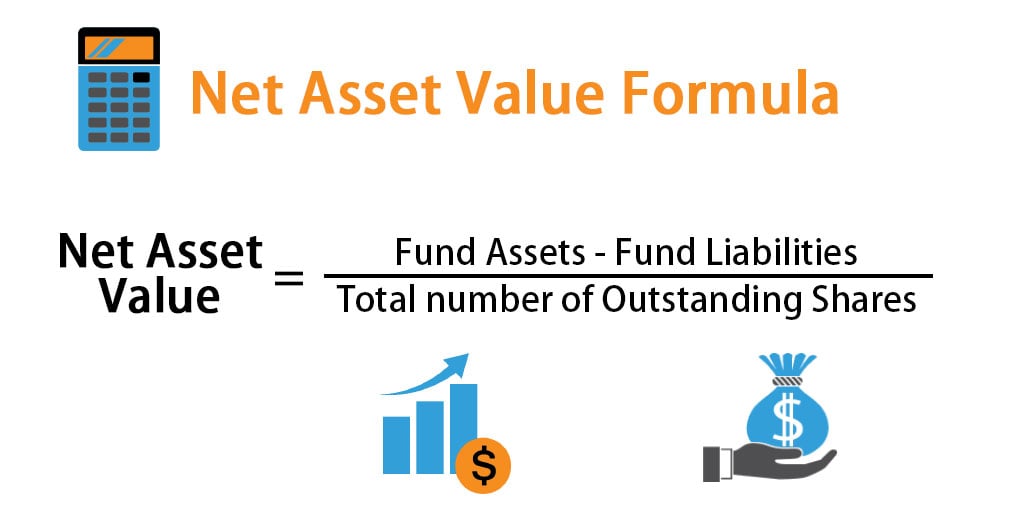

How To Calculate Net Asset Value Of A Private Company How to Calculate Net Asset Value NAV The net asset value NAV commonly appears in the context of mutual funds as the metric serves as the basis for setting the mutual fund share price NAV on a per unit basis represents the price at which units i e ownership shares in the mutual fund can be purchased or redeemed which is typically done at the end of each trading day

Net asset value is the value of a fund s assets minus any liabilities and expenses The NAV on a per share basis represents the price at which investors can buy or sell units of the fund When the value of the securities in the fund increases the NAV increases When the value of the securities in the fund decreases the NAV decreases Net Asset Value Explained Net Asset Value NAV applies to any business entity or financial instrument having assets and liabilities It is the difference between the fund s total assets and the total liabilities and dividing it by the number of outstanding shares When calculated on a per share or unit basis it helps investors determine the return on their investments by the end of the

How To Calculate Net Asset Value Of A Private Company

How To Calculate Net Asset Value Of A Private Company

https://www.thestreet.com/.image/t_share/MTk1NjQ3MTYxODYwMzY4MjY3/1.png

Which Of The Following Is An Asset Utilization Ratio

https://tutor2u-assets.ams3.digitaloceanspaces.com/transforms/s3business/diagrams/29388/asset-turnover-formula-example_2558ca17cfd574efc553cd677b3d659b.jpg

Net Asset Value Formula Calculator Examples With Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/06/Net-Asset-Value-Formula.jpg

Whether using it for a business or a fund the NAV is an important metric that reflects the total shareholder or unitholder equity position By dividing the NAV by the number of shares or units outstanding one can determine the net asset value per share NAVPS The higher the NAV or NAVPS the higher the value of the fund or the company The net asset value or NAV for short is defined as the difference between the assets and liabilities of an investment fund As an investment fund is usually a pool of money from various investors we commonly interpret this metric as the market value of the fund However it is important to note that not all NAV of investment funds is equivalent to their fund value

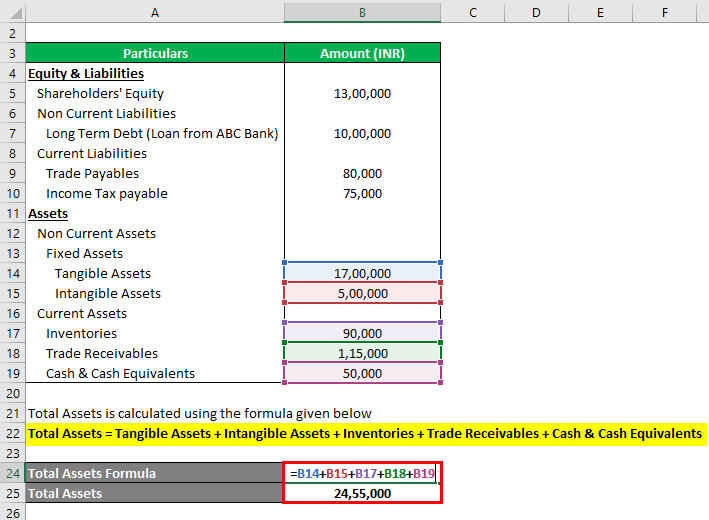

Hence we need to follow the definition of Asset and Liability given below strictly 1 Asset A mutual fund s assets include the market value of the investments cash reserves cash equivalents and other income These are included in various forms such as a percentage of capital in the form of liquid assets and cash and other items like interest payments dividends etc Asset Based Approach An asset based approach is a type of business valuation that focuses on a company s net asset value NAV or the fair market value of its total assets minus its total

More picture related to How To Calculate Net Asset Value Of A Private Company

Net Asset Formula Examples With Excel Template And Calculator

https://cdn.educba.com/academy/wp-content/uploads/2021/07/Net-Asset-Formula-Example-1-2.png

How To Calculate Net Worth Equity Haiper

https://www.educba.com/academy/wp-content/uploads/2019/06/Equity-Formula.jpg

What Is Net Asset Value Definition Formula Examples Snov io

https://lh3.googleusercontent.com/ZqlBWoBZWW0BUt8CLW0lLknUTeG0lejkZ3Bi2qcMFdFxCda2oP247sSTdTZfJHKpjaAVkbv5zomPNEKOO-zw5LqWbbnYhwvhYwZUslNxLtTY-tzZt5q7bxm8z1xONHaSH2RoJGId

Net asset value or NAV represents the value of an investment fund NAV most simply is calculated by adding up what a fund owns the assets and subtracting what it owes the liabilities NAV is typically used to represent the value of the fund per share however so the total above is usually divided by the number of outstanding shares Net Asset Value NAV represents the per share value of a mutual fund or an exchange traded fund ETF calculated by dividing the total value of the fund s assets minus its liabilities by the number of outstanding shares NAV is typically computed at the end of each trading day based on the closing market prices of the fund s underlying assets

The net asset value formula is calculated by adding up what a fund owns and subtracting what it owes For example if a fund holds investments valued at 100 million and has liabilities of 10 Net asset value or NAV of an investment company is the company s total assets minus its total liabilities For example if an investment company has securities and other assets worth 100 million and has liabilities of 10 million the investment company s NAV will be 90 million Because an investment company s assets and liabilities change daily NAV will also change daily

Assets In Accounting Identification Types And Learning Free Nude Porn

https://www.deskera.com/blog/content/images/2020/08/current_v_fixed_assets_76194-01-1.jpg

Net Asset Value NAV Definition Formula How It s Used Shortthestrike

https://shortthestrike.com/wp-content/uploads/2023/04/net_asset_value.jpg

How To Calculate Net Asset Value Of A Private Company - Hence we need to follow the definition of Asset and Liability given below strictly 1 Asset A mutual fund s assets include the market value of the investments cash reserves cash equivalents and other income These are included in various forms such as a percentage of capital in the form of liquid assets and cash and other items like interest payments dividends etc