How To Calculate Net Pay On Excel Table of Contents hide Calculate Net Salary in Excel Step by Step Procedures Step 1 Employee Database Basic Salary Structure Step 2 Create Allowance and Deduction Structure Step 3 Apply Data Validation Feature Step 4 Calculating Gross Salary in Excel Step 5 Deduction Calculation Step 6 Calculating Net Salary Conclusion Related Articles

What Is a Salary Sheet Common Salary Sheet Components Make a Salary Sheet in Excel with Formula Step by Step Procedures Step 1 Create Employee Database Salary Structure Step 2 Calculate Gross Salary Step 3 Calculate Amounts to Deduct Step 4 Calculate Net Salary Conclusion Related Articles What Is a Salary Sheet Steps to create Net Pay using Ms Excel Steps to create Net Pay using Ms Excel

How To Calculate Net Pay On Excel

How To Calculate Net Pay On Excel

https://www.patriotsoftware.com/wp-content/uploads/2018/05/calc-net-pay-gross-pay-1.jpg

How To Calculate Net Pay

https://www.learntocalculate.com/wp-content/uploads/2020/06/net-pay-2.jpg

Gross Pay Vs Net Pay Finance Management Simple Ideas

https://fmsi.biz/wp-content/uploads/2021/10/gross-vs-net-pay.jpg

Use our Free Paycheck Calculator spreadsheet to estimate the effect of deductions withholdings federal tax and allowances on your net take home pay Unlike most online paycheck calculators using our spreadsheet will allow you to save your results see how the calculations are done and even customize it How To Calculate Net Pay in 3 Steps Plus Definition Indeed Editorial Team Updated March 10 2023 As a wage earning employee it s important to understand the figures included on your paycheck One category is net pay Not only is it important to understand net pay but knowing how to calculate it can help you with your finances

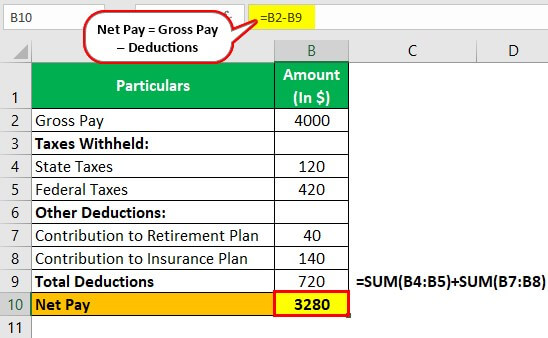

What are deductions To calculate net from gross you must withhold deductions each pay period There are both tax and non tax deductions And some deductions are mandatory while others are voluntary Taxes are mandatory You may need to withhold the following from an employee s gross pay Federal income tax Social Security tax Medicare tax To calculate the gross earnings of an employee during a certain pay period multiply the cell with the number of hours worked by the cell with the rate of pay using the format A1 B1 2 Deductions Deductions like income tax or health benefits can be calculated by subtracting their percentage from gross earnings

More picture related to How To Calculate Net Pay On Excel

Net Pay Definition Example How To Calculate Net Pay

https://wallstreetmojo.com/wp-content/uploads/2020/07/Net-Pay-Example.jpg

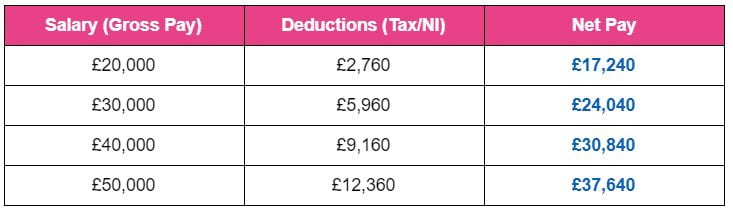

How To Calculate Net Pay From Gross Pay In Uk

https://www.reed.co.uk/career-advice/wp-content/uploads/sites/6/2020/08/Net-pay-examples.jpg

Net Pay Definition Example How To Calculate Net Pay

https://wallstreetmojo.com/wp-content/uploads/2020/07/Net-pay.jpg

Salary Basic HRA Transport Allowance FBP Allowance Bonus Provident Fund Income Tax Insurance The salary structure can vary significantly between countries due to cultural norms economic factors industry practices job market conditions cost of living and local labor laws This tutorial will help the students to calculate daily salary and then Net salary also student will deduct the absent days from the basic salary and how to

Click a cell in which you would like to calculate gross pay then type the following formula in the box Video of the Day SUM A1 A5 This formula assumes that the employee s separate pay totals are contained in cells A1 through A5 substitute the appropriate cell range in place of A1 A5 in the above example PRODUCT Function Microsoft Excel Tutorials 2 3K subscribers Subscribe Share Save 38K views 8 years ago Teach Yourself Microsoft Excel In 24 Hours How To Calculate Your Net Income Using Microsoft Excel

How To Calculate Net Pay YouTube

https://i.ytimg.com/vi/3ugoTvIl65g/maxresdefault.jpg

Cheque Jud as Verdes Corta Vida Calculate Your Net Salary Saludar

https://images.contentful.com/ifu905unnj2g/66K2AdsLlvARouig6tdw8D/9fb05a7c0c4b54eca5f4d7bb8c04ce1c/Net_income_formula.jpg

How To Calculate Net Pay On Excel - Trying to figure out how to calculate the required gross amount for a financial distribution when I know the net amount and individual taxes Can t use the normal grossing up formula of 1 Adding up all federal state and local tax rates 2 Subtract the total tax rates from 100 3 Divide net payments by the net percent Net Payment 1