How To Calculate Profit And Loss Account In Excel The profit and loss statement P L can be prepared by an accountant under two different methods Accrual Accounting Cash Basis Accounting Method 1 Accrual Accounting ASC 606

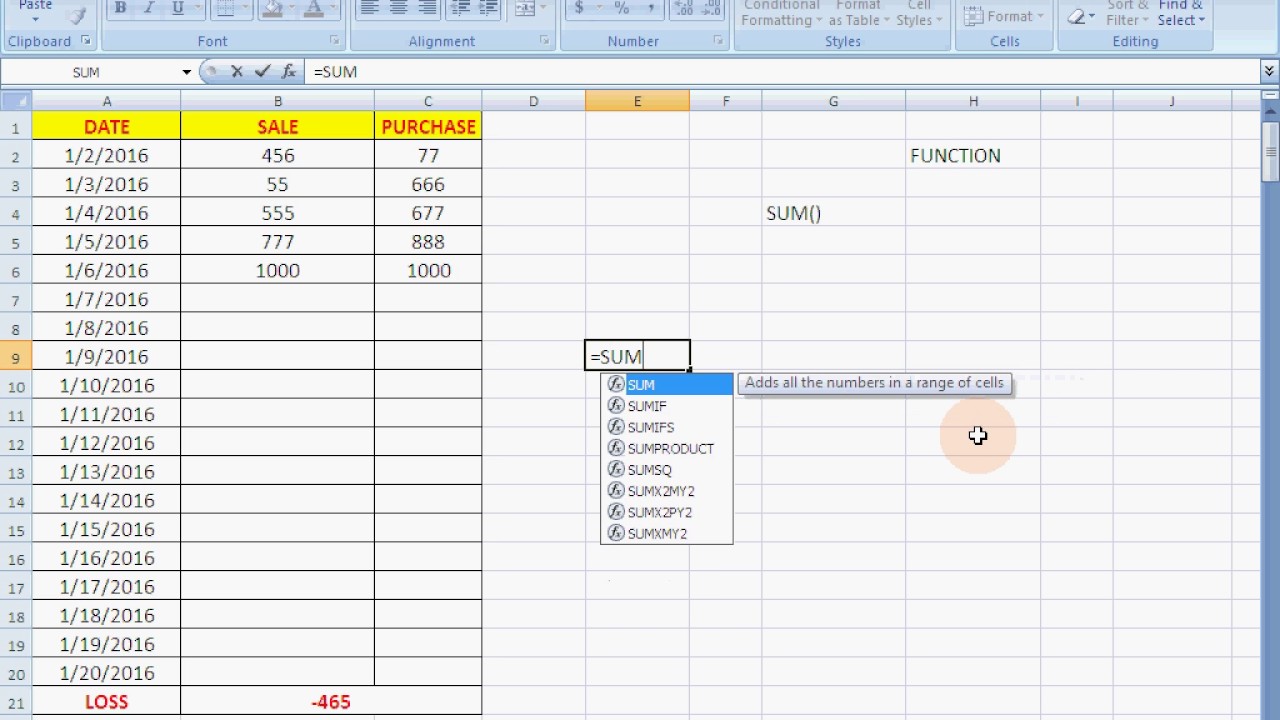

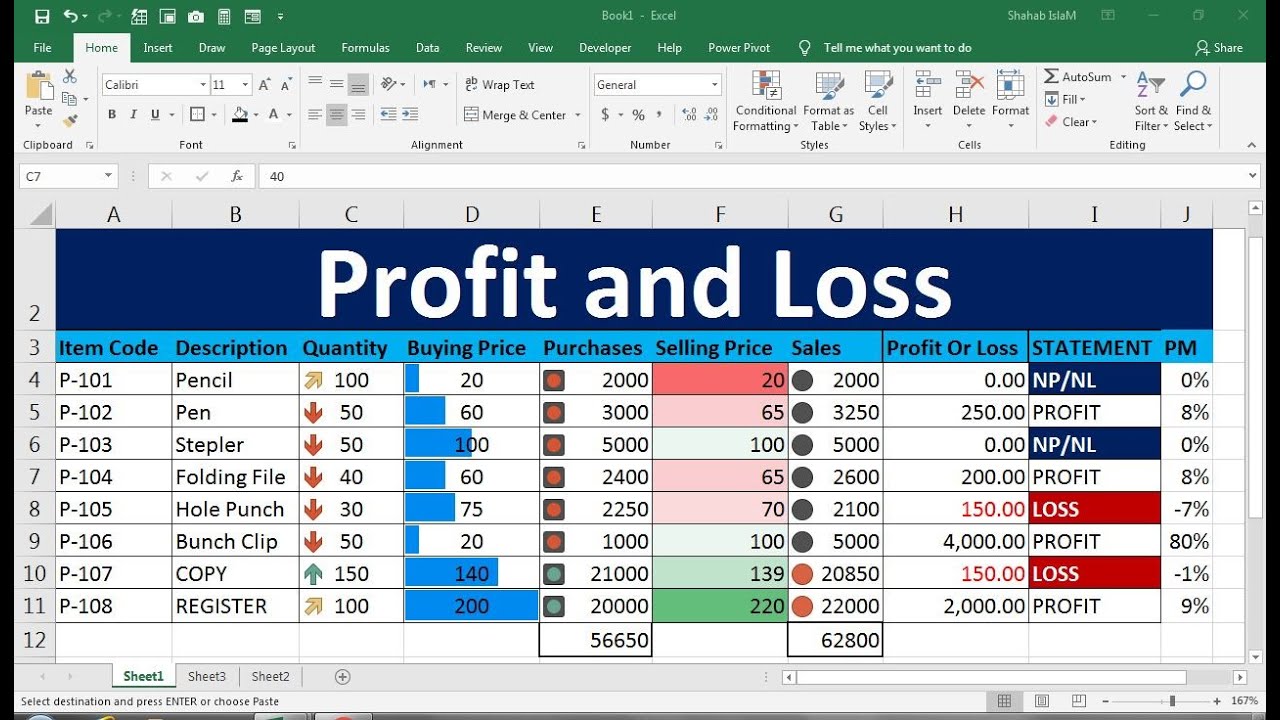

In this video we will learn to Create Stock Management with Profit and Loss Calculation in Microsoft Excel step by step stock management inventory managemen Step 1 Calculate revenue The first step in creating a profit and loss statement is to calculate all the revenue your business has received You can obtain current account balances from

