Is Net Income Same As Employment Income The self employment tax is calculated as a percentage of the individual s net earnings from self employment while income tax is a percentage tax on a person s taxable income

What is gross income Gross income is the total amount of income you receive from all sources before any taxes or other deductions are taken out This includes your salary or wages tips bonuses rental income investment income and any other sources of income you may have The difference between gross and net income is important for many reasons especially during tax season Find out what you should know about both to understand your own

Is Net Income Same As Employment Income

Is Net Income Same As Employment Income

https://i.ytimg.com/vi/qIgH0_ZoSLc/maxresdefault.jpg

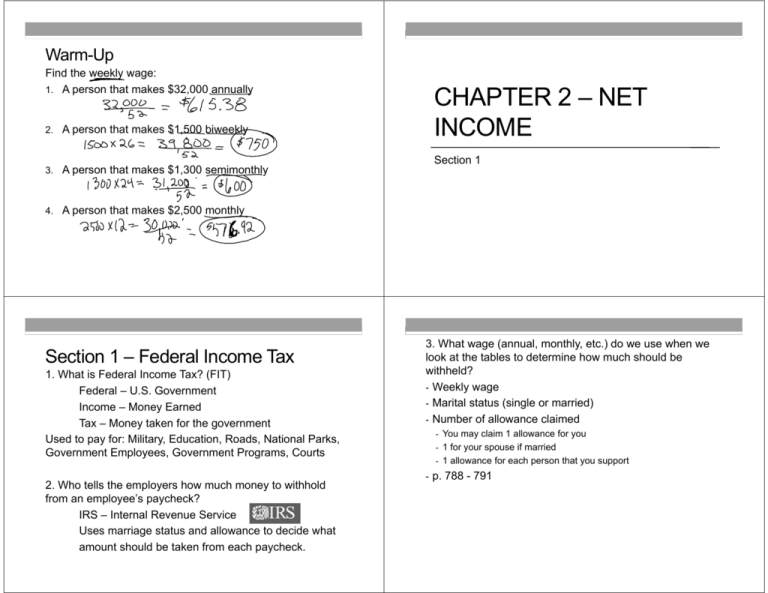

CHAPTER 2 NET INCOME

https://s3.studylib.net/store/data/008863815_1-6e987328b206d8a0f8163b43d27d6fa0-768x994.png

