How To Compute Daily Rate For Monthly Paid Employees Daily rate employees are paid for the days that they worked Daily rate Example Daily rate 500 00 of days worked 10 Total pay P500 00 x 10 P5 000 00 Monthly rate employees are paid a fixed amount per month If the payroll frequency is semi monthly the employee will receive half his her monthly rate per pay period

For monthly paid employees here is how it is computed Basic Monthly Salary x 12 Total Working Days in a Year DAILY RATE Important The total working days in a year TWD may vary from one employee to another If an employee regularly works from Mondays to Saturdays his expected TWD in a year is 313 days Special days can be anything from company holidays to Employee Appreciation Day and the like The calculated daily rate is based on Daily rate x 130 Using the daily rate above as a basis P689 66 x 1 30 P896 56 For Special Working Days scheduled on an employee rest day the computation is Daily rate x 150

How To Compute Daily Rate For Monthly Paid Employees

How To Compute Daily Rate For Monthly Paid Employees

https://media.cheggcdn.com/media/5c7/5c722ed2-45ba-4019-82cd-49243bffc249/phpxNvQNs

How to Calculate FTE: Full-Time Equivalent Formulas & More

https://www.wikihow.com/images/thumb/7/7a/Calculate-FTE-Step-7-Version-2.jpg/aid4295654-v4-1200px-Calculate-FTE-Step-7-Version-2.jpg

How to Calculate Your Annual Salary: Easy Formulas

https://www.wikihow.com/images/3/3a/Calculate-Annual-Salary-Step-17.jpg

How to Compute Daily Rate for Monthly Paid Employees in the Philippines based on the DOLE guidelines You can read the full guidelines in the link below https Daily Rate P20 000 12 261 919 54 For Employees Working Monday to Saturday 331 Days Employees who work six days a week have a total of 331 working days in a year Daily Rate Monthly Rate 12 331 Special Working Days and Holidays Special Working Days The pay is 130 of the daily Rate Pay Daily Rate 1 30

The computation of daily rate will be 11 000 x 12 312 423 08 423 08 is below minimum wage and you don t need to deduct withholding tax to the employees salary in fact at the time of this writing June 2016 423 08 is below minimum wage and should be increased to the correct minimum wage That rate will also be your basis when To calculate the daily rate of pay dividing the monthly rate by the number of working days in a month is necessary The formula is outlined as follows Daily Rate of Pay Monthly Rate Number of Working Days Example Consider an employee with a monthly rate of PHP 30 000 and 22 working days in a month excluding weekends and holidays

More picture related to How To Compute Daily Rate For Monthly Paid Employees

Prorated Salary: Easy Guide & Calculator - Hourly, Inc.

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/615382491c05244b255ffeab_hero-Prorated%20Salary.jpg

:max_bytes(150000):strip_icc()/CalculateCardPayments-5fd5f524f6b841ec8919fcd3bc17e16f.jpg)

Calculate Credit Card Payments and Costs: Examples

https://www.thebalancemoney.com/thmb/7LVw5XcNasZlKyvjU0lDiMP7Oc0=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/CalculateCardPayments-5fd5f524f6b841ec8919fcd3bc17e16f.jpg

Salary to Hourly Calculator

https://i.ytimg.com/vi/QbX6kuk4gAk/maxresdefault.jpg

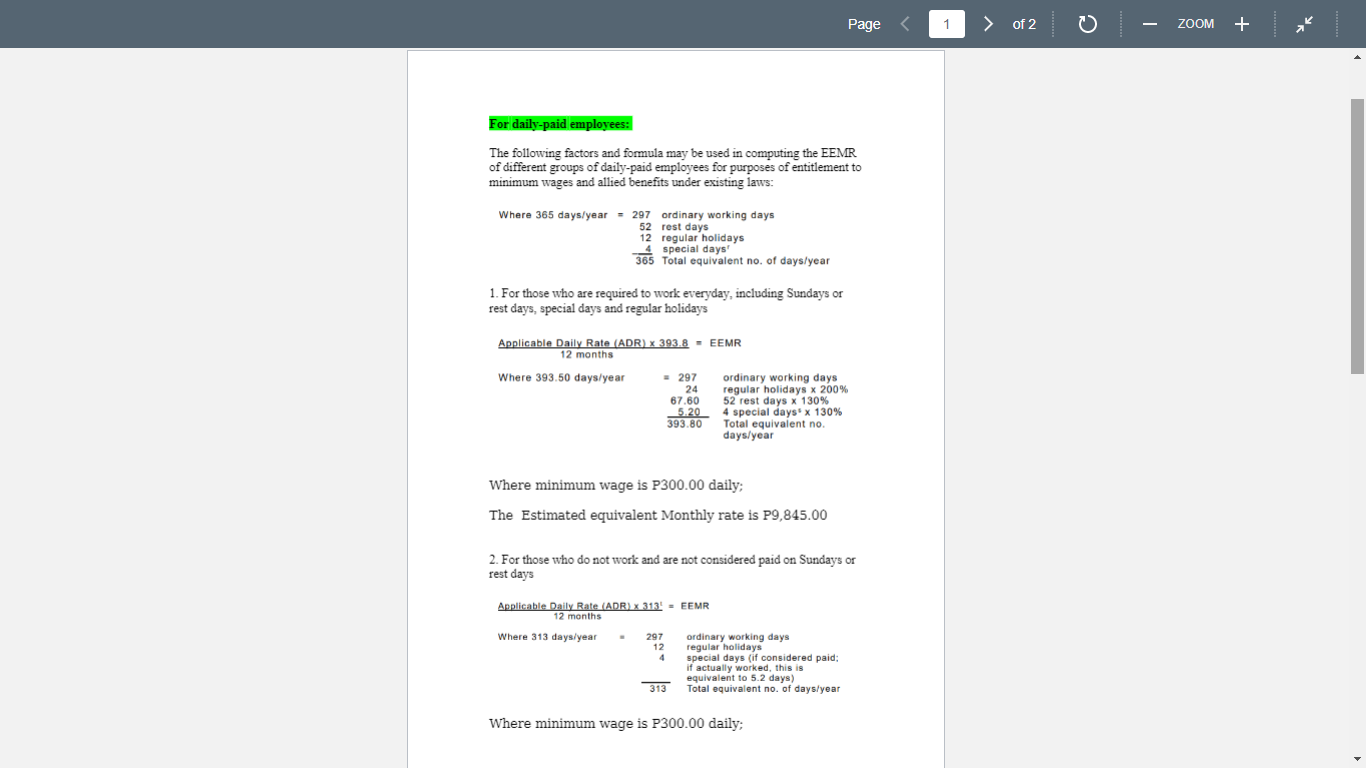

Wage rates are also computed differently when employees work overtime or rest days That said there are different formulas when calculating employee compensation such as the following Computing Pay for Work Done on A Regular Day basic daily rate monthly rate x number of months in a year 12 total working days in a year The general rule of no work no pay applies to both daily paid and monthly paid employees with only one exception during regular holidays when both are paid despite no work If there is a favorable stipulation or agreement monthly paid employees may be paid for un worked days such as rest days and special non working days 1 Concepts

Here s how to compute the employee s daily rate Daily Rate Monthly Rate X 12 Total working days in a year Php 575 08 Php 15 000 X 12 313 if working Mondays to Saturdays Php 689 66 Php 15 000 X 12 261 if working Mondays to Fridays Note Total working days in a year is 313 days if you re working Mondays to Saturday Formula Monthly Basic Salary X 12 mos Factor days in a year Daily Rate P30 000 X 12 313 P1 150 Daily rate P30 000 X 12 261 P1 379 Daily rate Daily paid employees are those who are paid on the days they actually worked and on unworked regular holidays

How to Calculate the Final Paycheck for Salaried Employees - Hourly, Inc.

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/63a2221684c8b83d1ac2348b_hero-Calculating%20final%20paycheck%20for%20salaried%20employee.jpg

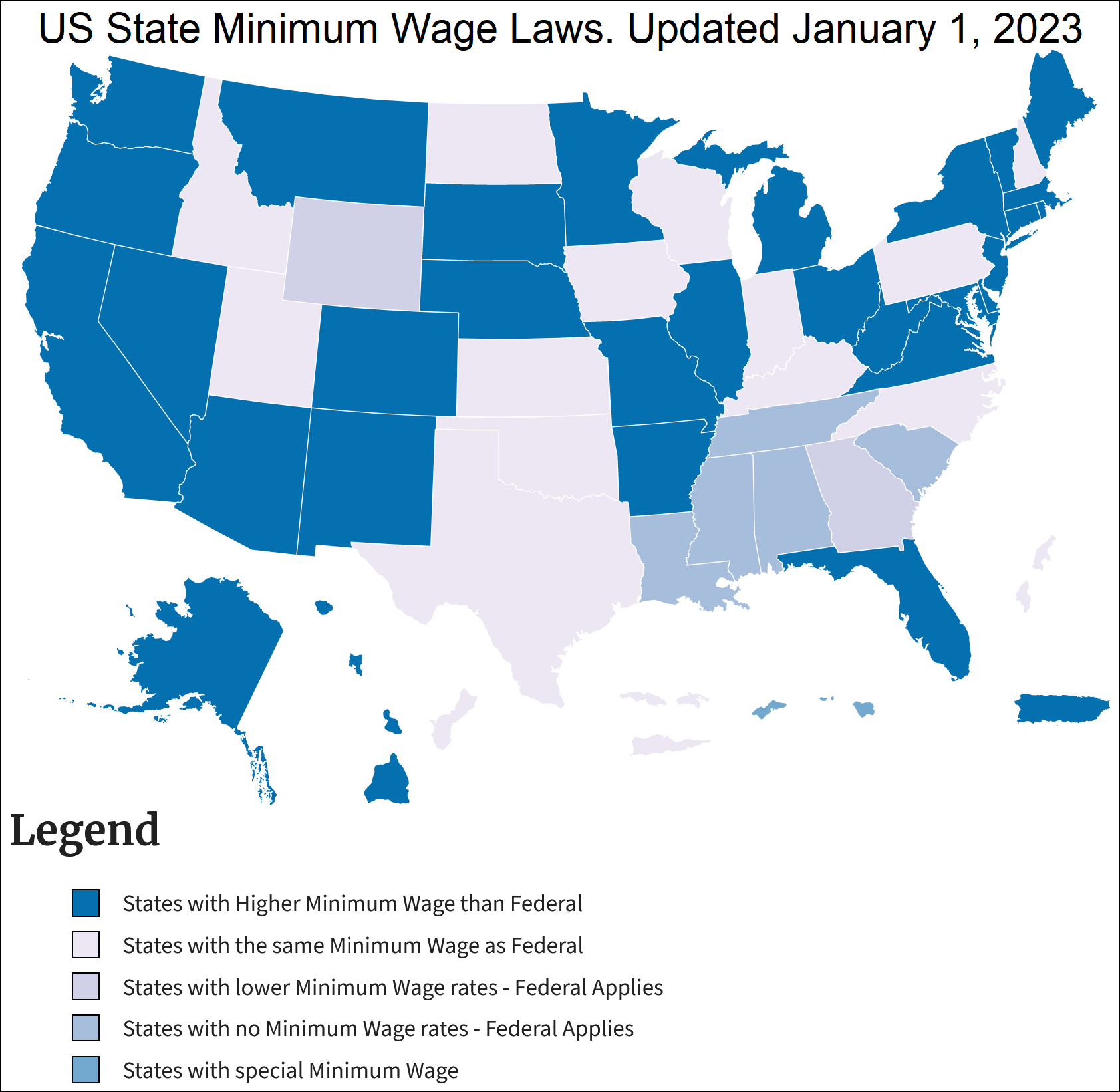

Minimum wage in the United States - Wikipedia

https://upload.wikimedia.org/wikipedia/commons/8/8c/US_minimum_wage_map.png

How To Compute Daily Rate For Monthly Paid Employees - How to Compute Monthly Rate for Daily Paid Employees in the Philippines based on the DOLE Guidelines You can read the full DOLE guidelines in the link below