How To Calculate Monthly Salary From Annual Ctc Calculate your in hand salary from CTC by our take home salary calculator Know detailed salary breakup and compare salary with other companies

Calculation of In Hand Salary under the old as well as the new tax regime Rs 7 23 024 per annum or Rs 60 252 per month To calculate the take home salary you must enter the Cost To Company CTC and the bonus if any as a fixed amount or a percentage of the CTC For example

How To Calculate Monthly Salary From Annual Ctc

How To Calculate Monthly Salary From Annual Ctc

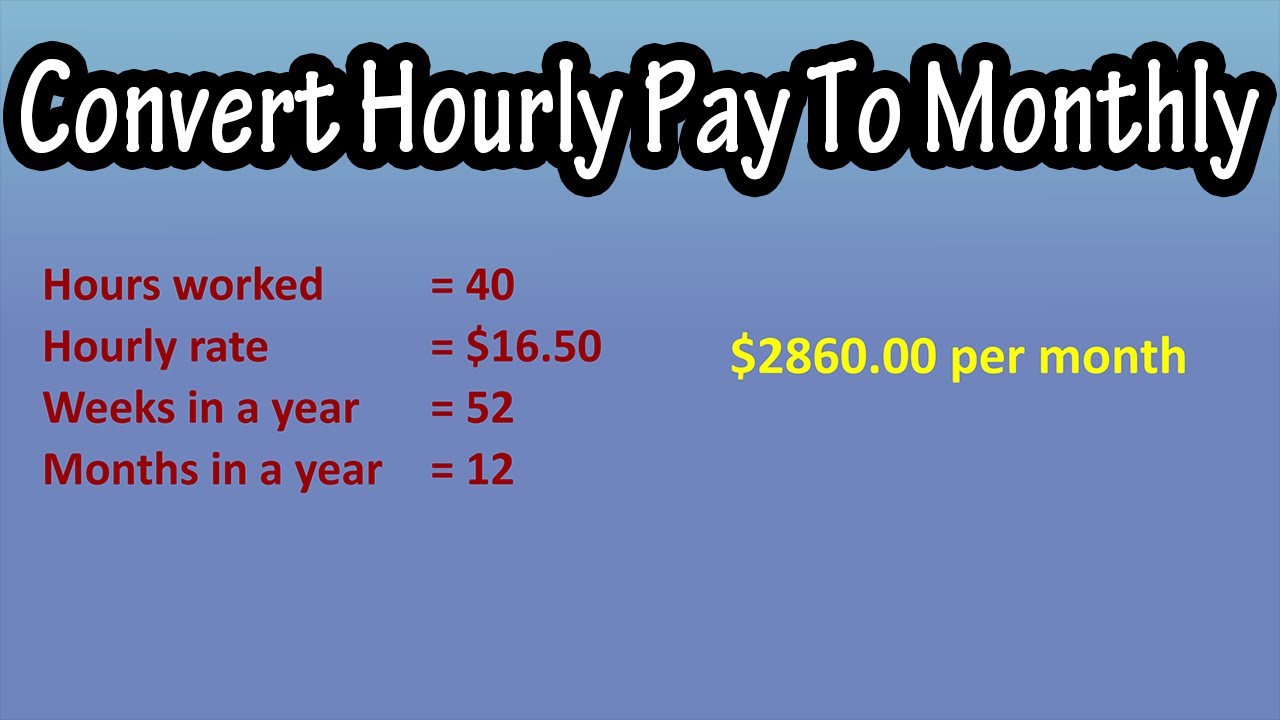

https://i.ytimg.com/vi/89MDPaCgLDQ/maxresdefault.jpg

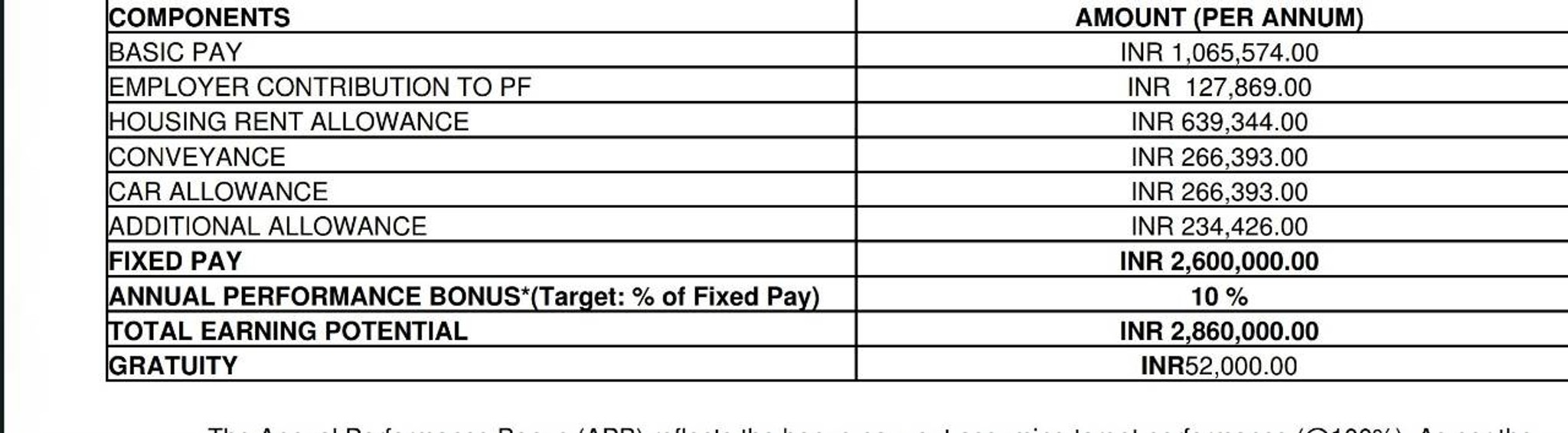

Please help me to calculate the in hand salary for... | Fishbowl

https://dslntlv9vhjr4.cloudfront.net/posts_images/TZfsMZHv8jB80.png

What would be the monthly salary with this CTC? | Fishbowl

https://dslntlv9vhjr4.cloudfront.net/posts_images/weXlMcEtuRgf6.jpg

Basic salary is the basic income of an employee and may range between 40 to 50 of the gross salary The basic salary of an employee serves as So you will need to add the yearly basic allowances then divide the sum by 12 to get your monthly fixed salary The basic salary is the

So your total gross salary will be CTC bonus 10 lakhs 50 000 9 50 lakhs Thereafter you need to deduct the yearly professional tax from the Assume your Cost To Company CTC is Rs 5 lakh The employer gives you a bonus of Rs 50 000 for the financial year Then your total gross salary is Rs 5 00 000

More picture related to How To Calculate Monthly Salary From Annual Ctc

How To Calculate Income Tax on Salary with Payslip Example | Income Tax Excel Calculator - YouTube

https://i.ytimg.com/vi/USW68EaURfg/maxresdefault.jpg

What is CTC? Difference between CTC Package and Net Salary? - India

https://www.am22tech.com/wp-content/uploads/2014/10/cost-to-company-india-take-home.jpg

Need help to calculate the in hand salary | Fishbowl

https://dslntlv9vhjr4.cloudfront.net/posts_images/9ES7Kg4HRsD8a.jpg

Basic Pay 40 000 12 000 28000 Thus although CTC and basic salary are considered to be analogous to each other they are quite different from each How To Calculate CTC On a basic level of understanding CTC equals the sum of earnings of an employee minus the deductions made from his salary both direct

The take home salary is equal to gross salary minus the total deductions i e 6 00 000 43 400 5 16 600 5 16 600 will be the final take home Monthly CTC 20 000 10 000 5 000 20 000 x 12 35 000 x 0 75 12 45 145 83

Basic Salary % Percentage of CTC Calculation | Simply Explained by AKumar - YouTube

https://i.ytimg.com/vi/Ntuv6zlWlRI/maxresdefault.jpg

Hi Folks Can someone please help me to calculate ... | Fishbowl

https://dslntlv9vhjr4.cloudfront.net/posts_images/pe7ECc6ILsat9.jpg

How To Calculate Monthly Salary From Annual Ctc - Basic salary is the basic income of an employee and may range between 40 to 50 of the gross salary The basic salary of an employee serves as