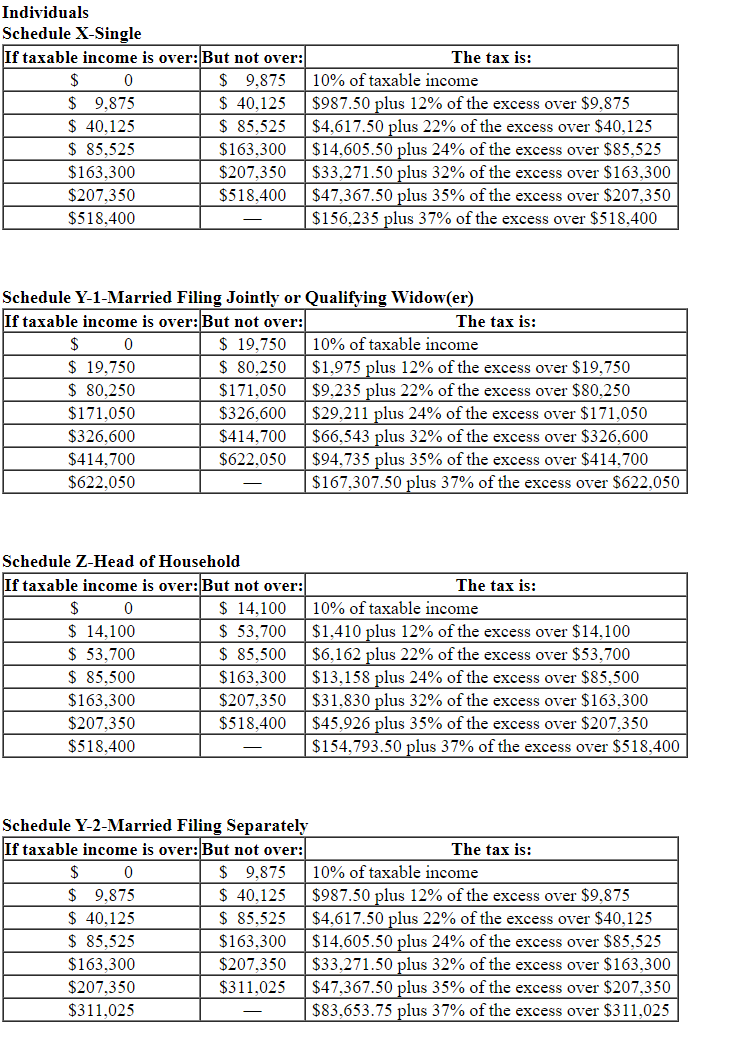

Marc and Michelle are married and earned salaries this year of 64 000 and 12 000 respectively In addition to their salaries they received interest of 350 from municipal bonds and 500 from corporate bonds Tax Return 1 Marc and Mikkel are married and earned salaries this year of 64 900 and 17 400 respectively In addition to their salaries they received interest of 350 from municipal bonds and 950 from corporate bonds

Marc And Michelle Are Married And Earned Salaries

Marc And Michelle Are Married And Earned Salaries

https://img.homeworklib.com/questions/e810aa80-1402-11eb-8a94-cf2bcf6035e5.png?x-oss-process=image/resize,w_560

Marc And Michelle Are Married And Earned Salaries Chegg

https://media.cheggcdn.com/media/710/710df989-296f-44fb-a1bb-05643d113e55/phpBhcxpG

Marc And Michelle Are Married And Earned Salaries Chegg

https://media.cheggcdn.com/media/031/03120754-be5f-4944-bbc8-d84f332f9863/php4knrtx

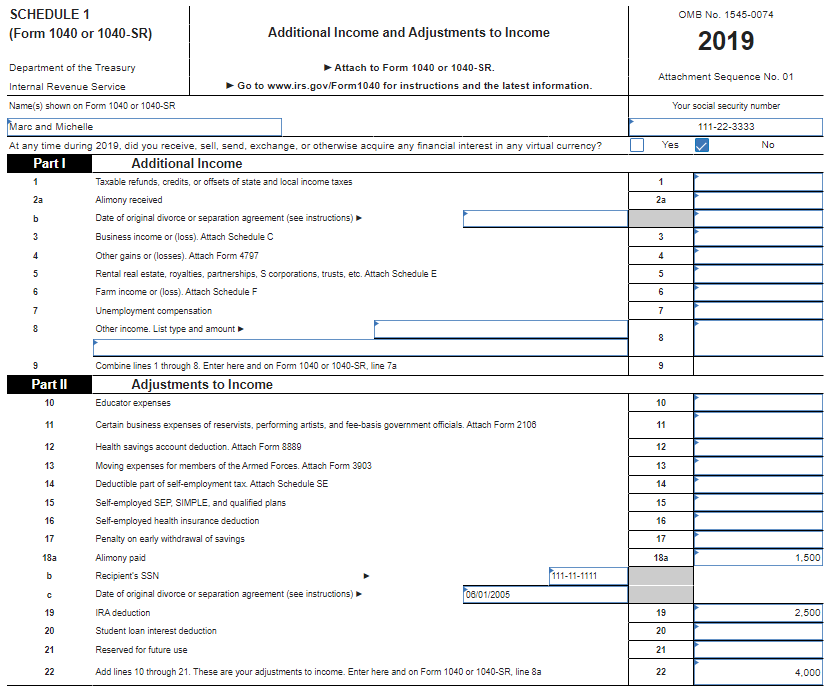

Marc and Michelle are married and earned salaries this year of 64 000 and 12 000 respectively In addition to their salaries they received interest of 350 from municipal bonds and 500 from corporate bonds Marc and Michelle also paid 2 500 of qualifying moving expenses and Marc paid alimony to a prior spouse in the amount of 1 500 Marc and Michelle are married and earned salaries this year of 64 000 and 12 000 respectively In addition to their salaries they received interest of 350 from municipal bonds and 500 from corporate bonds Marc contributed 2 500 to an individual retirement account and Marc paid alimony to a prior spouse in the amount of 1 500

