How To Calculate Gross Salary From Net Salary In South Africa First enter the net paycheck you require Then enter your current payroll information and deductions We will then calculate the gross pay amount required to achieve your net paycheck

For SA residents Gross income means the total amount of worldwide income that you earned during the tax year excluding income that is of a capital nature Note that income is also money that is owed to you for work you performed even if not paid to you yet for example payment for a service that you performed Net pay is take home pay The net to gross calculator helps you see how much an amount will be worth after we add or before we deduct a tax look below for an explanation it can be a bit tricky As with all Omni calculators you can input values into the fields in any order and the calculation will still work fine

How To Calculate Gross Salary From Net Salary In South Africa

How To Calculate Gross Salary From Net Salary In South Africa

https://99employee.com/wp-content/uploads/2021/01/gross-salary-employee.jpg

C Program To Calculate Gross Salary Employee Gross With HRA DA And TA

https://i.ytimg.com/vi/27amI69hoa8/maxresdefault.jpg

C Program To Calculate Gross Salary Of An Employee Tuts Make

https://www.tutsmake.com/wp-content/uploads/2021/12/C-Program-to-Calculate-Gross-Salary-of-an-Employee.jpg

Our online tax calculator is in line with changes announced in the 2023 2024 Budget Speech Simply enter your current monthly income and allowances to view what your tax saving or liability will be in the tax year Step 1 Insert your earnings and deductions Your Age Earnings R 0 00 Monthly Salary R Travel Allowance R Other Allowances R In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

The following steps show how to calculate gross pay for hourly wages Determine the actual number of hours worked Multiply the number of hours worked by the hourly wage If there is overtime multiply the number of overtime hours worked by the overtime pay rate Add regular pay and overtime pay together to find the gross pay for that pay period Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

More picture related to How To Calculate Gross Salary From Net Salary In South Africa

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or

https://i.ytimg.com/vi/ev3JQIvAaPY/maxresdefault.jpg

Gross Compensation Worksheet Turbotax

https://decoalert.com/wp-content/uploads/2021/06/Is-base-salary-the-same-as-gross-pay-1024x576.jpg

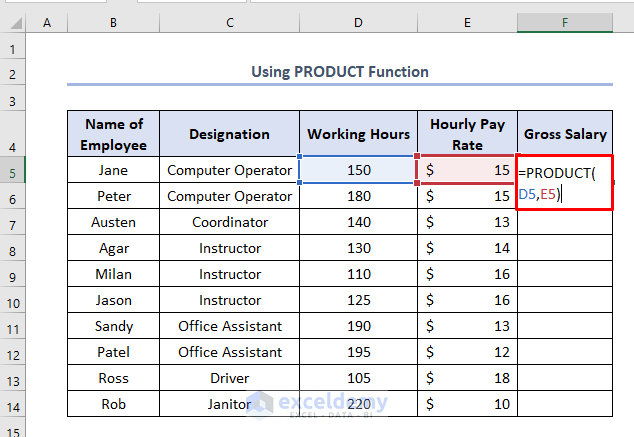

How To Calculate Gross Salary In Excel 3 Useful Methods ExcelDemy

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-gross-salary-2.png

Gross pay calculator Plug in the amount of money you d like to take home each pay period and this calculator will tell you what your before tax earnings need to be Important Note on Calculator The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates Gross Pay Calculator Straight Time ST Hours Rate Hr hourly rate of pay Overtime OT OT Hours OT Rate OT rate multiplier 1 5 is time and a half ST Double Time DT DT Hours DT Rate DT rate multiplier 2 is double time ST Round hours to Answer Gross Pay Rate Hr Hours Amount ST OT DT Total How could this calculator be better

Gross vs Net Salary Gross salary is an employee s total pay before any deductions are made Gross salary Basic salary allowances bonuses other forms of compensation Calculating your net salary is easier than you think See the example below Imagine your annual salary is 50 000 PAYE Calculator South Africa Gross to Nett PAYE Calculator 2023 2024 South African PAYE UIF Calculator Tax Year 2023 2024 Monthly Gross Income R Younger than 65 years Between 65 and 75 years Older than 75 years Clear Simple calculator for calculating South African PAYE for 2023 2024

Write A Program To Calculate Gross Salary Of An Employee In Java

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiMcPKAUCMp_3Jh3ALY4AMmzkMruruo0DUxsi-dlZoicSHWogxGgYXu7Dh6STQvfoxdtzWD2ozjnnTgFeISo8y6PDiV1PLg0YbgCjVpW6w59KIMbqeLqHFxIN7yWuTIsRmXI3V1D6WAwXKNgT0DYSQM3_I1ApX4fXqOoSrNvyNxCtwJc7GOWjVGIFlm/w1200-h630-p-k-no-nu/Gross Salary Program in Java.jpg

P11 Program To Calculate Gross Salary With HRA DA And TA From Basic

https://i.ytimg.com/vi/PzQ6pD9oE-g/maxresdefault.jpg

How To Calculate Gross Salary From Net Salary In South Africa - In simple terms net pay is the money you take home directly from your paycheck For example if someone gets paid 1 200 per week but 160 is taken away by deductions the person s net pay will