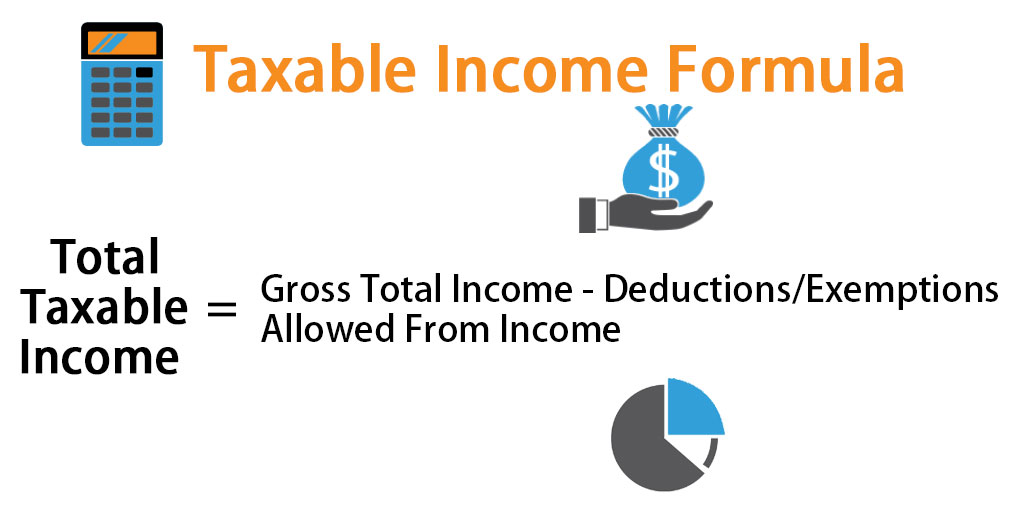

How To Determine Total Taxable Income Taxable income is the amount of income used to calculate how much tax an individual or a company owes to the government in a given tax year It is generally described as gross income or adjusted

Step 1 Determine Your Filing Status First determine your filing status If you are married your best option is usually to file jointly If you file your taxes jointly with your spouse you are required to add all of your income together to determine the total You can combine your deductions and you pay your taxes jointly Calculate your potential tax refund or bill with our free tax calculator The income tax estimator will project your 2023 2024 federal taxes based on your income deductions and credits Taxable

How To Determine Total Taxable Income

How To Determine Total Taxable Income

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-768x552.png

How To Calculate Federal Income Taxes Social Security Medicare

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Taxable Income Calculator India

https://i1.wp.com/www.thewealthwisher.com/wp-content/uploads/2012/05/IncomeTaxCalci-Final2.jpg

All features services support prices offers terms and conditions are subject to change without notice Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your federal tax rate Total Estimated 2023 Tax Burden First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401 k Next from AGI we subtract exemptions and deductions either itemized or standard to get your taxable income

Use this tool to Estimate your federal income tax withholding See how your refund take home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter Taxable income is the part of your gross income the total income you receive that is subject to federal tax Note Luckily your tax preparer if you use one will calculate your AGI and

More picture related to How To Determine Total Taxable Income

How To Calculate Taxable Income H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2013/01/how-to-calculate-taxable-income.jpg

How To Calculate Current Tax Haiper

https://www.educba.com/academy/wp-content/uploads/2019/06/Taxable-Income-Formula.jpg

What Is Taxable Income Explanation Importance Calculation Bizness

https://i1.wp.com/biznessprofessionals.com/wp-content/uploads/2020/02/Capture34.png?fit=2630%2C1497&ssl=1

Step by step Enter the filing status income deductions and credits to estimate your total taxes for 2008 Filing status Total exemption Total income Tips Determining your taxable income Generally if your taxable income is below the 2023 2024 standard deduction your tax is 0 Your filing status age and whether you qualify as legally blind also determine your standard deduction

Taxable income Most income is taxable unless it s specifically exempted by law Income can be money property goods or services Even if you don t receive a form reporting income you should report it on your tax return Income is taxable when you receive it even if you don t cash it or use it right away It s considered your income Key Takeaways Income received as wages salaries commissions rental income royalty payments stock options dividends and interest and self employment income are taxable Unemployment compensation generally is taxable Inheritances gifts cash rebates alimony payments for divorce decrees finalized after 2018 child support

Solved He Required Determine The Average Amount Of Taxable Income

https://www.coursehero.com/qa/attachment/17280208/

How To Calculate Net Income 12 Steps with Pictures WikiHow

https://www.wikihow.com/images/7/74/Calculate-Net-Income-Step-12-Version-2.jpg

How To Determine Total Taxable Income - Any income earned by an individual is subject to taxation by the government This includes earnings in the form of hourly pay overtime wages a salary commissions bonuses and even tips and