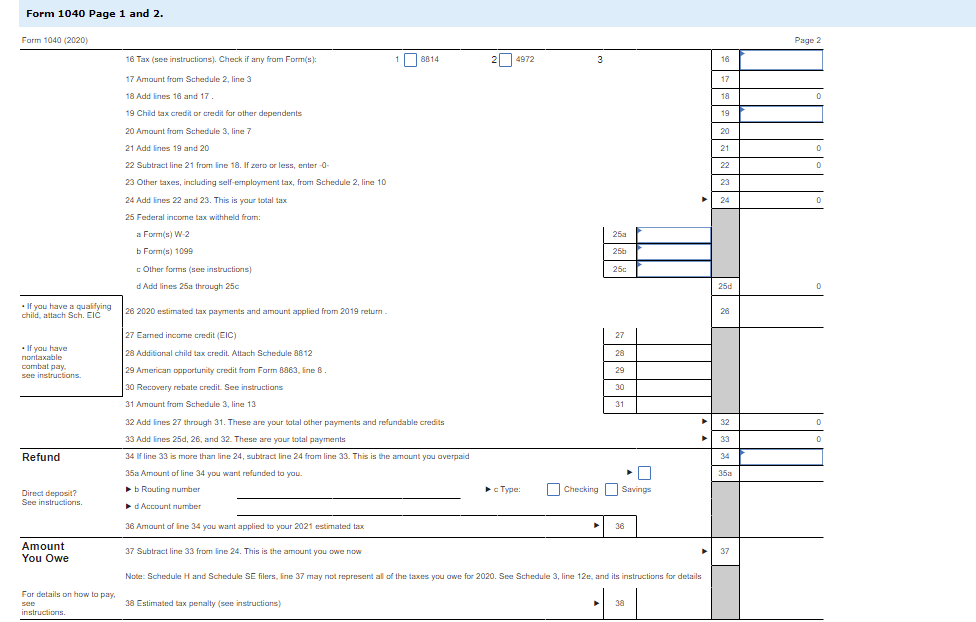

A Gross Income 76 850 B Adjusted Gross Income AGI 72 850C Total Deductions from AGI 8 000 D Taxable Income 64 850 E Marc and Michelle would need to use the tax rate schedules to determine their taxes payable or refund due based on their taxable income of 64 850 A Gross Income Gross Income is the total income before any deductions It includes salaries interest and other Answer I will use the 2020 tax schedule since recovery rebate credit applies to 2020 Marc and Michelle s gross income Marc s and Michelle s salaries interest from corporate bonds 64 000 12 000 500 76 500 they should choose the standard deduction since it is higher than their itemized deductions 24 400

More picture related to Marc And Michelle Are Married And Earned Salaries

Marc And Michelle Are Married And Earned Salaries Chegg

https://media.cheggcdn.com/media/d9f/d9f7541c-4a47-44c6-a6e7-d8b0cb30d0f7/phprQHd2r.png

Solved Marc And Michelle Are Married And Earned Salaries Course Hero

https://www.coursehero.com/qa/attachment/32271086/

Marc And Michelle Are Married And Earned Salaries Chegg

https://media.cheggcdn.com/media/f28/f28480c4-94d8-48dd-9cfa-5db3e586d12e/phpQlookx

Marc and Michelle are married and earned salaries this year of 64 000 and 12 000 respectively In addition to their salaries they received interest of 350 from municipal bonds and 500 from corporate bonds Marc contributed 2 500 to an individual retirement account and paid 1 500 in alimony to a prior spouse Chapter 4 taxation homework Marc and Michelle are married and file MFJ Marcs income is 64 400 and Michelles income is 12 150 Muncipal bond 350 Corporate bond 550 Retirement 2550 Alimony 1550 Child tax credit 2000 itemized 6100 federal income withheld 3550 a What is their goss income b what is their adjusted gross income

Marc and Michelle are married and earned salaries this year of 64 000 and 12 000 respectively In addition to their salaries they received interest of 350 from municipal bonds and 500 from corporate bonds Marc contributed 2 500 to an individual retirement account and Marc paid alimony to a prior spouse in the amount of 1 500 under a Marc and Michelle are married and earned salaries this year of 64 000 and 12 000 respectively In In addition to their salaries they received interest of 350 from municipal bonds and 500 from corporate

Solved Marc And Michelle Are Married And Earned Salaries Chegg

https://media.cheggcdn.com/media/e63/e631bfee-733c-4ced-af25-dc86f3eb51e0/phpKezIV2

Marc And Michelle Are Married And Earned Salaries Chegg

https://media.cheggcdn.com/media/9f0/9f007d89-2ed3-48b2-8208-c84a740171cb/phpsK5UuB

Marc And Michelle Are Married And Earned Salaries - A Gross Income 76 850 B Adjusted Gross Income AGI 72 850C Total Deductions from AGI 8 000 D Taxable Income 64 850 E Marc and Michelle would need to use the tax rate schedules to determine their taxes payable or refund due based on their taxable income of 64 850 A Gross Income Gross Income is the total income before any deductions It includes salaries interest and other