Is It Illegal To File Your Own Taxes The Failure to File penalty is 5 of your unpaid taxes for any month or part of a month that a tax return was late The total penalty can t exceed 25 of your unpaid tax bill The failure to pay penalty is only 0 5 of your unpaid tax bill for each month not to exceed 25 If both the Failure to File and failure to pay penalties apply to the

What Happens If You Don t File Taxes or File Taxes Late The failure to file penalty is usually 5 of the tax owed for each month your return is overdue up to 25 of the bill Updated May 20 However generally here are 13 things your boss can t legally do Ask prohibited questions on job applications Require employees to sign broad noncompete agreements Forbid you from discussing

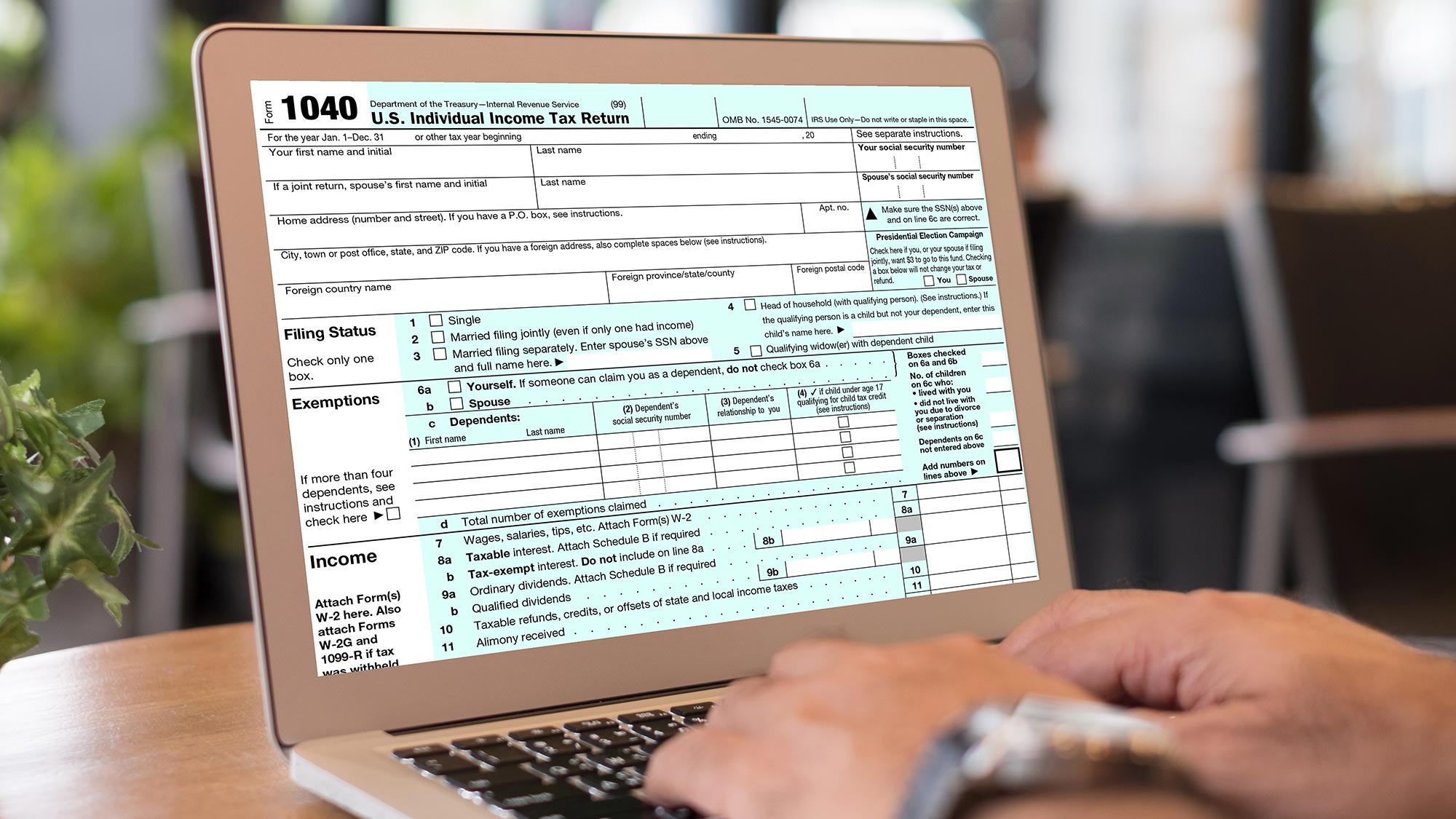

Is It Illegal To File Your Own Taxes

Is It Illegal To File Your Own Taxes

https://lawstuffexplained.com/wp-content/uploads/2022/08/Is-It-Illegal-To-Hit-a-Girl.png

Is It Illegal To Name Your Child God United States Law Stuff Explained

https://lawstuffexplained.com/wp-content/uploads/2022/08/Is-It-Illegal-To-Name-Your-Child-God.png

Expats Guide On How To File Your Own Taxes Expat US Tax

https://www.expatustax.com/wp-content/uploads/2021/07/First-Time-Filer-compressed.jpg

Failing to pay is usually a lot less expensive than paying the penalty for failing to file 0 5 of the unpaid taxes for each month or part of a month the tax remains unpaid The IRS won t typically assess a late payment penalty of more than 25 of your unpaid taxes plus interest If you incur both penalties in the same month the IRS will The claim There are no laws requiring American citizens to pay income taxes As the end of the tax year nears some social media users are sharing a video that claims Americans have no legal

That means you could be facing both penalties If both apply the combined penalty is 5 4 5 late filing and 0 5 late payment for each month or partial month up to 25 After five months the Failure to File Penalty will max out but the Failure to Pay Penalty keeps going until the tax is paid up to 25 The maximum total penalty for both However owing tax and having a filing requirement are two separate situations in the IRS eyes The IRS has restrictive guidelines for determining who needs to file which means even if you don t owe you may still have to submit a return These restrictions are based on the amount and type of income you receive and whether automatic

