How To Calculate The Net Profit After Tax The tax rate stands at 30 Calculate profit after tax PAT for the company Solution From the above data we get the following information Revenue of ABC private limited 500 Operating Expenses 150 Non Operating Expenses 68 Net Profit after tax or the Bottom line of the company decreases leaving less amount for the shareholders

Net income after taxes represents the profit or earnings after all expense have been deducted from revenue Net income after taxes calculation can be shown as both a total dollar amount and a per Calculating net income with a formula Net income is your company s total profits after deducting all business expenses Some people refer to net income as net earnings net profit or simply your bottom line nicknamed from its location at the bottom of the income statement It s the amount of money you have left to pay shareholders

How To Calculate The Net Profit After Tax

How To Calculate The Net Profit After Tax

https://www.bdc.ca/PublishingImages/definitions/earnings-after-tax-exemple.jpg

.png)

How To Calculate Gross Profit Formula And Examples Hourly Inc

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/63646b209859532b69040e08_Net Profit Calculation (1).png

How To Calculate Net Profit In Business Haiper

https://cdn.educba.com/academy/wp-content/uploads/2019/06/Profit-Formula.jpg

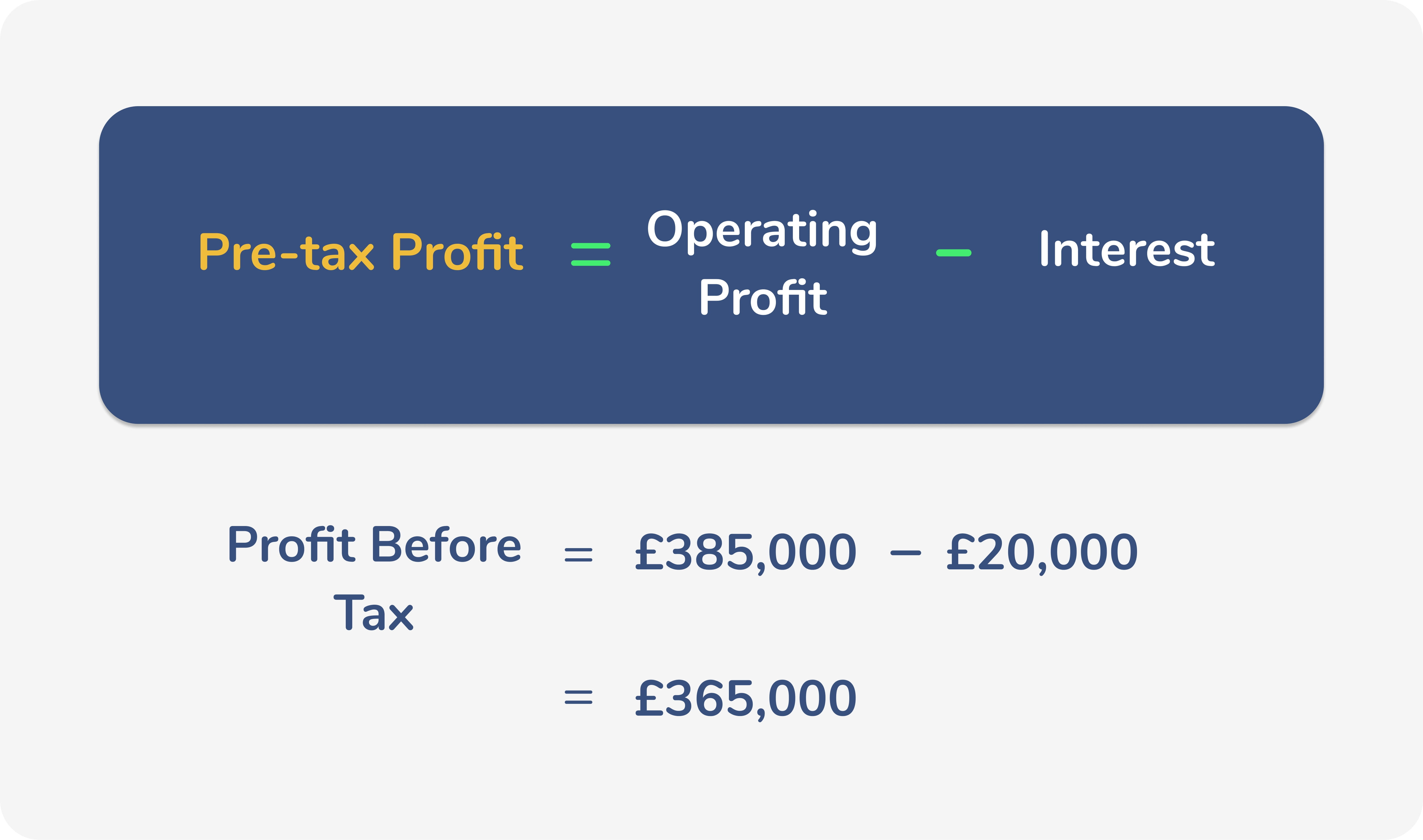

Some simple explanation of the main terms in the above table Revenue The total value of business generated from the regular activities of a company Operating expense The cost incurred by the company to generate Revenue Operating profit The money remaining with the company after paying for its operating activities Interest Interest repayment for any borrowings similar to the The net operating profit after tax calculator calculates the after tax profit from the operations of a company To clarify net operating profit is net earnings generated from the core business operations of the company And it is a difference between the revenues from operations and expenses which are directly attributable to such core

