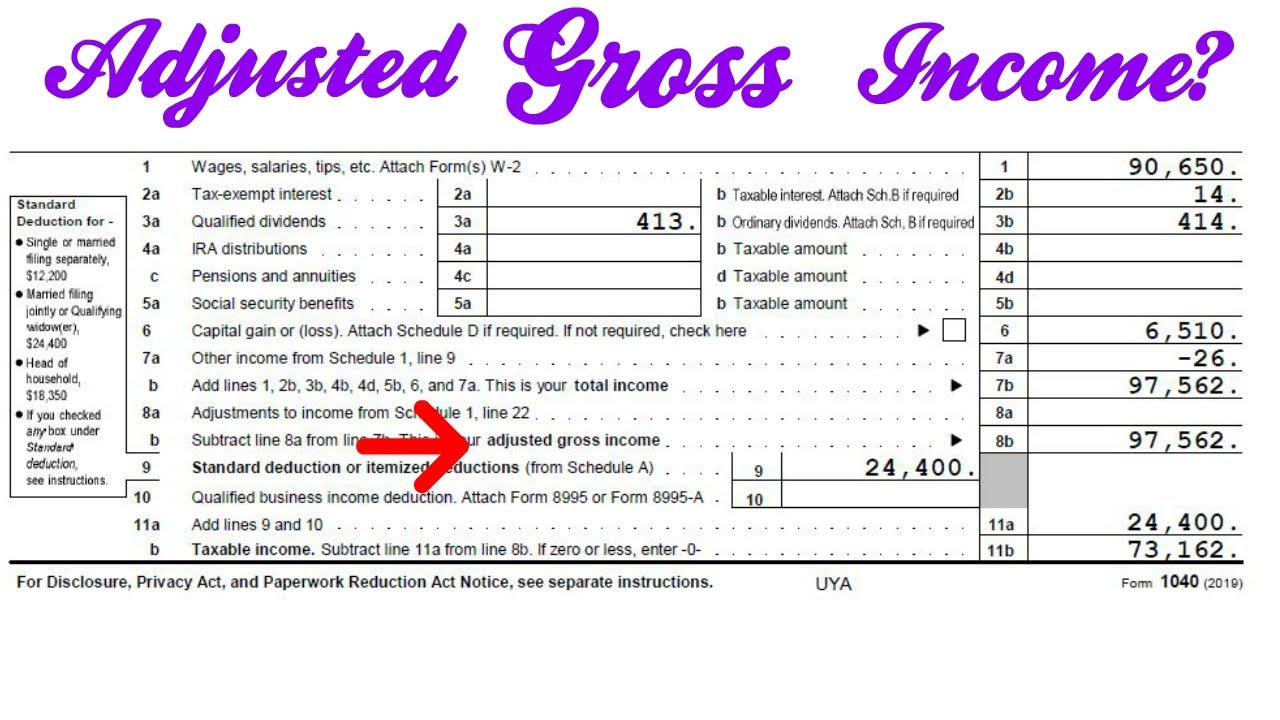

How To Find Annual Gross Income On Tax Return Your gross annual income appears on line 9 of the IRS Form 1040 tax return as of tax year 2021 the return you d file in 2022 The IRS periodically makes adjustments to Form 1040 but the line is marked total income so you can identify it in tax years 2022 or later Tips Your total gross income will be listed on line 9 of your IRS Form 1040

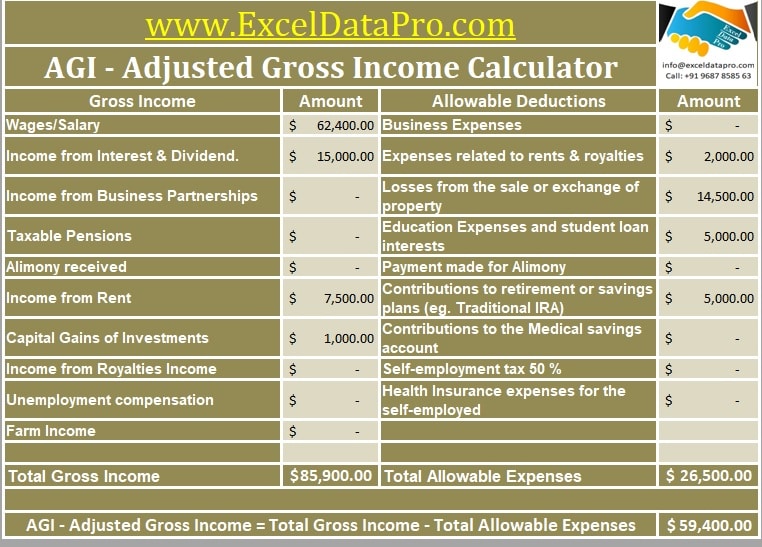

Your adjusted gross income AGI is your total gross income from all sources minus certain adjustments such as educator expenses student loan interest alimony payments and retirement contributions If you use software to prepare your return it will automatically calculate your AGI Under the expansion the maximum amount a lower income family can receive is multiplied by the number of children in the family A married couple making 12 500 a year would be eligible for a

How To Find Annual Gross Income On Tax Return

How To Find Annual Gross Income On Tax Return

https://exceldatapro.com/wp-content/uploads/2017/11/AGI-Calculator.jpg

Gross Annual Income Calculator Hourly JeremyAarya

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/07/11073323/Annual-Income-Calculator.jpg

Adjusted Gross Income Definition How To Calculate AGI

https://www.patriotsoftware.com/wp-content/uploads/2019/01/what-is-adjusted-gross-income-1.jpg

Annual Gross Income AGI represents the total earnings someone receives over a year before any deductions or taxes are taken out It s a comprehensive figure including wages bonuses and additional income sources Calculate your potential tax liability or refund with our free income tax calculator Plug in your expected income deductions and credits and the calculator will quickly estimate

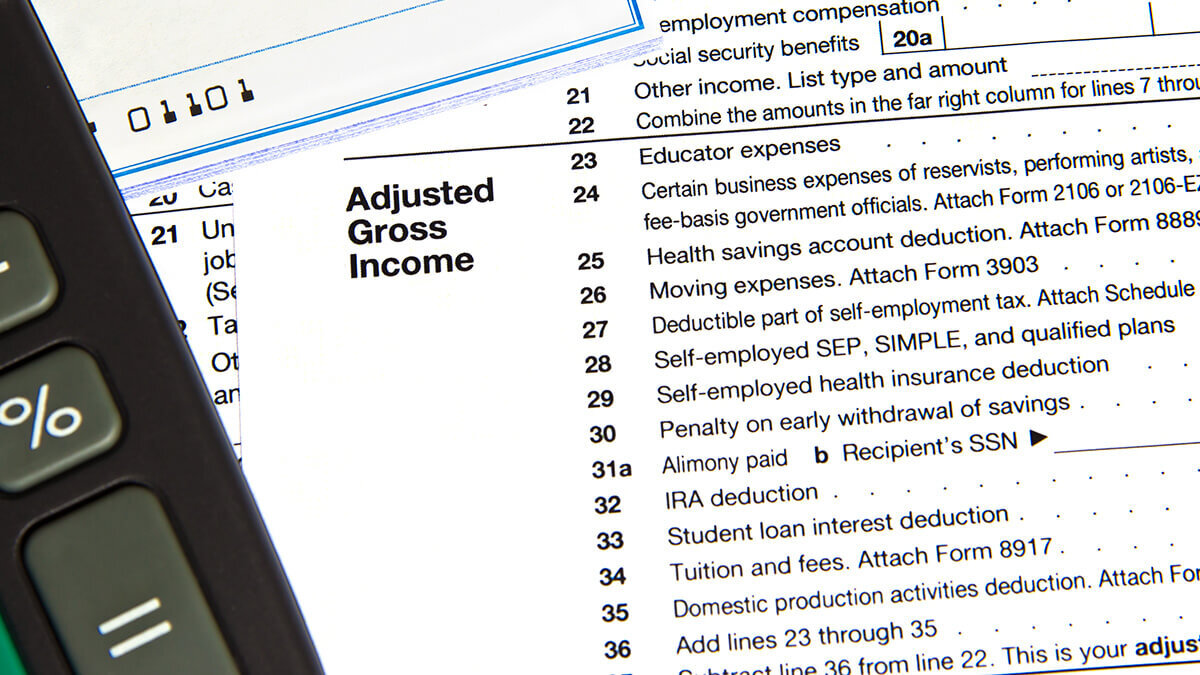

According to the IRS your MAGI is your AGI with the addition of the appropriate deductions potentially including Student loan interest One half of self employment tax Qualified tuition expenses Tuition and fees deduction Passive loss or passive income IRA contributions Non taxable social security payments It refers generally to your annual gross income after certain adjustments You can find your adjusted gross income right on line 11 of your tax return also known as the IRS Form 1040

More picture related to How To Find Annual Gross Income On Tax Return

2021 Child Tax Credit And Payments What Your Family Needs To Know

https://static.twentyoverten.com/5d5413591d304774fba39eb3/6kFYVeqmtJC/Adjusted-Gross-Income.jpg

What Is Adjusted Gross Income Qualify For The Coronavirus Economic

https://i.ytimg.com/vi/ByI_RRbKZ1U/maxresdefault.jpg

Is Base Salary The Same As Gross Pay

https://decoalert.com/wp-content/uploads/2021/06/Is-base-salary-the-same-as-gross-pay-1024x576.jpg

Your requirement to file a tax return depends on your Age Filing status Income Check if you need to file If you re a dependent on someone else s tax return If you were under 65 at the end of 2023 If you were 65 or older at the end of 2023 Previous To calculate taxable income you begin by making certain adjustments from gross income to arrive at adjusted gross income AGI Once you have calculated adjusted gross income you can subtract any deductions for which you qualify either itemized or standard to arrive at taxable income

Taxable income Next you re going to add the amount on Form 1040 line 12 either your standard or itemized deduction and your qualified business income deduction from Form 8995 or Form 8995 Taxable income Most income is taxable unless it s specifically exempted by law Income can be money property goods or services Even if you don t receive a form reporting income you should report it on your tax return Income is taxable when you receive it even if you don t cash it or use it right away It s considered your income

How To Get Your Coronavirus Money News The Finance Gourmet

https://financegourmet.com/blog/wp-content/uploads/2020/04/form-1040-adjusted-gross-income.jpg

How To Calculate Net Income 12 Steps with Pictures WikiHow

https://www.wikihow.com/images/7/74/Calculate-Net-Income-Step-12-Version-2.jpg

How To Find Annual Gross Income On Tax Return - It refers generally to your annual gross income after certain adjustments You can find your adjusted gross income right on line 11 of your tax return also known as the IRS Form 1040