How To Find Net Income Loss Net loss also referred to as a net operating loss NOL is the result that occurs when expenses exceed the income or total revenue produced for a given period of time Businesses that have a net

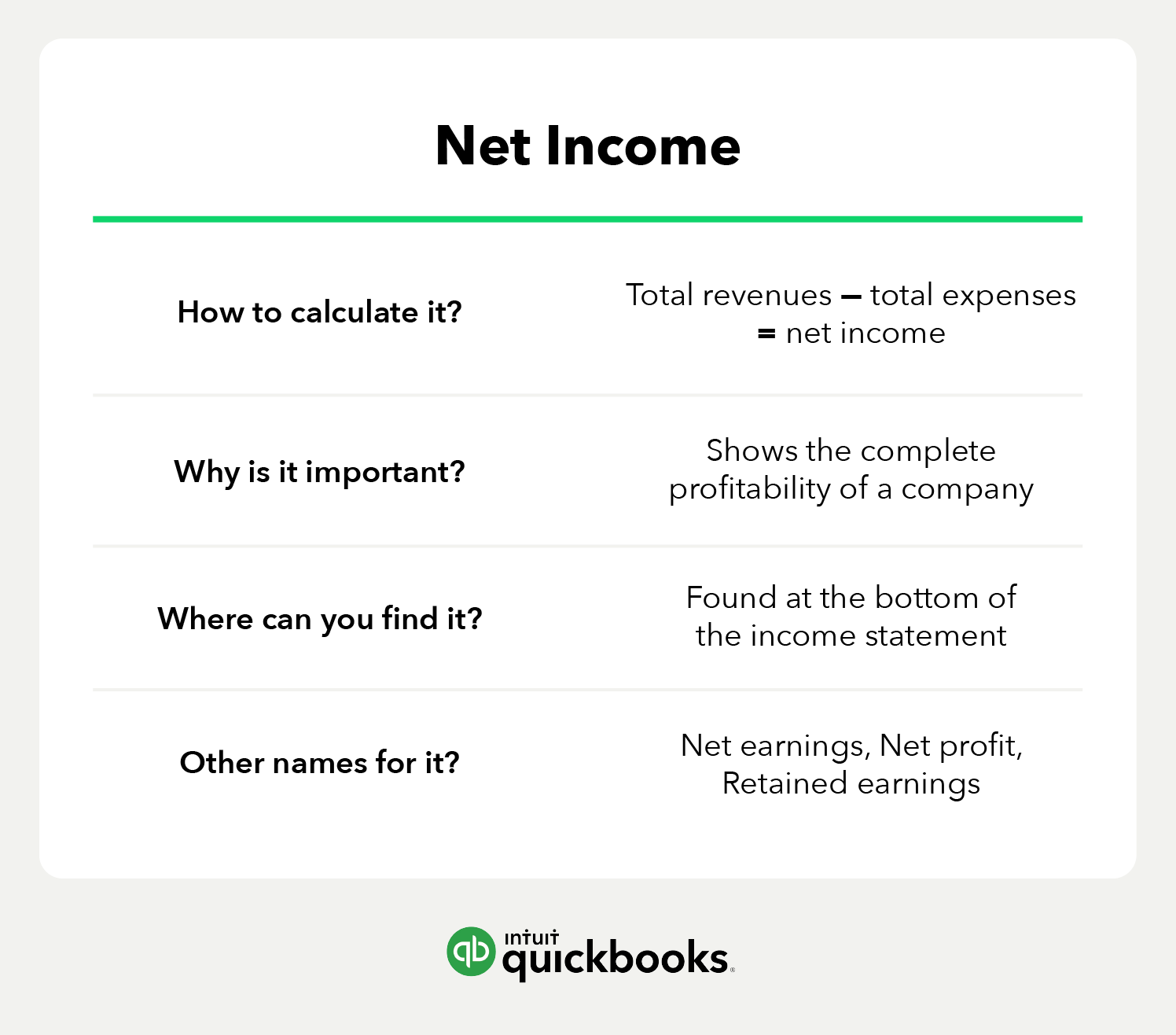

Net income also known as the bottom line indicates a business s profitability It shows how much profit is left from revenue after accounting for expenses Net income is profit that can be distributed to business owners or shareholders or invested in business growth Investors and banks consider net income when deciding whether to invest in Here s its formula Net profit loss total revenue or income total expenses Here s a step by step guide for calculating net loss Calculate revenue First determine the revenue which is the income the business generates If net income and net loss are the bottom line of a financial statement then revenue is the top line Identify expenses

