How To Work Out Your Annual Income Uk You can use the following formula to calculate the net annual income net annual income 25 per hour 2 000 hours 8 000 in taxes net annual income 50 000 8 000 net annual income 42 000 Your annual income is also different from your adjusted gross income and modified adjusted gross income which is the pre tax income

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2024 to 5 April 2025 This tells you your take home pay if you do not have The Salary Calculator has been updated with the latest tax rates which take effect from April 2024 Try out the take home calculator choose the 2024 25 tax year and see how it affects your take home pay If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by

How To Work Out Your Annual Income Uk

How To Work Out Your Annual Income Uk

https://www.wikihow.com/images/7/7e/Calculate-Annual-Salary-from-Hourly-Wage-Step-10.jpg

How To Calculate Net Income 12 Steps with Pictures WikiHow

http://www.wikihow.com/images/7/74/Calculate-Net-Income-Step-12-Version-2.jpg

How To Work Out Your Calories Hodgson Health

https://hodgsonhealth.com/wp-content/uploads/2017/09/Working-out-your-calories.jpeg

There are six main steps to work out your final paycheck Step 1 Gross income First we need to determine your gross income If you are salaried your annual salary will be your gross income If you are paid hourly you must multiple the hours days and weeks The following is the formula for both cases Annual salary Annual salary Find out the benefit of that overtime Enter the number of hours and the rate at which you will get paid For example for 5 hours a month at time and a half enter 5 1 5 There are two options in case you have two different overtime rates To keep the calculations simple overtime rates are based on a normal week of 37 5 hours

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major Understanding how your annual income is calculated is key to knowing your overall financial health and how to plan for your future The amount you can save invest and spend comes from understanding your annual income For example if you make 200 per day and work 200 days per year your annual income would be 200 x 200 40 000

More picture related to How To Work Out Your Annual Income Uk

Annual Income Calculator Ghepard Diplom Filtru

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/07/11073323/Annual-Income-Calculator.jpg

How To Work Out Your Day Rate Ellwood Atfield

https://www.ellwoodatfield.com/wp-content/uploads/2017/08/how-to-figure-out-your-day-rat-1.jpg

3 Ways To Calculate Your Real Hourly Wage WikiHow

https://www.wikihow.com/images/f/f7/Calculate-Your-Real-Hourly-Wage-Step-13.jpg

Personal Allowance is an amount of money you re allowed to earn each year without having to pay income tax on it You can used this allowance for your salary savings interests dividends and other income For the 2024 25 tax year the Personal Allowance is set at 12 570 If you earn less than this amount you typically won t owe any Income Tax You work 50 hours per week some say a little bit too much and currently earn 35 000 monthly Similarly if your annual salary is 12 000 a 10 annual raise represents 1 200 a year or 100 a month dividing your new 1 200 raise by the 12 months contained in a year Check out 44 similar tax and salary calculators

For example if you are earning an annual income of 30 000 and you have a Personal Allowance of 12 570 per year then 30 000 minus the 12 570 is a total of 17 430 The 17 430 is the only money that will be taxed and will be taken as a percentage If your salary is 45 000 a year you ll take home 2 851 every month You ll pay 6 486 in tax 4 297 in National Insurance and your yearly take home will be 34 217 Your gross hourly rate will be 21 63 if you re working 40 hours per week Please see the table below for a more detailed break down Salary