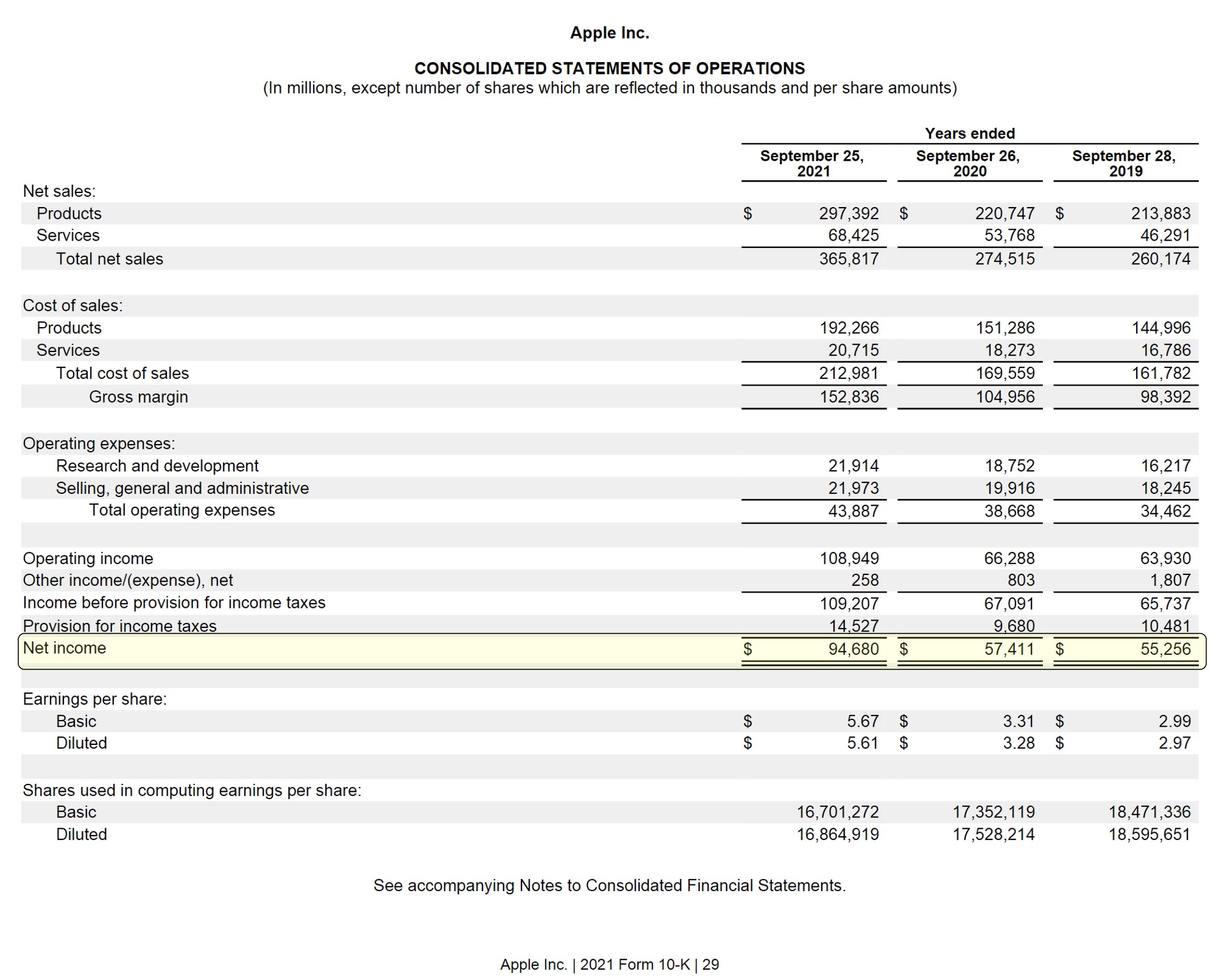

Reconciling Net Income To Free Cash Flow The Motley Fool Net Income

https://i.pinimg.com/originals/da/03/91/da03914f493952fd9a445fb83d5ee0c9.png

You ll use Schedule C to calculate net earnings and Schedule SE to calculate how much tax you owe You can deduct 50 of your self employment tax on your income taxes Self Employment Tax Who Needs to Pay As a rule you need to pay self employment tax if your net earnings from self employment are at least 400 over the tax year This includes individuals who have their own businesses as well as independent contractors and freelancers

Find out how much self employment tax you owe with Forbes Advisor s easy to use calculator and guide Save money and time on your taxes Gross income is business income before expense deductions while net income is after deductions Learn how they relate to your business and self employment taxes

More picture related to Is Net Income Same As Employment Income

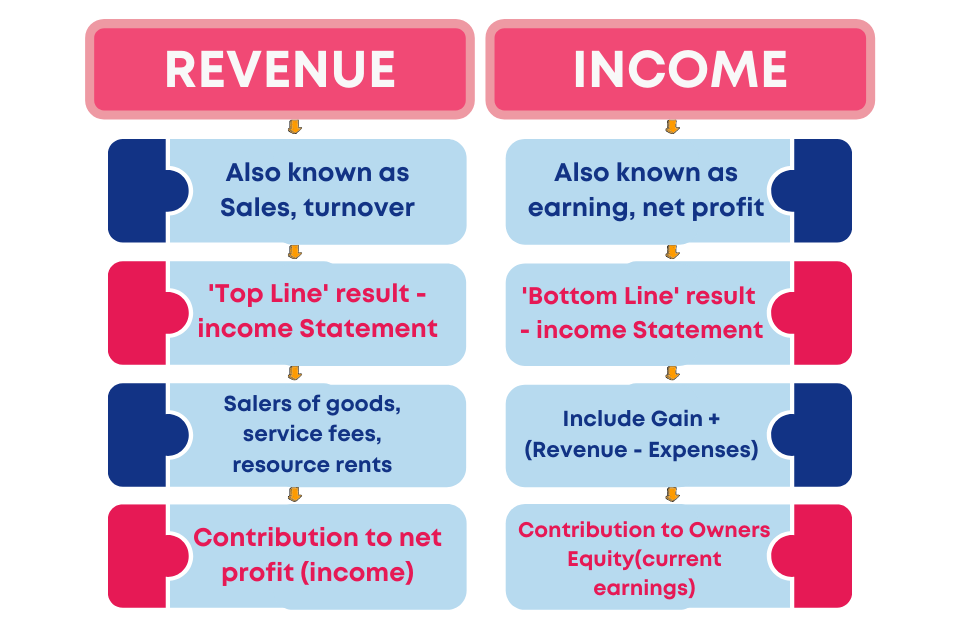

What Is The Difference Between Revenue And Income

https://cheap-accountants-in-london.co.uk/wp-content/uploads/2021/05/revenue-income.png

Are All Pension Incomes Created Equal Financial Independence Hub

https://findependencehub.com/wp-content/uploads/2019/01/shutterstock_137934176.jpg

Preliminary Net Income Formula JunaidTasnim

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/16190411/Net-Income-Apple.jpg

What is Earned Income Earned income includes all the taxable income and wages from working either as an employee or from running or owning a business It also includes certain other types of taxable income Earned income includes Wages salaries tips and other taxable employee pay Net earnings from self employment Union strike benefits Long term disability benefits received prior to minimum Self Employment Tax SE tax is a social security and Medicare tax primarily for individuals who work for themselves It is similar to the social security and Medicare taxes withheld from the pay of most employees Understand the various types of taxes you need to deposit and report such as federal income tax social security and Medicare