How To Find Net Income Loss

How To Find Net Income Loss

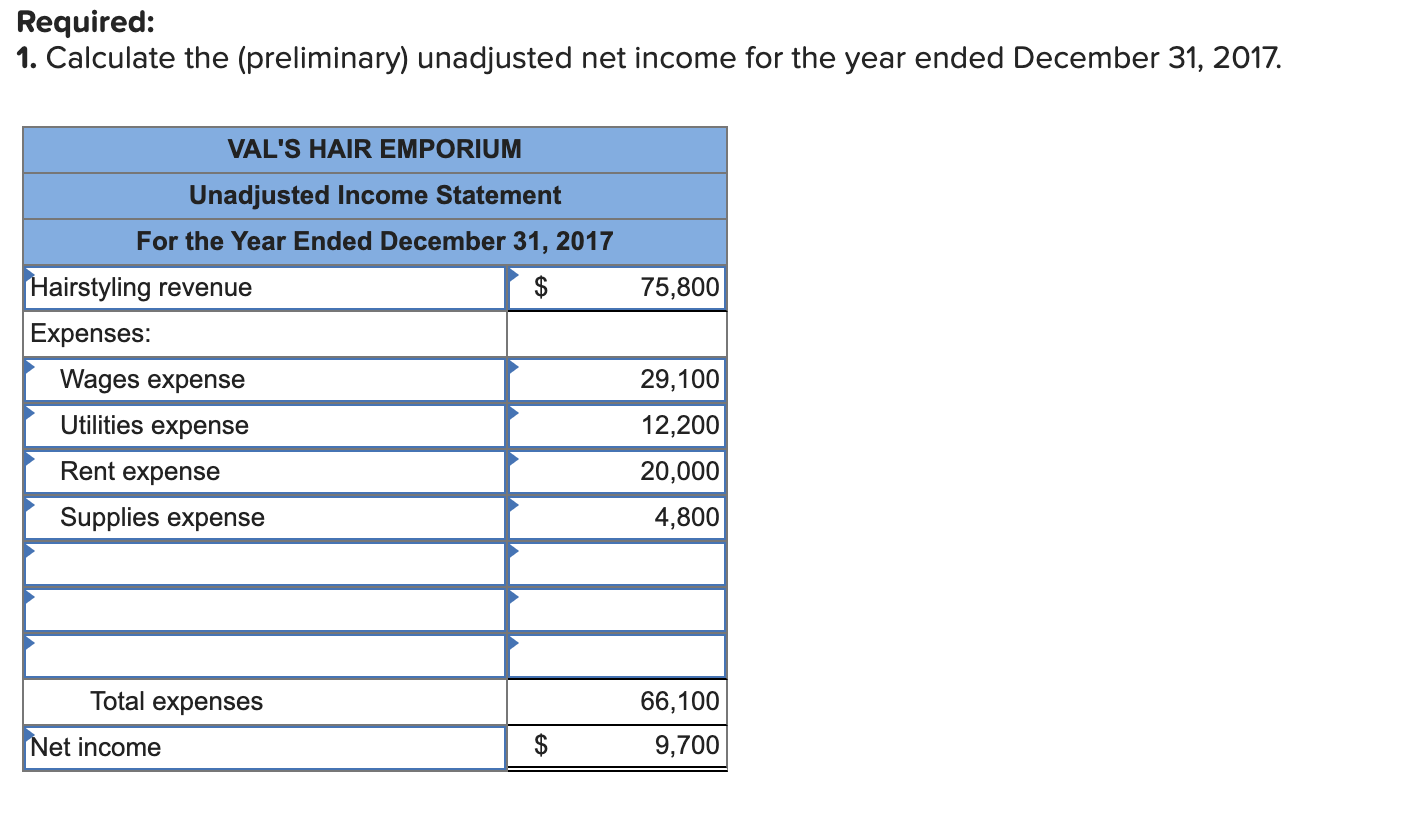

https://media.cheggcdn.com/media/ab0/ab0b2e47-5d6f-43a4-a710-19f9eb6e462d/phpnjidhI.png