How To Calculate Profit And Loss Account In Excel

How To Calculate Profit And Loss Account In Excel

https://i.ytimg.com/vi/USNPbYVn2ds/maxresdefault.jpg

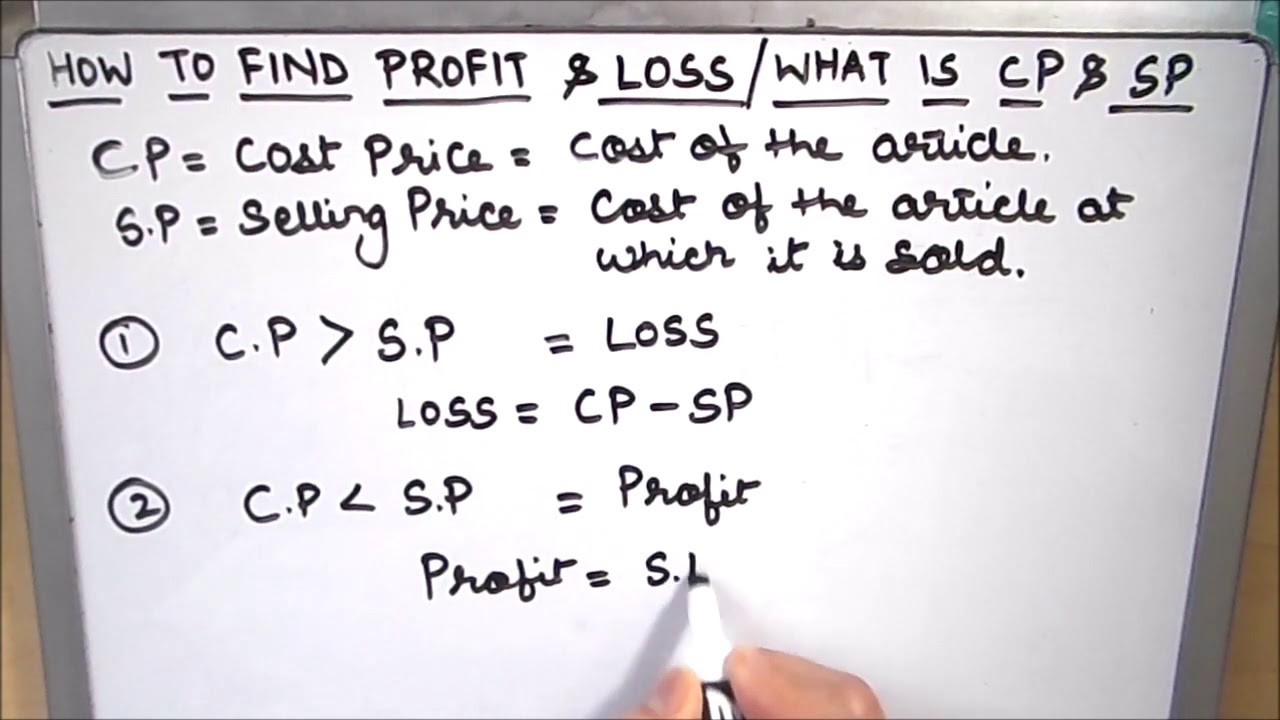

How To Calculate Accounting Profit And Loss Simple Accounting

https://simple-accounting.org/wp-content/uploads/2020/04/image3.png

HOW TO CALCULATE LOSS PROFIT IN EXCEL YouTube

https://i.ytimg.com/vi/H9gUED70VUM/maxresdefault.jpg

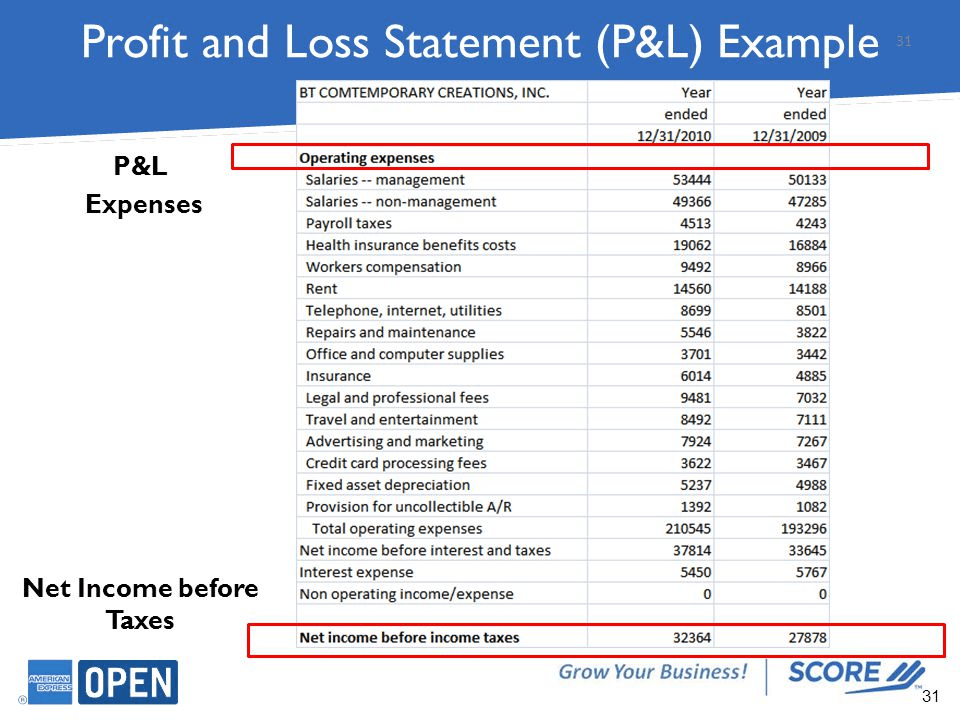

Intro Easy Excel PivotTable Profit Loss Statements MyOnlineTrainingHub 570K subscribers Subscribe Subscribed 159K views 3 years ago Automate creating Profit and Loss statements with To prepare a profit and loss statement you ll essentially be solving the basic equation for calculating profit Profit Revenues Expenses Here are the steps to prepare an accurate profit and loss statement for your small business using the equation above in greater detail Show Net Income

How Do You Calculate Profit and Loss There are several components to any profit and loss structure but the simplest way to calculate profit and loss is to Add up all income revenue Add up all of the expenses e g COGS operating expenses interest taxes Subtract the difference between the two 17 53 Net Profit 6 016 43 10 60 Common size profit and loss statements can help you compare trends and changes in your business For example if your Operating Earnings change from 21 052 44 to 23 443 33 that might not tell you much by itself because other numbers might have changed as well

More picture related to How To Calculate Profit And Loss Account In Excel

How To Show Profit And Loss In Excel Sheet YouTube

https://i.ytimg.com/vi/9WO6a-NKoIc/maxresdefault.jpg

How To Calculate Profit Haiper

https://i.ytimg.com/vi/hlUUepm35tE/maxresdefault.jpg

Online Account Reading What Is Profit And Loss Account Advantages Of

