How To Use Excel For Business Expenses Method 1 Using a Template to Keep Track of Small Business Expenses in Excel Excel offers numerous templates for financial related tasks including for expense tracking In an Excel workbook go to File New Type Expense Tracker in the Search Bar Then select a template that fits your need

This formula will divide the Total Expense by the Total Income and then multiply it by 100 to return the Expense Percentage as result Press ENTER to return the Expense Percentage Now we insert a graph for Total Income and Total Expense Select the rows to graph Here Total Income and Total Expense Go to the Insert tab Select Column or Bar Chart Select the type of chart Related Get a Free Business Expenses Spreadsheet Benefits of Using an Excel Expense Template Using an expense tracking template in Excel has been a game changer for managing my business finances Here are some of the benefits I experienced Easy Expense Tracking Using an expense tracking Excel template has simplified my expense tracking

How To Use Excel For Business Expenses

How To Use Excel For Business Expenses

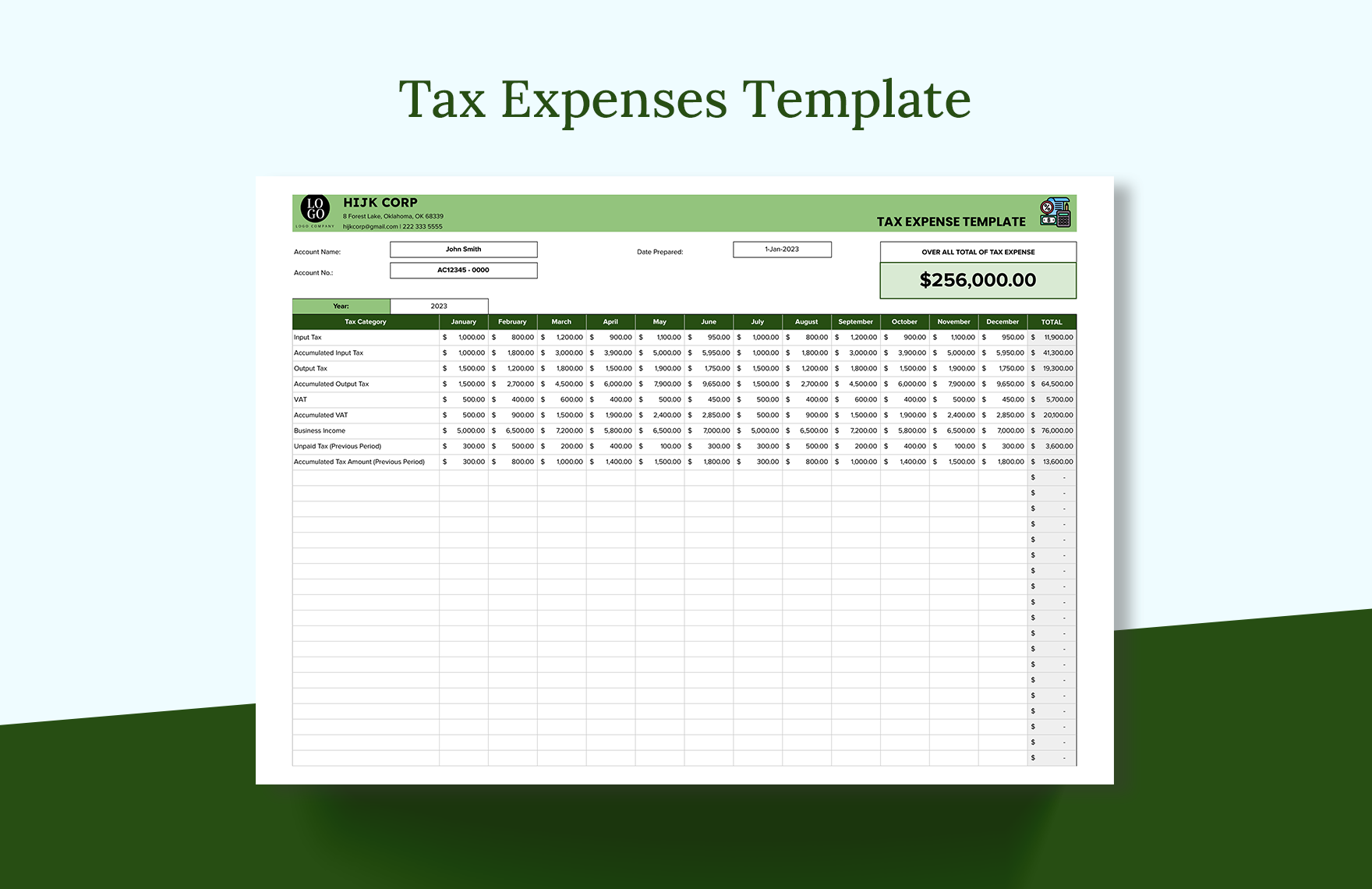

https://images.template.net/136131/tax--expenses-template-lcwmc.png

Free Excel Expense Report Templates Smartsheet EroFound

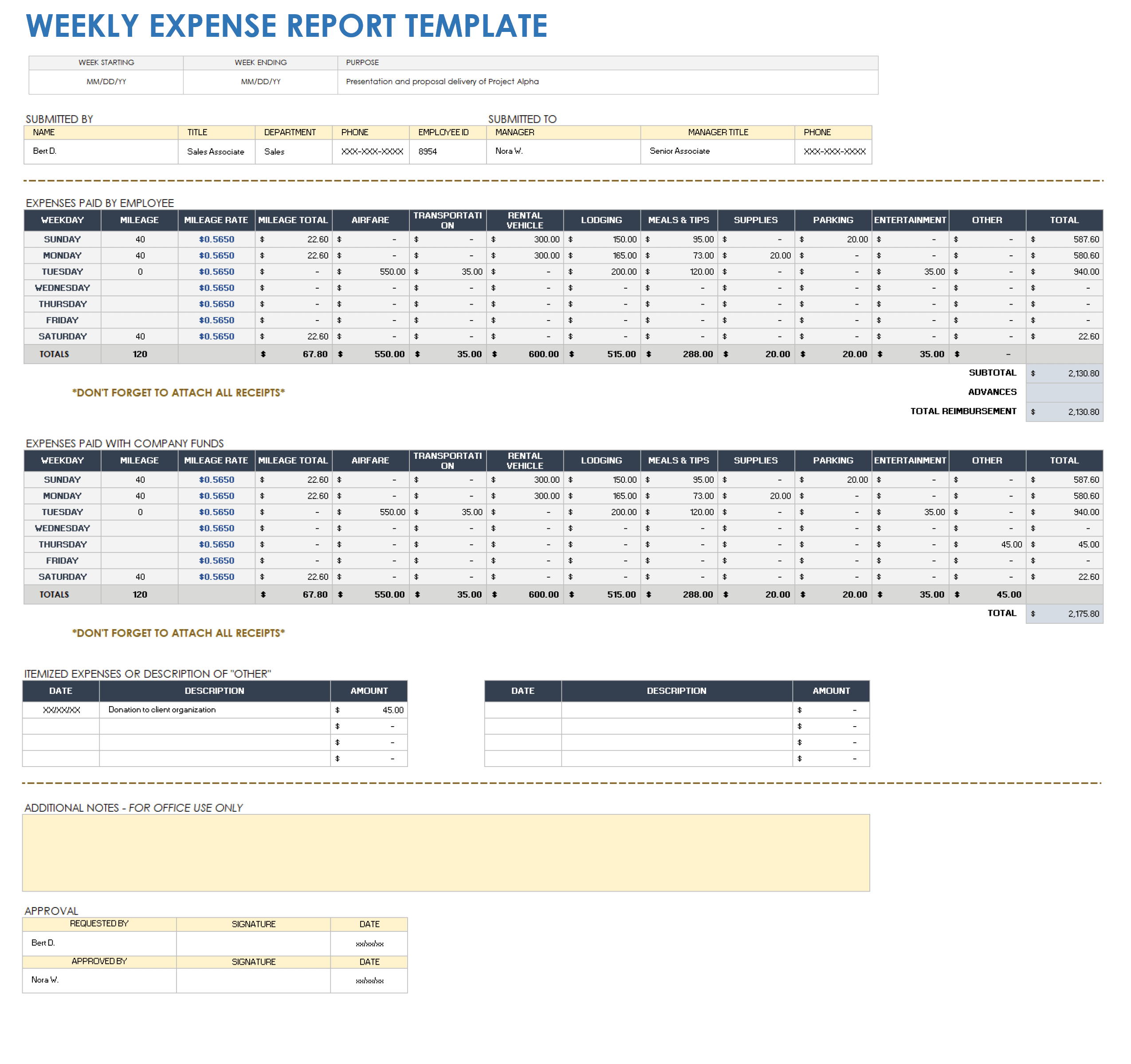

https://www.smartsheet.com/sites/default/files/2022-12/IC-Weekly-Expense-Report-Template.png

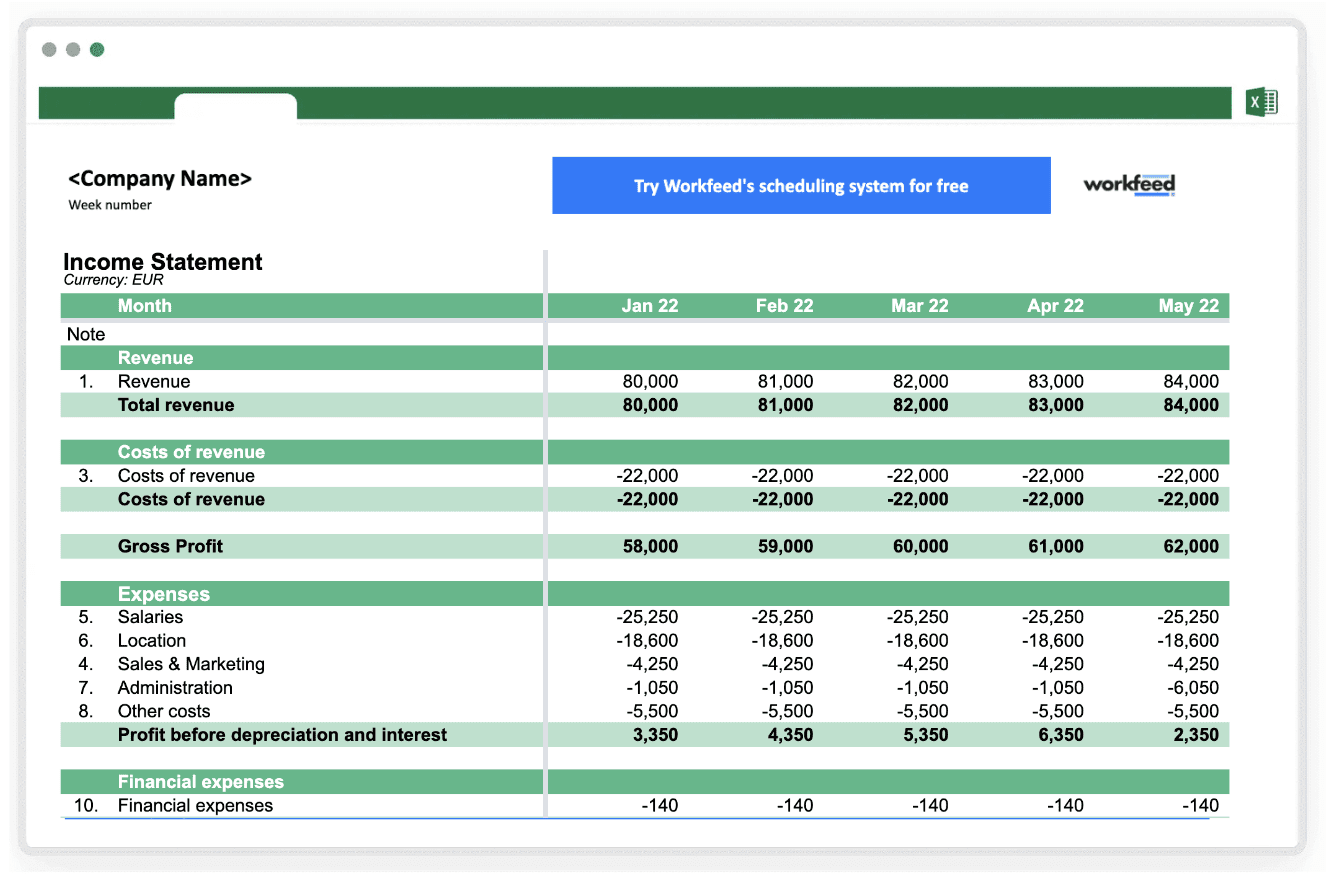

Free Excel Business Budget Template Workfeed

https://workfeed.io/wp-content/uploads/2022/09/free-excel-business-budget-template.png

