How To Get Net Annual Salary Factors that Influence Salary and Wage in the U S Most Statistics are from the U S Bureau of Labor in 2024 In the third quarter of 2024 the average salary of a full time employee in the U S is 1 165 per week which comes out to 60 580 per year While this is an average keep in mind that it will vary according to many different factors

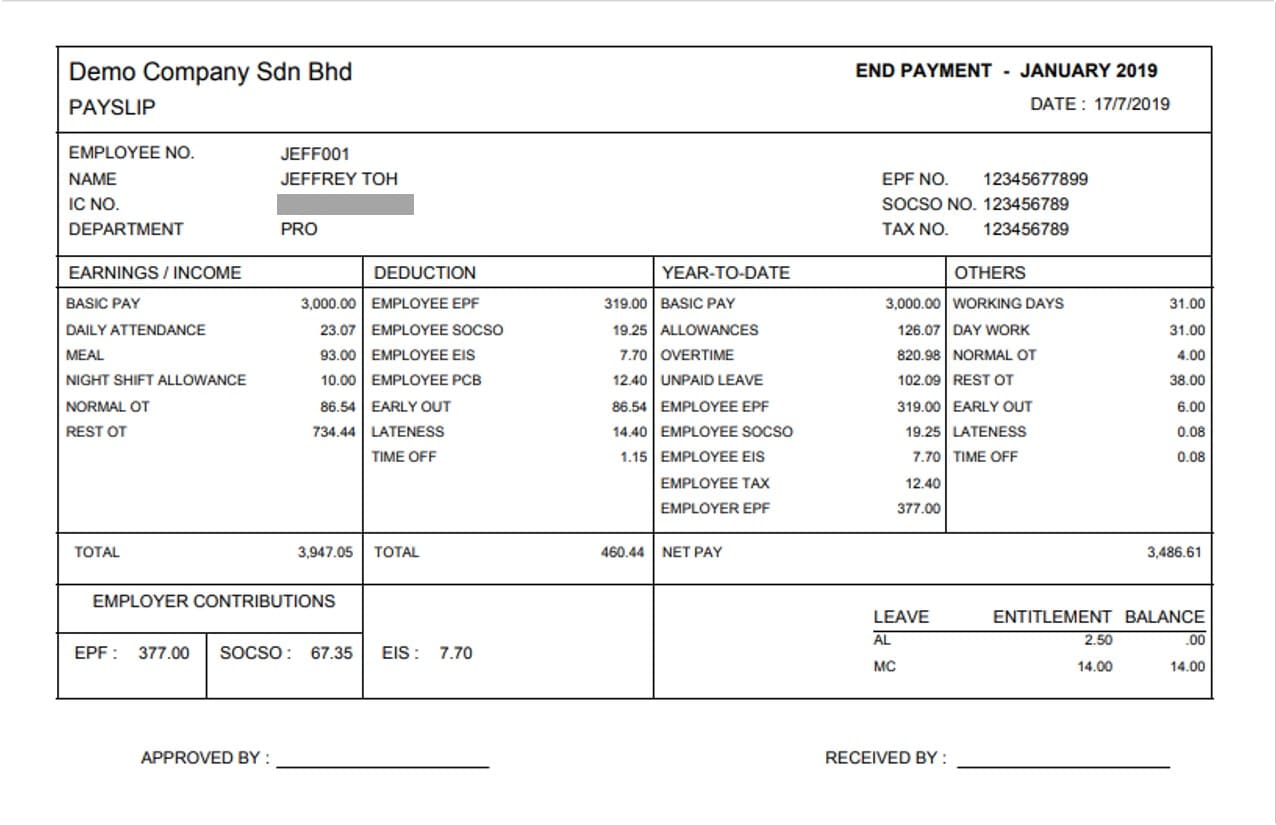

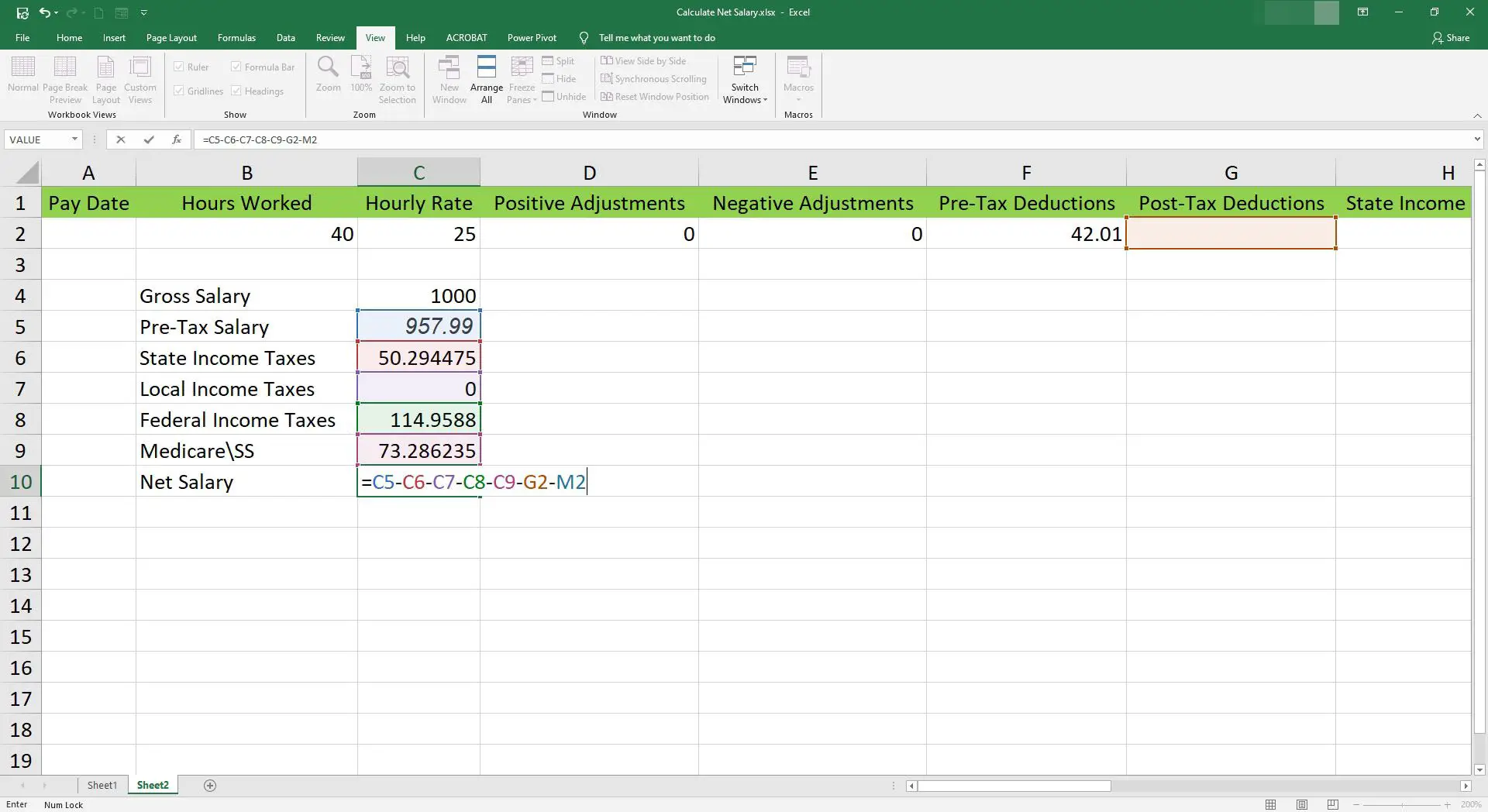

Similarly if you have your net salary and know your tax rate you can work backward to find out your gross annual income For instance if your hourly wage is 34 you work 40 hours per week and 52 weeks per year your annual income would be 70 720 Below is how to calculate the amount of annual net income you make based on your gross income 1 Determine your annual salary If you re considered a salaried employee then your annual salary may already be listed on your pay stub If you receive an hourly wage and are unsure of your annual salary you can use simple math to determine this

How To Get Net Annual Salary

How To Get Net Annual Salary

https://iflexi.asia/wp-content/uploads/2022/09/Payslip-5.jpg

:max_bytes(150000):strip_icc()/woman-forehead-acne-82cc24484a3045fba804bced493aba73.png)

Why Do I Have Pimples Around My Hairline Infoupdate

https://www.byrdie.com/thmb/3peqOCi0lL81AqKgZ6WNBK-IvdU=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/woman-forehead-acne-82cc24484a3045fba804bced493aba73.png

How To Pay Tds Online Archives CA GuruJi

https://taxupdates.cagurujiclasses.com/wp-content/uploads/2024/03/xblog-9.jpg.pagespeed.ic.SwhauuqDo_.jpg

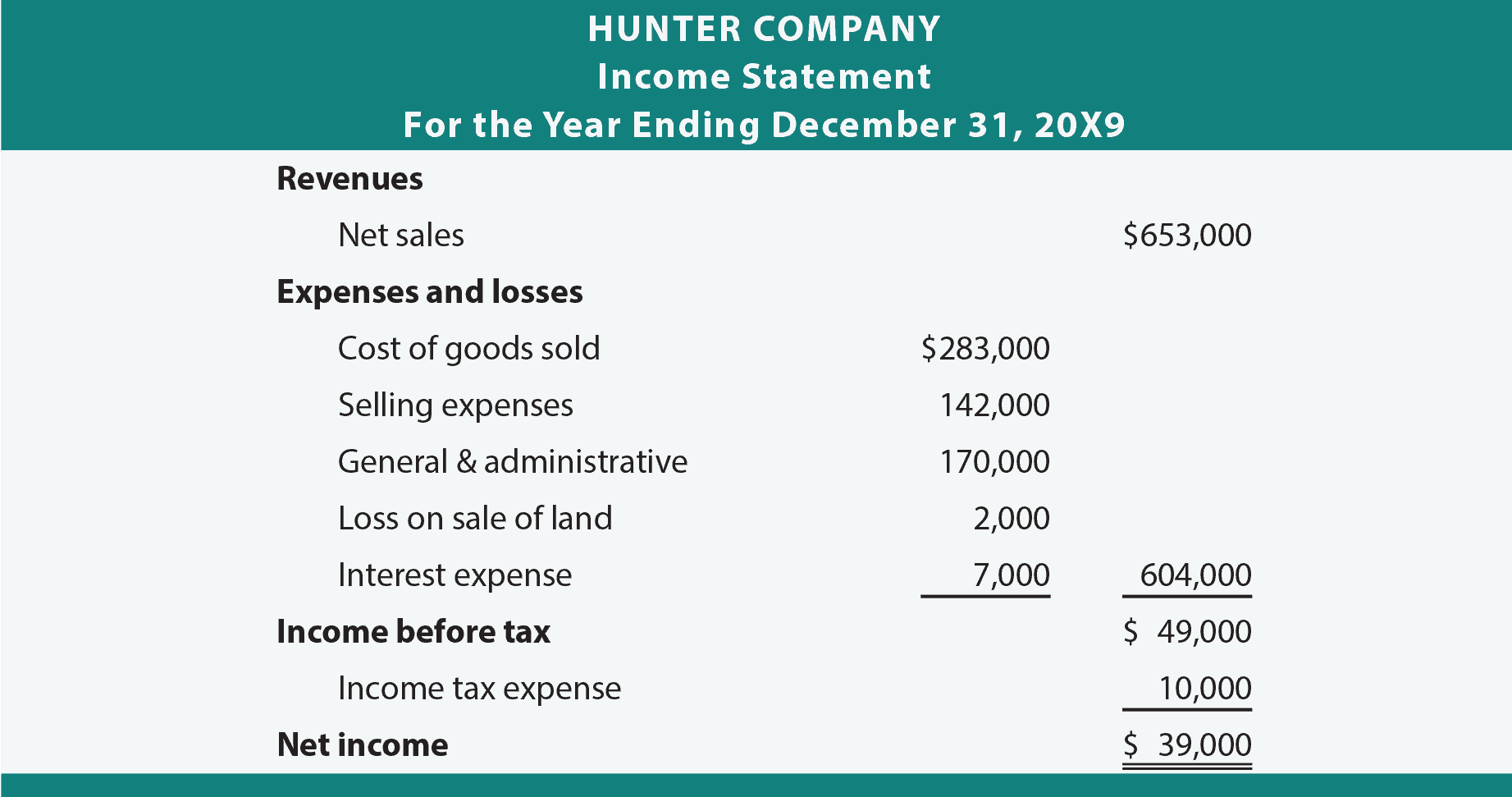

Subtract all of the deductions listed on your pay stub from your gross salary to determine your net salary or take home salary For example if your paystub is monthly with a gross income of 5 000 but your company puts aside 16 for federal taxes 14 for state taxes 40 for healthcare and 50 for Social Security subtract 5 000 14 Suppose your average federal tax rate is 10 this is not an actual estimate for how much someone at this income would pay If you multiply the gross annual income by the 10 tax rate you would pay 3 276 in taxes The net annual income would be net annual income gross income taxes net annual income 32 760 3 276

