How To Find Annual Gross Pay You can use the following formula to calculate the net annual income net annual income 25 per hour 2 000 hours 8 000 in taxes net annual income 50 000 8 000 net annual income 42 000 Your annual income is also different from your adjusted gross income and modified adjusted gross income which is the pre tax income

An easy way to do this is Estimated number of hours worked per week x hourly rate x 52 gross annual income The 52 represents the number of weeks you work throughout the year If you work fewer weeks you want to use that number instead For example if you work roughly 35 hours per week every week and you earn 16 per hour your gross To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

How To Find Annual Gross Pay

How To Find Annual Gross Pay

https://pix4free.org/assets/library/2021-11-18/originals/gross-pay.jpg

Formula For Calculating Gross Pay

https://apspayroll.com/wp-content/uploads/2021/07/Gross-Pay-Calculation.png

How To Calculate Your Net Pay From Your Gross Pay

https://www.realcheckstubs.com/media/calculate-net-pay-from-gross-pay-1640x840.jpg

To calculate gross pay for a salaried employee take their total annual salary and divide it by the number of pay periods within the year If a business pays its employees once a week then you would have 52 pay periods in a year Annual salary number of pay periods gross pay per pay period A salary is normally paid on a regular basis and the amount normally does not fluctuate based on the quality or quantity of work performed An employee s salary is commonly defined as an annual figure in an employment contract that is signed upon hiring Salary can sometimes be accompanied by additional compensation such as goods or services Wage

Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime To enter your time card times for a payroll related calculation use this time card calculator Gross Pay or Salary Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary Gross pay calculator Plug in the amount of money you d like to take home each pay period and this calculator will tell you what your before tax earnings need to be Important Note on Calculator The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates

More picture related to How To Find Annual Gross Pay

Gross Salary Vs Net Salary Key Differences Components And Calculation

https://uploads-ssl.webflow.com/60ae205a9765a905fb4d243c/626aefc44f197c209ab27fe9_Gross vs net salary c.jpg

