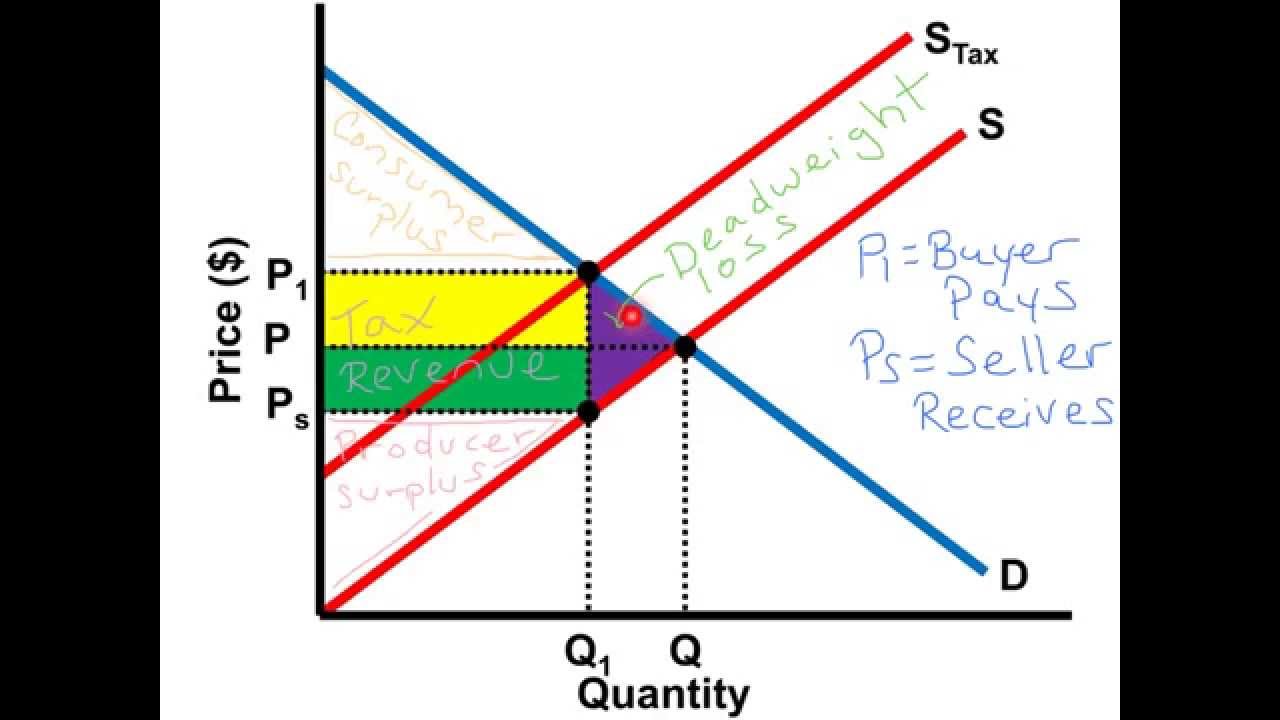

How To Find Total Tax Revenue To calculate tax revenue we need to determine the taxable income For example if we are calculating income tax revenue we need to determine the taxable income of individuals or businesses Tax Liability 2 250 Total Tax Revenue 2 250 x 10 000 taxpayers 22 500 000 In this example the government would collect a total of

Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes Total revenue is revenue from all sources both operating and non operating for which a business has a source document usually a cash receipt and it occurs within an accounting period The total revenue of your business can help you decide how to price your product or service To analyze your total revenue and whether it is appropriate you can do a trend analysis and an industry analysis

How To Find Total Tax Revenue

How To Find Total Tax Revenue

https://courses.byui.edu/ECON_150/ECON_150_Old_Site/images/8-1_Monopolies_10.jpg

Per Unit Tax Graph AP Microeconomics YouTube

http://i.ytimg.com/vi/hiuij6nBzm0/maxresdefault.jpg

The Study Economics For Ma Ignou Microeconomics Macroeconomics

https://courses.byui.edu/econ_150/econ_150_old_site/images/4-1_Own_Price_Elas_01.jpg

Finally calculate the Tax Revenue using the equation above Rtax TPU U The values given above are inserted into the equation below Rtax 137 59 8083 Example Problem 2 The variables needed for this problem are provided below tax per unit unit 581 total number of units 489 Entering these values and solving gives Age Enter the age you were on Jan 1 2024 Your age can have an effect on certain tax rules or deductions For example people aged 65 or older get a higher standard deduction 401 k

State taxes Marginal tax rate 5 85 Effective tax rate 4 88 New York state tax 3 413 Gross income 70 000 Total income tax 11 074 After Tax Income 58 926 Disclaimer Calculations are 1040 Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS next April Change the information currently provided in the calculator to match your personal information

More picture related to How To Find Total Tax Revenue

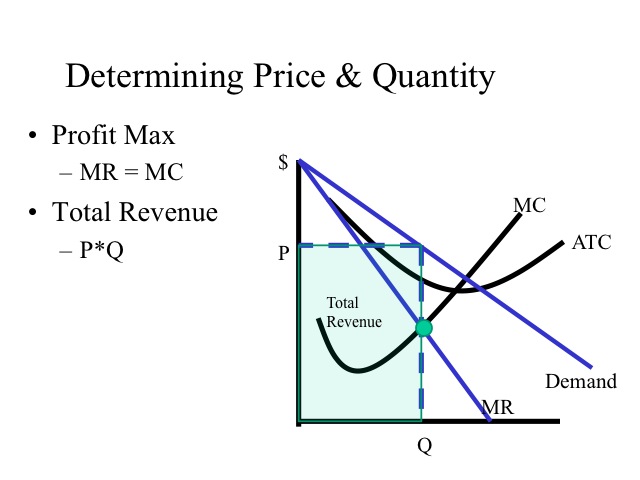

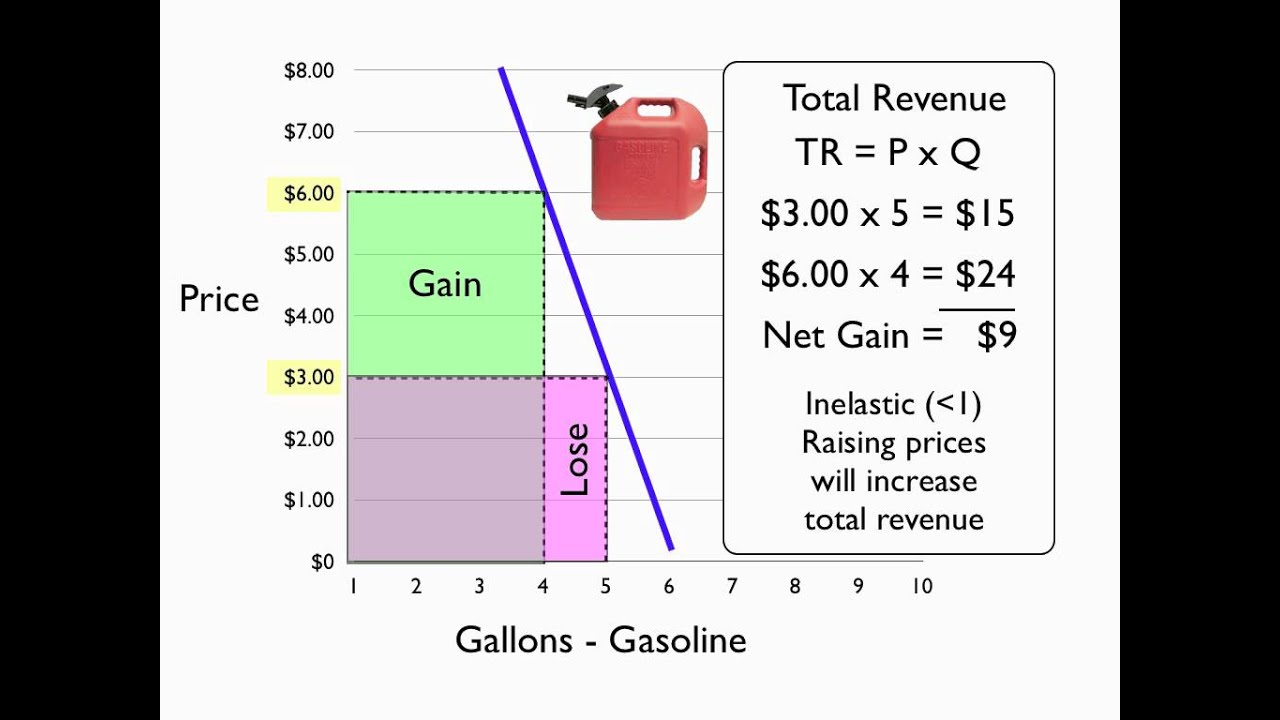

How To Calculate Total Revenue In Microeconomics

https://intelligenteconomist.com/wp-content/uploads/2020/02/Total-Revenue-Formula.png

How To Find Total Tax Revenue

https://lh3.googleusercontent.com/proxy/iIhOv3B4RCSq6hyJEGqxdLJi2FlXCEe2ZkxFll5TyZSKpurj_wuZ4KokeqqLrg2LJjNKc0HWYVVBTeXTrmz8Eb_qo1zYhh-d-WEP1J_BxamoMrP20K6UZ9jxmNGW6DWclFwuYELGCrb2DUXJrA=s0-d

Relationship Between Total Revenue Marginal Revenue And Average

https://i.ytimg.com/vi/nquo7ZJXai4/maxresdefault.jpg

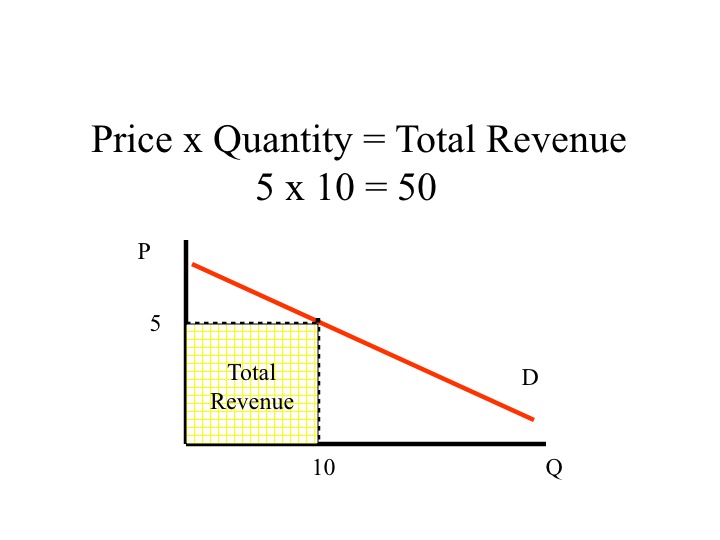

We then added the dollar amount for income sales property and fuel taxes to calculate a total tax burden Finally each county was ranked and indexed on a scale of 0 to100 The county with the lowest tax burden received a score of 100 and the remaining counties in the study were scored based on how closely their tax burden compares To find it use the total revenue formula Total Revenue Number of Units Sold X Cost Per Unit You can use the total revenue equation to calculate revenue for both products and services To make it easy to remember think quantity times the price If you have multiple products and or services calculate the total revenue for each

Total Tax The composite total of all taxes that is owed by a taxpayer for the year This number is essentially the penultimate point in the tax formula It accounts for all credits and deductions The Tax Withholding Estimator doesn t ask for personal information such as your name social security number address or bank account numbers We don t save or record the information you enter in the estimator For details on how to protect yourself from scams see Tax Scams Consumer Alerts Check your W 4 tax withholding with the IRS Tax

How To Find Total Revenue SariahgroShah

https://www.intelligenteconomist.com/wp-content/uploads/2020/05/profit-formula.png

How To Calculate Revenue Function REVMUOP

https://i2.wp.com/courses.byui.edu/econ_150/econ_150_old_site/images/7-2_SR_Pure_Competiton_08.jpg

How To Find Total Tax Revenue - State taxes Marginal tax rate 5 85 Effective tax rate 4 88 New York state tax 3 413 Gross income 70 000 Total income tax 11 074 After Tax Income 58 926 Disclaimer Calculations are