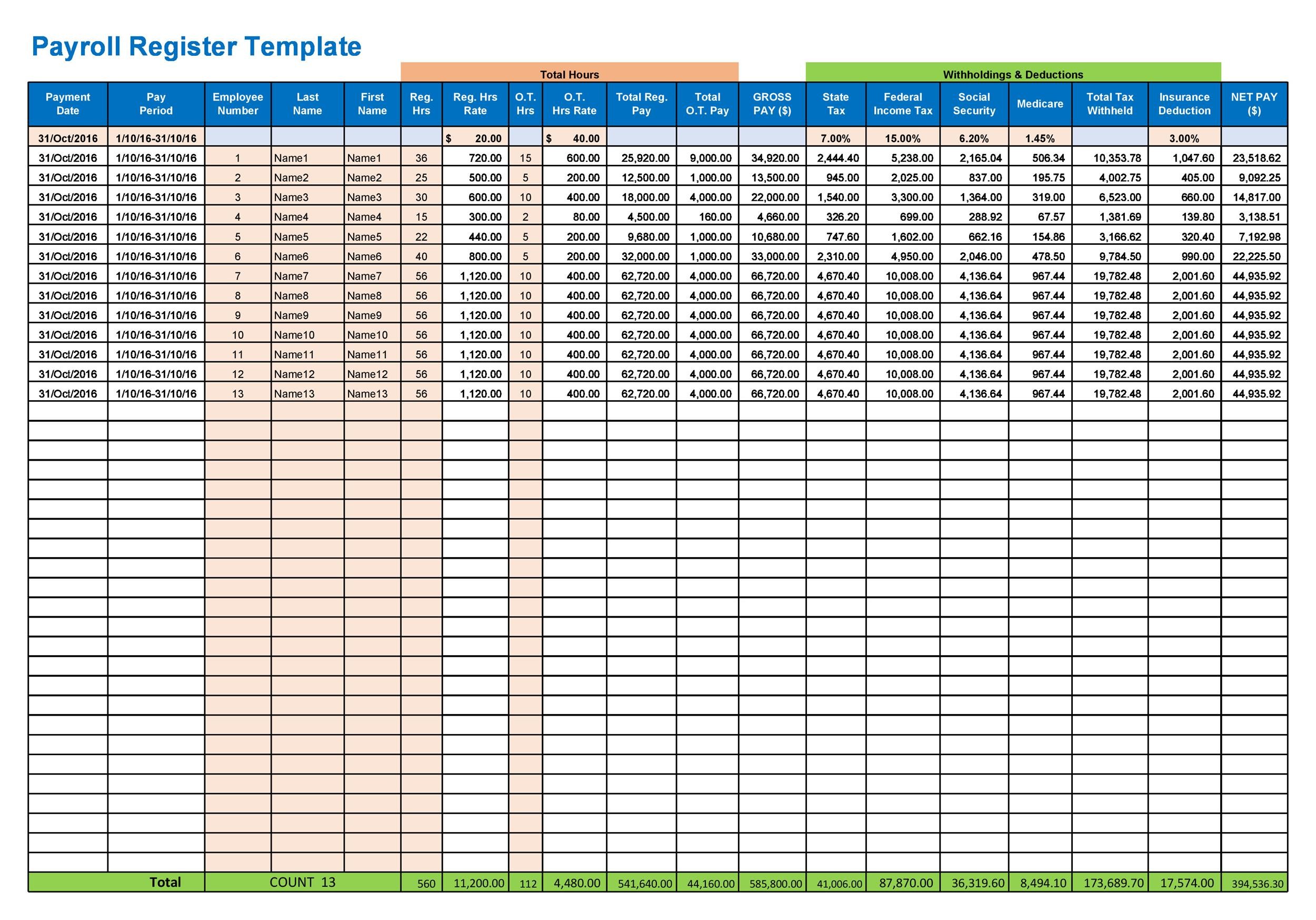

How To Do Payroll In Texas To calculate overtime pay take the number of hours worked over 40 and multiply it by their hourly overtime pay rate 1 5 So if Jane worked 10 overtime hours at 22 50 15 x 1 5 she would be owed 10 x 22 5 225 Adding in her normal hours Jane s total gross pay for that week would be 600 225 825

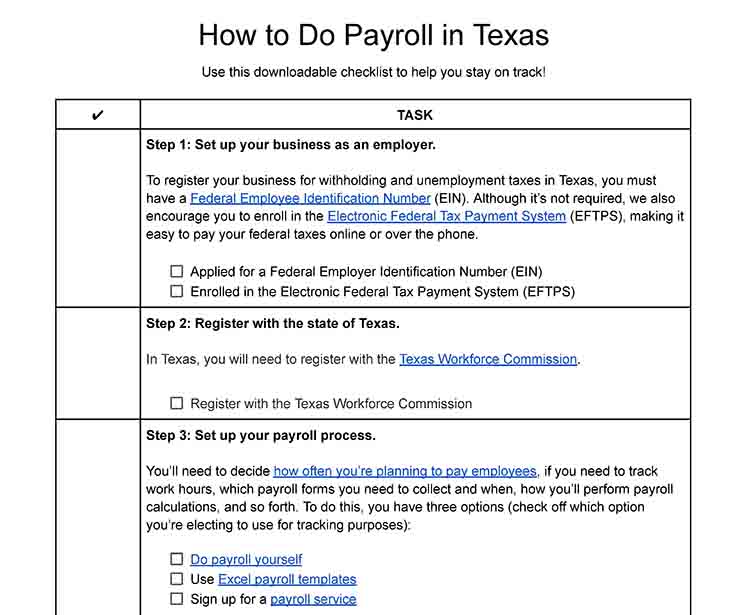

Step 1 Register your company as an employer Your EIN and an account in the Electronic Federal Transfer System are required at the federal level Step 2 Fill out an application with the Texas Workforce Commission To obtain your TWC Account Number you must register online within 10 days of the first check date Texas has a lower number of payroll tax requirements than other states amking processing payroll easier for employers There is no state income tax in Texas Texas has a state sales tax rate of 6 25 and local tax can be no more than 2 so the highest sales tax rate in Texas is 8 25 Texas minimum wage is the same as the federal minimum

How To Do Payroll In Texas

How To Do Payroll In Texas

https://mira-strapi-blog.s3.amazonaws.com/large_how_to_payroll_yourself_1_ac5ade39dd.jpeg

How To Do Payroll In Texas What Employers Need To Know

https://fitsmallbusiness.com/wp-content/uploads/2021/04/FeatureImage_how_to_do_payroll_in_Texas.jpg

How To Do Payroll In Texas What Employers Need To Know

https://fitsmallbusiness.com/wp-content/uploads/2023/09/Thumbnail_How_to_Do_Payroll_in_Texas.jpg

