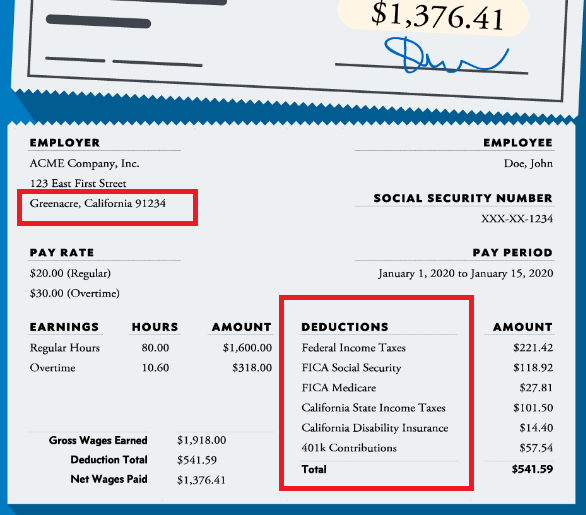

If I Make 60 000 A Year How Much Will My Paychecks Be FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

The Tax Withholding Estimator doesn t ask for personal information such as your name social security number address or bank account numbers We don t save or record the information you enter in the estimator For details on how to protect yourself from scams see Tax Scams Consumer Alerts Check your W 4 tax withholding with the IRS Tax This salary calculator assumes the hourly and daily salary inputs to be unadjusted values All other pay frequency inputs are assumed to be holidays and vacation days adjusted values This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations The unadjusted results ignore the holidays and paid vacation days

If I Make 60 000 A Year How Much Will My Paychecks Be

If I Make 60 000 A Year How Much Will My Paychecks Be

https://youngandtheinvested.com/wp-content/uploads/40000-a-year-is-how-much-an-hour.webp

How Is The World Going To Get To A Net Zero Economy Asia Rising

https://i0.wp.com/asiarisingtv.com/wp-content/uploads/2022/10/getty-images-Wxs-wLBz4hQ-unsplash-scaled.jpg?resize=2000%2C1440&ssl=1

50 An Hour Is How Much A Year Am I Rich What You Need To Know

https://www.moneyforthemamas.com/wp-content/uploads/2022/06/afford-on-50-an-hour-pay.jpg

For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with 6000 372 87 5541 In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

For this purpose let s assume some numbers the annual salary in our case is 50 000 and we work 40 hours per week Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 24 04 per hour Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours per week 28 85 Weekly paycheck to hourly rate Much more To calculate the biweekly salary simply input the annual hourly There are 26 biweekly pay periods in a year as a year has 52 weeks and biweekly payments occur every two weeks 52 2 26 The only exception is leap years whose January 1 falls on Thursday like 2032 or Friday like 2044 Those years can have 27 biweekly pay

More picture related to If I Make 60 000 A Year How Much Will My Paychecks Be

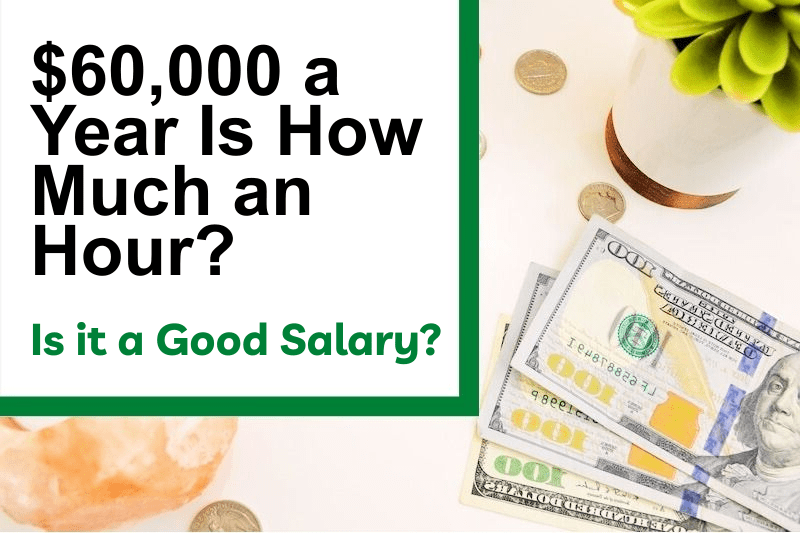

60 000 A Year Is How Much An Hour Is It A Good Salary

https://www.pineapplemoney.com/img/60000-a-year-is-how-much-an-hour.jpg#header-image

60000 A Year Is How Much An Hour Good Salary Or Not Money Bliss

https://moneybliss.org/wp-content/uploads/2021/05/60000-a-year.jpg

How Much Money Do Investors Make Modulartz

https://i.pinimg.com/originals/4e/1c/52/4e1c52431e395272f74d0775ad3e9fae.png

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator A typical working year is 260 days 260 working days are equal to 52 working weeks I Our today s question is 25 an hour is how much a year not adjusted for holidays and vacation In this case your hourly pay is 25 dollars You worked 25 hours per week for 5 days per week We re going to use equations typical for all hourly to salary

There s a wage base limit on Social Security taxes but at 127 200 the amount for 2017 is well into the high income category With current taxes of 6 2 going to Social Security you ll have 2014 52 005 2013 56 567 2012 50 015 Michigan collects a state income tax and in some cities there is a local income tax too As with federal taxes your employer withholds money from each of your paychecks to put toward your Michigan income taxes

How Much Are Paycheck Tax Deductions In California Unemployment Gov

https://unemployment-gov.us/wp-content/uploads/2022/02/paycheck-deductions-in-california.png

60 000 A Year Is How Much An Hour

https://www.savvyhoney.com/wp-content/uploads/2022/05/60000-a-year-is-how-much-an-hour.jpg

If I Make 60 000 A Year How Much Will My Paychecks Be - 2014 46 784 2013 46 337 2012 41 553 Every taxpayer in North Carolina will pay 4 75 of their taxable income in state taxes North Carolina has not always had a flat income tax rate though In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes