Is 70 000 A Good Salary In Texas Living Wage Calculation for Texas The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family The assumption is the sole provider is working full time 2080 hours per year The tool provides information for individuals and households with one or two working adults and zero

If you make 70 000 a year living in the region of Texas USA you will be taxed 13 523 That means that your net pay will be 56 477 per year or 4 706 per month Your average tax rate is 19 3 and your marginal tax rate is 29 7 This marginal tax rate means that your immediate additional income will be taxed at this rate A 70 000 Salary Is Enough for Emotional Wellbeing Research Shows Is 70K a good salary Find out how 70 000 compares to the median yearly earnings of U S workers and how cost of living affects

Is 70 000 A Good Salary In Texas

Is 70 000 A Good Salary In Texas

https://image.cnbcfm.com/api/v1/image/105915436-1557951069433familyof4livingwage.png?v=1557951143

Median household income in every US state from the Census Bureau

https://image.cnbcfm.com/api/v1/image/105611572-1544212982611medianhouseholdincomebystate.png?v=1544213313&w=1920&h=1080

70000 a Year Is How Much an Hour? Full Financial Analysis » Savoteur

https://savoteur.com/wp-content/uploads/2022/04/pexels-rfstudio-3810788.jpg

Fifty percent of American households earn less than 75 000 per year Just 37 of American households earn more than 100 000 Average U S income versus average U S salary The graphic below illustrates common salary deductions in Texas for a 70k Salary and the actual percentages deducted when factoring in personal allowances and tax thresholds for 2024 You can find the full details on how these figures are calculated for a 70k annual salary in 2024 below 10 34 7 241 00 Income Tax 7 65 5 355 00

Texas Income Tax Calculator 2022 2023 Learn More On TurboTax s Website If you make 70 000 a year living in Texas you will be taxed 8 168 Your average tax rate is 11 67 and your marginal tax Average Salary In Texas Per Hour Breaking down the average 57 300 salary you ll find that the hourly rate is 27 55 This is lower than the national average of 33 74 but again we must consider the lack of income tax Furthermore salaries are on the increase in Texas all around the state

More picture related to Is 70 000 A Good Salary In Texas

Tech professionals make up to 85% more than state averages in other industries | TechRepublic

https://www.techrepublic.com/wp-content/uploads/2021/07/best-paying-states.jpg

What is a good salary in Dallas, TX? - Zippia

https://static.zippia.com/answer-images/what-is-a-good-salary-in-dallas-tx.png

$70,000 a Year Is How Much an Hour in the US? | GOBankingRates

https://cdn.gobankingrates.com/wp-content/uploads/2019/09/middle-aged-office-leader-giving-presentation-iStock-1059661386.jpg

Texas Paycheck Quick Facts Texas income tax rate 67 404 U S Census Bureau Number of cities that have local income taxes Your hourly wage or annual salary can t give a perfect indication of how much you ll see in your paychecks each year because your employer also withholds taxes from your pay You and your employer will each contribute 6 After entering it into the calculator it will perform the following calculations Federal Tax Filing 70 000 00 of earnings will result in 7 660 50 of that amount being taxed as federal tax FICA Social Security and Medicare Filing 70 000 00 of earnings will result in 5 355 00 being taxed for FICA purposes Texas State Tax

70 000 00 Salary Income Tax Calculation for Texas This tax calculation produced using the TXS Tax Calculator is for a single filer earning 70 000 00 per year The Texas income tax example and payroll calculations are provided to illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year when filing a tax return in Texas for 70 000 00 with no Many retirees fall far short of that amount though According to data from the BLS average incomes in 2021 after taxes were as follows for older households 65 74 years 59 872 per year or