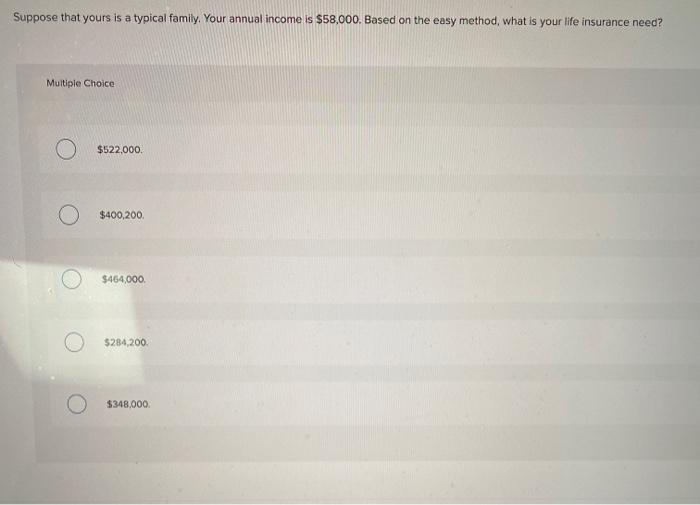

Solved Suppose That Yours Is A Typical Family Your Annual Chegg

https://media.cheggcdn.com/study/49f/49f4d517-95d8-4a13-820f-c7bf338d9bcf/image

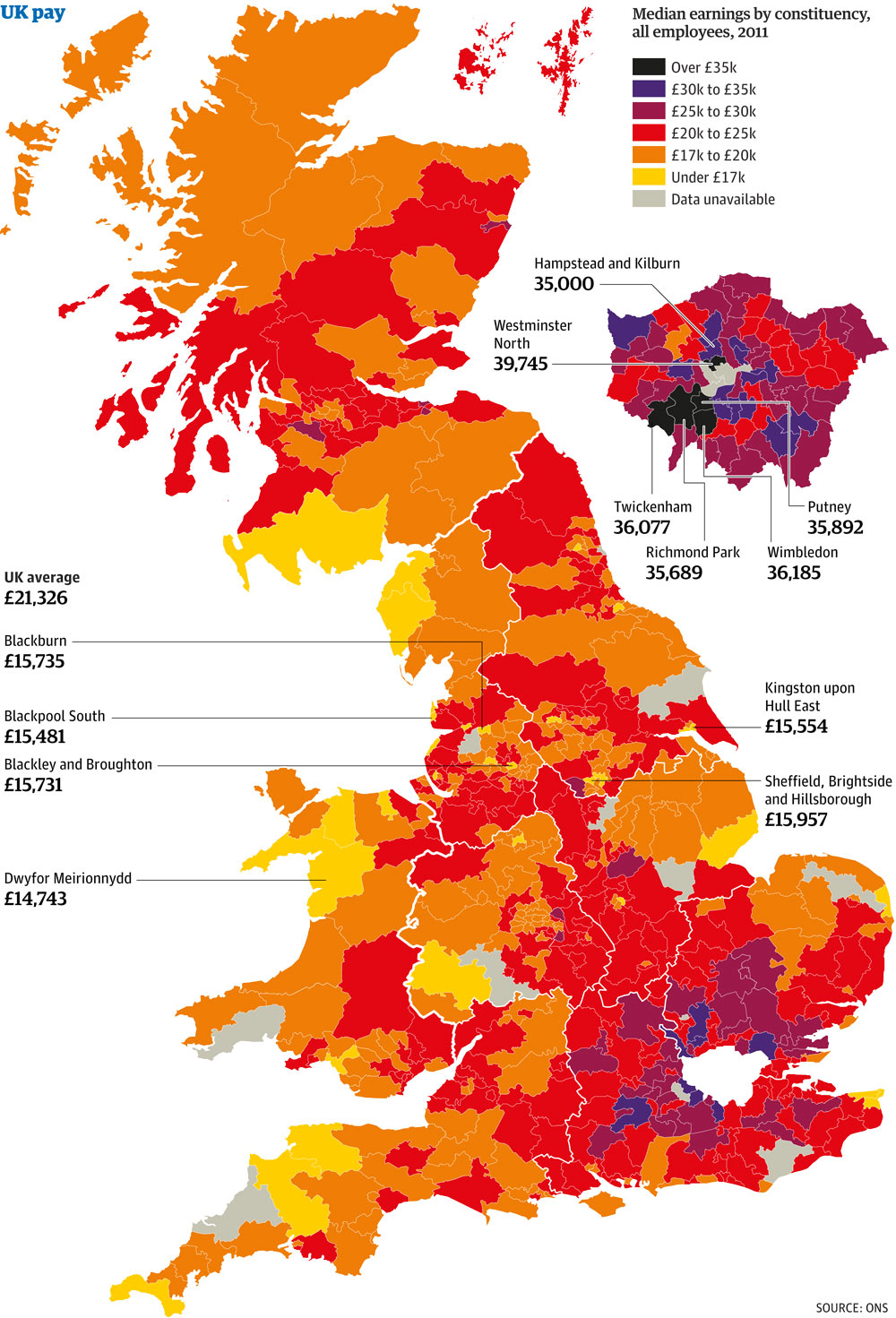

Wages Throughout The Country How Does Your Area Compare News

https://static-secure.guim.co.uk/sys-images/Guardian/Pix/pictures/2011/11/24/1322127188757/Heat-map-wages-002.jpg

How To Work Out Your Annual Income Uk - Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major