How To Repay Salary Advance The employees then repay the advance out of their next paycheck or in installments over several paychecks A payroll advance is sometimes known as a salary advance although it is not necessarily limited to only those who earn salaries You and the employee will agree to terms including the amount of the loan when repayment is due and the

Here is an example of a salary advance request letter you can use to help you write your own Dear Mr Grant I am writing to request a 750 salary advance on my November 15 paycheck please My sister in law passed away yesterday and I need the funds to buy last minute cross country airplane tickets If you choose to allow advances however you need to follow some basic rules when it comes to getting your money back Under federal law you may deduct an advance from your employee s paycheck However you may not deduct so much that it reduces your employee s pay to less than the hourly minimum wage 7 25 currently

How To Repay Salary Advance

How To Repay Salary Advance

https://discuss.erpnext.com/uploads/default/original/3X/6/2/62648d3c0e709b26b62f9ed7c6904f80aeed3029.png

Family Bank Limited On Twitter Curious About How To Repay Your Salary Advance It s Really

https://pbs.twimg.com/media/FlLSwtsaUAAns6q.jpg

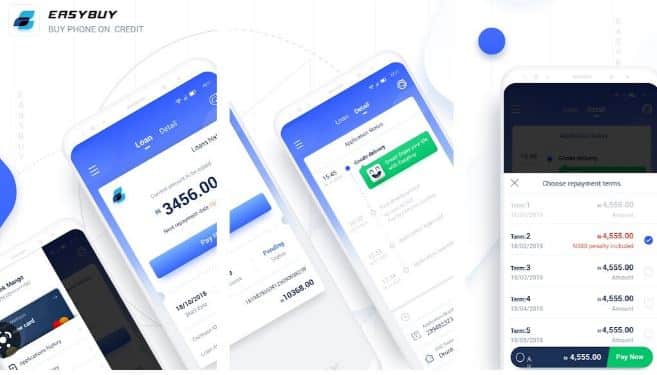

Easybuy Loans Nigeria How To Buy Repay And Join Their VIP

https://advancefinancialtips.com/wp-content/uploads/2023/01/Easybuy-Loans-Nigeria-app-image.jpg

A salary advance is when an employer agrees to let a worker borrow against their future earnings to cover a one time emergency How Salary Advances Work Not all employers offer salary advances and those that do typically have restrictions in place An employee who wants a salary advance should first research the company policies since there A payroll advance is a financial agreement between you and an employee The terms of a payroll advance vary but you essentially grant the employee early access to wages sometimes weeks ahead of time through a short term loan They later repay the loan with future wages earned according to the advance agreement

Employee must repay the advance through payroll deduction over a maximum of 14 pay periods although partial or lump sum repayment may be accepted at any time Purpose An advance in pay for relocating employees is intended to help defray extra out of pocket expenses associated with moving between duty stations in the U S and its territories Select Cash Advance Repayment for the Type Enter a description and then click OK Next assign the cash advance repayment deduction to your employees From the left menu go to the Workers tab Under the Employee list click the employee s name Click the Edit pencil icon in the Pay section

More picture related to How To Repay Salary Advance

How Long Do Your Advance Take To Repay You Simply Pay Back A Small Pre agreed Portion Of Your

https://i.pinimg.com/originals/c5/cb/0d/c5cb0d2261065098a5f07197d77d1797.jpg

Putting Out Fires The 13th Fire And Rescue Sports Championship Middle East Monitor

https://i1.wp.com/www.middleeastmonitor.com/wp-content/uploads/2017/09/20170929_2_26012527_26334348.jpg?quality=75&strip=all&ssl=1

Business Templates And Project Managment Software Excel Templates For Salary Advance

https://1.bp.blogspot.com/-InYjktiLTOk/VycFU67Q9aI/AAAAAAAAAtg/84_vkzRSaaMFcr17BqODNMEMKToPlngwACLcB/s1600/Excel%2BTemplates%2BFor%2BSalary%2BAdvance.jpg

If you choose to write and print a check make sure to select the account where the advance payroll item is tracked Then when you create a repayment paycheck the amount will be deducted from the account used to provide the advance Method 2 Pay through payroll Step 1 Set up an advance payroll item Go to Lists then Payroll Item List A salary advance involves getting a portion of the salary or the full salary as an advance in times of need However in case of an advance to employee the amount is treated as an asset in the company s books The advance repayment entry is made by crediting the employee s advance account and debiting the company s bank or cash account

I agree to repay this advance as follows select one One lump sum payroll deduction to be made from my wages salary on the first pay period immediately following the pay period from which The employee shall repay the entire amount of the hardship advance within the same pay period In the event the full pay warrant is released to the employee without clearing this advance the entire amount will be collected by payroll deduction from the employees next applicable salary warrant according to Government Code section 19838

HOW TO REPAY Q4 2021 ERC ADVANCE PAYMENTS Westfair Communications

https://westfaironline.com/wp-content/uploads/2022/02/money.jpg

Letter Of Recommendation For Advance Salary SemiOffice Com

https://i0.wp.com/semioffice.com/wp-content/uploads/2021/12/Sample-Letter-of-Recommendation-by-the-Manager-for-Advance-Salary.png?resize=1152%2C1536&ssl=1

How To Repay Salary Advance - Select Cash Advance Repayment for the Type Enter a description and then click OK Next assign the cash advance repayment deduction to your employees From the left menu go to the Workers tab Under the Employee list click the employee s name Click the Edit pencil icon in the Pay section