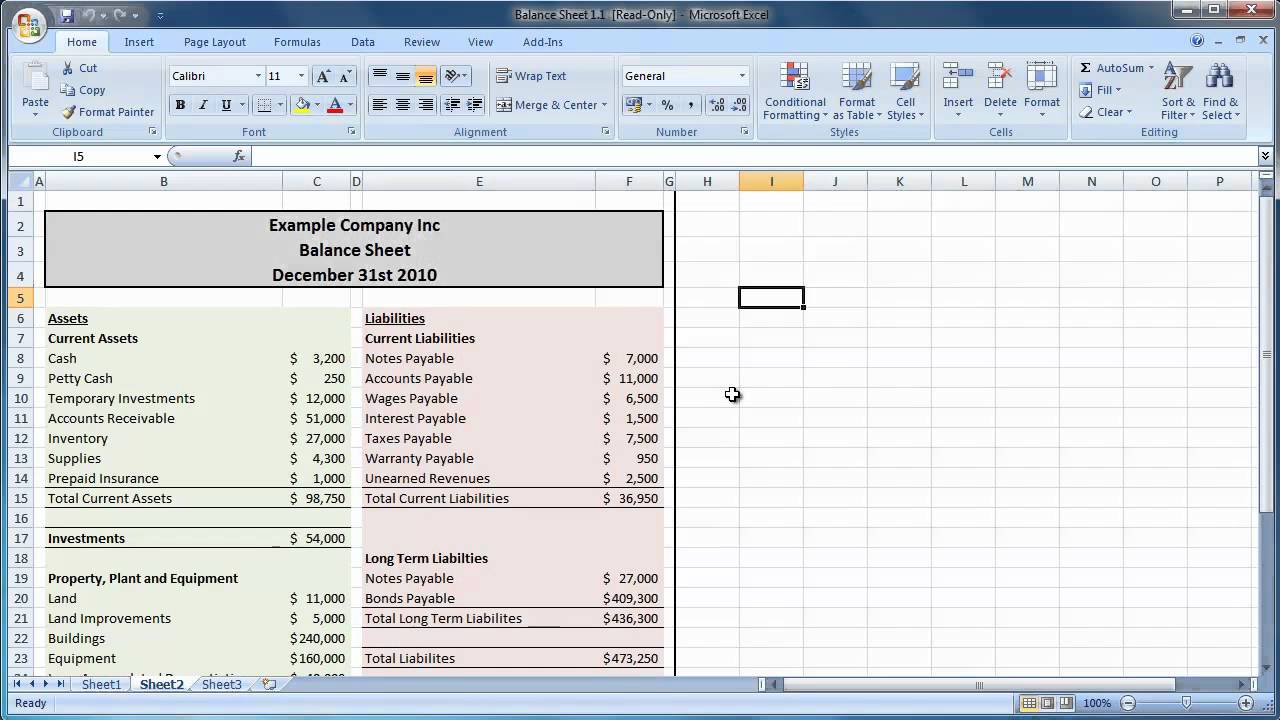

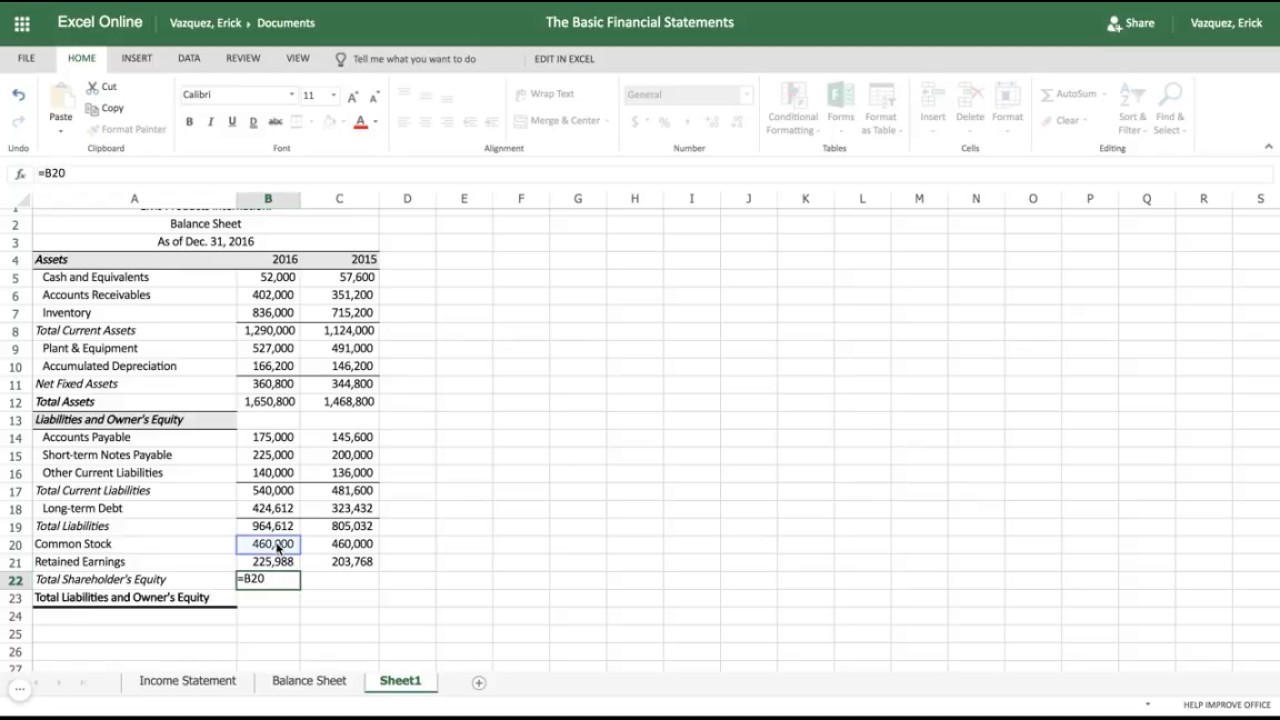

How To Prepare Balance Sheet In Excel For Income Tax Return Step 2 Create the Income Statement Sheet Part 1 Calculate Total Revenue Calculate the total sales value and subtract the value of the fewer quality products from it Add initial inventory purchased goods and materials and labor costs Subtract the value of ending inventory from the total cost of goods Calculate the gross revenue by subtracting the total cost of goods from the

How to prepare Balance sheet in excel Balance Sheet For ITR 3 ITR 4 Income Tax Return Filing Find my recording equipment here Mic https amzn Income tax return Proper filing of Income Tax Return require proper maintenance of records Making of balance sheet and profit loss is utmost important Filing of ITR 3 and ITR 4 requires the details of Profit and loss A C and Balance in the Format provided in the Income Tax Utility Forms Every business is supposed to make Profit and loss and Balance Sheet at the end of the financial year