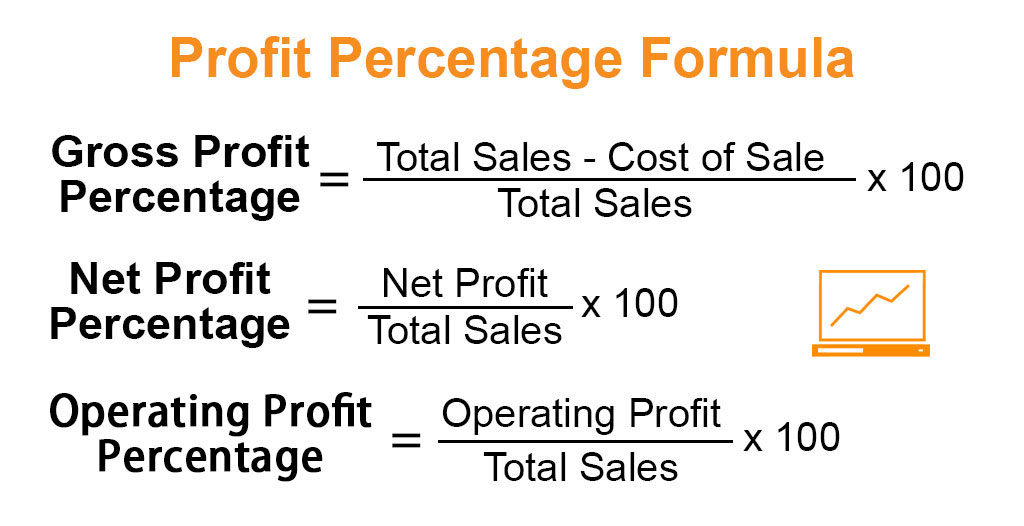

Learn how to use the net profit formula to calculate the net profit for your company and discover some tips on how to improve it selling and administrative costs and the income tax added together giving 95 205 000 Applying the net profit formula you subtract the two giving you the bottom line figure of 16 571 000 For example if EBIT is 10 000 and the tax rate is 30 the net operating profit after tax is 0 7 which equals 7 000 calculation 10 000 x 1 0 3 This is an approximation of after tax

More picture related to How To Calculate The Net Profit After Tax

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

How To Calculate Net Income In Finance Haiper

https://www.investopedia.com/thmb/kXfSkhhw0-QCdPUbrNqPeI9rpn4=/2092x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg

How To Calculate Net Profit Percentage Haiper

https://www.educba.com/academy/wp-content/uploads/2019/08/Profit-Percentage-Formula-educba.jpg

Net Vs Gross Profit Explained How To Calculate Capalona

https://www.capalona.co.uk/include/newsimages/infographic/how-to-calculate-gross-vs-net-profit.jpg

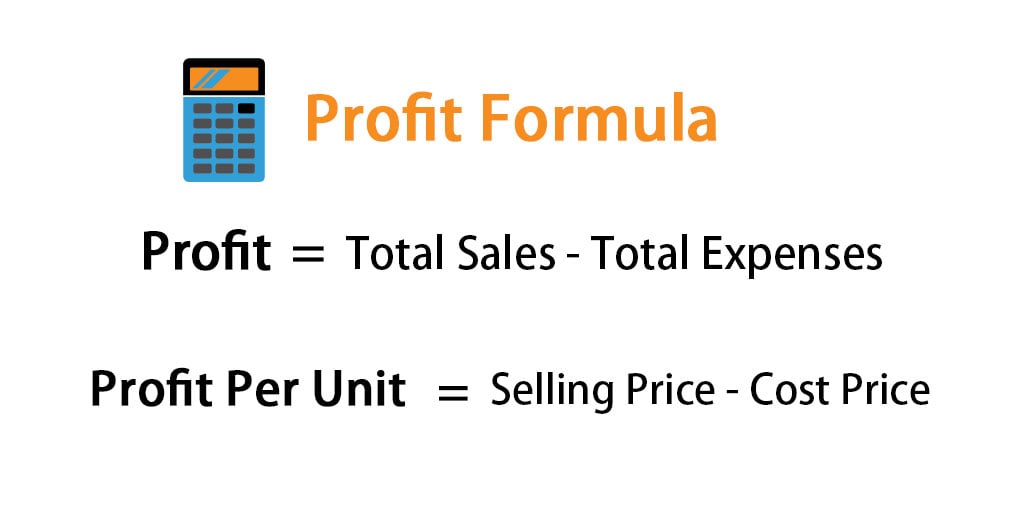

4 Calculate net profit after tax Operating income and the answer to your tax rate equation are used to calculate net profit after tax The net profit after taxes is determined by multiplying the two items together As an illustration if operating income is 10 000 and the solution to the tax rate equation is 0 50 the net profit after tax The formula to calculate profit after tax is as follows PAT or NOPAT Operating Income x 1 tax Where Operating income gross profit operating expenses Another formula to calculate PAT is PAT Net profit before tax Total tax expense Net profit before tax refers to the earnings of the company before deducting taxes

[desc-10] [desc-11]

Profit Margin The 4 Types Formula And Definition Wise

https://wise.com/imaginary/251e126aeedb4b6609f03c68975428c2.jpg

Profit Before Tax PBT All You Need To Know InvestSmall

https://www.investsmall.co/wp-content/uploads/2020/07/PBT-scaled.jpg

How To Calculate The Net Profit After Tax - [desc-12]