How To Calculate Net Annual Income The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

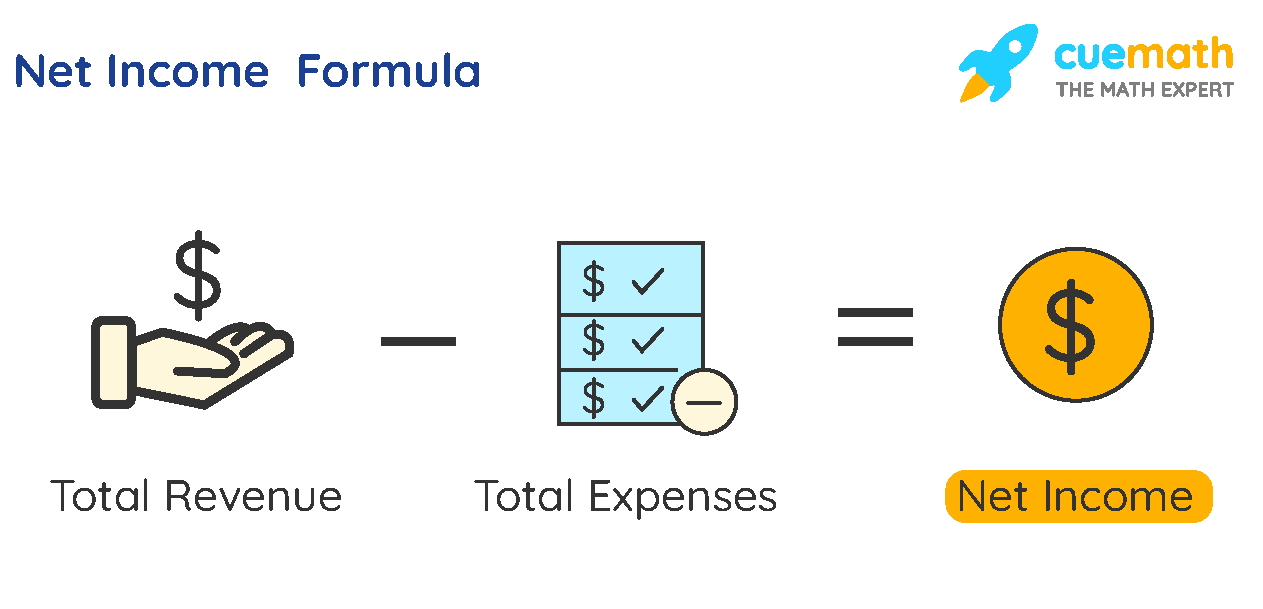

Learn how to calculate your annual income whether you re salaried hourly or self employed Discover tips for accurate calculations and understanding your financial picture To calculate your annual net income take your annual gross income and subtract any deductions Deductions often include things like Federal state and local income taxes Social Security and Medicare taxes Retirement contributions Health insurance premiums

How To Calculate Net Annual Income

How To Calculate Net Annual Income

https://thirdspacelearning.com/wp-content/uploads/2022/06/Percentage-Profit-What-is.png

Taxable Income Formula Calculator Examples With Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/06/Taxable-Income-Formula.jpg

Net Income

https://d138zd1ktt9iqe.cloudfront.net/media/seo_landing_files/net-income-formula-1623236027.png

