How To Calculate Salary Tax Deduction After you use the estimator Use your estimate to change your tax withholding amount on Form W 4 Or keep the same amount To change your tax withholding amount

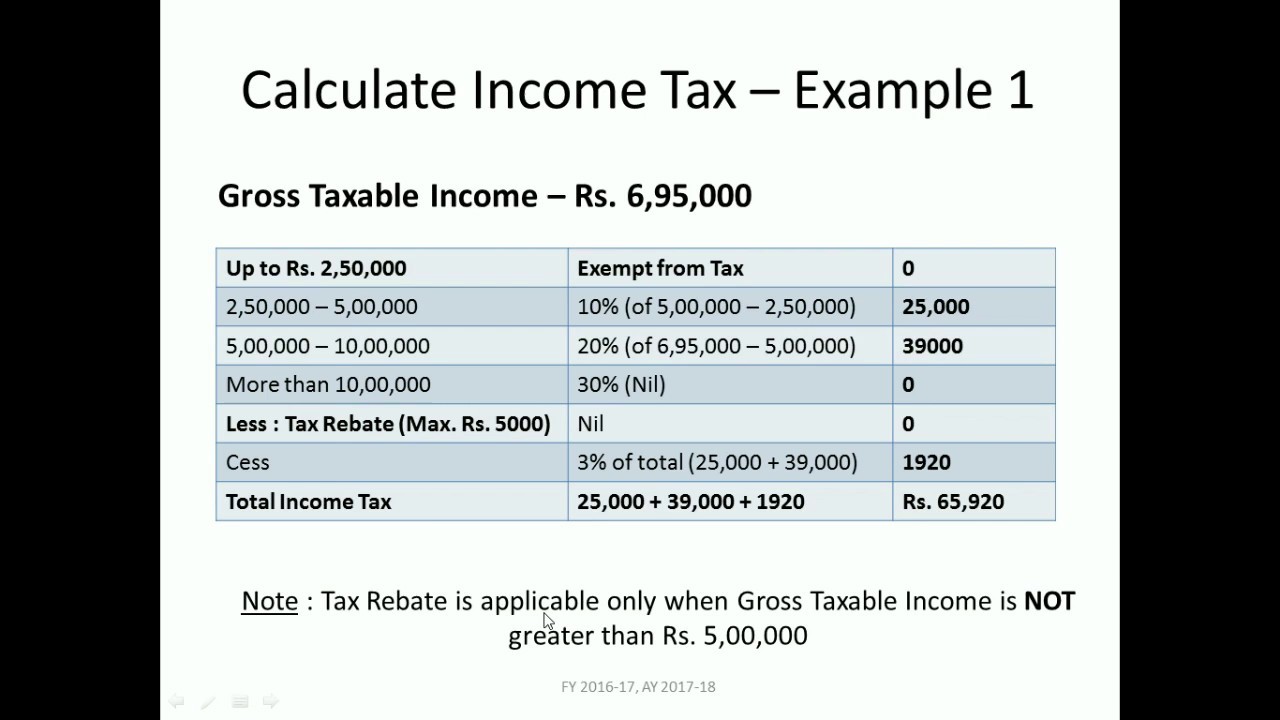

The more someone makes the more their income will be taxed as a percentage In 2025 the federal income tax rate tops out at 37 Only the highest earners are subject to this percentage Federal income tax is usually the largest tax deduction from gross pay on a paycheck Starting with your salary of 40 000 your standard deduction of 14 600 is deducted the personal exemption of 4 050 is eliminated for 2018 2025 This makes your total taxable income amount 25 400 Given that the first tax bracket is 10 you will pay 10 tax on 11 600 of your income This comes to 1 160

How To Calculate Salary Tax Deduction

How To Calculate Salary Tax Deduction

https://www.hrcabin.com/wp-content/uploads/2021/07/Screenshot-2021-07-28-at-12.03.38-AM.png

Standard Deduction For 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3.jpg

Article Update How To Calculate Your Taxes In Nigeria BartonHeyman

https://i0.wp.com/nairametrics.com/wp-content/uploads/2016/07/Tax-payable.jpg?ssl=1

