How To Calculate Net Household Income Household income is the combined gross income of all the members of a household who are 15 years or older Individuals do not have to be related in any way to be considered members of the same

Here are the basic steps you need to take to calculate the household income for your home 1 Identify the gross income for each person The first step is to calculate the gross income for each person living in your home age 15 or older You can include the income of everyone living in the home regardless of whether they are related to you Federal Paycheck Calculator Federal income tax rates range from 10 up to a top marginal rate of 37 The U S real median household income adjusted for inflation in 2022 was 74 580 9 U S states don t impose their own income tax for tax year 2023

How To Calculate Net Household Income

How To Calculate Net Household Income

https://images.contentful.com/ifu905unnj2g/66K2AdsLlvARouig6tdw8D/9fb05a7c0c4b54eca5f4d7bb8c04ce1c/Net_income_formula.jpg

How To Find Net Income For Beginners Pareto Labs

https://www.paretolabs.com/wp-content/uploads/2021/06/Illustration-of-net-income-formula.png

How To Calculate Net Income With Tax Rate Haiper

https://learn.financestrategists.com/wp-content/uploads/2020/09/Net-Income-Formula-SIMPLE-1024x512.jpg

The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed Also calculated is your net income the amount you

So to put it another way Annual income hourly wage x weekly hours x weeks worked in a year Say you earn 30 per hour and work 40 hours per week Your annual gross income will be 62 400 if Here are the steps you need to follow Add up the annual salaries of all household members Include other sources of income such as capital gains tips pension etc Subtract taxes and add tax exempt income Consider any major changes you expect in the earnings of household members during the following year

More picture related to How To Calculate Net Household Income

:max_bytes(150000):strip_icc()/household_income.aspfinal-dddb0f870b8e4195993e0a9fa2c2fa20.jpg)

Household Income What It Is And How To Calculate It

https://www.investopedia.com/thmb/Jtzd_23rWmjEyNzpP-Yp4BY4a14=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/household_income.aspfinal-dddb0f870b8e4195993e0a9fa2c2fa20.jpg

Gross Income Vs Net Income Differences And How To Calculate Each

https://blog.mint.com/wp-content/uploads/2019/10/how-to-calculate-net-income-1.png?resize=768

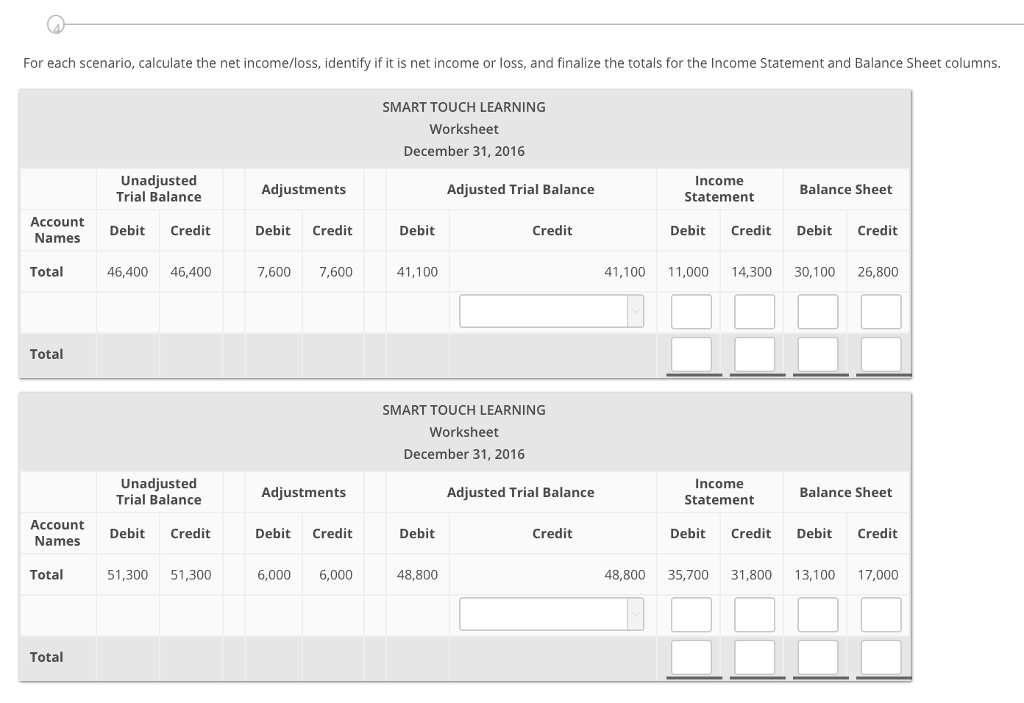

How To Calculate Net Income Or Loss Haiper

https://media.cheggcdn.com/media/2e2/2e20e176-4360-45a3-b1e7-87c5cf8e4391/phpPn2U8T.png

Example Consider an individual with a gross monthly income of 5 000 facing 800 in taxes and 200 in deductions Using the Net Monthly Income Calculator the net monthly income would be calculated as follows text Net Monthly Income 5 000 800 200 4 000 Therefore the net monthly income for this individual is 4 000 How to calculate net income To calculate net income take the gross income the total amount of money earned then subtract expenses such as taxes and interest payments

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major 1 Add up your gross income for the last year For businesses net income refers to profit after expenses and taxes To start gather your records and add up your total income for the past year before taxes or expenses Subtract returns and discounts from your gross income

Net Income Formula How To Calculate Net Income Mint

https://blog.mint.com/wp-content/uploads/2022/08/in-post03-how-to-calculate-net-income-for-your-business.png?resize=740

How To Calculate Household Size And Income YouTube

https://i.ytimg.com/vi/11R7sozxl4Q/maxresdefault.jpg

How To Calculate Net Household Income - The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck