Is Operating Income The Same As Net Earnings Operating profit is a company s profit after all expenses are taken out except for the cost of debt taxes and certain one off items Net income is the profit remaining after all costs incurred

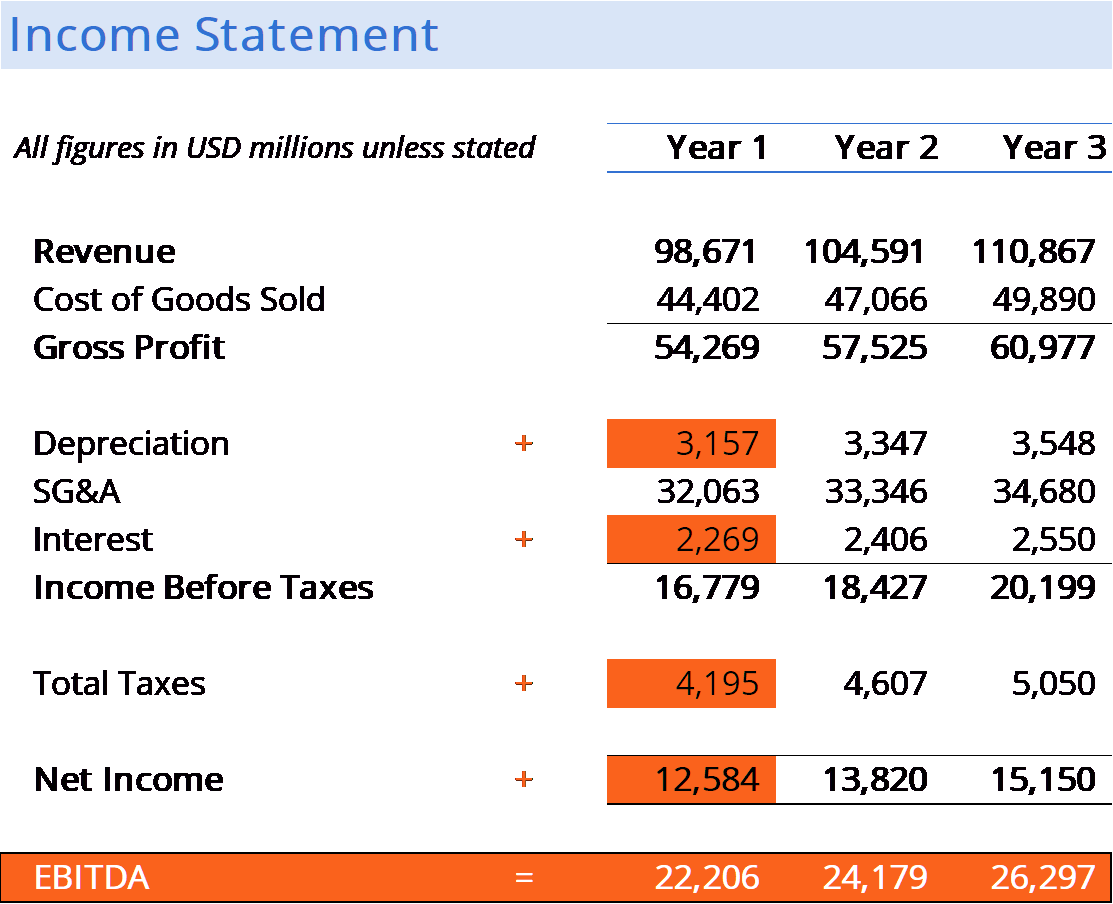

Gross profit operating profit and net income are reflected on a company s income statement and each metric represents profit at different parts of the production cycle and earnings process The above equation helps us identify the relationship between operating and net income Operating income on the one hand identifies the income generated from the operating activities of the business net income on the other hand quantifies any income generated by the business entity either from operations or from interests earned from investments or even an income generated by liquidating

