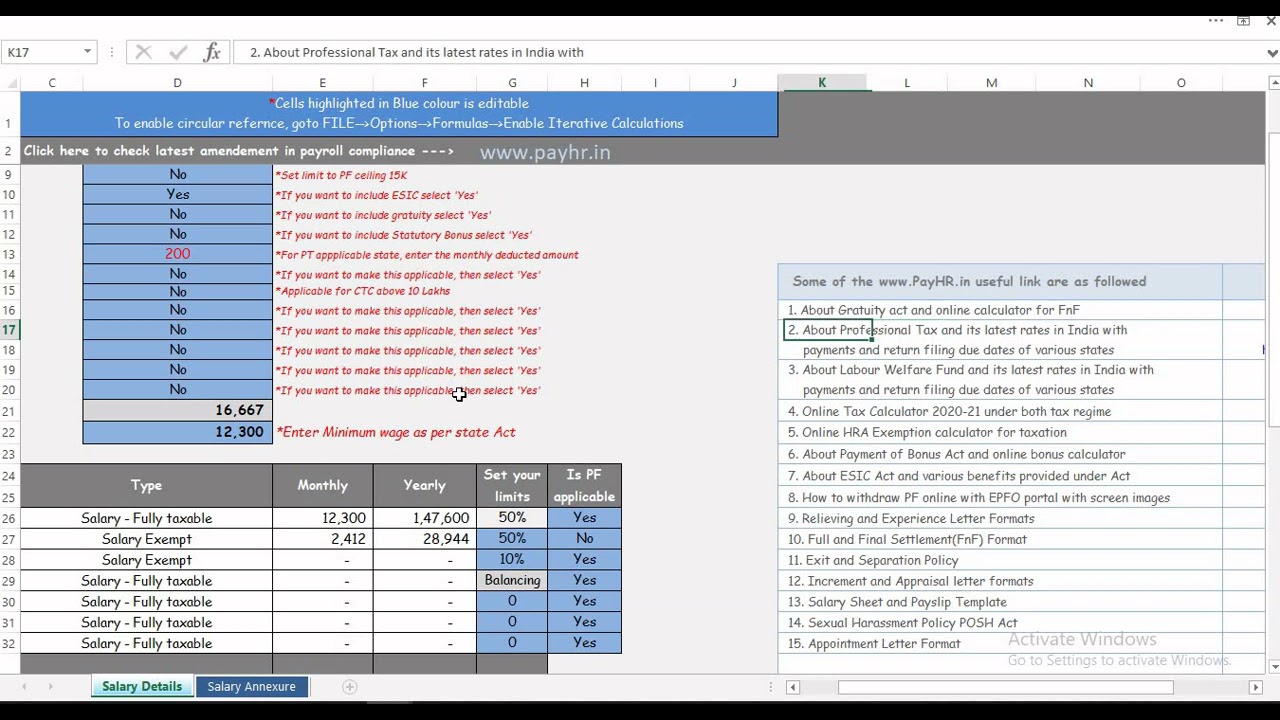

How To Make Ctc Structure In Excel Click on Reset button Select State and Employee Skill Type Annual CTC Amount CTC Salary Breakup will be calculate Automatic Important Your Excel Macros should be Enable Know more Minimum wages list should be update Change Allowance name Bonus as applicable Employee Skill and State name required

A Payslip or Salary Slip is a document provided by the employer to all the employees It is a monthly statement that consists of the details about all the components of the salary All elements of the salary breakup including the deductions are enlisted in a payslip or a salary slip It provides the detailed structure of the salary at a glance The VLOOKUP functionlooks for the EmplpyeeID A 102 in the range B5 D8 in the sheet named Structure where we have kept the salary structure of the company Then in the 3rd argument we will enter 3 because the value Basic Salary is in the 3rd column of that range

How To Make Ctc Structure In Excel

How To Make Ctc Structure In Excel

https://i.ytimg.com/vi/LEDuXuR0HC8/maxresdefault.jpg

What Is CTC Cost To Company Meaning Akrivia HCM

https://akriviahcm.com/wp-content/uploads/2022/01/CTC-Image.png

Template Slip Gaji Excel ElizaqiDonovan

https://i.pinimg.com/736x/3c/90/f0/3c90f0e9c6917e44cb429ea2ac285d34.jpg

1 Enter the Annual Income CTC Amount Start by entering the annual salary amounts in the designated fields This includes basic salary HRA LTA special allowance and other allowances 2 Select Compliance Settings Next select the compliance settings as per your establishment s applicability The compliance settings include Provident The article discusses a tool called the CTC Salary Calculator which is an Excel based calculator designed to help businesses and HR professionals calculate the cost to company CTC of an employee s salary The calculator includes various components such as basic salary HRA bonus gratuity and more and allows users to input their own

Precise and ensure parity amongst grades levels In just a few minutes you will be able to create a CTC structure This template covers vital information like Break down of the total cost to the company by each component Discussing the structure with employee candidate Effective dates Agreement and sign offs from all parties Salary CTC IPTMNoidaThis video explain how to make CTC salary breakup calculation excel sheet automatically and calculation of cost to company means salar

More picture related to How To Make Ctc Structure In Excel

CTC Structure Salary Slip

https://www.firstnaukri.com/career-guidance/wp-content/uploads/2023/07/CTC-structure-Salary-slip-1024x600.jpg

CTC Calculator In Excel Download Cost to company Calculator

https://techguruplus.com/wp-content/uploads/2023/04/CTC-Calculator-in-Excel-Download-Cost-to-company-Calculator.gif

