If I Make 70000 A Year How Much Is That After Taxes After calculation using ongoing year 2025 data the salary of 70 000 a year is 1 01 times or 1 11 lower than the national median So is 70 000 a year a good salary Based on comparison to the national median and that it is merely below average in our opinion it is a reasonably good salary to get in the United States

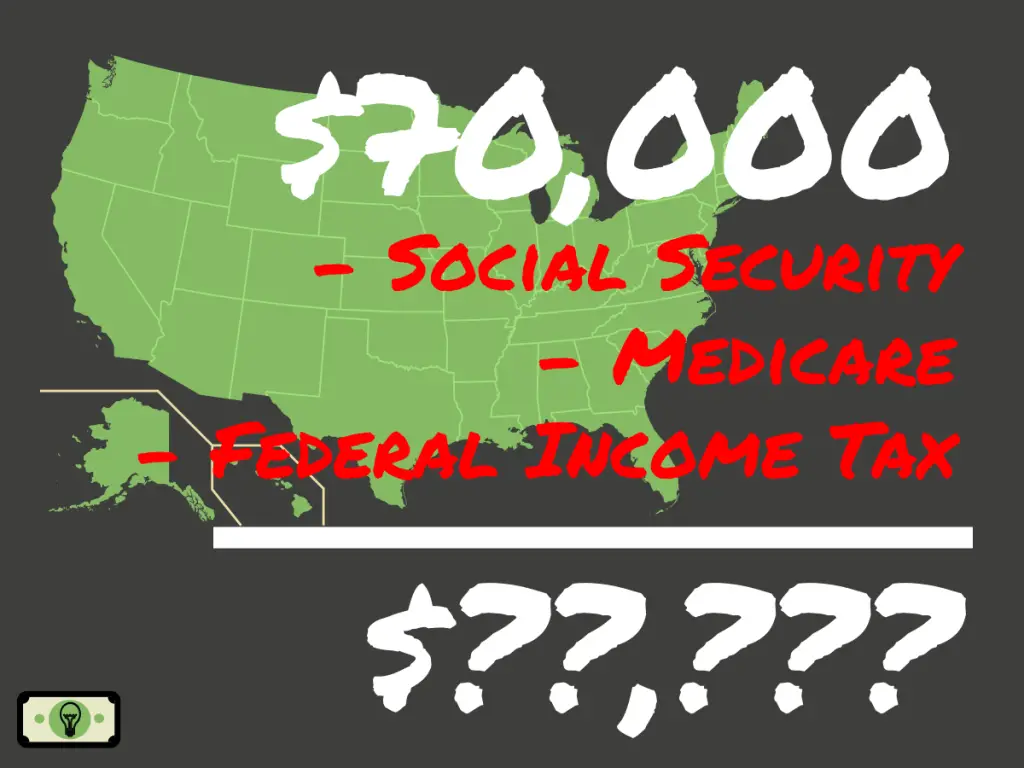

An individual who receives 57 631 00 net salary after taxes is paid 70 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Answer is 36 14 assuming you work roughly 40 hours per week or you may want to know how much 70k a year is per month after taxes Answer is 4 802 58 in this example Some people get monthly paychecks 12 per year while some are paid twice a month on set dates 24 paychecks per year and others are paid bi weekly 26 paychecks per year The frequency of your paychecks will affect their size The more paychecks you get each year the smaller each paycheck is assuming the same salary

If I Make 70000 A Year How Much Is That After Taxes

If I Make 70000 A Year How Much Is That After Taxes

https://www.moneyforthemamas.com/wp-content/uploads/2022/06/50-30-20-budget-breakdown-for-70000-salary.jpg

70k A Year Is How Much An Hour Before After Tax Breakdown

https://www.moneyforthemamas.com/wp-content/uploads/2022/06/what-can-i-afford-on-70000-salary.jpg

70 000 A Year Is How Much An Hour And 6 Tips To Make Save Money

https://radicalfire.com/wp-content/uploads/2022/09/70000-A-Year-Is-How-Much-An-Hour-and-6-Tips-To-Make-Save-Money.jpg

70 000 00 After Tax This income tax calculation for an individual earning a 70 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance California Salary and Tax Illustration If you make 70 000 a year living in the region of Florida USA you will be taxed 13 523 That means that your net pay will be 56 477 per year or 4 706 per month Your average tax rate is 19 3 and your marginal tax rate is 29 7 This marginal tax rate means that your immediate additional income will be taxed at this rate

Paid months per year 12 paid months per year 12 payments per year 26 paid weeks per year 52 paid days per week 5 paid hours per week 40 0 Also on this page This translates to approximately 4 715 per month after taxes and contributions Since salaries can vary significantly across the US we have compiled the average salary for each So if you make 70 000 a year and contribute 5 that means 3 500 annually in workplace retirement plan contributions by you and another 3 500 with your employer match You now have a taxable income of 66 500

More picture related to If I Make 70000 A Year How Much Is That After Taxes

I Make 70000 A Year How Much House Can I Afford Askcorran

https://askcorran.com/wp-content/uploads/2022/05/i-make-70000-a-year-how-much-house-can-i-afford.jpg

How Much Is 70 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-70000-dollars-sm-2-1024x768.png

Income Tax Rates For The Self Employed 2020 2021 TurboTax Canada Tips

https://turbotax.intuit.ca/tips/images/self-employed-taxes-canada.jpg

70 000 a year is 2 692 31 biweekly before taxes and approximately 2 019 23 after taxes Paying a tax rate of 25 and working full time at 40 hours a week you would earn 2 019 23 after taxes To calculate how much you make biweekly before taxes you would multiply the hourly wage for 70 000 a year 33 65 by 80 hours to get 2 692 31 70 000 a year is how much a month after taxes Assuming an annual salary of 70 000 a federal tax rate of 22 and a state tax rate of 4 the estimated monthly take home pay after taxes would be approximately 4 372 67 per month

[desc-10] [desc-11]

How Much Should I Spend On A Car If I Make 70000 A Year YouTube

https://i.ytimg.com/vi/6zCUfmXSdxk/maxresdefault.jpg

70 000 A Year Is How Much An Hour Know Your Annual Salary Story

https://radicalfire.com/wp-content/uploads/2022/09/65000-A-Year-Is-How-Much-An-Hour-Calculate-6-Ways-To-Save.jpg

If I Make 70000 A Year How Much Is That After Taxes - 70 000 00 After Tax This income tax calculation for an individual earning a 70 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance California Salary and Tax Illustration