How To Calculate Tax On Total Income In Form 16 Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes

Use 1 of the following methods to calculate the tax for Line 16 of Form 1040 Use the tax tables in the Form 1040 instructions Use the Qualified Dividend and Capital Gain Tax Worksheet The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2024 and 2025 The 2025 tax values can be used for 1040 ES estimation planning ahead or comparison

How To Calculate Tax On Total Income In Form 16

How To Calculate Tax On Total Income In Form 16

https://www.hrblock.com/tax-center/wp-content/uploads/2013/01/how-to-calculate-taxable-income-1080x675.jpg

2022 Tax Brackets Calculator SabinaPriya

https://exceljet.net/sites/default/files/styles/function_screen/public/images/formulas/income tax bracket calculation_0.png

How To Calculate Cannabis Taxes At Your Dispensary

https://flowhub.imgix.net/Education/normal-tax-calculation.jpg

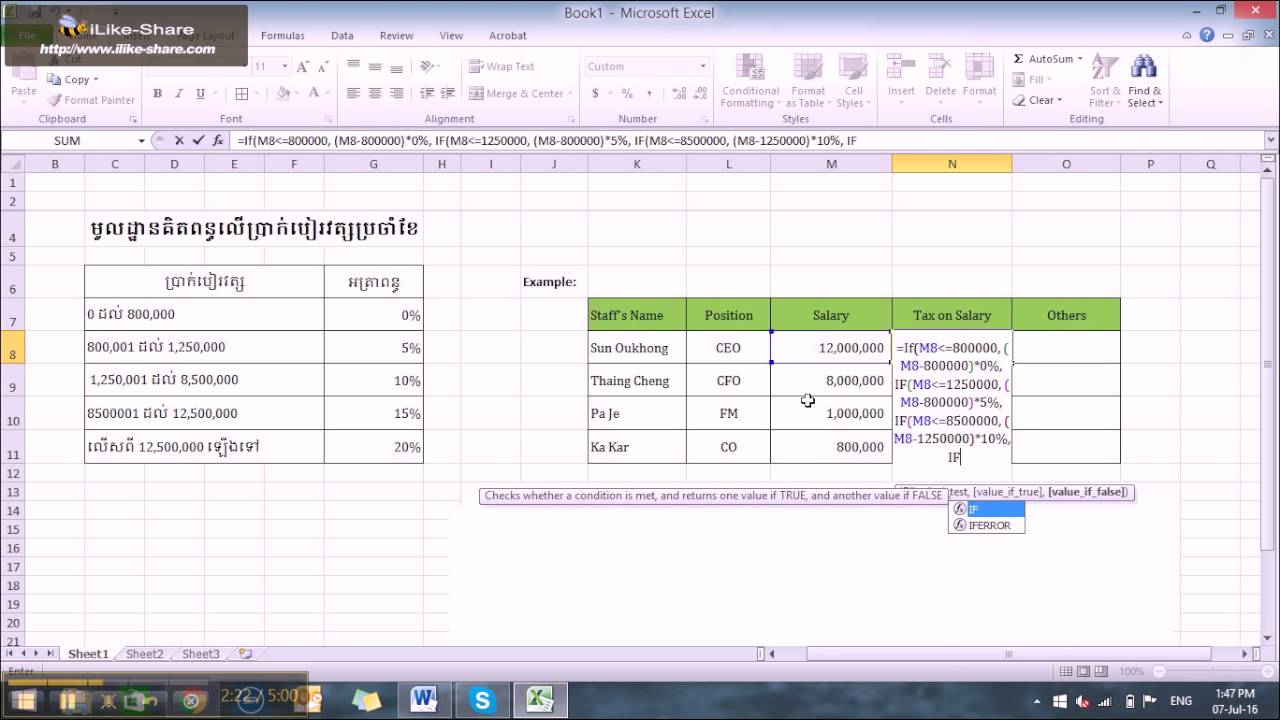

Line 16 is not Total Tax It s just Tax based on the income on line 15 Other taxes get added below that Total tax is on line 24 On the Tax Smart Worksheet below line A there are 7 check boxes The one that is checked indicates what worksheet was used to calculate the tax But if box 1 or 2 is checked there is no worksheet in TurboTax Calculating the Federal Income Tax Rate The United States has a progressive income tax system This means there are higher tax rates for higher income levels These are called marginal tax rates meaning they do not apply to total income but only to the income within a specific range These ranges are referred to as brackets

Use this calculator to estimate your total taxes as well as your tax refund or the amount you will owe in taxes The 1040 tax calculator gives you an estimate for the tax you owe on income you earned Use this calculator to easily calculate your taxable income which is reported on Form 1099 INT as well as dividends and capital gains This is 0 of your total income of 0 00 Your total tax payments for the year were 0 00 Your tax refund is estimated at 0 00 This puts you in the 0 tax bracket Leave this amount as 0 if you are unsure of the amount or do not have access to your spouse s W 2 Form s If this amount is 0 the calculator will use the amount entered

More picture related to How To Calculate Tax On Total Income In Form 16

How To Calculate Accounts Payable Formula Modeladvisor

https://imgmidel.modeladvisor.com/how_to_calculate_accounts_payable_from_income_statement.png

How To Calculate Tax On Salary YouTube

https://i.ytimg.com/vi/hVNRJEljsxI/maxresdefault.jpg

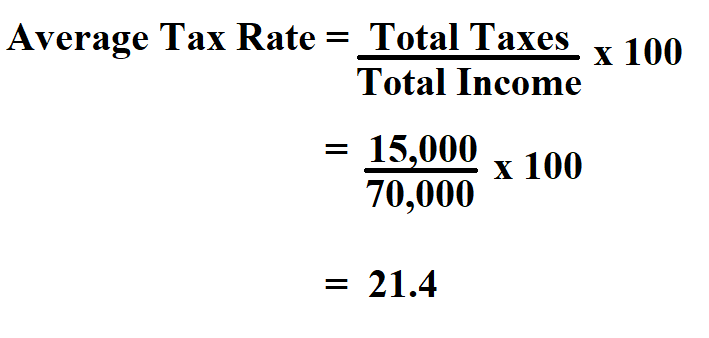

How To Calculate Average Tax Rate

https://www.learntocalculate.com/wp-content/uploads/2020/06/Average-Tax-Rate-2.png

Remember that a tax deduction reduces your taxable income cutting your tax bill indirectly by reducing the income that s subject to a marginal tax rate A tax credit is a dollar for dollar discount on your tax bill So if you owe 1 000 but qualify for a 500 tax credit your tax bill goes down to 500 SmartAsset s hourly and salary paycheck calculator shows your income after federal state and local taxes Enter your info to see your take home pay Income Tax Withholding you can indicate this on your W 4 Form For reference the top federal income tax rate is 37 and the bottom rate is 10 Here s a breakdown of the income tax

[desc-10] [desc-11]

How To Calculate Income Tax On Monthly Salary In India Tax Walls

https://www.bankbazaar.com/images/india/infographic/how-calculate-income-tax-on-salary-with-example.png

What Is Form 16 Upload Form 16 And File Income Tax Return Online

https://assets1.cleartax-cdn.com/s/img/2017/04/24115126/Form-16-part-B-02.png

How To Calculate Tax On Total Income In Form 16 - [desc-12]