https://1.bp.blogspot.com/-ti-VMSQk1jg/VNyIipJpG6I/AAAAAAAAE4M/xfBWODuCq60/s1600/profit%2Band%2Bloss%2Baccounts.jpg

Download the Profit and Loss Template Download the free Excel template now to advance your knowledge of financial modeling Income Accounts vs Expenditure Accounts There are two main categories of accounts for accountants to use when preparing a profit and loss statement The table below summarizes these two accounts income and expenditures A P and L statement is a go to financial statement that shows how much your business has spent and earned over a specific period of time Your P L statement shows your revenue minus expenses and losses The outcome is either your final profit or loss Small business owners have two reporting options when preparing an income statement a single

Step 4 Add Calculated Items for Gross Profit and Net Profit Select one of the Account Group cells in the row labels area of the PivotTable PivotTable Analyze tab Fields Items Sets Calculated Item We ll create the Gross Profit item first Then one for Net Profit They should now appear in the PivotTable row labels An introduction to creating a P L statement using Microsoft excelLink to next video https www youtube watch v fQuGY4r6dr0Create a bookkeeping spreadsh

How To Calculate Profit And Loss Account Step By Step Business

https://business-accounting.net/wp-content/uploads/2021/03/image-1.jpeg

How To Calculate Trading Profit And Loss Account Pdf Best Bank Stocks

https://templatelab.com/wp-content/uploads/2020/06/Hotel-Profit-Loss-Statement-Template-TemplateLab-scaled.jpg

How To Calculate Profit And Loss Account In Excel - A profit and loss statement is one of the most important financial documents as it assesses whether a company has made profits or incurred losses in a fiscal quarter year The report in turn lets investors and other stakeholders decide whether to invest and involve in the organizations initiatives and operations Table of contents