How To Calculate Net Profit Before Tax In Cash Flow Statement Profit before tax PBT is a measure of a company s profitability that looks at the profits made before any tax is paid It is usually the third to last item on the income statement How to Calculate Profit Before Tax To calculate the PBT of a company one must follow several steps They are 1 Collect all the financial data about the

How to Calculate Net Profit Before tax extraordinary items in Cash Flow Statement Class 12Profit before Tax Taxes Profit after Tax Statement of Profi The measure shows all of a company s profits before tax A run through of the income statement shows the different kinds of expenses a company must pay leading up to the operating profit

How To Calculate Net Profit Before Tax In Cash Flow Statement

How To Calculate Net Profit Before Tax In Cash Flow Statement

https://i.ytimg.com/vi/ggLTWmkeotM/maxresdefault.jpg

Cash Flow Statement Operating Activity Indirect Method How To

https://i.ytimg.com/vi/RIovNt6A7wE/maxresdefault.jpg

Easy Way To Get Net Profit Before Tax In Cash Flow Statement YouTube

https://i.ytimg.com/vi/9QI2gex1yww/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AZQDgALQBYoCDAgAEAEYZSBlKGUwDw==&rs=AOn4CLD9FIMkSXxJgGyKkD0Ia6KuiF50kg

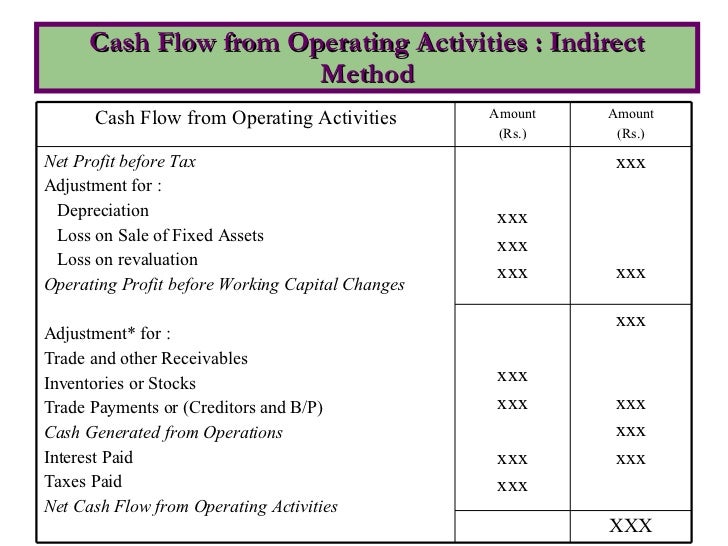

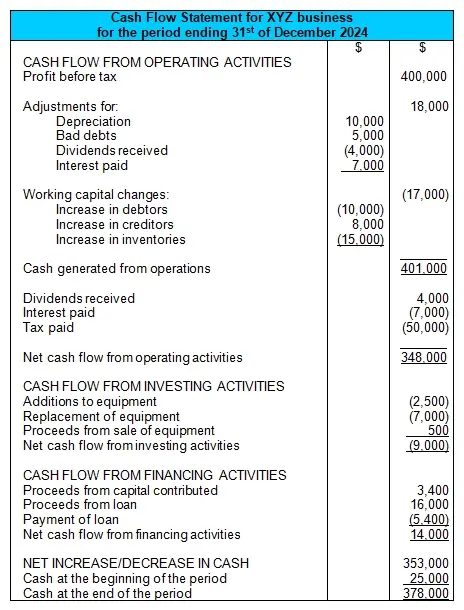

The cash flow from operating activities are derived under two stages Calculating the operating profit before changes in working capital The effect of changes in working capital Stage 1 Operating profit before changes in working capital can be calculated as follows The profit before tax value is found on the income statement which is generated either quarterly half yearly or annually The first calculation that we must do is to calculate the profit before tax is the total revenue earned by the business To calculate this you need to add up the revenue earned from store or stores that you operate

Additional Information Tax paid during the year 8 000 Solution In this case below the provision for taxation the account is prepared The credit side 28000 would be added as a provision for taxation of the current year to calculate net profit before taxation and extraordinary items Calculating taxes in operating cash flow involves reverse engineering the following equation Operating Cash Flow EBIT Depreciation Taxes where EBIT refers to earnings before interest and taxes

More picture related to How To Calculate Net Profit Before Tax In Cash Flow Statement

Income Tax In Cash Flow YouTube

https://i.ytimg.com/vi/Q1XSvl2doek/maxresdefault.jpg

How To Calculate Net Profit Before Tax Extraordinary Items In Cash

https://i.ytimg.com/vi/EAoKze6rbg4/maxresdefault.jpg

Cash Flow Statement

https://image.slidesharecdn.com/cash-flow-statement-1220159910575245-9/95/cash-flow-statement-13-728.jpg?cb=1220137726

Apple s Earnings Before Taxes 53 394 million 1 26 1 Another method Another way to calculate pre tax profit You can also calculate a company s pre tax profit by subtracting a company s For a single step income statement you add up all your income and gains then add your expenses and losses together Subtract the negative items from the positive and you get your net income The last line above the entry for your tax expense gives you your income before taxes A multiple step income statement is more complex

[desc-10] [desc-11]

Calculation Of Net Profit Before Tax In Cash Flow Statements Useful

https://i.ytimg.com/vi/nt1DhGOYE0U/maxresdefault.jpg

Cash Flow Statement And Depreciation

https://www.accounting-basics-for-students.com/images/Indirect_cash_flow_statement_full_464.jpg

How To Calculate Net Profit Before Tax In Cash Flow Statement - [desc-14]