What Is Cost To Company And What Are CTC Components

https://ebizfiling.com/wp-content/uploads/2022/11/Understanding-CTC-Components.jpg.jpg

Many companies often use the term CTC package while offering jobs to candidates You can calculate CTC by adding the salary and all the benefits that you receive from the company CTC represents the amount a company bears to employ and sustain all employees Here are the steps to calculate the CTC structure 1 Determine your basic salary 1 1 1 Here is the formula to calculate your basic salary 1 1 2 Basic salary Gross Salary All Allowances 1 2 Find out House Rent Allowance HRA 1 3 Find out Dearness Allowance DA 1 4 Determine Medical and Conveyance Allowances 1 5 Find out Leave Travel and Other Allowances 1 6 Add Incentives or Bonuses

A salary breakup structure also known as a CTC cost to company breakup structure is a comprehensive breakdown of the various components that constitute the total compensation offered to an employee This structured format allows both employers and employees to understand how the total cost to the company is distributed across different Email ajityadav121 gmail Click here to Download Automated Excel Sheet to calculate cost to company CTC Income Tax Calculation along with all investment planning Deduction U C VI A and all Major Exemptions allowed reimbursement in Salary This sheet will allowed to planning your tax saving make salary structure as per your choice

What Is CTC Tea Originals Tea

https://originalstea.com/wp-content/uploads/2020/09/CTC-4.jpg

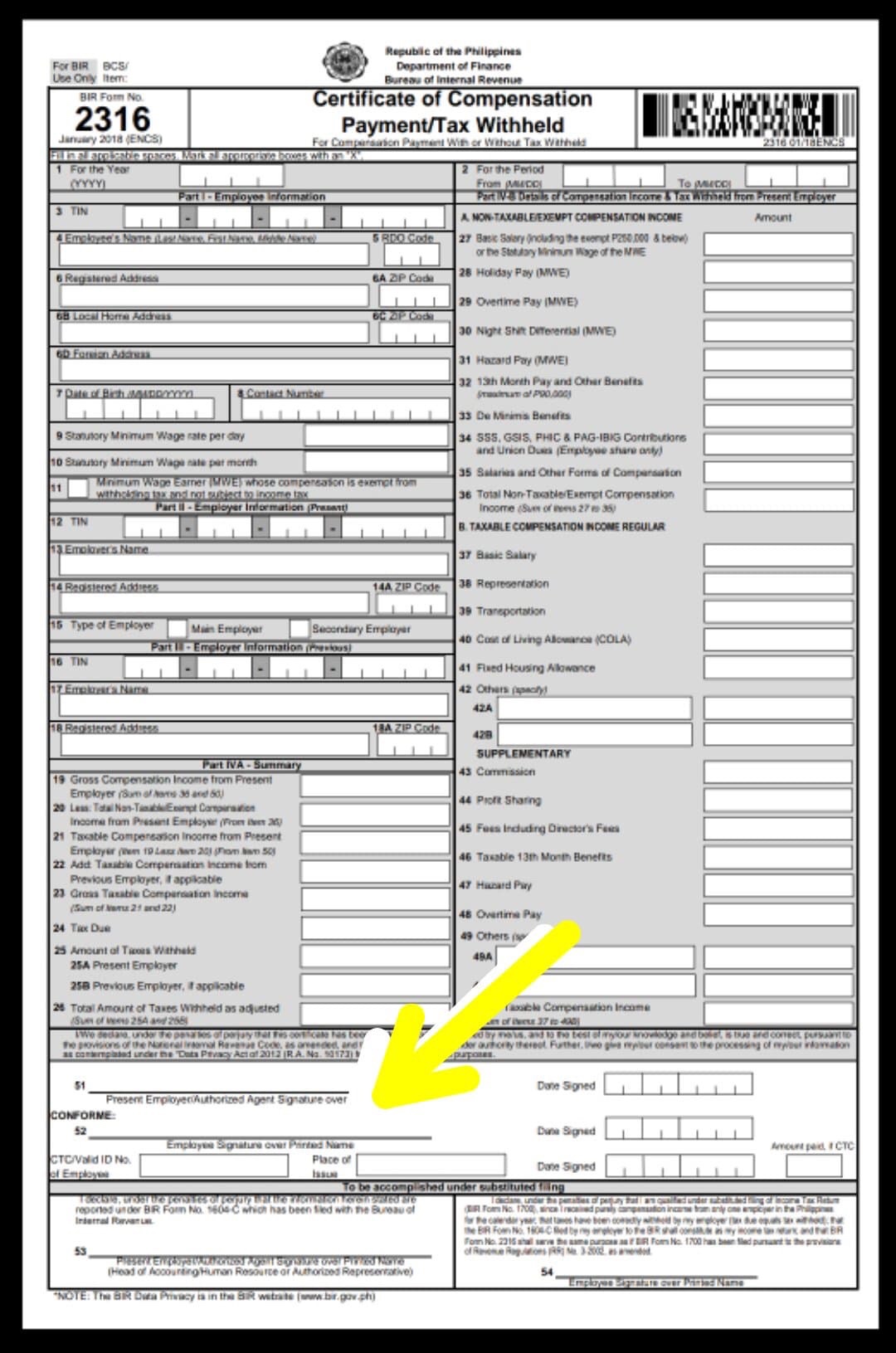

2316 Form Printable

https://gabotaf.com/wp-content/uploads/2020/02/img_4282.jpg?is-pending-load=1

How To Make Ctc Structure In Excel - Salary CTC IPTMNoidaThis video explain how to make CTC salary breakup calculation excel sheet automatically and calculation of cost to company means salar