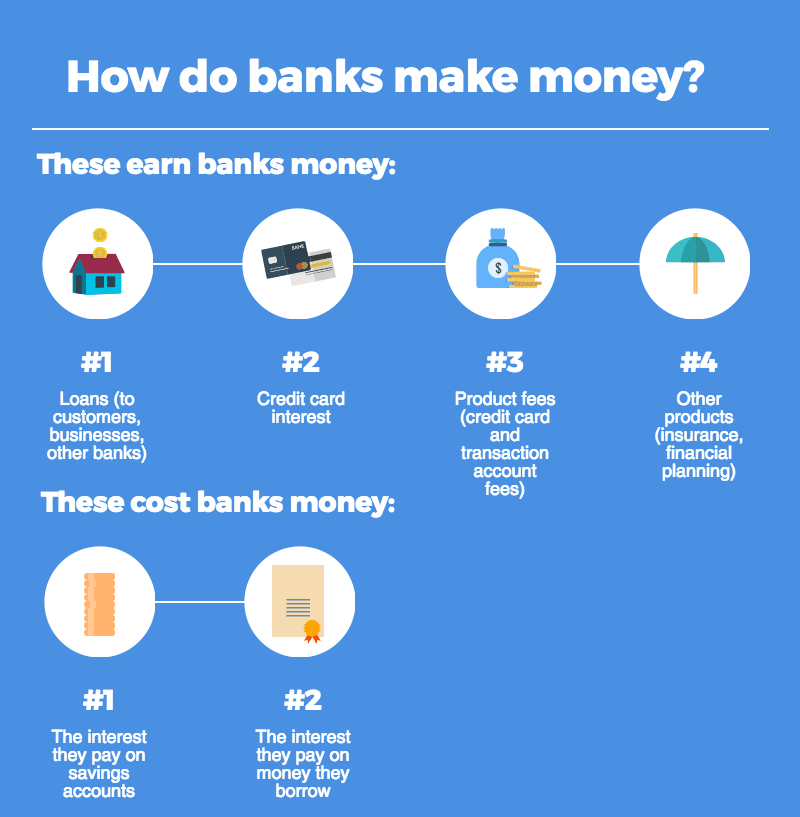

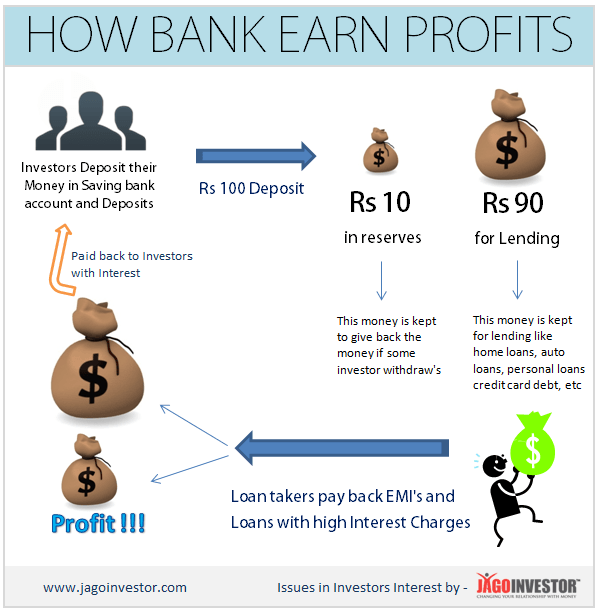

How To Investment Banks Make Money Traditional banks generally make most of their money from lending out money They take in deposits at a lower cost lend money out at a higher cost and profit from the spread between the two

Get ready to dive into the inner workings of the financial world and discover how investment banks make money 1 Underwriting Fees Underwriting fees are a significant source of income for investment banks These fees are charged when an investment bank assists a company in issuing new securities such as stocks or bonds to investors The Investment banking fees Banks that have investment banking operations make money from advisory fees they charge to clients For example if a company wants to go public and complete an IPO an

How To Investment Banks Make Money

How To Investment Banks Make Money

https://cdn.educba.com/academy/wp-content/uploads/2020/06/Investment-banking.jpg

How Do Banks Make Money

https://blog.mint.com/wp-content/uploads/2021/04/ways-banks-make-money-copy-2.png?resize=807