Net Income Equation

https://www.paretolabs.com/wp-content/uploads/2021/06/Example-of-net-income-as-seen-on-a-balance-sheet.png

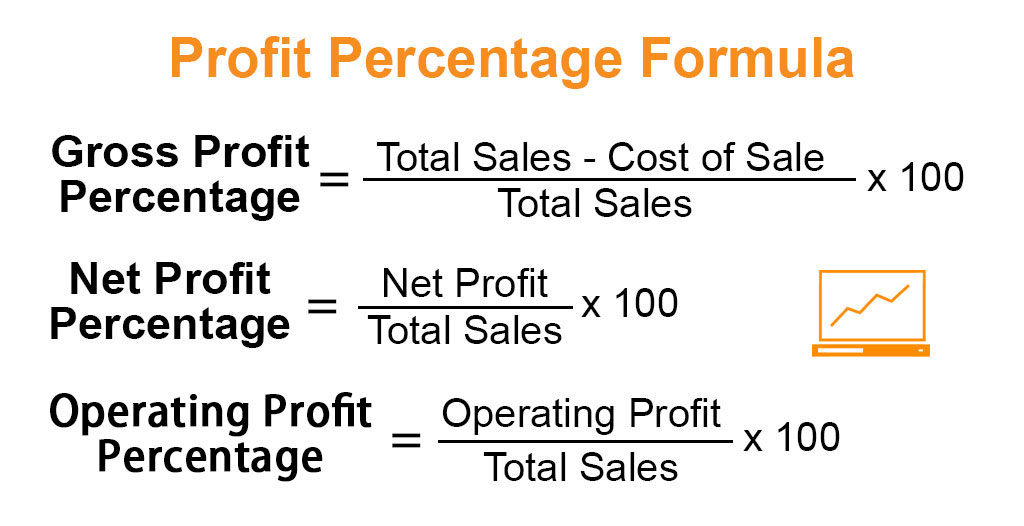

How To Calculate Net Profit Percentage Haiper

https://www.educba.com/academy/wp-content/uploads/2019/08/Profit-Percentage-Formula-educba.jpg

The matching principle states that to calculate the net income loss all the expenses and related revenues be recorded in the same period The matching principle is a key factor in the calculation of net income loss All the expenses related to a specific earned income must be considered in the calculation regardless of when they will be The interest expense is expressed on a net basis because a company could have earned interest income on its marketable securities short term investments or savings accounts Hence the gross interest expense must be subtracted by interest income to determine the net interest expense i e more interest income should reduce the interest burden

Learn how to determine net income or loss in accounting with this easy to follow video tutorial Gain in depth knowledge and skills to master your finances A Net Loss is the difference between total expenditures including taxes fees interest and depreciation and total income or revenue for a certain period the result is a negative profit Net loss also called negative profit is a financial metric that assesses a company s overall profitability A net loss occurs when earnings fall below

More picture related to How To Find Net Income Loss

How To Find Net Income For Beginners Pareto Labs

https://www.paretolabs.com/wp-content/uploads/2021/06/Illustration-of-net-income-formula-1364x780.png

Net Profit Calculator Online NaidiaGelica

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/net-income-summary-image-2x-us-en.png

View Net Income loss For The Current Trial Balance

https://cs.thomsonreuters.com/ua/_images/advflow-ng/advfl-net-income.png

Source Net Loss wallstreetmojo Net loss or net profit is usually recorded at the bottom of an income statement A business can survive despite incurring net losses by relying on revenues earned during an earlier period or with the help of loans Still it goes without saying that the purpose of a business is to turn profits eventually From here you find net income by adding together the total of all expenses and the total cost of sales You then subtract that number from the overall revenue of your business Total Revenue Total Cost of Sales Total of Other Expenses Net Income There is also a more simplified formula

