Is Net Earnings After Tax Federal Income Tax The federal income tax is a progressive tax meaning it increases in accordance with the taxable amount The more someone makes the more their income will be taxed as a percentage In 2025 the federal income tax rate tops out at 37 Only the highest earners are subject to this percentage

Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Salary Calculators Net Income 4 715 56 585 2 176 1 088 217 63 27 20 22 tax translating to approximately 4 715 per month after taxes and contributions The latter has a wage base limit of 176 100 which means that after employees earn that much the tax is no longer deducted from their earnings for the rest of the year Those with high income may also be subject to Additional Medicare tax which is 0 9 paid for only by the employee not the employer

Is Net Earnings After Tax

Is Net Earnings After Tax

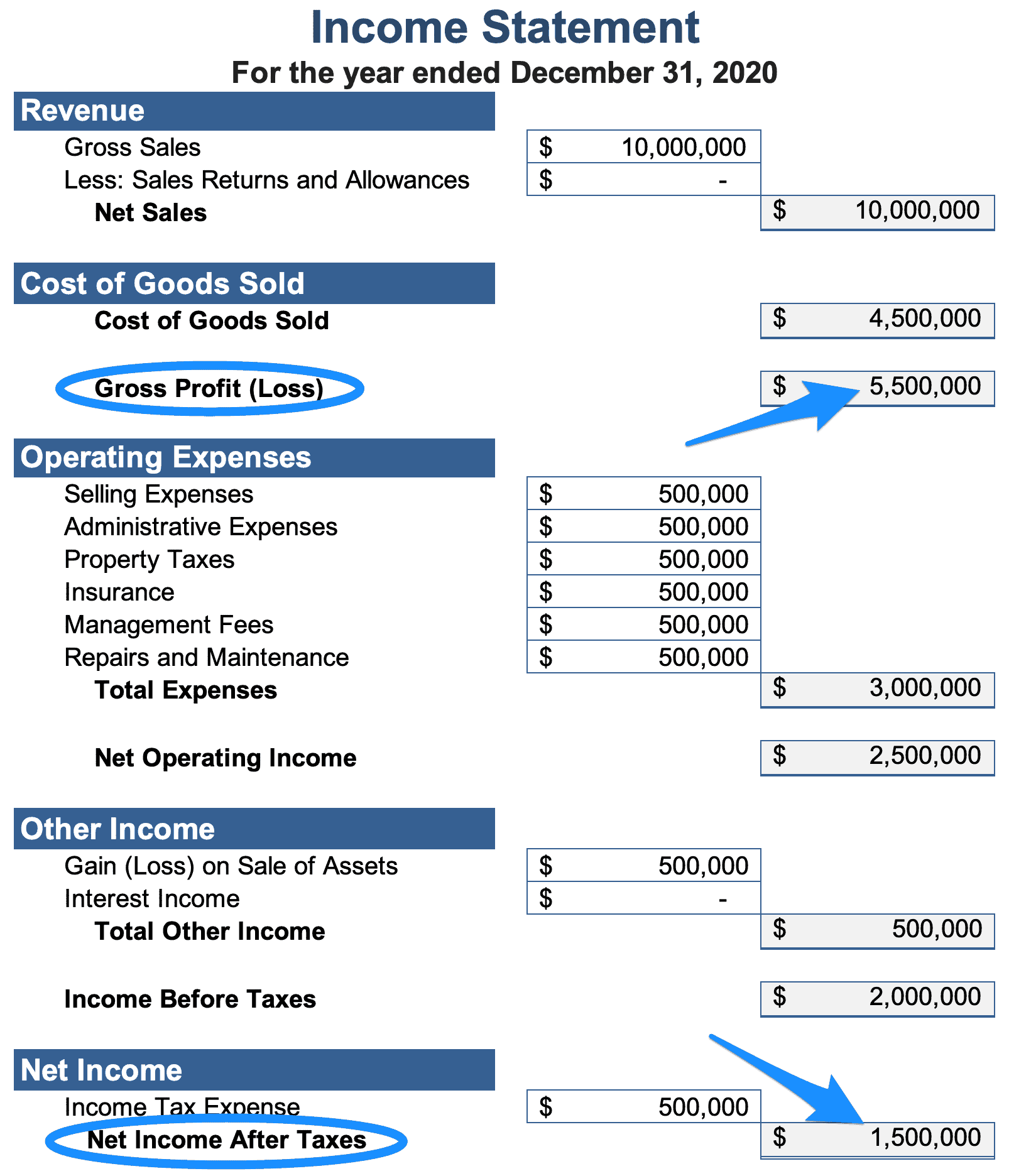

https://www.taxproadvice.com/wp-content/uploads/what-is-net-income-retipster-com.png

