How To Calculate Your Hourly Wage After Taxes Step 6 Your paycheck For the final step divide your net pay by your pay frequency The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck

Multiply the hourly wage by the number of hours worked per week Then multiply that number by the total number of weeks in a year 52 For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52 000 Important Note on the Hourly Paycheck Calculator The calculator on this page is To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get

How To Calculate Your Hourly Wage After Taxes

How To Calculate Your Hourly Wage After Taxes

https://i.pinimg.com/originals/a3/3e/98/a33e983ae15b34ff2f3e4c532e85e195.png

How To Calculate Your Hourly Rate Caroline M Wood

http://carolinemwood.com/wp-content/uploads/2015/05/How-to-calculate-your-hourly-rate-1024x768.jpg

Use This Calculator To Convert Your Hourly Wage To An Equivalent Annual

https://i.pinimg.com/originals/a5/9c/8a/a59c8a177479043874f98c2a5a9b5415.jpg

An hourly calculator lets you enter the hours you worked and amount earned per hour and calculate your net pay paycheck amount after taxes You will see what federal and state taxes were deducted based on the information entered You can use this tool to see how changing your paycheck affects your tax results Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

How Your Illinois Paycheck Works For each pay period your employer will withhold 6 2 of your earnings for Social Security taxes and 1 45 of your earnings for Medicare taxes Together these are called FICA taxes and your employer will pony up a matching contribution If you file your taxes as single any earnings you make in excess of To calculate employer taxes use PaycheckCity Payroll Unlimited companies employees and payroll runs for only 199 a year All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Use PaycheckCity s free paycheck calculators withholding calculators and tax calculators for all your paycheck and

More picture related to How To Calculate Your Hourly Wage After Taxes

How To Calculate Annual Salary From Hourly Wage Sapling

http://img.saplingcdn.com/640/clsd/getty/cache.gettyimages.com/03c6932d55464c8a88569a4f80d18f89.jpg

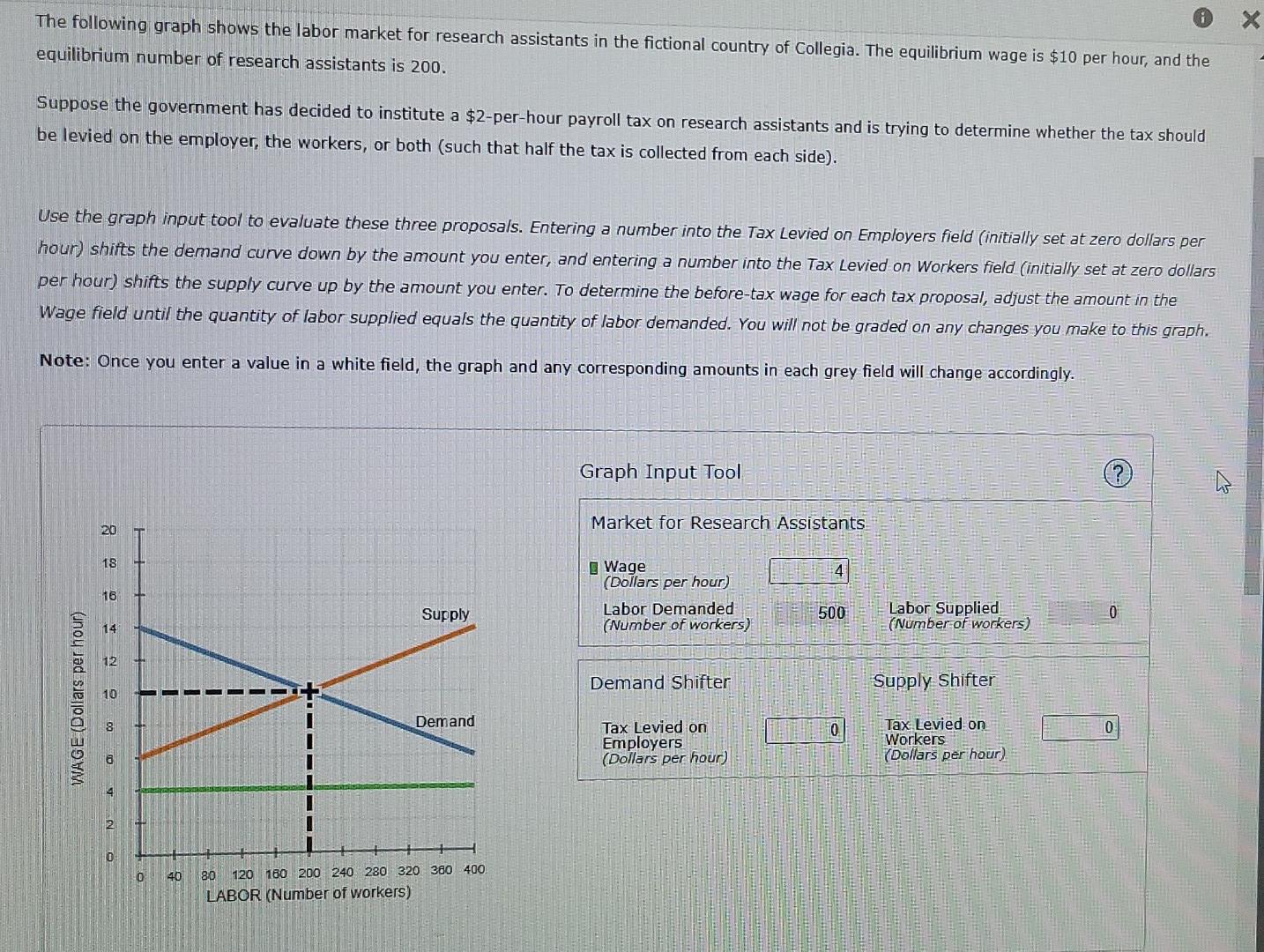

Solved The Following Graph Shows The Labor Market For Chegg

https://media.cheggcdn.com/study/16b/16b200ce-4736-486b-8f98-1b3dafc34ff5/image

3 Ways To Calculate Annual Salary From Hourly Wage WikiHow

https://www.wikihow.com/images/7/7e/Calculate-Annual-Salary-from-Hourly-Wage-Step-10.jpg

This free hourly and salary paycheck calculator can estimate an employee s net pay based on their taxes and withholdings Get an accurate picture of the employee s gross pay including overtime commissions bonuses and more Deduct state taxes and federal taxes factoring in employee requested allowances to get a more accurate picture Paycheck Calculator Use our Free Paycheck Calculator spreadsheet to estimate the effect of deductions withholdings federal tax and allowances on your net take home pay Unlike most online paycheck calculators using our spreadsheet will allow you to save your results see how the calculations are done and even customize it

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator 2014 55 173 2013 55 156 2012 51 904 Pennsylvania levies a flat state income tax rate of 3 07 Therefore your income level and filing status will not affect the income tax rate you pay at the state level Pennsylvania is one of just eight states that has a flat income tax rate and of those states it has the lowest rate

Calculate Base Salary From Hourly Rate BobbieDerren

https://www.marketing91.com/wp-content/uploads/2019/04/How-To-Calculate-Hourly-Rate-Of-Work-1.jpg

Annual Salary To Hourly Income Conversion Calculator

https://calculator.me/img/salary-raise.png

How To Calculate Your Hourly Wage After Taxes - How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000