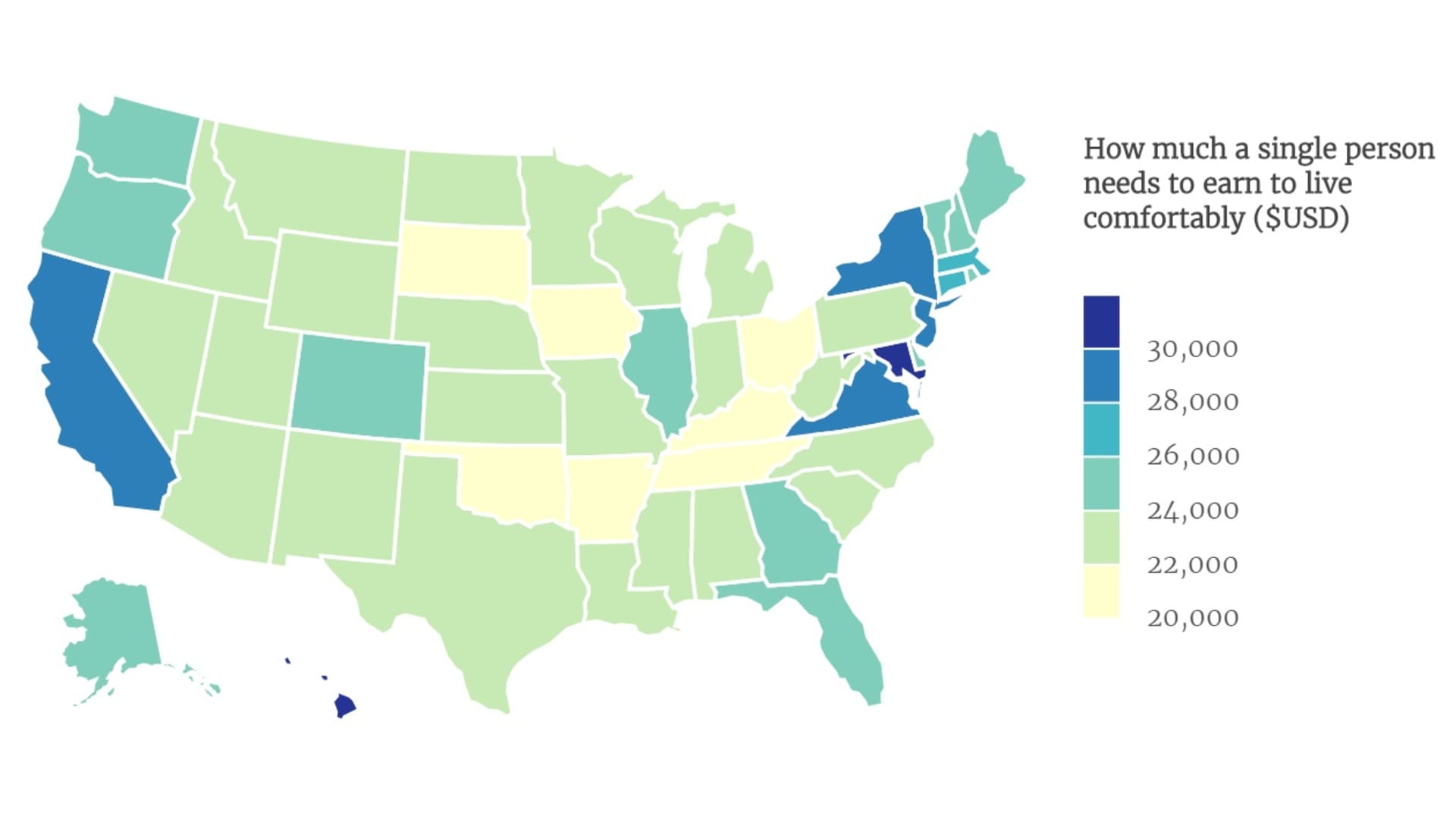

This map shows the living wage for a single person across America

https://image.cnbcfm.com/api/v1/image/105343399-1532101091381howmuchasinglepersonneedstolivecomfortably.jpg?v=1532101236&w=1920&h=1080

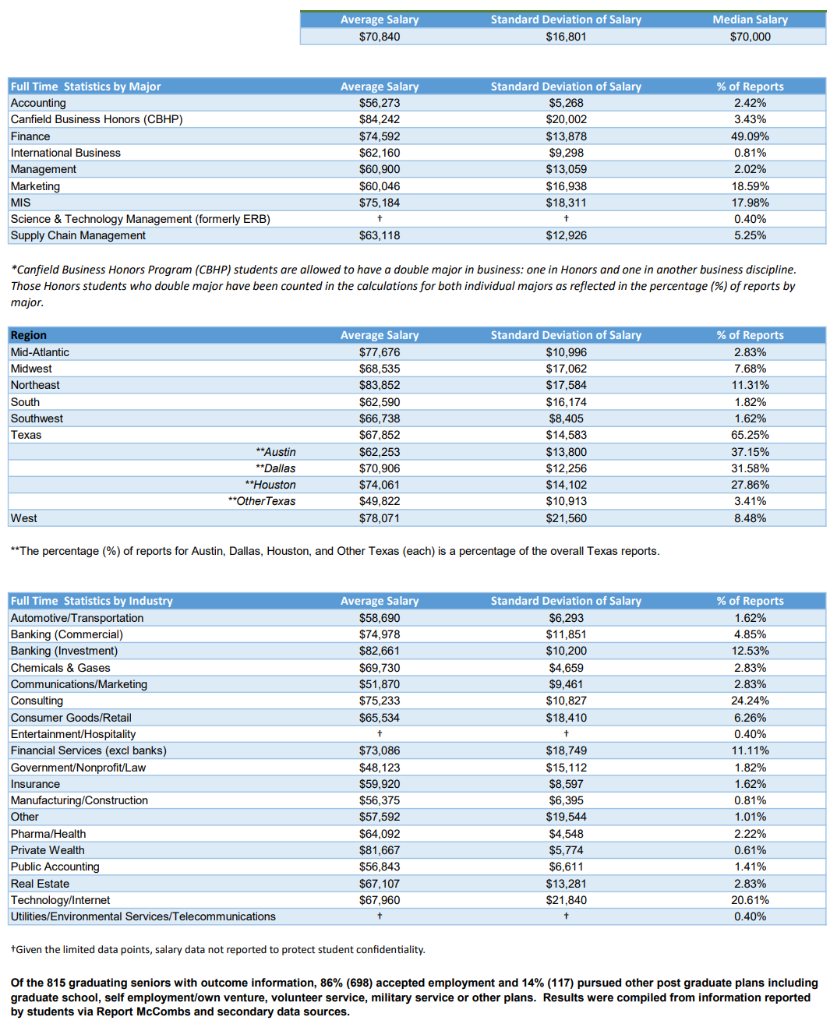

Average Salary $70,840 Standard Deviation of Salary | Chegg.com

https://media.cheggcdn.com/media/98f/98fbae0c-8ab8-4c07-aa90-77a7f0f1ec3d/phpV7ofS9

Is 70 000 A Good Salary In Texas - Texas Income Tax Calculator 2022 2023 Learn More On TurboTax s Website If you make 70 000 a year living in Texas you will be taxed 8 168 Your average tax rate is 11 67 and your marginal tax