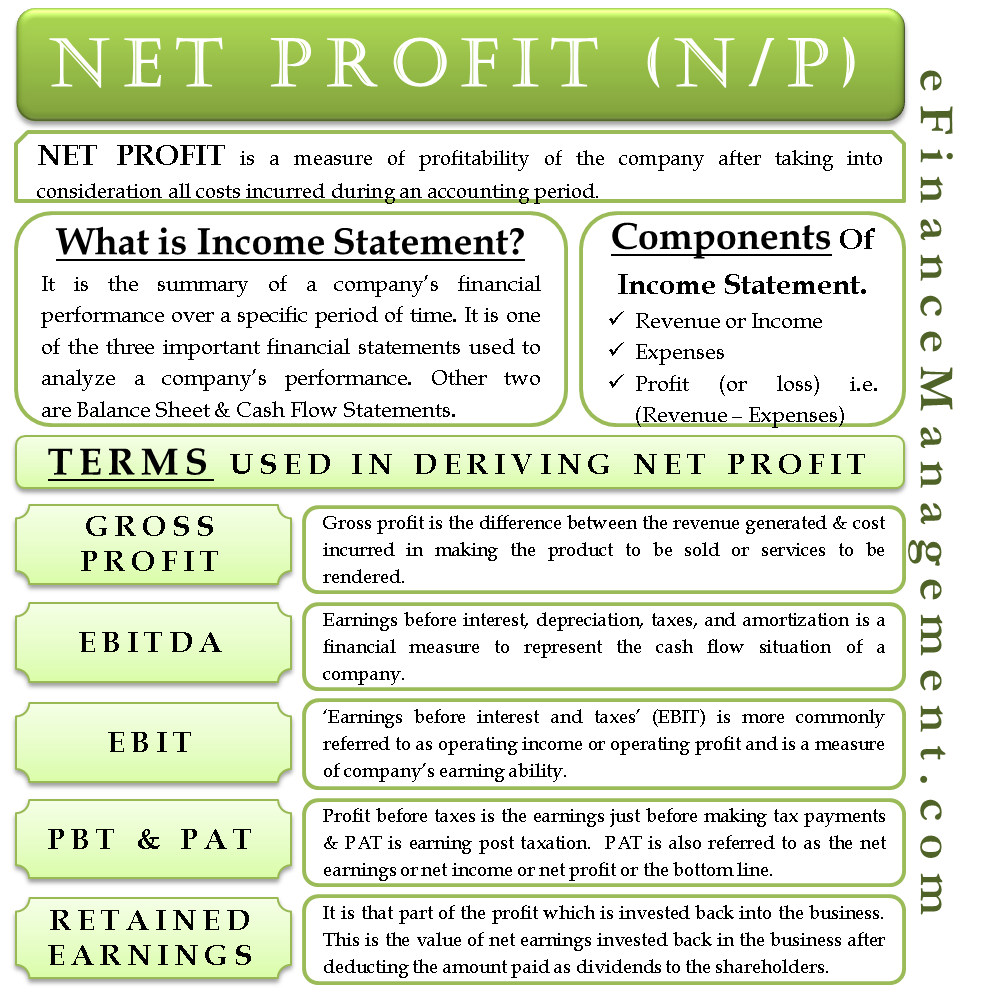

Net Profit Income Statement Terms EBIT PBT Retained Earnings Etc

https://efinancemanagement.com/wp-content/uploads/2015/10/Net-Profit.png

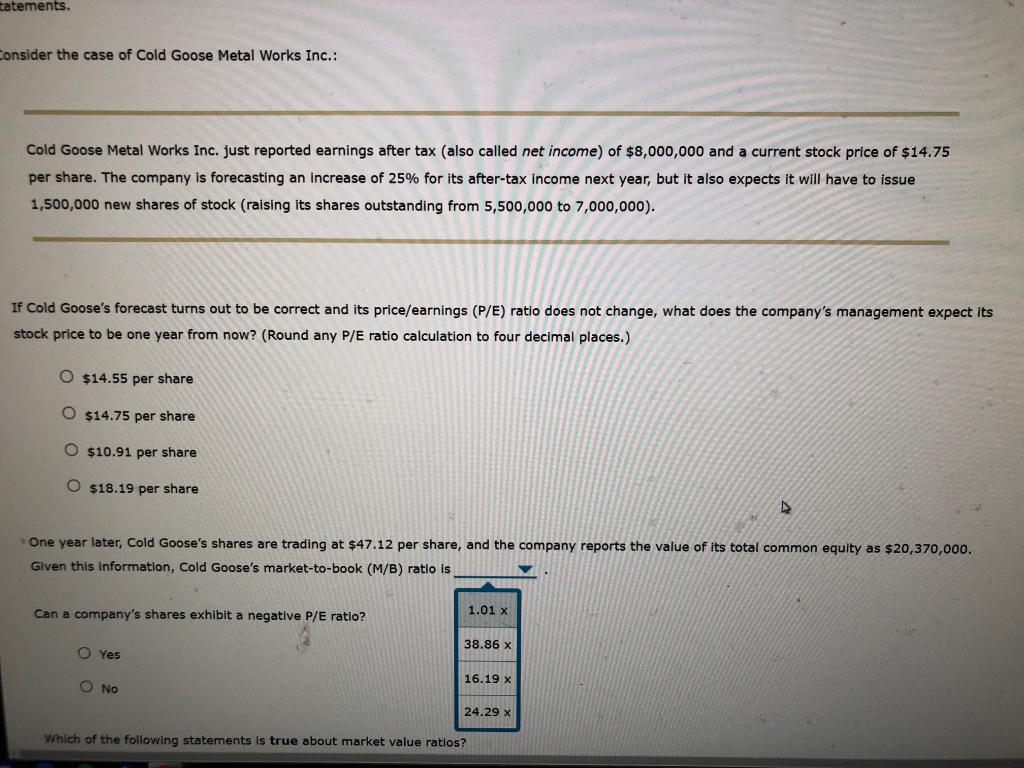

Solved Tatements Consider The Case Of Cold Goose Metal Chegg

https://media.cheggcdn.com/media/4c9/4c987663-dac9-4f5a-95cc-e469f6c374d6/phpFh6kBV

The money also grows tax free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially Some deductions from your paycheck are made post tax These include Roth 401 k contributions The money for these accounts comes out of your wages after income tax has already been applied A salary calculator lets you enter your annual income gross pay and calculate your net pay paycheck amount after taxes You will see what federal and state taxes were deducted based on the information entered The federal income tax is a tax on annual earnings for individuals businesses and other legal entities All wages salaries

Glossary of Terms Related to Net Income After Tax US Gross Income Total earnings before any deductions Example A salary of 60 000 annually Net Income Income remaining after all deductions including taxes Example 60 000 gross income with 15 tax results in a net income of 51 000 Tax Rate The percentage of income paid in taxes Step 4 Local income tax liability Some cities or counties impose local income tax The formula is Gross income or State taxable income Local income tax rate Local income tax liability Step 5 Your net pay After calculating your total tax liability subtract deductions pre and post tax and any withholdings if applicable

More picture related to Is Net Earnings After Tax

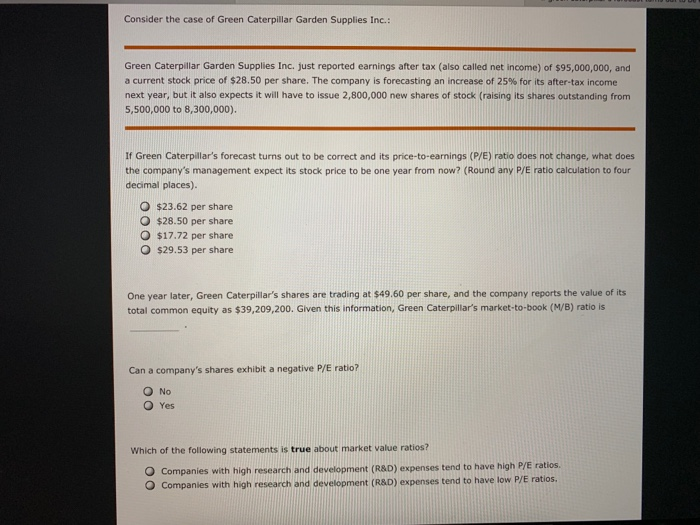

Solved Consider The Case Of Green Caterpillar Garden Chegg

https://media.cheggcdn.com/media/0b5/0b58d5c4-c98c-4c49-a098-24fcee5b89f4/image.png

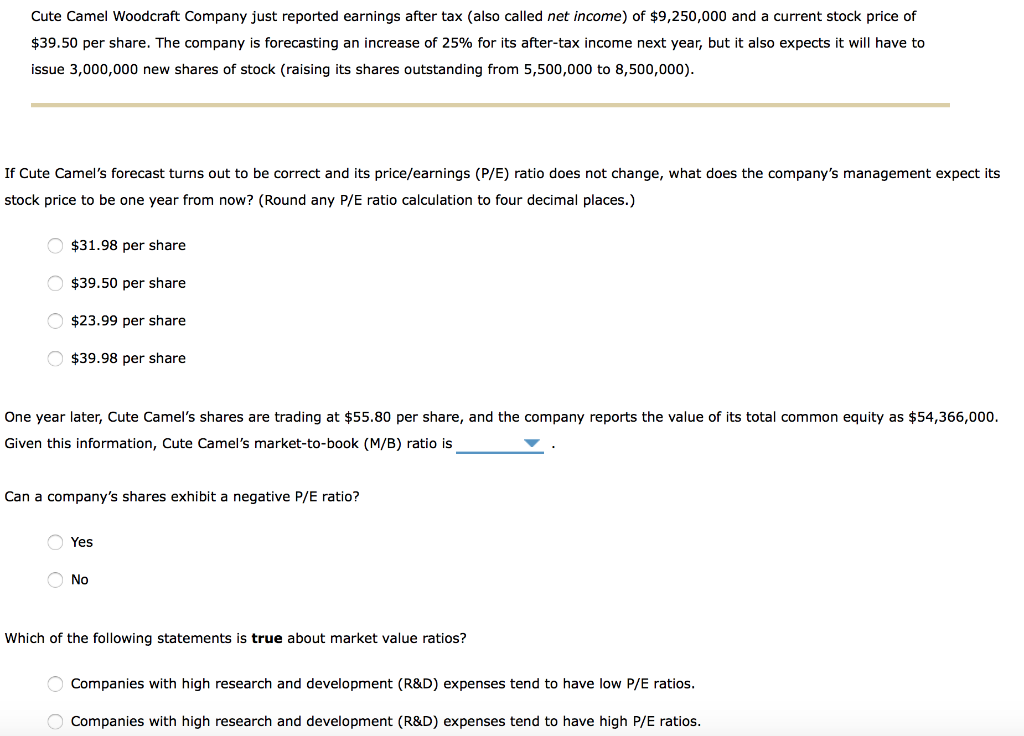

Solved Cute Camel Woodcraft Company Just Reported Earnings Chegg

https://media.cheggcdn.com/media/8cf/8cfe182a-5a10-4f7a-8da0-f1913e8c100d/php1SuZvb

What Is A Statement Of Retained Earnings Business Overview

https://www.patriotsoftware.com/wp-content/uploads/2020/01/statement-of-retained-earnings-visual-1-scaled.jpg

The standard deduction reduces your taxable income which reduces the amount of tax you owe Once you have provided all the inputs the paycheck tax calculator will calculate your gross pay tax deductions and net pay The net pay is the amount you will take home after taxes A Salary Calculator Post Tax helps employees estimate their net income after deducting taxes and other mandatory contributions It considers various factors like income tax social security contributions and other deductions to provide an accurate picture of take home pay This tool is essential for financial planning budgeting and

[desc-10] [desc-11]

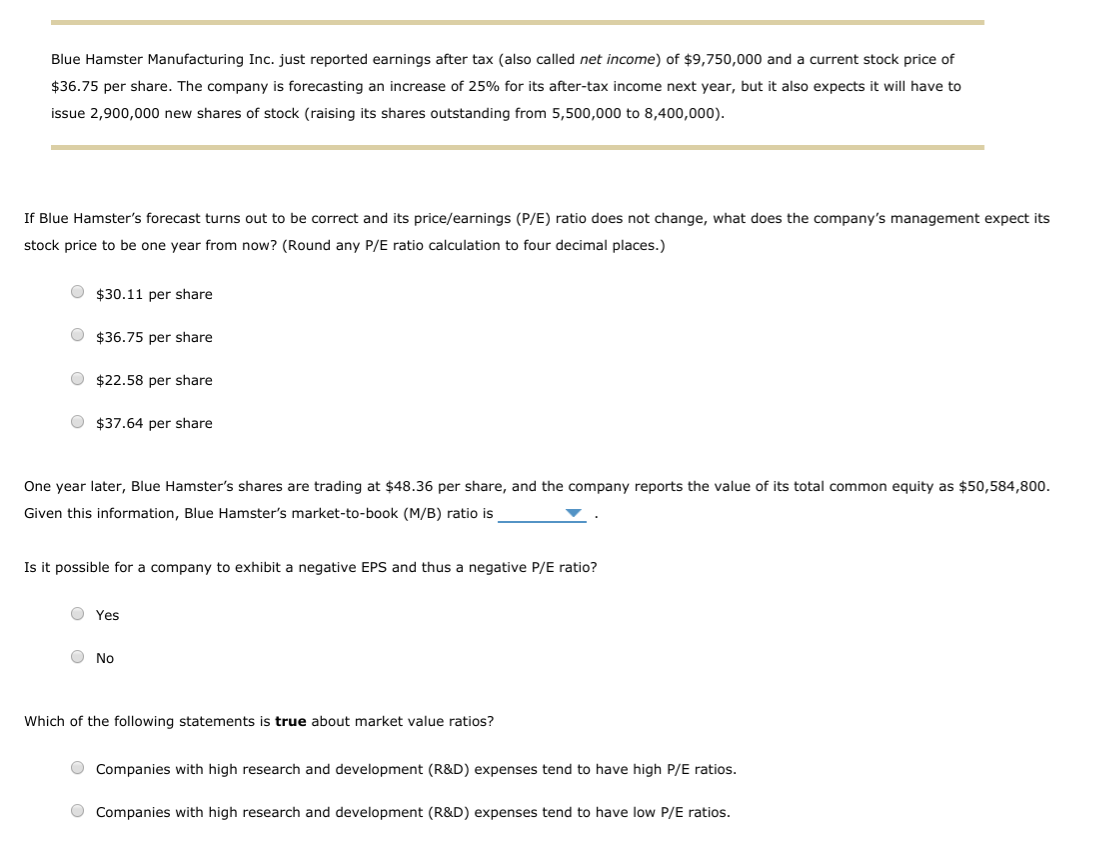

Solved Blue Hamster Manufacturing Inc Just Reported Chegg

https://media.cheggcdn.com/media/00e/00ee1f41-26b5-4852-86bd-5e4e8fbabb42/php4CD663.png

CSM Machine Shop Is Considering A Four year Project To Improve Its

https://img.homeworklib.com/questions/fbac3fa0-722d-11ea-ac1a-59ffdd721c5b.png?x-oss-process=image/resize,w_560

Is Net Earnings After Tax - [desc-14]