How To Prepare Balance Sheet In Excel For Income Tax Return

How To Prepare Balance Sheet In Excel For Income Tax Return

https://i.ytimg.com/vi/X_MmX9BtHS4/maxresdefault.jpg

Excel 2007 How To Create A Balance Sheet Guide Level 1 YouTube

https://i.ytimg.com/vi/FijB2jJ1Goo/maxresdefault.jpg

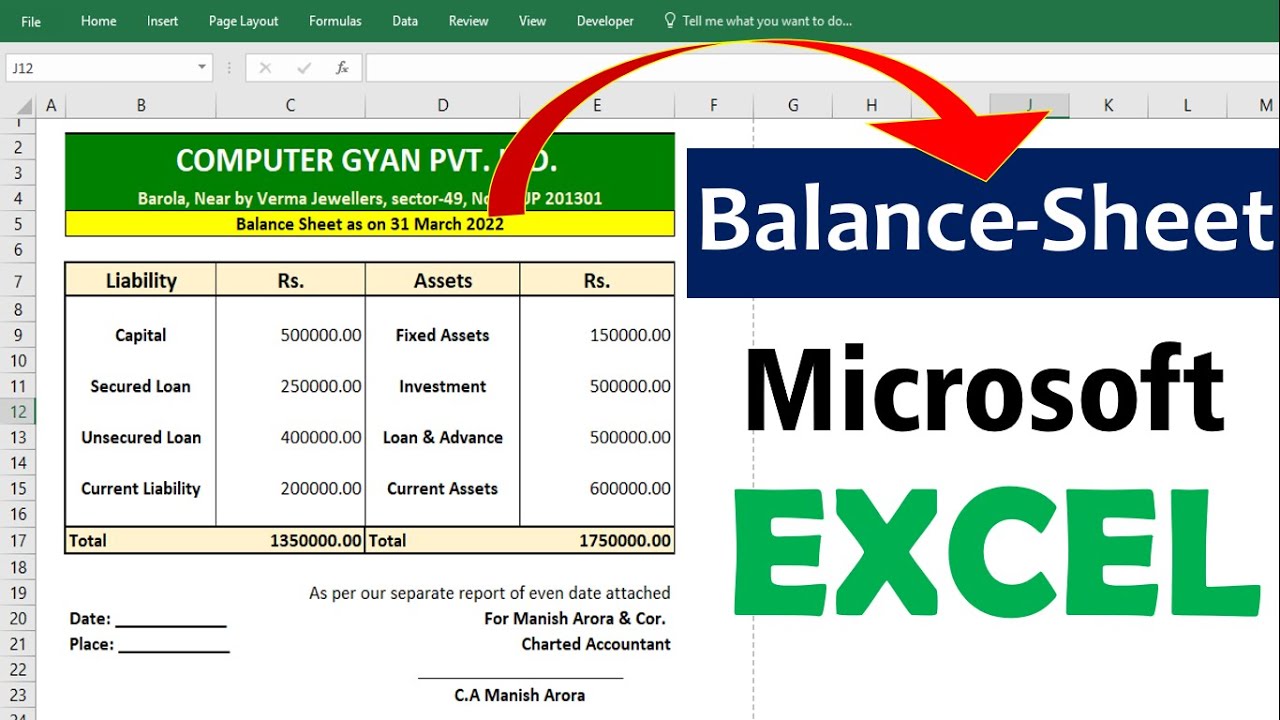

How To Create Balance Sheet In Excel Accounting Balance Sheet In

https://i.ytimg.com/vi/JzQOd3_eECU/maxresdefault.jpg

Hello Kumar Chavan You need to create two sheets to present your expenses Firstly create Income and Expenditure Account sheet to record all incomes and expenditures for the year including the deferred income adjustment for repairs Then create Balance Sheet to present the assets liabilities and equity as of the year end date Here is your Example Format Template for Income and ITR Income Tax Return Miscellaneous PAN Aadhar Excel Learning Search for Main Menu One Comment on Profit Loss and Balance Sheet with Computation in Excel for Individual ITR Filing VIKASH KUMAR says January 26 2023 at 1 40 pm educational Reply Leave a Reply Cancel reply

Income Tax Return ITR 4 For FY 2019 2020 Balance sheet Free Excel Formats for ITR 4 Balance sheet for fy 2019 20 Free Excel format balance sheet 19 20 Download Popular Topics GST Income Tax Company law Latest Post Dep in P l and Fixed assets in Balance sheet should tally Use dep as per income tax act No loan taken or given should be normally shown however if there is genuine loan take exact figure as on 31 march as per loan statement Stock figures depends upon business Some business do not have stock like Service Sector

More picture related to How To Prepare Balance Sheet In Excel For Income Tax Return

Income Tax Rates 2021 22 Calculator Infoupdate

https://cdn.educba.com/academy/wp-content/uploads/2019/08/Calculate-Income-Tax-in-Excel-1.png

Balancesheet balancesheet

http://templatelab.com/wp-content/uploads/2016/01/Balance-Sheet-Template-29.jpg

How To Prepare Balance Sheet From Given Receipt And Payments Account

https://hi-static.z-dn.net/files/d14/bc613d467fdce4f275fd2a894bd263fa.jpg

And lastly we have also made a comparison between balance sheets and income statements Here are the key takeaways Balance Sheets are picture of your financial state at a certain point of time Microsoft Excel is maybe the best tool to create balance sheets You can create balance sheets in Excel with calculations and formatting Income Statement Shows a company s profit over time Balance Sheet Lists a company s assets liabilities and equity Cash Flow Statement Shows the company s cash coming in and going out Creating an Income Statement in Excel Set up your table Column A Line items e g Revenue Cost of Goods Sold Gross Profit Column B Amounts

[desc-10] [desc-11]

Does Excel Have A Balance Sheet Template Printable Form Templates

https://i.ytimg.com/vi/XzXL2dx7G34/maxresdefault.jpg

Balance Sheet Template Free Instant Balance Sheets Excel Templates

https://i.pinimg.com/originals/ec/65/ed/ec65ed73738fce78832e51a7d80f6fa1.jpg

How To Prepare Balance Sheet In Excel For Income Tax Return - [desc-12]