How Investment Banks Make Money Financial Market News

https://onlinebeststor.com/wp-content/uploads/2020/08/How-Investment-Banks-Make-Money-1024x576.png

For the most part investment banks make their money from fees For example when a corporation hires investment bankers to advise on a merger they pay an advisory fee The same is true for They make loans from the pooled deposits of individuals businesses and other entities The difference between the rate at which they lend and the rate at which they take the money is known as

Traditional banks generally make most of their money from lending out money They take in deposits at a lower cost lend money out at a higher cost and profit from the spread between the two Above I described how investment banks make money by underwriting and arranging debt deals Well banks also make some money though a small amount by holding onto a small percentage of the debt they issue for clients When they hold onto debt they earn interest on the debt as it is paid by the borrower Typically the debt held by investment

More picture related to How To Investment Banks Make Money

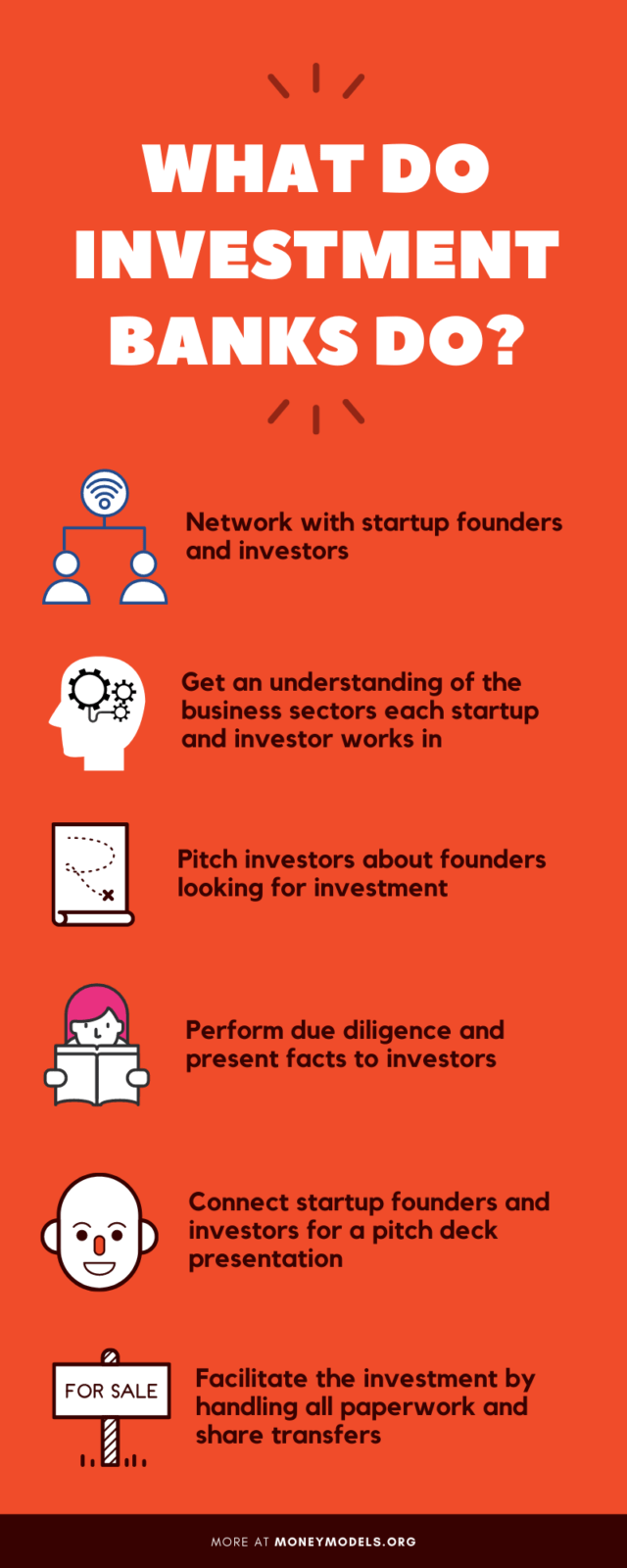

How Do Banks Make Money Unravel The Bank Business Model MoneyModels

https://moneymodels.org/wp-content/uploads/2020/08/Investment-Banks.png

How Do Banks Make Money In Australia Finder

https://dvh1deh6tagwk.cloudfront.net/finder-au/wp-uploads/2017/04/How-do-banks-make-money-infographic-1.png?fit=1200