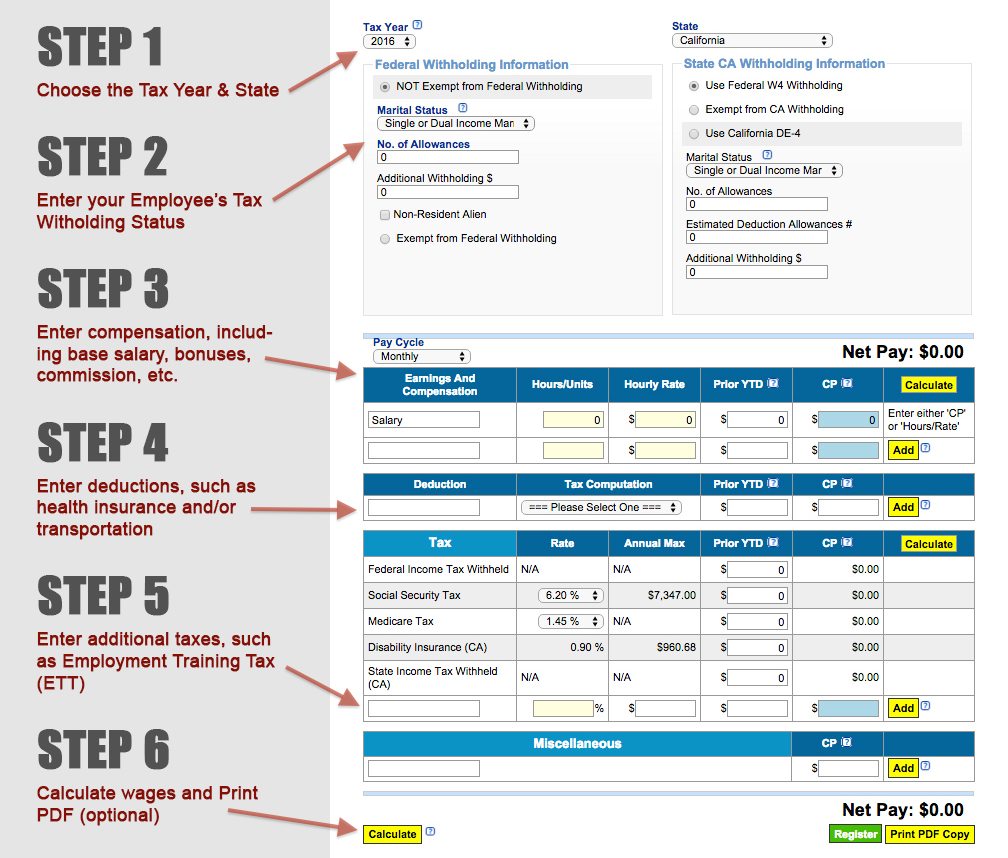

Step 2 Calculate Gross Pay Employee paychecks start with gross pay which is the total amount of pay before any deductions or withholding To determine income tax and FICA tax for Social Security and Medicare use all wages salaries and tips Bankrate provides a FREE payroll deductions calculator and other paycheck tax calculators to help consumers determine the change in take home pay with different deductions

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2024 and 2025 Sales and local tax Sometimes referred to as SALT state and local tax this federal deduction can be either income tax or sales tax but not Updated on Feb 14 2025 Free paycheck calculator to calculate your hourly and salary income after taxes deductions and exemptions

More picture related to How To Calculate Salary Tax Deduction

Hati Perempuan Episod 26

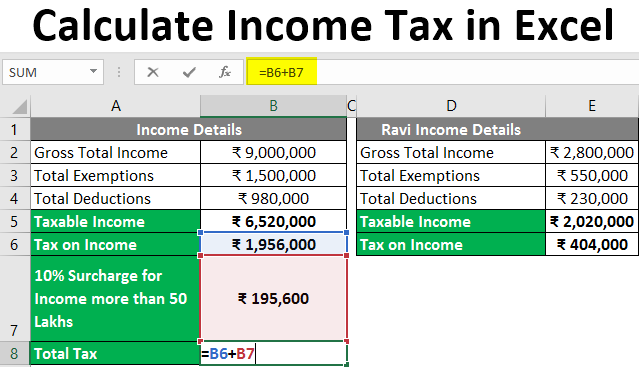

https://www.educba.com/academy/wp-content/uploads/2019/08/Calculate-Income-Tax-in-Excel.png

What Is Medicare Tax Withheld On Paystub

https://fitsmallbusiness.com/wp-content/uploads/2016/01/FreePayrollCalc001.jpg

How To Calculate Income Tax FY 2016 17 FinCalC TV YouTube

https://i.ytimg.com/vi/n88iQ1EfB-Y/maxresdefault.jpg

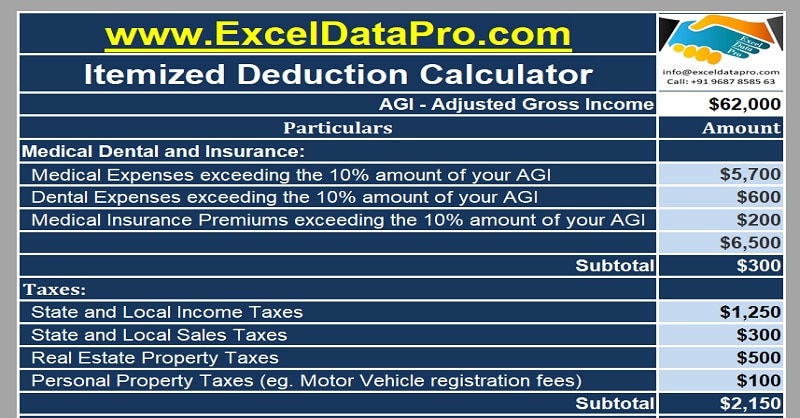

Tax deductions on the other hand reduce how much of your income is subject to taxes Deductions lower your taxable income by the percentage of your highest federal income tax bracket For For example when you look at your paycheck you might see an amount deducted for your company s health insurance plan and for your 401k plan Pre tax deductions result in lower take home but also means less of your income is subject to tax Some deductions are post tax like Roth 401 k and are deducted after being taxed

[desc-10] [desc-11]

354 How TO Make Salary Deduction Calculation In Excel Hindi YouTube

https://i.ytimg.com/vi/luPJvJBVlNY/maxresdefault.jpg

Download Itemized Deductions Calculator Excel Template ExcelDataPro

https://exceldatapro.com/wp-content/uploads/2017/12/Itemized-Deduction-Calculator.jpg

How To Calculate Salary Tax Deduction - Bankrate provides a FREE payroll deductions calculator and other paycheck tax calculators to help consumers determine the change in take home pay with different deductions