How To Calculate Semi Monthly Pay Based On Hourly Rate The Salary Calculator converts salary amounts to their corresponding values based on payment frequency Examples of payment frequencies include biweekly semi monthly or monthly payments Results include unadjusted figures and adjusted figures that account for vacation days and holidays per year Salary amount

The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck Bi weekly Your net pay 26 Your bi weekly paycheck Semi monthly Your net pay 24 Your semi monthly paycheck If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary Divide that number by 2 and you have the semi monthly salary Annual Income

How To Calculate Semi Monthly Pay Based On Hourly Rate

How To Calculate Semi Monthly Pay Based On Hourly Rate

https://i.ytimg.com/vi/9ng2TgPRWWk/maxresdefault.jpg

How To Calculate Price Of A Semi Annual Coupon Bond In Excel 2 Ways

https://www.exceldemy.com/wp-content/uploads/2022/06/calculate-price-of-a-semi-annual-coupon-bond-in-excel-14-1.png

Using The Semi empirical Formula To Calculate The Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/bca/bcaf50f8-1ea6-4088-9f48-51926b2e1175/php6mzig8.png

If your monthly salary is 6 500 your hourly pay is 37 5 h on average To find this result Find the number of hours you worked in a month In an average 8 hours per day job you work 8 5 52 12 173 34 hours monthly Divide your monthly salary by the number of hours you worked in a month 6 500 173 34 h 37 5 h How to Calculate Overtime on a Semi Monthly Pay Period If overtime is paid for over 8 or 10 hours in a workday then overtime for semi monthly pay is calculated the same as any other payroll timeframe However if overtime is paid for time worked above 40 hours per week a carry over system must be implemented

Semi monthly pay Yearly pay 24 32 500 24 1 354 Monthly pay Yearly pay 12 To calculate the hourly pay from the yearly salary Determine the number of working days per year Typically Determine the gross salary Express the tax rate as a fraction dividing it by 100 for example Companies can back a salary into an hourly wage For instance if a grocery store hires cashiers for an hourly rate of 15 00 per hour on a full time schedule of 40 hours a week you can calculate the annual pre tax salary by multiplying the hourly rate by 40 Then multiply the product by the number of weeks in a year 52

More picture related to How To Calculate Semi Monthly Pay Based On Hourly Rate

Blog Articles About Finance Tax HR PayStubs

https://www.paystubs.net/cms-uploads/media/cache/blog_main_first_post/files/cms/standalone-content/thumbnail/648621a3e69f2106247050.jpg

Calculate Semi Monthly Pay After Taxes KatyaLainey

https://i.pinimg.com/736x/cb/6d/82/cb6d82d5ed8a1eabb9cdb3709e59e70c.jpg

How To Calculate Semi Monthly Payroll PayStubs

https://cms.paystubs.net/media/cache/resolve/ckeditor_photo_thumnail/files/content-body-images/d4d5c3beedcc82e568f6759739c0bc65.jpeg

Add the answers found in the fourth and fifth points 10 1 11 Divide your gross monthly salary by the answer found in the third point 1 500 20 75 This is your daily pay rate Multiply the answer found in the previous point by the answer found in the sixth point 75 11 825 This is your prorated salary How Does Salary Calculator Work Using a 50 hourly rate with an average of eight hours worked each day and 260 working days a year calculated by multiplying 52 weeks by 5 working days a week the annual unadjusted salary can be calculated as follows 50 8 260 104 000 To obtain the adjusted annual salary take into account 10

Calculating semi monthly pay involves converting an annual salary into the amount paid per each of the two monthly pay periods Here s how to do it Semi monthly pay Gross annual salary 24 Gross annual salary This is your total gross salary over a year 24 Represents the total number of pay periods in a year when you are paid twice a Here s how you do it Semi Monthly Daily Rate Annual Salary 260 Salaried employees are typically paid for 260 days in a year 5 days a week x 52 weeks in a year So if you want to calculate a semi monthly daily rate divide your employee s annual salary by 260 Semi Monthly Hourly Rate Annual Salary 2 080

Calculate Semi Monthly Paycheck KatelynDeryn

https://i.pinimg.com/originals/07/36/90/073690db7d3432ed310969a977e624ac.png

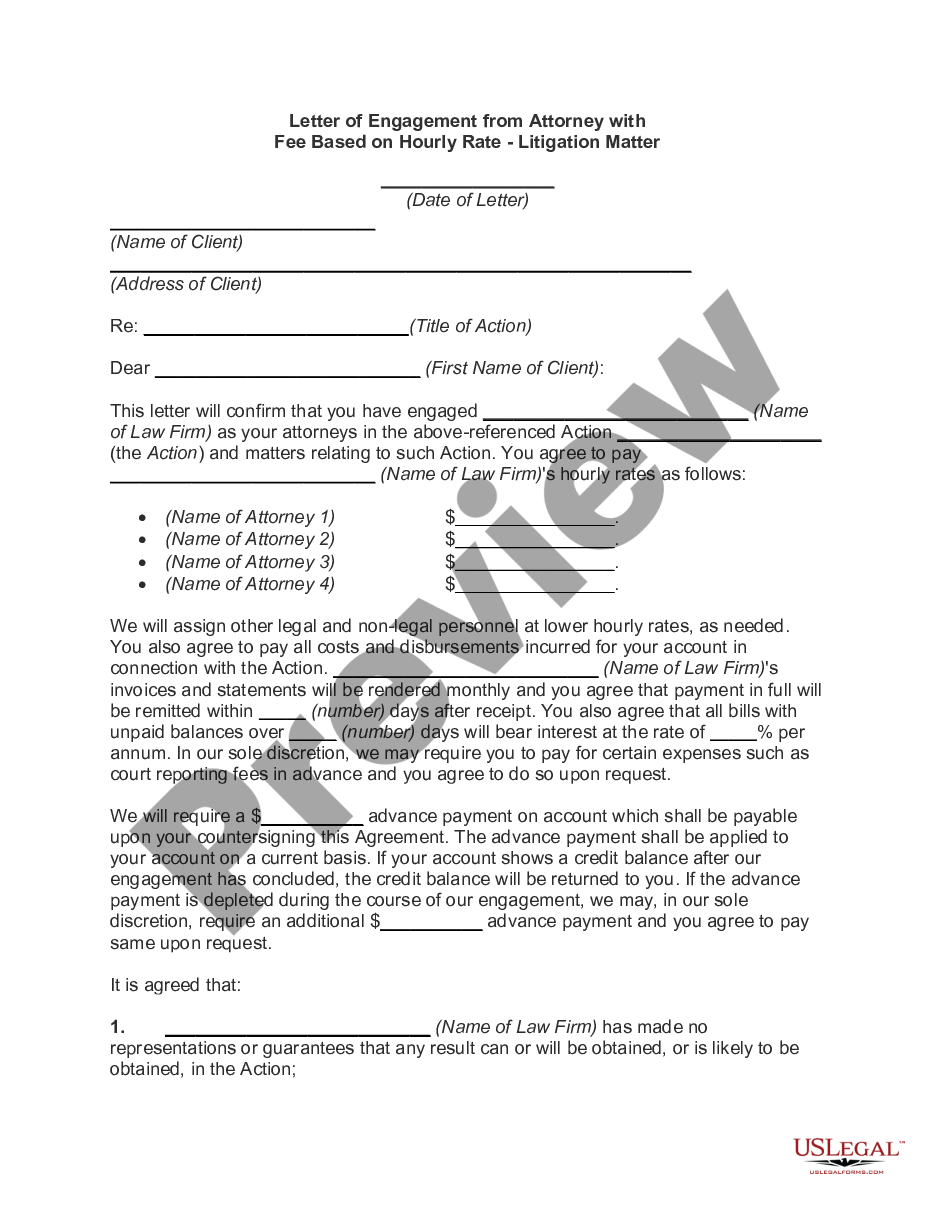

Phoenix Arizona Letter Of Engagement From Attorney With Fee Based On Hourly Rate Litigation

https://cdn.uslegal.com/uslegal-preview/US/US-1000BG/1.png

How To Calculate Semi Monthly Pay Based On Hourly Rate - How to Calculate Overtime on a Semi Monthly Pay Period If overtime is paid for over 8 or 10 hours in a workday then overtime for semi monthly pay is calculated the same as any other payroll timeframe However if overtime is paid for time worked above 40 hours per week a carry over system must be implemented