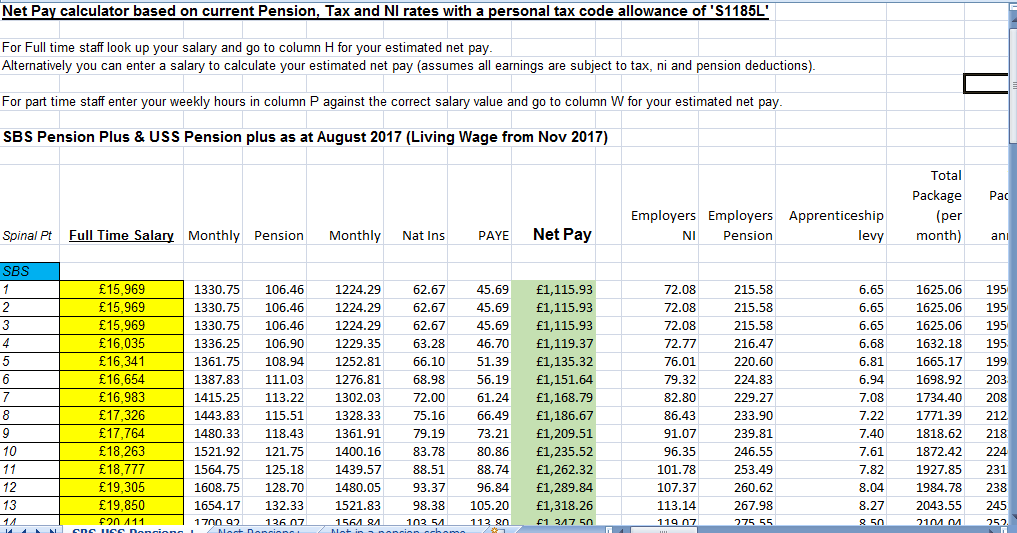

The main difference between gross pay and net pay is simple gross pay is what an employee earns while net pay is what they actually get to keep Here s an example Gross Pay 3 000 salary 500 bonus 3 500 Deductions 400 for taxes 150 for health insurance 100 for retirement 650 Net Pay 3 500 650 2 850 The gross pay method refers to whether the gross pay is an annual amount or a per period amount The annual amount is your gross pay for the whole year Per period amount is your gross pay every payday For example if your annual salary were 52 000 and you are paid weekly your annual amount is 52 000 and your per period amount is 1 000

More picture related to How To Get Net Annual Salary

How To Apply For Solar Archives CA GuruJi

https://taxupdates.cagurujiclasses.com/wp-content/uploads/2023/11/xblog.jpg.pagespeed.ic.fHvwEUs0Ur.jpg

Calcular Salario Liquido 2025 Daniela Wren

https://fiodevida.com/wp-content/uploads/2021/04/1619192715_796_Calcular-o-salario-liquido-usando-o-Microsoft-Excel.jpg

Total Profit Formula

https://learn.financestrategists.com/wp-content/uploads/Exxample_of_Calculating_Net_Profit.png

If you re paid monthly multiply your salary by 12 to get your annual gross income Do you only know your hourly pay rate Take your hourly rate and multiply it by 2080 if you work 40 hour weeks throughout the year to get your annual income Businesses can also calculate their annual net income and get a good idea of how their company is Annual Income Biweekly Pay 26 pay periods How to Use 1 Enter your biweekly take home pay in the input field 2 Click Calculate button 3 View your estimated annual income 4 Use Clear button to reset Calculation Process The calculation multiplies biweekly pay by 26 because there are typically 26 biweekly pay periods in a year 52

[desc-10] [desc-11]

Uk Salary Tax Calculator 2025 Micah Vegas

https://www.excelstemplates.com/wp-content/uploads/2018/10/net-salary.png

What Are Net Sales Formulas Calculations And Examples

https://www.engagebay.com/blog/wp-content/uploads/2023/02/huntercompany2.png

How To Get Net Annual Salary - The gross pay method refers to whether the gross pay is an annual amount or a per period amount The annual amount is your gross pay for the whole year Per period amount is your gross pay every payday For example if your annual salary were 52 000 and you are paid weekly your annual amount is 52 000 and your per period amount is 1 000