Business expenses to consider for your monthly tracker If you own a small business you ll have expenses in different categories to track Some of the most common categories for business expenses include Supplier costs Work travel broken down to lodging meals etc Office supplies Workplace rent Employee insurance and benefits This Excel expense template helps me keep track of all my expenses in one place Every time I make a purchase I enter it into the sheet right away This Excel expense tracker helps me stay organized and ensures that I don t forget any expenses I use a pivot table to analyze all my expenses easily

Advantages of Using Expense Reports Using an expense report offers several advantages Expense Tracking It helps you keep track of expenses making cost control more efficient Budget Information Provides valuable data for creating and managing budgets Tax Compliance Simplifies tax payments and deductions Step By Step Tutorial for Tracking Business Expenses and Income in Excel In this section we will walk you through how to set up an Excel spreadsheet to track your business expenses and income This guide will help you create categories input data and generate reports to monitor your financial status efficiently Step 1 Open a New Excel

More picture related to How To Use Excel For Business Expenses

EXCEL Of Income And Expense xlsx WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20190826/42c4673e960f4a78ae730ac669615eab.jpg

Travel Expense Claim Form Excel Template Infoupdate

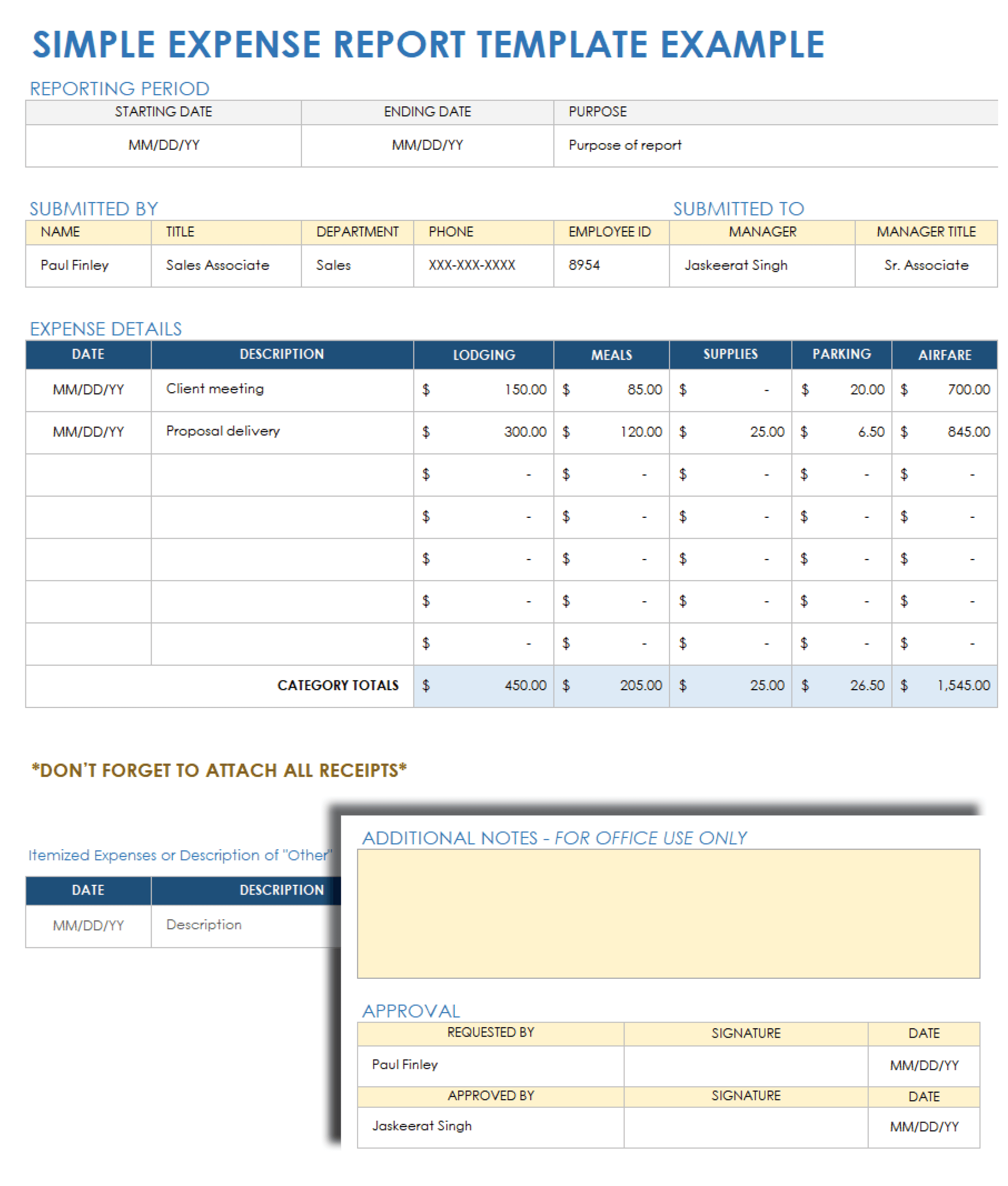

https://www.smartsheet.com/sites/default/files/2022-12/IC-Simple-Expense-Report-Template-Example.png

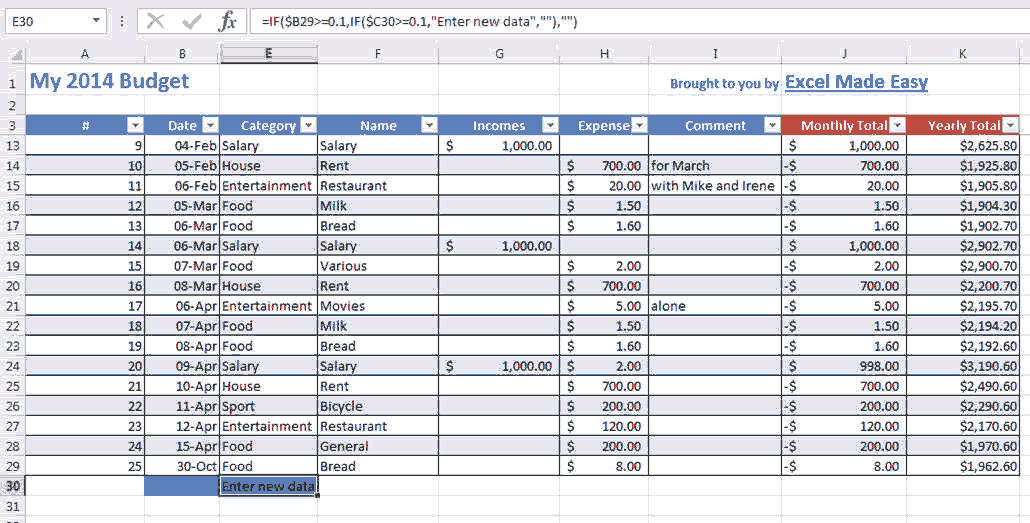

Excel Budget Template By ExcelMadeEasy

https://www.excelmadeeasy.com/images/image-excel-budget-template-img124.png

This formula sums up all total costs to display the final expense amount Use AutoFill to apply formulas to multiple rows quickly Step 4 Analyze Cost Data Using Excel Tools Create a Cost Breakdown Chart To visualize costs Select your cost categories and total cost column Click on Insert Chart Pie Chart or Bar Chart Why Use a Dynamic Budget Tracker in Excel A dynamic budget tracker in Excel offers Automated Data Import Pull transactions directly from bank statements using Power Query Real Time Dashboards Track income expenses and net balance visually Customizable Categories Adapt to personal or business needs

[desc-10] [desc-11]

Deductions For Business Expenses 2025 Emi Dehorst

https://www.financialdesignsinc.com/wp-content/uploads/2020/11/Expenses-1.jpg

Reimbursement Template Excel

https://newdocer.cache.wpscdn.com/photo/20191105/617f684f72de4404adc1142ae6365ee3.jpg

How To Use Excel For Business Expenses - [desc-14]