You usually must pay self employment tax if you had net earnings from self employment of 400 or more Generally the amount subject to self employment tax is 92 35 of your net earnings from self employment You calculate net earnings by subtracting ordinary and necessary trade or business expenses from the gross income you derived from your Learn about the differences between adjusted gross income AGI and net income two terms that are sometimes synonymous but can also be used differently

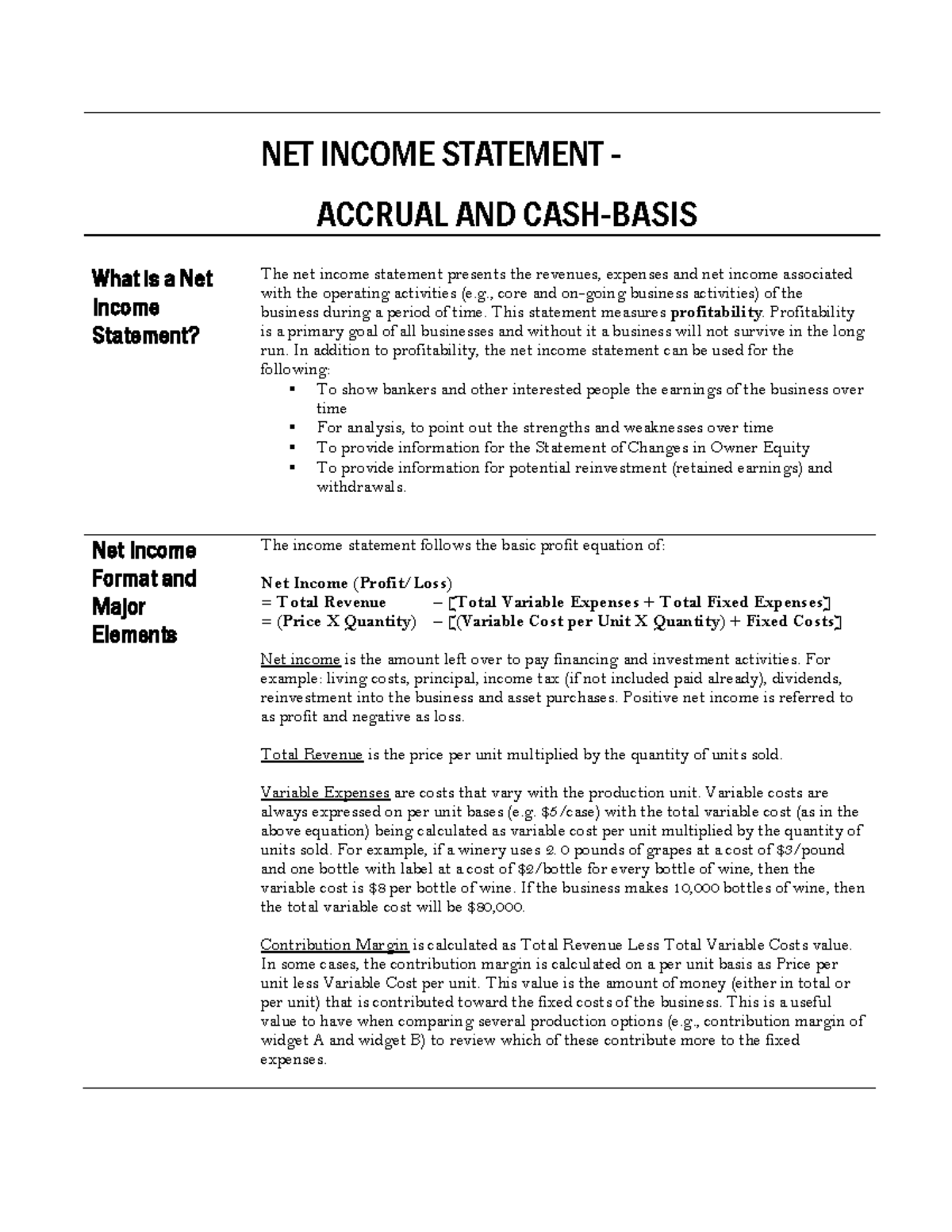

Income Statement Fact Sheets NET INCOME STATEMENT ACCRUAL AND CASH

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/e5f730cc21b1cf1c6c60c3da01226386/thumb_1200_1553.png

:max_bytes(150000):strip_icc()/Apple12-29-2018incomestatement-5c537a8fc9e77c0001cff2a8.jpg)

How To Calculate Net Income Example Haiper

https://www.investopedia.com/thmb/YensjMD8yWu66ZKmA4J0LzGvFGA=/910x826/filters:no_upscale():max_bytes(150000):strip_icc()/Apple12-29-2018incomestatement-5c537a8fc9e77c0001cff2a8.jpg

Is Net Income Same As Employment Income - You ll use Schedule C to calculate net earnings and Schedule SE to calculate how much tax you owe You can deduct 50 of your self employment tax on your income taxes