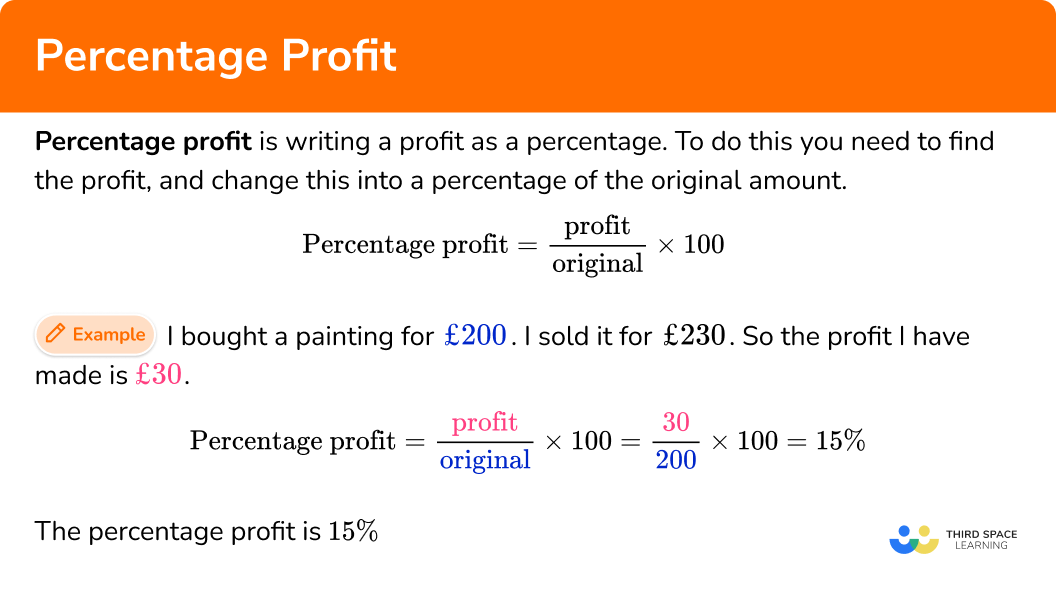

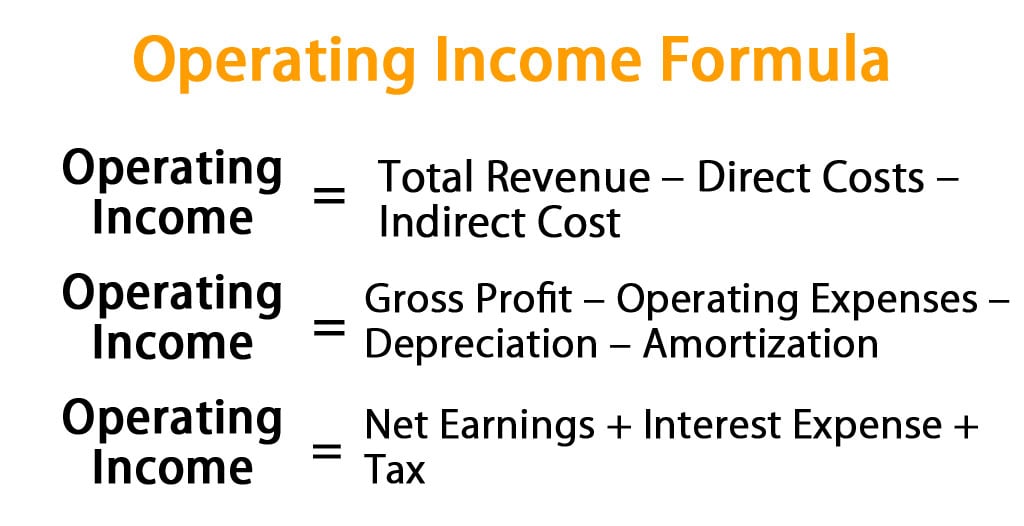

The net annual income sometimes called your annual income is the money you earn that you can spend or save however you want Let s look at another simplified example Suppose you already know that you worked 2 000 hours over the course of the year your average hourly wage was 25 and your final tax bill was 8 000 this number is Net Income vs Profit Net income is different than other forms of profit because the former accounts for all money flowing in and out of the company while profit usually only accounts for one type of expense For instance gross profit refers to revenue minus the cost of goods sold while operating profit refers to revenue minus operating costs Net income on the other hand takes all

Calculate your gross annual income Your first step to calculating your net income is finding out your gross income Gross income is the total amount of money you make in a year before taking taxes or deductions into account It serves as your starting point for calculating net income How to calculate annual net income Below is how to calculate the amount of annual net income you make based on your gross income 1 Determine your annual salary If you re considered a salaried employee then your annual salary may already be listed on your pay stub If you receive an hourly wage and are unsure of your annual salary you can

More picture related to How To Calculate Net Annual Income

Operating Income Formula Calculations And Examples

https://www.financestrategists.com/wp-content/uploads/2020/09/OPERATING-FORMULA-RIBBET-1024x512.jpg

Operating Income Formula Calculator Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/04/Operating-Income-Formula.jpg

Total Profit Formula

https://learn.financestrategists.com/wp-content/uploads/Exxample_of_Calculating_Net_Profit.png

Your net annual income would be 37 000 5 000 2 000 30 000 This 30 000 is what you actually have to spend or save during the year Gross annual income calculator A gross annual income calculator makes it easy to figure out your yearly income Here s how you might use one Net income is what remains after all pre tax and post tax deductions are taken from your gross income Formula Net Income Taxable Income Taxes and Other Withholdings Detailed Example Let s calculate the net income for an individual with a 60 000 gross income Pre Tax Deductions 401 k 5 000 HSA 2 000 Health Insurance 3 000

[desc-10] [desc-11]

How To Calculate Net Income 12 Steps with Pictures WikiHow

https://www.wikihow.com/images/7/74/Calculate-Net-Income-Step-12-Version-2.jpg

Cash Flow Definition And Meaning Market Business News

https://i0.wp.com/marketbusinessnews.com/wp-content/uploads/2015/07/Calculating-net-cash-flow-image.jpg?w=899&ssl=1

How To Calculate Net Annual Income - Calculate your gross annual income Your first step to calculating your net income is finding out your gross income Gross income is the total amount of money you make in a year before taking taxes or deductions into account It serves as your starting point for calculating net income