Is Net Operating Income The Same As Ebit Key Takeaways Calculating net operating income NOI involves subtracting operating expenses from a property s revenues Calculating earnings before interest and taxes EBIT uses the same

Ebit and Net Operating Income NOI are two important financial metrics used by businesses to evaluate their profitability Ebit or earnings before interest and taxes is a measure of a company s operating performance that excludes any interest expense or income tax expenses On the other hand NOI represents a property s potential income Net operating income is generally the same as operating income for a company Operating income is often referred to as earnings before interest and taxes EBIT although the two may differ at

Is Net Operating Income The Same As Ebit

:max_bytes(150000):strip_icc()/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

Is Net Operating Income The Same As Ebit

https://www.investopedia.com/thmb/sXVjju1dgFQhrd6OKtjFVHcrod0=/1101x1400/filters:no_upscale():max_bytes(150000):strip_icc()/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg

Difference Between EBIT And Operating Income Martinlechler

http://cdn.differencebetween.net/wp-content/uploads/2022/01/EBIT-vs.-Operating-Income.jpg

Operating Profit Financial Edge

https://financial-edge-staging-media.s3-eu-west-2.amazonaws.com/2020/10/Income-Statement-1.png

For both companies EBIT FCF is around 100 and EBITDA Cash Flow from Operations is around 100 And Net Income is not great for comparisons or for approximating companies cash flows It s best as a quick and simple metric for quickly assessing a company s profitability without doing extra work Net operating income isn t exactly the same thing as earnings before interest and taxes EBIT That metric takes a couple of extra steps down the income statement EBIT accounts for depreciation

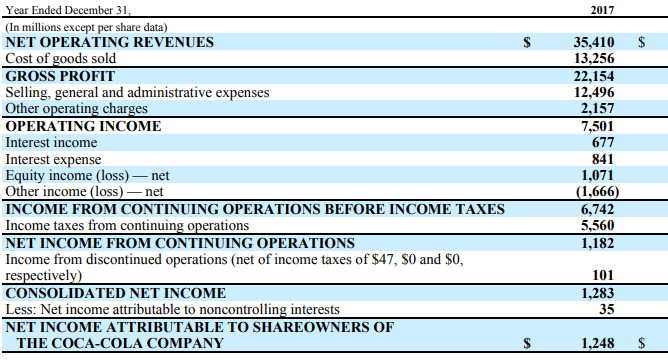

EBIT is an indicator that calculates the income of the company mostly operating income before paying the expenses and taxes On the other hand net income is an indicator that calculates the total earnings of the company after paying the expenses and taxes EBIT is used as an indicator to determine a company s total profit making capability Operating Income EBIT Another way to calculate income from operations is to start at the bottom of the income statement at Net Earnings and then add back interest expense and taxes This is a common method used by analysts to calculate EBIT which can then be used for valuation in the EV EBIT ratio Below is an example calculation of EBIT

More picture related to Is Net Operating Income The Same As Ebit

Operating Profit Vs EBIT Earnings Before Interest Tax

https://www.elearnmarkets.com/blog/wp-content/uploads/2019/04/EBIT_01.png

EBIT Vs EBITDA Vs Net Income Ultimate Valuation Tutorial

https://biwsuploads-assest.s3.amazonaws.com/biws/wp-content/uploads/2019/04/28172707/EBIT-vs-EBITDA-Best-Buy-Target-1024x300.jpg

EBIT Vs Operating Income Top 5 Differences with Infographics

https://www.wallstreetmojo.com/wp-content/uploads/2018/06/EBIT-vs-Operating-Income-1.jpg

Net income of 4 882 billion Operating income of 5 802 billion EBITDA of 5 99 billion Looking at these three metrics we can see that the EBITDA calculation provides the most optimistic measurement of Adobe s profit This is usually the case since it includes non operating income and adds back most expenses In theory the metric should represent the core operating income EBIT of a company taxed after removing the impact of non operating gains losses debt financing e g tax shield and taxes paid We need to work our way from net income to EBIT before repeating the same process as the first approach EBIT Company A 137m

Learn More Net Operating Income NOI EBITDA Definition EBITDA measures a company s profitability before the effects of certain accounting or financial decisions Since it is a non GAAP measure of profitability companies are not required to report EBITDA on their financial statements However investors will almost always use a company s GAAP measures to determine EBITDA given the How to Calculate EBIT EBIT or Operating Income measures the operating profitability of a company in a specific period with all core operating costs deducted from revenue On the income statement operating income takes into account the following line items Revenue The net sales generated throughout the period Cost of Goods Sold COGS The direct costs incurred in the

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

Ucide Baraj Inversa How To Calculate Profit Margin Jurnal Se Decodifica

https://www.investopedia.com/thmb/KdOpX1jPdOTJmkLUOR0Xb1WdliM=/2448x1377/smart/filters:no_upscale()/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg

EBIT Vs EBITDA Vs Net Income Ultimate Valuation Tutorial

https://biwsuploads-assest.s3.amazonaws.com/biws/wp-content/uploads/2019/04/28172955/EBIT-Investor-Groups-1024x511.jpg

Is Net Operating Income The Same As Ebit - For both companies EBIT FCF is around 100 and EBITDA Cash Flow from Operations is around 100 And Net Income is not great for comparisons or for approximating companies cash flows It s best as a quick and simple metric for quickly assessing a company s profitability without doing extra work