More picture related to Is It Illegal To File Your Own Taxes

Doing Your Own Taxes Make Sure You Follow These 15 Tips Tips

https://i.pinimg.com/originals/74/0d/8b/740d8b5514bc1a330a41b12b38f1d27e.jpg

Is It Illegal To Post Screenshots Of Conversations Law Stuff Explained

https://lawstuffexplained.com/wp-content/uploads/2022/08/Is-It-Illegal-To-Post-Screenshots-of-Conversations.png

How To File Your Taxes Online Tom s Guide

https://cdn.mos.cms.futurecdn.net/FYmrX62zWPRUkorKLQnKx5.jpg

Filing a tax return late may bring risks that go beyond missing out on an unclaimed tax refund Here are three of them 1 Failure To File Penalty If you don t file your tax return in a timely The failure to file penalty will max out after five months After 60 days you ll owe a minimum Failure to File Penalty of 435 or 100 of the tax required to be shown on the return whichever

1 1 250 or 2 earned income up to 13 450 plus 400 And if you are married under age 65 are not blind and are claimed as a dependent on another taxpayer s return you will need to file if Your unearned income money from dividends or interest is more than 1 250 or Your earned income like wages is more than 27 700 or An IRS study showed 53 of all taxpayers in 2021 used a paid tax professional but Gen Z was significantly less likely to than any other age group Thirty three percent of people 18 to 24 used a

Is It Illegal To Quit On The Spot Law Stuff Explained

https://lawstuffexplained.com/wp-content/uploads/2022/08/Is-It-Illegal-To-Quit-On-the-Spot-1024x1024.png

How To File Your Own IRS 2290 Highway Use Tax Step By Step

https://i.ytimg.com/vi/yxnhoM6Zb-s/maxresdefault.jpg

Is It Illegal To File Your Own Taxes - In one of its provisions the bill makes it illegal for the IRS to create its own online system of tax filing Companies like Intuit the maker of TurboTax and H R Block have lobbied for years to