How To Compute Net Income After Tax The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

Federal Income Tax The federal income tax is a progressive tax meaning it increases in accordance with the taxable amount The more someone makes the more their income will be taxed as a percentage In 2025 the federal income tax rate tops out at 37 Only the highest earners are subject to this percentage The average annual salary in the United States is 72 280 translating to approximately 4 715 per month after taxes and contributions though the exact amount depends on where you live Since salaries can vary significantly across states we have compiled the average annual salary for each state in the table below along with the monthly take home pay estimated by our calculator

How To Compute Net Income After Tax

How To Compute Net Income After Tax

https://www.taxestalk.net/wp-content/uploads/net-income-after-taxes-niat.jpeg

How To Find Net Income Calculations For Business

https://www.patriotsoftware.com/wp-content/uploads/2019/12/net-income-visual.jpg

Question 2 Compute Net Income Under Different Alternatives MoonCover

https://answerhappy.com/download/file.php?id=489474

Updated on Feb 14 2025 Free paycheck calculator to calculate your hourly and salary income after taxes deductions and exemptions A salary calculator lets you enter your annual income gross pay and calculate your net pay paycheck amount after taxes You will see what federal and state taxes were deducted based on the information entered You can use this tool to see how changing your paycheck affects your tax results

Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes Your average tax rate is 21 7 and your marginal tax rate is 36 0 This marginal tax rate means that your immediate additional income will be taxed at this rate For instance an increase of 100 in your salary will be taxed 36 01 hence your net pay will only increase by 63 99

More picture related to How To Compute Net Income After Tax

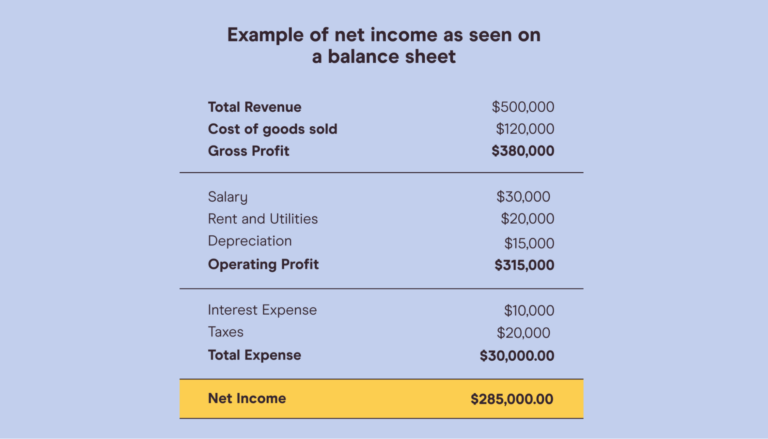

How To Find Net Income For Beginners Pareto Labs

https://www.paretolabs.com/wp-content/uploads/2021/06/Example-of-net-income-as-seen-on-a-balance-sheet-768x439.png

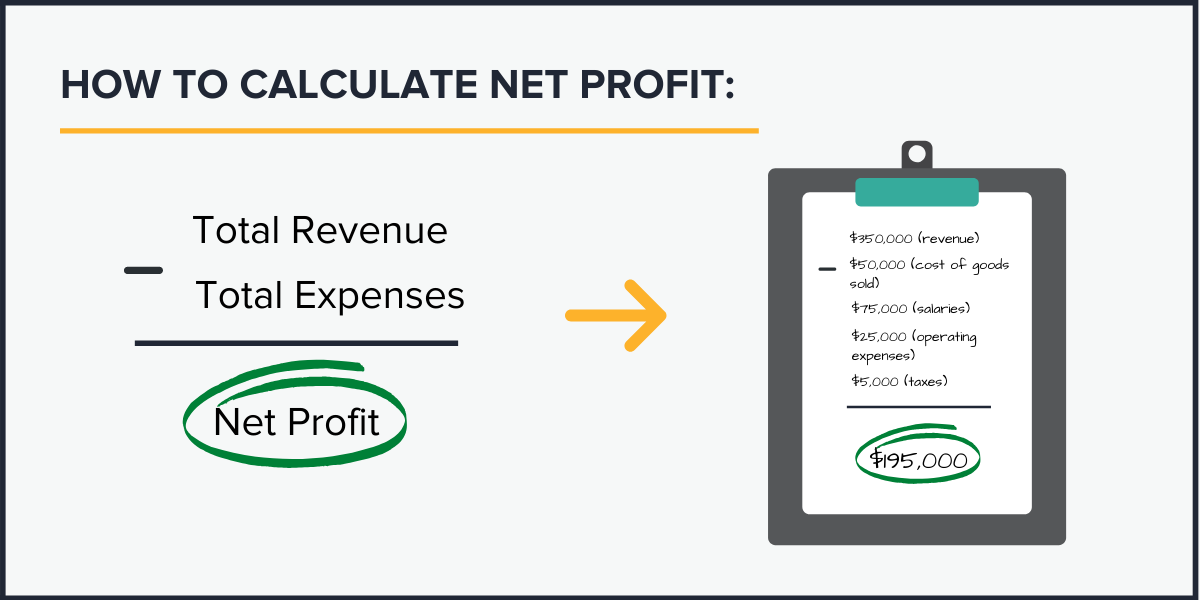

What Is Net Profit Net Profit Formula updated 2022

https://fastloans.ph/wp-content/uploads/2020/11/Created-by-2-copy.png

How To Compute Income Tax In The Philippines

https://www.thinkpesos.com/wp-content/uploads/2016/07/How-to-compute-income-tax-in-the-philippines-1.png

Input your income details and see how much you make after taxes and deductions Salary Employee Calculator Determine your net pay if you re paid a salary Calculate the gross wages based on a net pay amount Withholding Forms Electronic Form W4 Fill out a Form W4 step by step with helpful tips Specialty Calculators The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Select State This input

[desc-10] [desc-11]

How Do The Income Statement And Balance Sheet Differ

https://www.investopedia.com/thmb/3_P-A0mM913j3zZYmQC0o5-EM6g=/498x908/filters:no_upscale():max_bytes(150000):strip_icc()/jcp_income_statement_cogs-5bfd86c84cedfd0026fff145

EXPLAINER Step By Step Guide On How To Compute Your Income Tax Under

https://i.pinimg.com/originals/f4/93/53/f493532850b87c2ea40d40ad80186664.jpg

How To Compute Net Income After Tax - Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes