How To Calculate Tax On Gross Total Income Calculate your potential tax liability or refund with our free income tax calculator Plug in your expected income deductions and credits and the calculator will quickly estimate

Use our Tax Calculator Tax Bracket Calculator Enter your tax year filing status and taxable income to calculate your estimated tax rate What Is My Tax Rate 2021 Filing status Annual taxable income Your 2023 marginal tax rate 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 This calculator estimates the average tax rate as the state income tax liability divided by the total gross income Some calculators may use taxable income when calculating the average tax rate

How To Calculate Tax On Gross Total Income

How To Calculate Tax On Gross Total Income

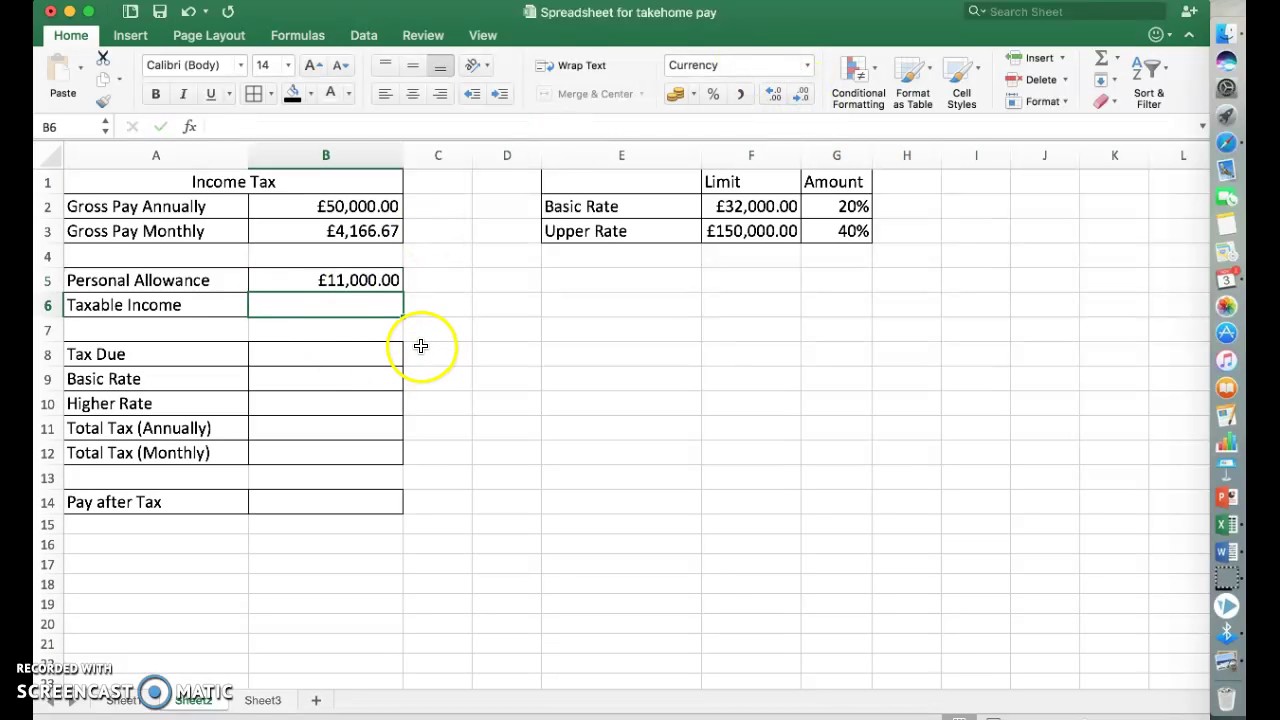

https://i.ytimg.com/vi/A6Sb-lesBao/maxresdefault.jpg

How To Calculate Net Income 12 Steps with Pictures WikiHow

http://www.wikihow.com/images/7/74/Calculate-Net-Income-Step-12-Version-2.jpg

How To Calculate Gross Annual Taxable Income

https://i.ytimg.com/vi/Er8UrF3l0P8/maxresdefault.jpg

This is because you may be eligible for a tax return if you paid income tax or you may be eligible for certain credits To calculate your AGI Calculate your total taxable income Sum totals of How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000

Gross income for an individual also known as gross pay when it s on a paycheck is an individual s total earnings before taxes or other deductions This includes income from all sources not 1 It s an important figure to help you calculate the total tax you owe and eligibility for tax credits and deductions Gross income is the starting point to determine your taxable income and to calculate adjusted gross income and modified adjusted gross income It helps you determine your adjusted gross income AGI

More picture related to How To Calculate Tax On Gross Total Income

Calculate Tax Deductions From Gross Salary TAXW

https://i.pinimg.com/originals/0d/64/ee/0d64ee7c40776e183ded8138b0e15f5b.jpg

How To Calculate Income Tax On Salary With Example

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/02/Facebook-post-17-1024x908.png

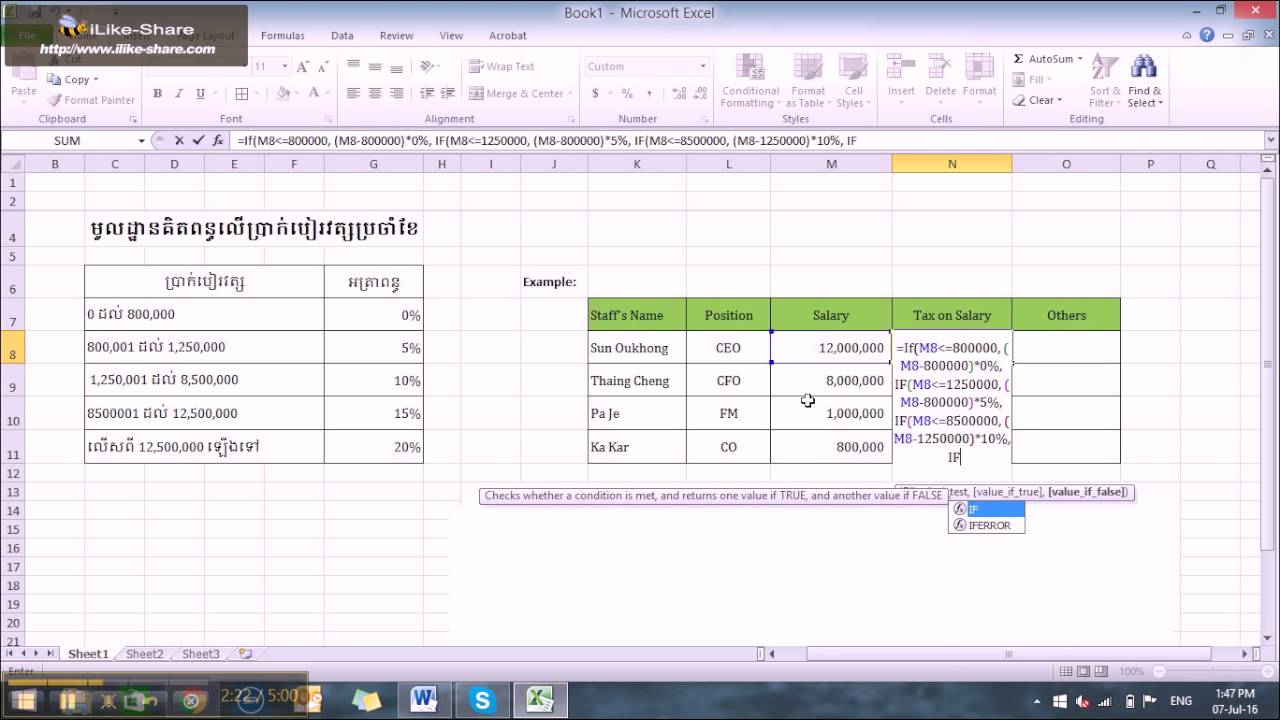

Income Tax Calculation Formula In Excel Fasrbeer

https://fasrbeer849.weebly.com/uploads/1/2/5/3/125316631/338096476.jpg

Calculating AGI is a straightforward process involving the subtraction of specific deductions known as adjustments from the total income subject to income tax This includes earnings from 69 State Filing Fee 59 1 TurboTax Deluxe Learn More On Intuit s Website Federal Filing Fee 54 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee

The income tax is 20 so your net income is 50 20 50 10 40 In both examples we had the same gross and net amounts but the tax percentage turned out to be different This is all down to how in the first example the net price was the base for the tax calculation while in the second one the gross amount was Gross pay vs net pay The formula for calculating the gross income or gross profit of a business is as follows Gross Income Gross Revenue Cost of Goods Sold Example Assume that the gross revenue of ABC a paint manufacturing company totaled 1 300 000 and the expenses were as follows Cost of raw materials 150 000

How To Calculate Tax On Salary YouTube

https://i.ytimg.com/vi/hVNRJEljsxI/maxresdefault.jpg

How To Calculate Income Tax On Monthly Salary In India Tax Walls

https://www.bankbazaar.com/images/india/infographic/how-calculate-income-tax-on-salary-with-example.png

How To Calculate Tax On Gross Total Income - How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000