Is Operating Profit Margin The Same As Net Profit Margin The operating margin is an important measure of a company s overall profitability from operations It is the ratio of operating profits to revenues for a company or business segment

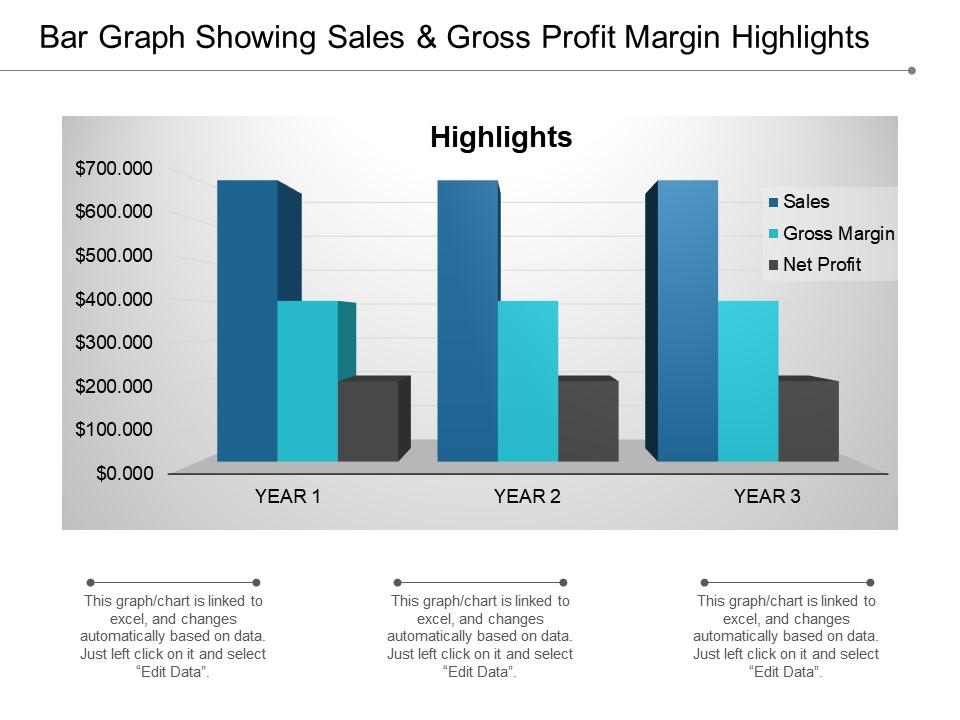

The operating margin reveals the percentage of profit generated by operating activities The operating margin is calculated by subtracting all operating expenses from sales and then dividing the result by sales This margin is used to discern the profitability of an organization s core activities with all financing issues and discontinued Comparing Gross Profit Margin and Operating Profit Margin Below is a portion of the income statement for JCPenney as of May 5 2018 In this example JCPenney earned only 3 million in operating

Is Operating Profit Margin The Same As Net Profit Margin

Is Operating Profit Margin The Same As Net Profit Margin

https://i.pinimg.com/originals/0f/95/cc/0f95cc0ce70f36805f466cf9caade151.png

Gm Ebit 2024 Dana Milena

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/11/21232823/EBITDA-Margin-Calculator.jpg

Gross Profit Vs Markup Table Elcho Table

https://www.slideteam.net/media/catalog/product/cache/1280x720/e/b/ebitda_graph_with_gross_profit_and_margin_slide01.jpg

To compute operating margin divide the operating income by net sales and multiply by 100 The formula is Is Operating Margin the Same as Profit Margin Operating margin is one of three widely used profit ratio metrics The others are gross margin and net profit margin Each of these metrics provides a different perspective on a company Low Operating Margin Airlines tend to have lower operating margins because they have high fixed costs and operate in a price competitive industry 3 Net Profit Margin Definition The net profit margin measures the percentage of revenue that remains as profit after all expenses including taxes and interest are deducted It represents the

Understanding the nuances between operating margin and profit margin can significantly influence a company s strategic decisions For instance a company with a strong operating margin but a weak profit margin might need to scrutinize its non operational expenses such as interest payments or tax strategies There are a variety of margin ratios Gross operating EBITDA and net profit margins are explained in depth in Strategic Financial Analysis and defined as follows 1 Gross Margin Gross margin is a simple calculation that determines the percentage of sales revenue your business retains after deducting the costs directly associated with producing or delivering those sales

More picture related to Is Operating Profit Margin The Same As Net Profit Margin

Operating Margin Formula Calculator Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/07/Operating-Margin-Formula-1.jpg

Net Margin

https://www.thestreet.com/.image/t_share/MTk4MzQyMDc4NTUwMjU1MTUw/6.png

Profit Margin

https://www.slideteam.net/media/catalog/product/cache/1280x720/b/a/bar_graph_showing_sales_and_gross_profit_margin_highlights_Slide01.jpg

What is Net Profit Margin Net Profit Margin also known as the Bottom Line Margin represents the percentage of revenue that remains after all expenses have been deducted including operating expenses interest taxes and other non operating costs It provides the most comprehensive view of a company s profitability The net profit margins compute the actual margin gained after considering the impact of interest payments on debt and tax outflows In contrast operational margins as the name implies refer to the profits earned from the company s primary operations The context matters more than the content in the argument between operational profit margin

[desc-10] [desc-11]

Profit Margin

https://d1eipm3vz40hy0.cloudfront.net/images/AMER/net-profit-margin-formula.png

Ense ando Poderoso Masacre How To Calculate Operating Margin M s Que

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/11/24195029/Operating-Margin-Formula.jpg

Is Operating Profit Margin The Same As Net Profit Margin - Understanding the nuances between operating margin and profit margin can significantly influence a company s strategic decisions For instance a company with a strong operating margin but a weak profit margin might need to scrutinize its non operational expenses such as interest payments or tax strategies