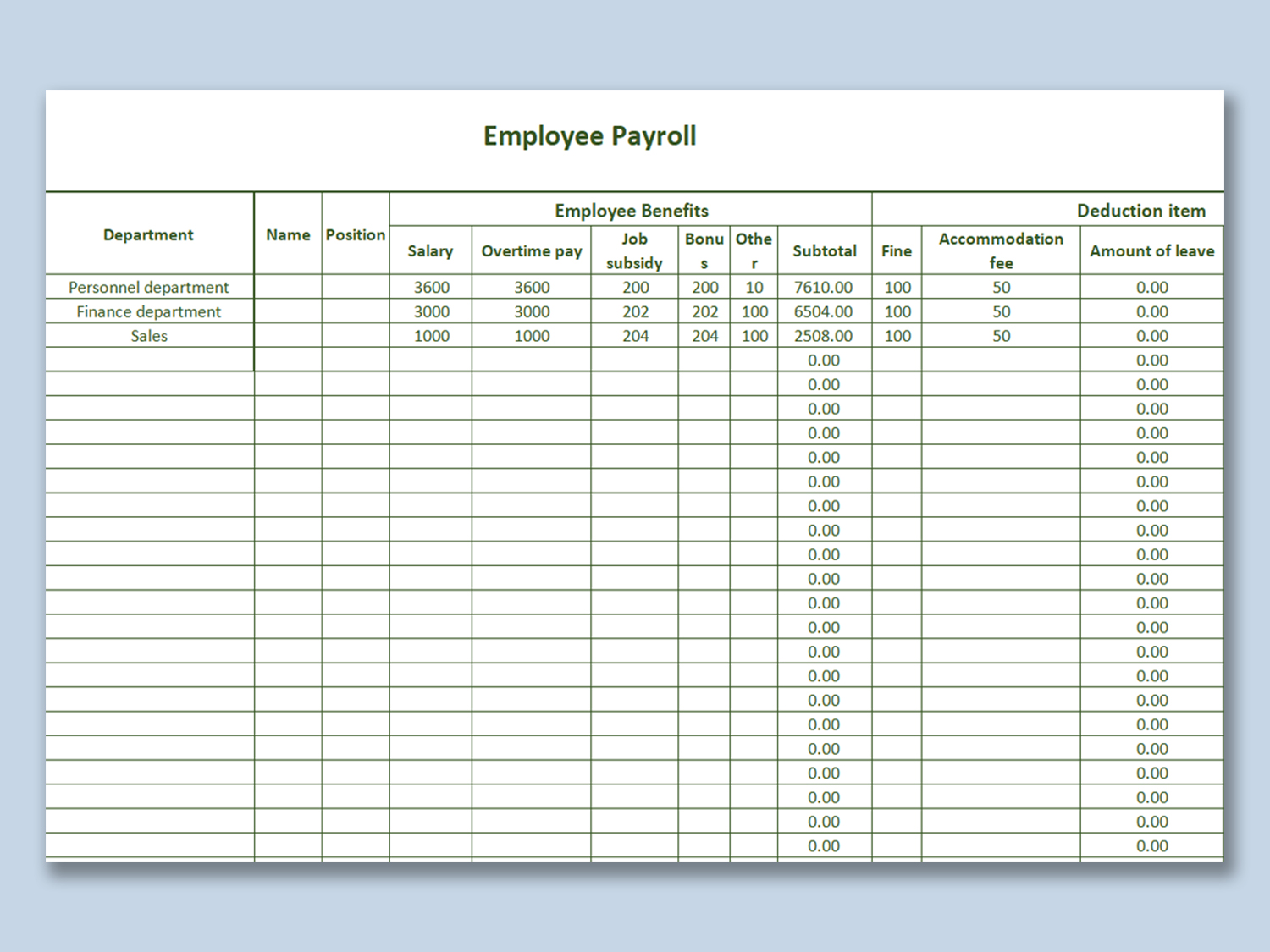

If an employer is found conspiring with employees to falsify or insufficiently complete reports they may face additional penalties up to 500 Minimum Wage The minimum wage in Texas is 7 25 however certain exemptions exist Additionally Texas employers should use a minimum wage of 2 13 and together with a maximum tip credit of 5 12 The goal of payroll is to pay employees accurately and on time while complying with all government regulations This process encompasses the following steps Calculate hours worked and gross pay First the total number of hours worked by each employee must be calculated and multiplied by the individual s pay rate

Owners must pay 6 of their workers first 7 000 in yearly earnings to the FUTA Because most companies are generally eligible for government tax breaks the FUTA rate often becomes 0 6 percent of the first 7 000 of an employee s yearly income Texas minimum pay is 7 25 per hour the same as the federal minimum wage Texas minimum wage is 7 25 per hour which is the same as the federal minimum wage Texas employers can count tips and any applicable meal and lodging costs toward minimum wage payments as long as they follow state guidelines Tipped employees must receive a base wage of 2 13 per hour supplemented by tips to reach the 7 25 minimum wage

More picture related to How To Do Payroll In Texas

Make An Efficient Payroll Statement Template Using These Tips And

https://free-template.co/wp-content/uploads/2022/01/8955583aa7d0c677/payroll-statement-template.jpeg

4 Advantages Of Outsourcing Payroll

https://www.youroffice.com/wp-content/uploads/2017/02/payroll.jpg

Make An Efficient Payroll Statement Template Using These Tips And

https://free-template.co/wp-content/uploads/2022/01/1cf53f8084dd3be6/payroll-statement.jpeg

Texas sets its minimum wage to the federal minimum wage rate In 2020 the federal minimum wage was 7 25 per hour Employers are allowed to count tips and the cost of work related meals and lodging towards an employee s minimum wage Agricultural workers may earn the minimum wage But those who harvest crops can also earn more or a piece Then print checks yourself or use free direct deposit 2 Get set up for e pay Go through the e services setup in our system For states where e pay isn t available we ll give you the form to mail to your tax agency or we ll give you step by step instructions on how to complete the forms the agencies mail to you 3

The minimum reemployment tax rate in Texas is 0 31 percent with a maximum rate of 6 31 percent Employers must pay the Texas unemployment insurance tax on the first 9 000 each of their employees earns in a calendar year Employers must also contribute to the FUTA scheme to pay reemployment tax at the federal level Here are the eight essential steps to run payroll on your own 1 Set the Process Up If you are running payroll manually the process will be important to ensure that you don t overlook any

Payroll Service Providers In Dallas Texas My Count Solutions

http://mycountsolutions.com/wp-content/uploads/2020/04/payroll-1-1024x717.png

Home Human Resource

https://humanresource.com/wp-content/uploads/2022/12/How-to-Do-Payroll-in-Virginia-870x570.jpg

How To Do Payroll In Texas - Texas paycheck calculator Use ADP s Texas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest Looking for managed Payroll and benefits for your business Important note on the