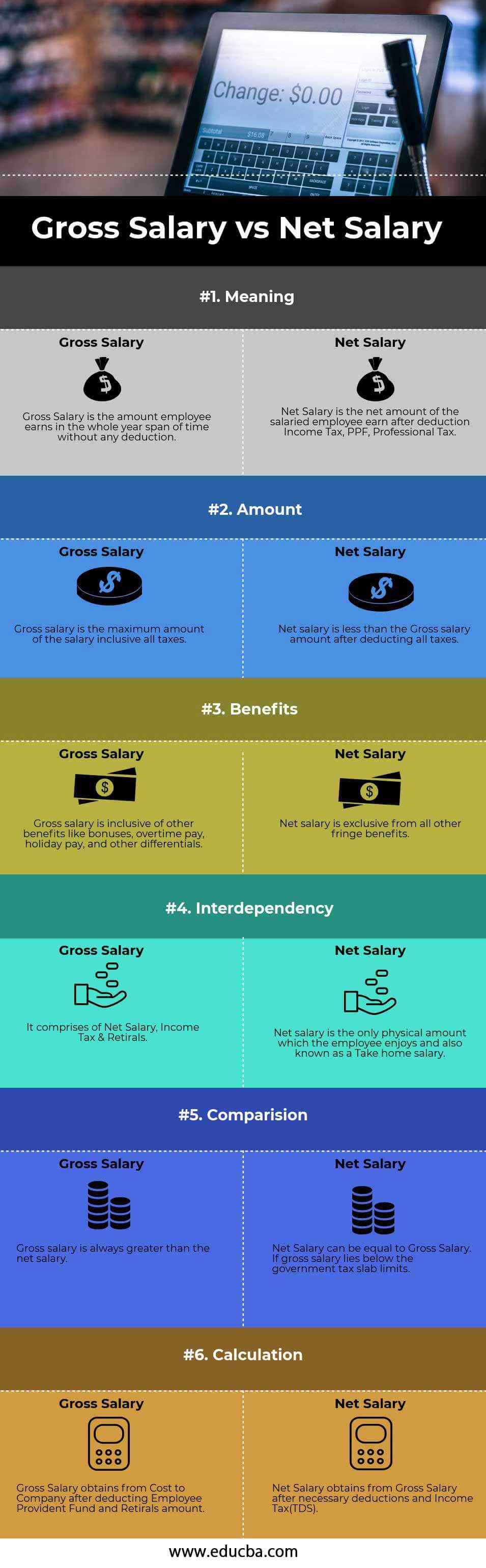

Gross Salary Vs Net Salary Top 6 Differences With Infographics

https://cdn.educba.com/academy/wp-content/uploads/2019/01/Gross-Salary-vs-Net-Salary-info.jpg

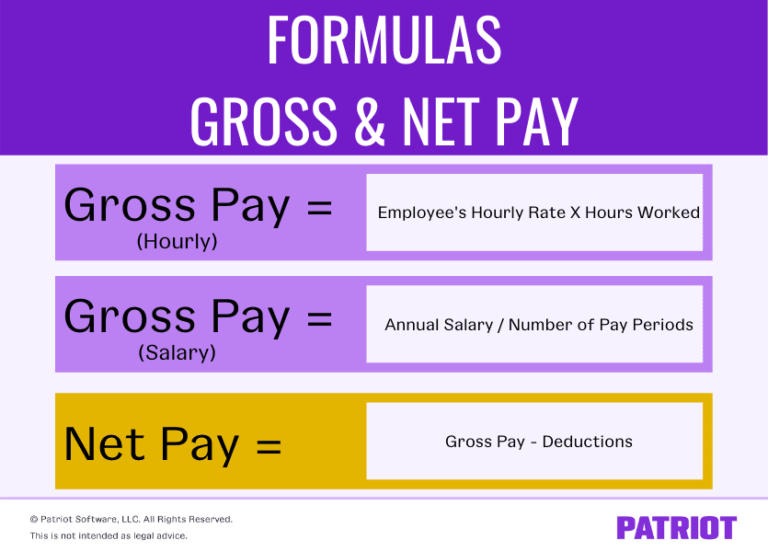

How To Calculate Net Take Home Salary Haiper

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

Annual salary Annual salary Gross income Hourly wage Hourly wage Hours worked per day Days worked per week Weeks worked per year Your weekly paycheck Step 2 Federal income tax liability There are four substeps to take to work out your total federal taxes Step 2 1 Gross income adjusted The formula is Gross annual income gross monthly pay x 12 Gross annual income gross weekly pay x 52 Adjust the equation accordingly if you work fewer than 12 months or 52 weeks per year For example if

For someone with an income of 30 per hour the annual salary is 62 400 assuming 40 weekly working hours We can use the following formula for the total yearly pay to calculate it Annual salary Hours per week Weeks per year Hourly wage Annual salary 40 hrs week 52 weeks yr 30 hr Annual salary 62 400 yr Holiday adjusted pay is pay that excludes all your paid vacation and holidays this pay is usually lower since it excludes all these days when you weren t working An average American has 7 8 days of holidays per year that s why we decided to use 8 days as the default value but don t hesitate to adjust it to your needs An average number of paid vacation days in the US is 15 days

How To Calculate Net Income From Hourly Wage Haiper

https://www.patriotsoftware.com/wp-content/uploads/2018/09/gross-vs.-net-pay-part-2-1-768x552.png

What Is Annual Income Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/07/11073323/Annual-Income-Calculator.jpg

How To Find Annual Gross Pay - Figure out your annual gross income by multiplying your weekly pay by the number of weeks you work in a year For example if you earn 15 an hour and work an average of 35 hours every week of the year you d make 27 300 in annual income 15 35 52 27 300