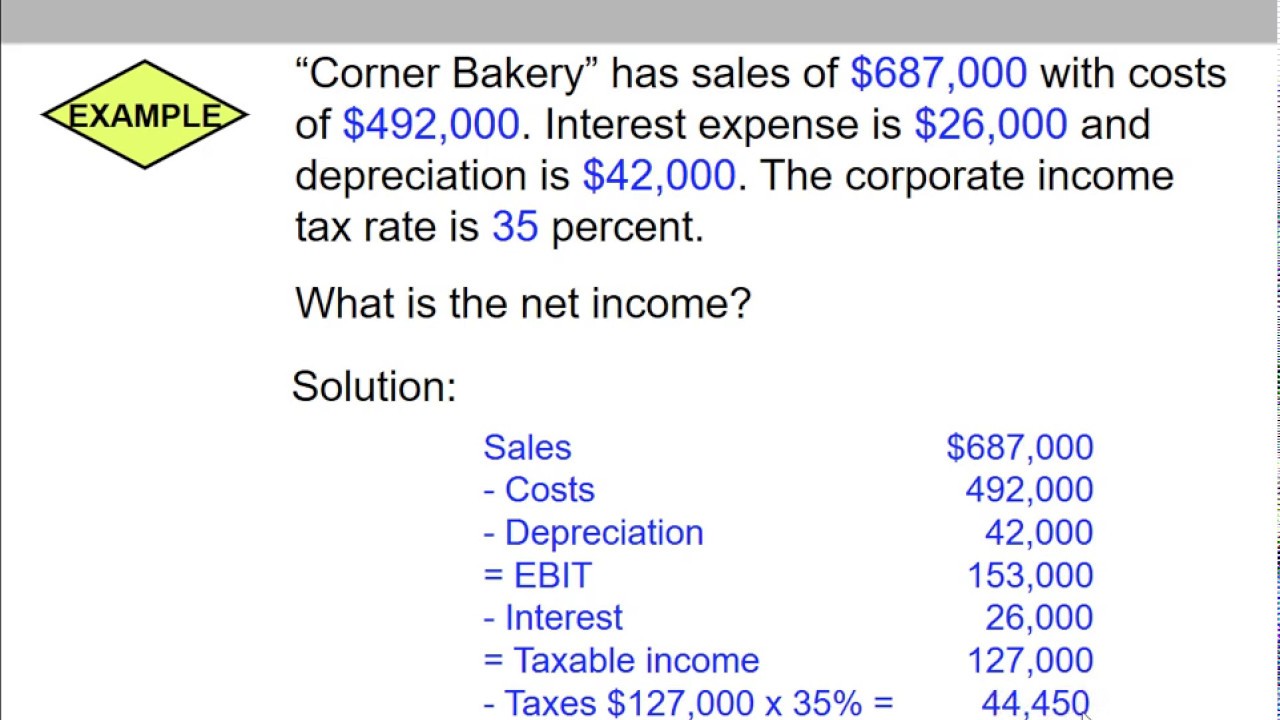

Net Income Gross Income Operating Expenses Tax With this formula the first thing to find out is the gross income Gross Income Total Revenue Cost of Goods Sold COGS The total revenue is 50 000 while the cost of goods sold is 10 000 Gross Income 50 000 10 000 Gross Income 40 000 The net income formula is calculated by subtracting total expenses from total revenues Many different textbooks break the expenses down into subcategories like cost of goods sold operating expenses interest and taxes but it doesn t matter All revenues and all expenses are used in this formula As you can see the net income equation is

What Is Net Profit And Net Loss Accounting Capital

https://www.accountingcapital.com/wp-content/uploads/2018/12/Net-Profit-in-Income-Statement-and-Balance-Sheet.png

7 Of 9 Ch 2 Calculate Net Income YouTube

https://i.ytimg.com/vi/P3l8wez3Glo/maxresdefault.jpg

How To Find Net Income Loss - Learn how to determine net income or loss in accounting with this easy to follow video tutorial Gain in depth knowledge and skills to master your finances