Investment Banking Overview Investment Mania

https://i.pinimg.com/originals/bb/1a/35/bb1a3588e3c5d84a7fa14e7c1ce73bf6.jpg

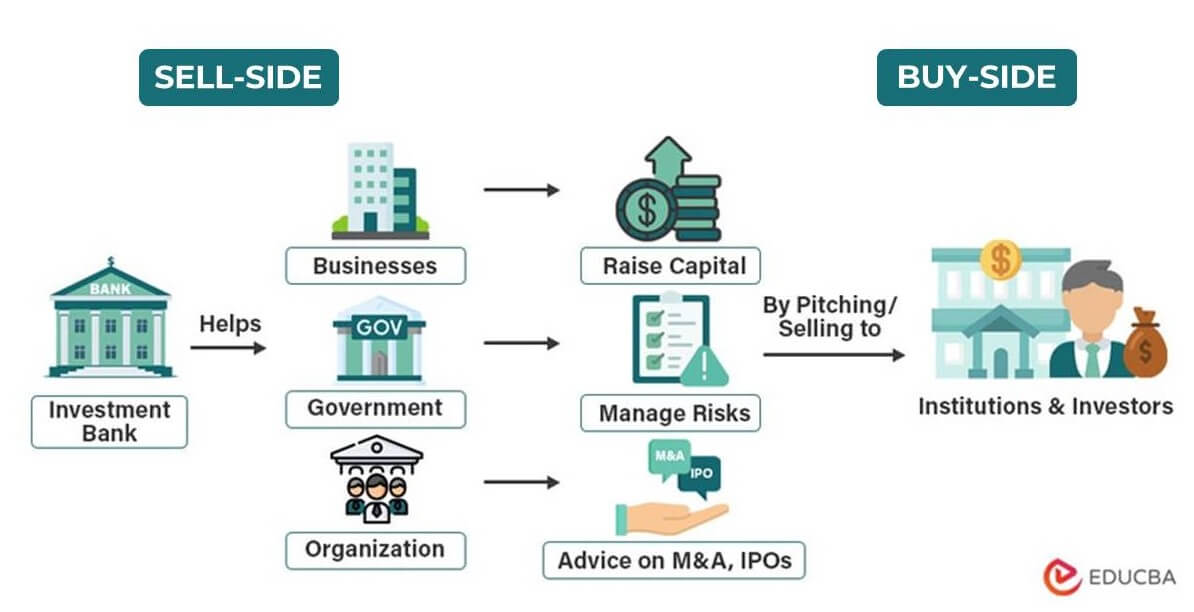

Investment Bank IB An investment bank IB is a financial intermediary that performs a variety of services Investment banks specialize in large and complex financial transactions such as Investment banking is a specific division of banking related to the creation of capital for other companies governments and other entities Investment banks underwrite new debt and equity

For Example loan origination fees are expenses banks may charge for handling and approving loans 2 Trading Income Another way banks make money is through trading gains Trading income is money gained through buying and selling financial items such as derivatives stocks bonds and currencies Banks generally make money by borrowing money from depositors and compensating them with a certain interest rate The banks will lend the money out to borrowers charging the borrowers a higher interest rate and profiting off the interest rate spread Additionally banks usually diversify their business mixes and generate money through

How Do Banks Make Money Banks Business Model In A Nutshell FourWeekMBA

https://i0.wp.com/fourweekmba.com/wp-content/uploads/2018/11/how-do-banks-make-money.png?resize=1288%2C2048&ssl=1

How Banks In India Make Money Through Lending And Your Card Swipe

https://www.jagoinvestor.com/wp-content/uploads/files/how-banks-earn-profits-and-money.png

How To Investment Banks Make Money - Investment banks often make money by connecting and creating trading opportunities for buyers and sellers from different markets Those banks then charge a commission on each trade that the two parties manage to finalise The commission may depend on the size and prestige of the bank which means that bigger investment banks usually earn more