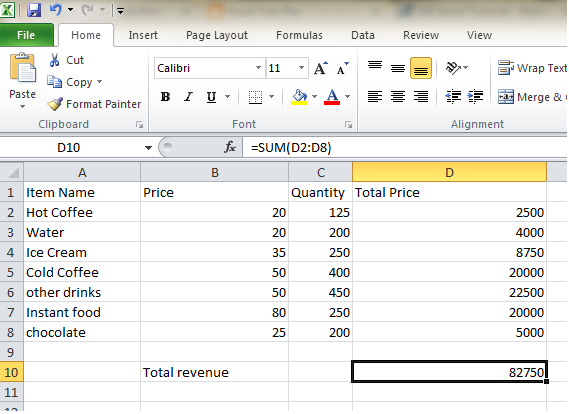

How To Calculate Total Income In Excel 2 Select an empty cell beneath the last item in your income column 3 Type Total Income in this cell then press the Enter key 4 Select the cell directly beneath the Total Income label

Net Income Formula in Excel With Excel Template Here we will do the same example of the Net Income formula in Excel It is very easy and simple You need to provide two inputs i e Total Revenue and Total Expense You can easily calculate the Net Income using the Formula in the template provided Total In cell B6 enter the formula SUM B2 B5 to calculate the total gross income In cell C6 enter the formula SUM C2 C5 to calculate the total deductions In cell D6 enter the formula B6 C6 to calculate the net income Format the cells as currency or number and apply any formatting or styling you prefer

How To Calculate Total Income In Excel

How To Calculate Total Income In Excel

https://1.bp.blogspot.com/-8IRjbBUgA6Q/V3OLNn5sebI/AAAAAAAAAGc/8qaL54vLX0IY_i8uziCBzfsn48AmZ_V9gCLcB/s640/revenue.png

Total Income TI What Is Total Income And How To Calculate Total

https://gstguntur.com/wp-content/uploads/2021/07/Total-Income-TI-1024x576.png

Deductions From Total Income How To Calculate Total Income Income Tax

https://i.ytimg.com/vi/fz3MlEpzlMQ/maxresdefault.jpg

To calculate total income tax based on multiple tax brackets you can use VLOOKUP and a rate table structured as shown in the example The formula in G5 is VLOOKUP inc rates 3 1 inc VLOOKUP inc rates 1 1 VLOOKUP inc rates 2 1 where inc G4 and rates B5 D11 are named ranges and column D is a helper column that calculates total accumulated tax at each bracket Using Excel formula to calculate the total gross income In Excel the SUM function can be used to add up all the income sources By entering the range of cells containing the income values you can easily calculate the total gross income For example the formula SUM A1 A10 will calculate the sum of income values in the range from cell A1

1 Add and Subtract Income and Expenses SUM The SUM function is one that you ll use the most when it comes to finances in Excel It allows you to add numbers cells that contain numbers or a combination of both You can use the SUM formula in your budget for totaling your income and adding your expenses The net income formula in accounting calculates the net earning or profit of the company represents the amount remaining in the books of accounts after subtracting all its expenses from the sales made during that period The formula for the calculation is as follows Net Income Total Revenues Total Expenses

More picture related to How To Calculate Total Income In Excel

How To Calculate Total Income For Form 15G Hindi FY 2022 23 1st

https://i.ytimg.com/vi/VfZkQ5KVG88/maxresdefault.jpg

How To Calculate Total Income And Tax As Per Normal Provision Vs Sec

https://i.ytimg.com/vi/1o8n8rkuhXg/maxresdefault.jpg

How To Calculate Per Capita In Excel Excel Wizard

https://i0.wp.com/excelweez.com/wp-content/uploads/2022/10/word-image-1556-1-2.png?w=1012&ssl=1

Make the Excel File To make your Income Statement first open up Microsoft Excel then create a new file In the first cell type in Company Name Income Statement This helps you organize your files especially if you need to print this document Skip one row and then write Covered Period Formulas for Calculating Net Income With your data in place it s time to use Excel s formula capabilities to calculate net income The basic formula for net income is Total Revenue Total Expenses However Excel allows you to be more dynamic with your calculations Here s how to apply formulas to your data

If the income is not at least 9 951 then I just multiply the total income by the tax rate Here is what the formula looks like using named ranges IF Income IncomeLevel2 IncomeLevel2 IncomeLevel1 Income TaxRate1 For the second tax bracket calculation I can follow similar logic I will multiply the difference between the start of the The formula for calculating net income is Revenue Cost of Goods Sold Expenses Net Income The first part of the formula revenue minus cost of goods sold is also the formula for gross income Check out our simple guide for how to calculate cost of goods sold So put another way the net income formula is

How To Calculate Per Capita In Excel Excel Wizard

https://i0.wp.com/excelweez.com/wp-content/uploads/2022/10/word-image-1556-4-2.png?w=833&ssl=1

How To Calculate Per Capita In Excel Excel Wizard

https://i0.wp.com/excelweez.com/wp-content/uploads/2022/10/word-image-1556-2-2.png?w=1189&ssl=1

How To Calculate Total Income In Excel - Use the following formulas to calculate your net salary and other financial metrics Net Salary Hours worked x Hourly Rate Positive Adjustments Negative Adjustments Pre tax Adjustments and Pre tax Retirement Contributions All taxes Local State Federal and Medicare Post tax deductions Gross Salary Hours worked x Hourly Rate