Is Operating Income The Same As Net Earnings

Is Operating Income The Same As Net Earnings

https://i.ytimg.com/vi/wCJrXdWmOks/maxresdefault.jpg

EBITDA Vs Operating Income Top Differences You Must Know YouTube

https://i.ytimg.com/vi/gAHI9vTvSBg/maxresdefault.jpg

Differences Between Net Sales And Net Income YouTube

https://i.ytimg.com/vi/qIgH0_ZoSLc/maxresdefault.jpg

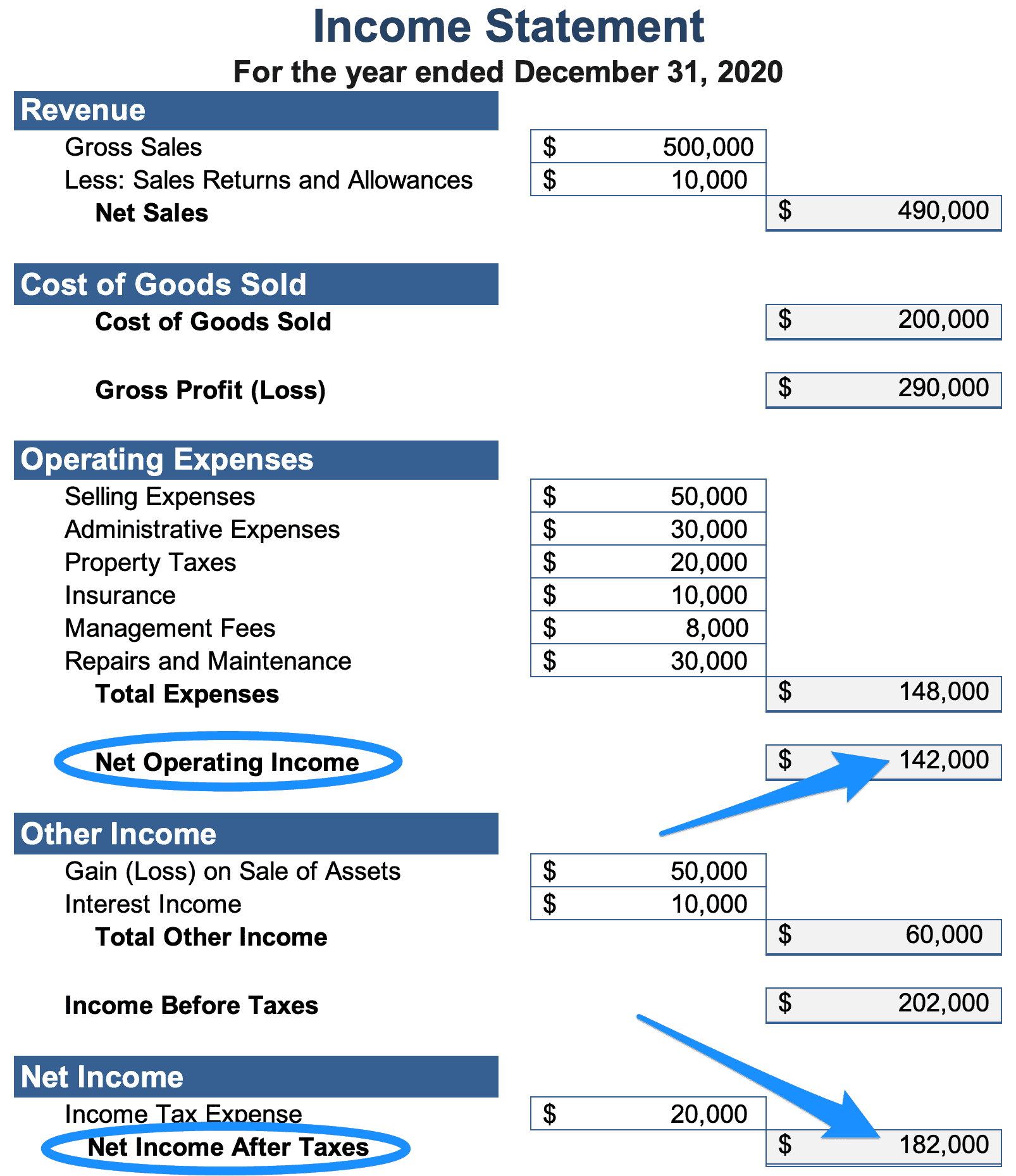

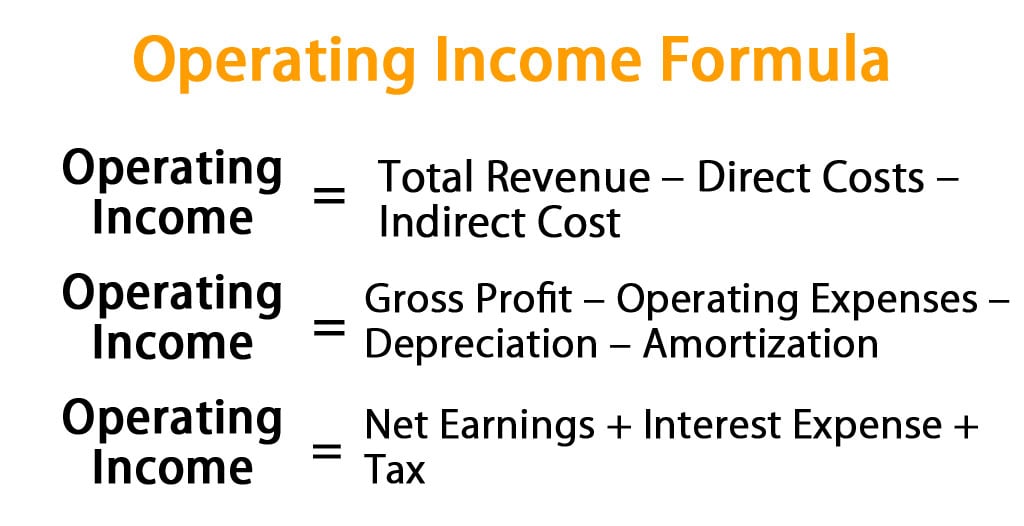

For example a company with substantial operating income could report low net income due to significant interest expenses or legal settlements Another misconception is relying solely on net income to evaluate performance While comprehensive net income may be influenced by non recurring events like asset sales or tax adjustments Operating income gross profit operating expenses Net income method It s a common misconception that operating income is the same as earnings before interest and taxes or EBIT They are similar but not identical The main difference is that EBIT includes non operating items other than interest and taxes which are often listed as

Net Income Operating Profit Interest Expense Taxes Net Income 150 000 30 000 40 000 80 000 Net income is lower because it includes extra expenses like interest and taxes Investor Focus Investors focus on operating profit and net income for different reasons Professionals managing Fortune 500 companies look at The difference between operating income and net income is that operating income does not take into consideration non operating income such as the income from investments expenses from financing taxes and non recurring expenses or income items such as the gain on the sale of an asset Net income on the other hand is the bottom line profit that factors in all expenses debts additional

More picture related to Is Operating Income The Same As Net Earnings

Tax Vs Debt BURSAHAGA COM

https://www.investopedia.com/thmb/OhYH-DAe61WH1KYO1lkXB4CJ8dg=/1412x914/filters:no_upscale():max_bytes(150000):strip_icc()/jcpenney_ebitda_op_income__depreciation_may_2018-5bfd866fc9e77c00266f7217

What Is Net Operating Income NOI REtipster

https://retipster.com/wp-content/uploads/2020/08/Income_statement_1_year1.png

EBITDA FINANCYTE

https://cdn.corporatefinanceinstitute.com/assets/ebitda-1.png

However ABC Corp also incurs 50 000 in interest expenses and has a tax obligation of 30 000 By accounting for these non operating costs its net income comes to 220 000 This example demonstrates how non operating items impact net income and highlights the essential differences between operating and net income Operating income and net income show how profitable a company is but they are not the same Operating income focuses on a company s main activities Net income considers all earnings and costs To read income statements you should look at different revenue streams operating expenses and the effects of taxes and interest

[desc-10] [desc-11]

Operating Income Formula Calculator Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/04/Operating-Income-Formula.jpg

What Is Ebit

https://learn.financestrategists.com/wp-content/uploads/EBIT_Example.png

Is Operating Income The Same As Net Earnings - For example a company with substantial operating income could report low net income due to significant interest expenses or legal settlements Another misconception is relying solely on net income to evaluate performance While comprehensive net income may be influenced by non recurring events like asset sales or tax adjustments