How To Do Payroll In Illinois Calculate Gross Pay Determine Withholdings Deductions and Allowances Calculate Net Pay Pay Employees Keep Records Pay Federal Payroll Taxes Pay Illinois Payroll Taxes Using a Payroll Service If you re just starting a business in Illinois and expecting to hire employees you ll soon need to tackle the challenge of payroll

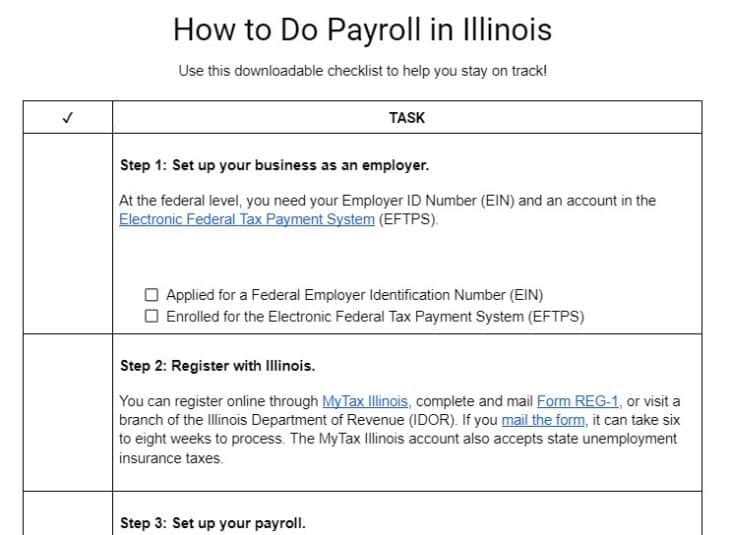

A Step by Step Guide to Setting up Payroll in Illinois Set Your Business up and Register as an Employer Register with Illinois State as an Employer Start Setting up Your Payroll System Collect Payroll Forms from Employees Work With Timesheets Work Out Payroll File Payroll Taxes Record Everything Payroll Tax Reports Illinois Payroll Taxes I 9 Direct deposit authorization form Step 5 Collect review and approve time sheets If you have hourly or nonexempt employees you ll need a way to track employee work hours Most small business owners create their own time sheets or use time and attendance software some of which have free plans A paper timesheet

How To Do Payroll In Illinois

How To Do Payroll In Illinois

https://humanresource.com/wp-content/uploads/2022/12/How-to-Do-Payroll-in-Illinois-1024x612.jpg

How To Do Payroll In Illinois An Employer s Guide

https://fitsmallbusiness.com/wp-content/uploads/2021/08/FeatureImage_how_to_do_payroll_in_illinois.jpg

How To Do Payroll In Illinois An Employer s Guide

https://fitsmallbusiness.com/wp-content/uploads/2022/11/Thumbanail_How_to_Do_Payrol_-in_Illinois-730x535.jpg

Launch ADP s Illinois Paycheck Calculator to estimate your or your employees net pay Free and simple Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed The wage base is 13 590 for 2024 and rates range from 850 to 8 650 If you re a new employer your rate is 3 950

Managing payroll in Illinois requires a lot of legal knowledge and compliance with laws Employees must ensure they adhere to Illinois s payroll regulations To make the process of managing payroll easier consider exploring our list of the top 6 applications tailored to streamline payroll responsibilities in the United States In 2022 the Illinois state unemployment insurance SUI tax rate will range from 0 725 to 7 1 with a maximum taxable wage base of 12 960 This year s guidelines saw a modest increase from 2021 which had a range of 0 675 to 6 4 the taxable wage base did not change from 2021 to 2022

More picture related to How To Do Payroll In Illinois

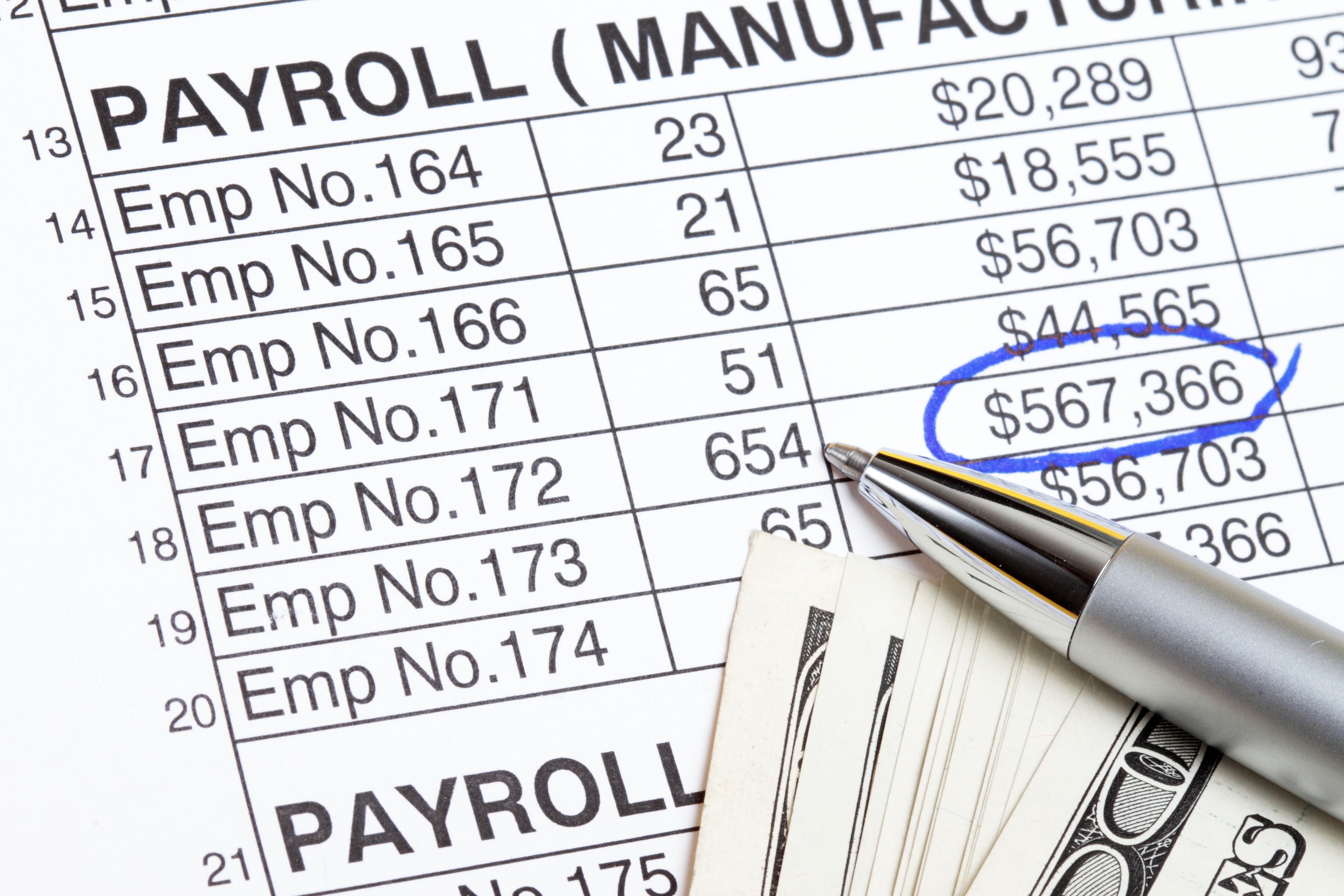

4 Advantages Of Outsourcing Payroll

https://www.youroffice.com/wp-content/uploads/2017/02/payroll.jpg

Ytd Payroll Calculator CharlesKobey

https://fitsmallbusiness.com/wp-content/uploads/2022/01/Thumbnail_Annual_Payroll_Excel_Template.jpg

A Complete Guide To Illinois Payroll Taxes

https://www.deskera.com/blog/content/images/size/w2000/2022/05/Untitled-design--71-.png

The how to prepare payroll is a guide on how to do payroll in Illinois It includes information on what you need and the different ways of doing it Illinois has Income Taxes in Different States as well as Agreements of Reciprocity with neighboring states that allow workers to pay income taxes in their home state Complete and mail Form REG 1 Illinois Business Registration Application to the address on the form Form REG 1 is also available on their website as a fillable form Registration forms are also available by calling the Department of Revenue at 1 800 356 6302 You ll be able to register using your Federal EIN

Definition Generally you must withhold Illinois Income Tax if you are required to withhold or have a voluntary agreement to withhold federal income tax from payments you make for employee compensation i e wages and salaries paid in Illinois gambling or lottery winnings in Illinois paid to an Illinois resident Mail completed forms and payments to IDES P O Box 19300 Springfield Illinois 62794 9300 For more IDES employer contact information or call The Employer Services Hotline at 800 247 4984 The Tax Hotline TTY number is 866 212 8831

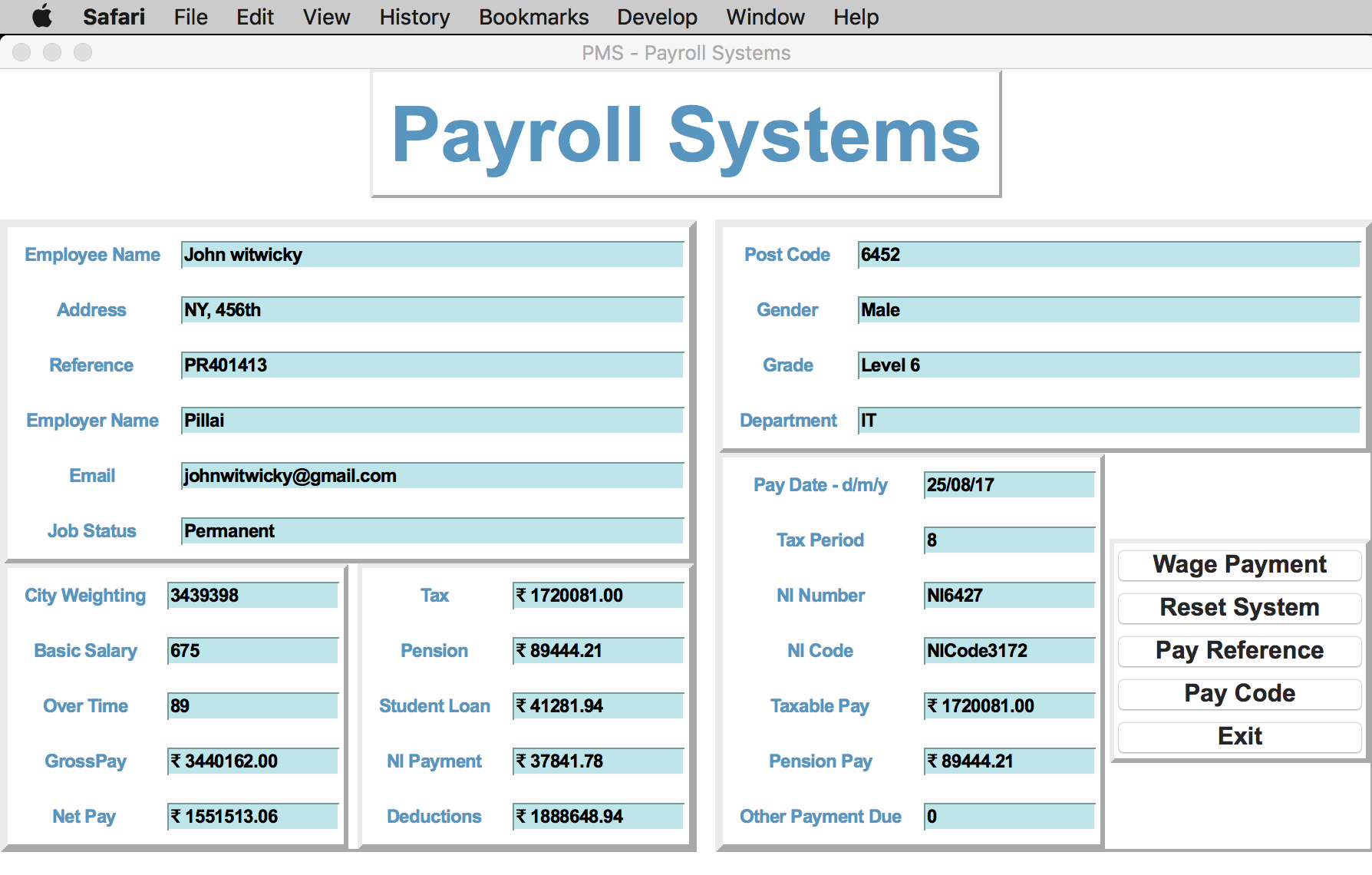

Payroll System Payroll System Using Vb Net Riset

https://raw.githubusercontent.com/niraj007m/payrollsystem/master/pms.png

5 Occasions When Small Businesses Should Outsource Their Payroll

https://cdn2.hubspot.net/hubfs/2242316/Imported_Blog_Media/payroll.jpg

How To Do Payroll In Illinois - Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed The wage base is 13 590 for 2024 and rates range from 850 to 8 650 If you re a new employer your rate is 3 950