How To Calculate Gross Salary From Net Pay To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

Enter the amount of money you d like to take home each pay period and the gross pay calculator will tell you what your before tax earnings need to be The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks It s your employer s responsibility to withhold this money based on the information you provide in your Form W 4

How To Calculate Gross Salary From Net Pay

How To Calculate Gross Salary From Net Pay

http://img.aws.ehowcdn.com/intl-1200x630/ds-photo/getty/article/170/192/AA017941.jpg

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or

https://i.ytimg.com/vi/ev3JQIvAaPY/maxresdefault.jpg

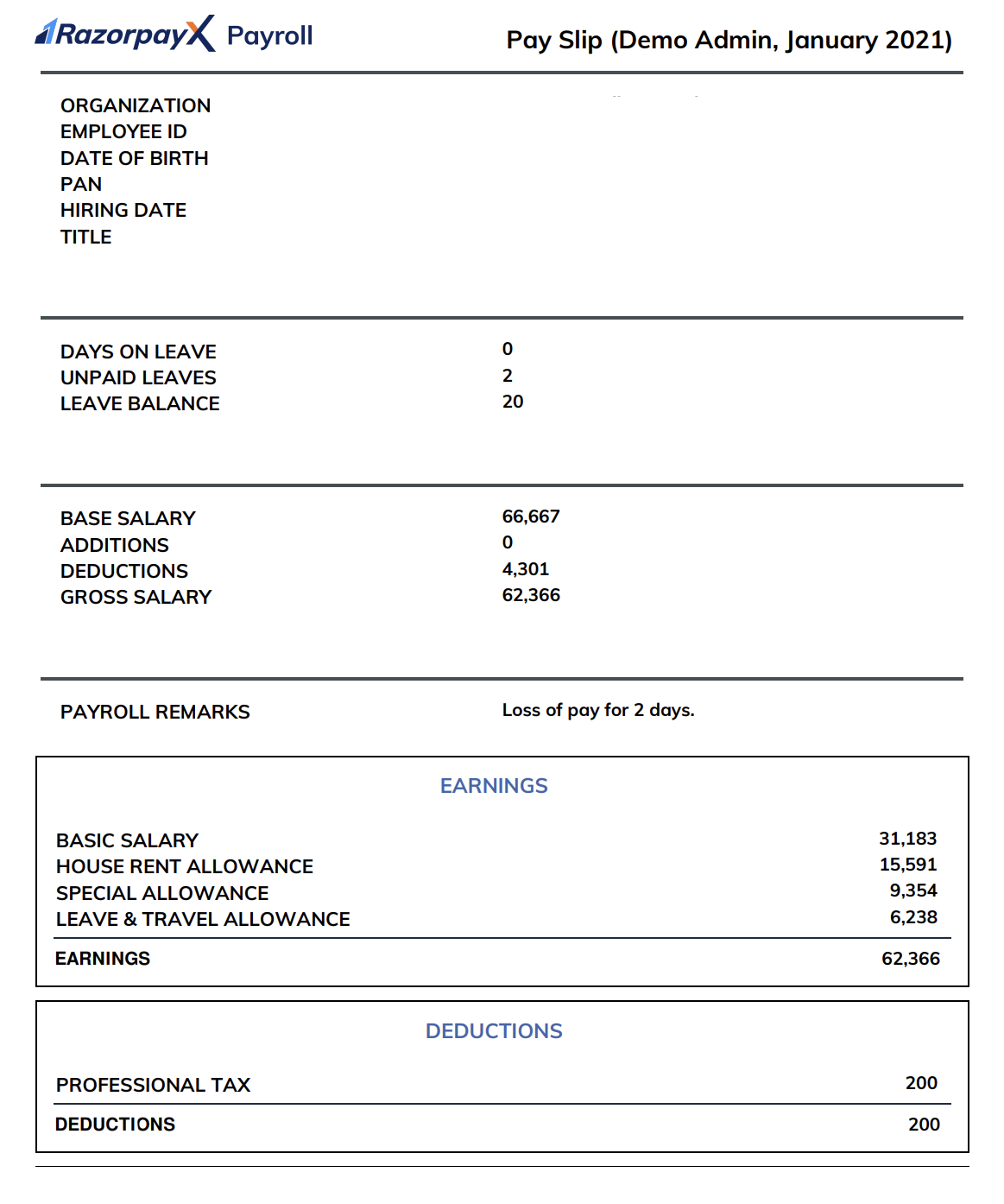

Gross Salary Simplified Meaning Components Calculation RazorpayX

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2021/02/Screenshot-2021-03-04-at-4.20.13-PM.png

If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status Then we ll divide the net pay 700 by the rate 0 7035 700 divided by 0 7035 is 995 00 this number totals the gross payment 995 x 2965 is 295 00 this number equals the total tax withheld 995 295 700 this is the net bonus the employee should receive So the gross up or extra pay the employer pays to ensure the employee

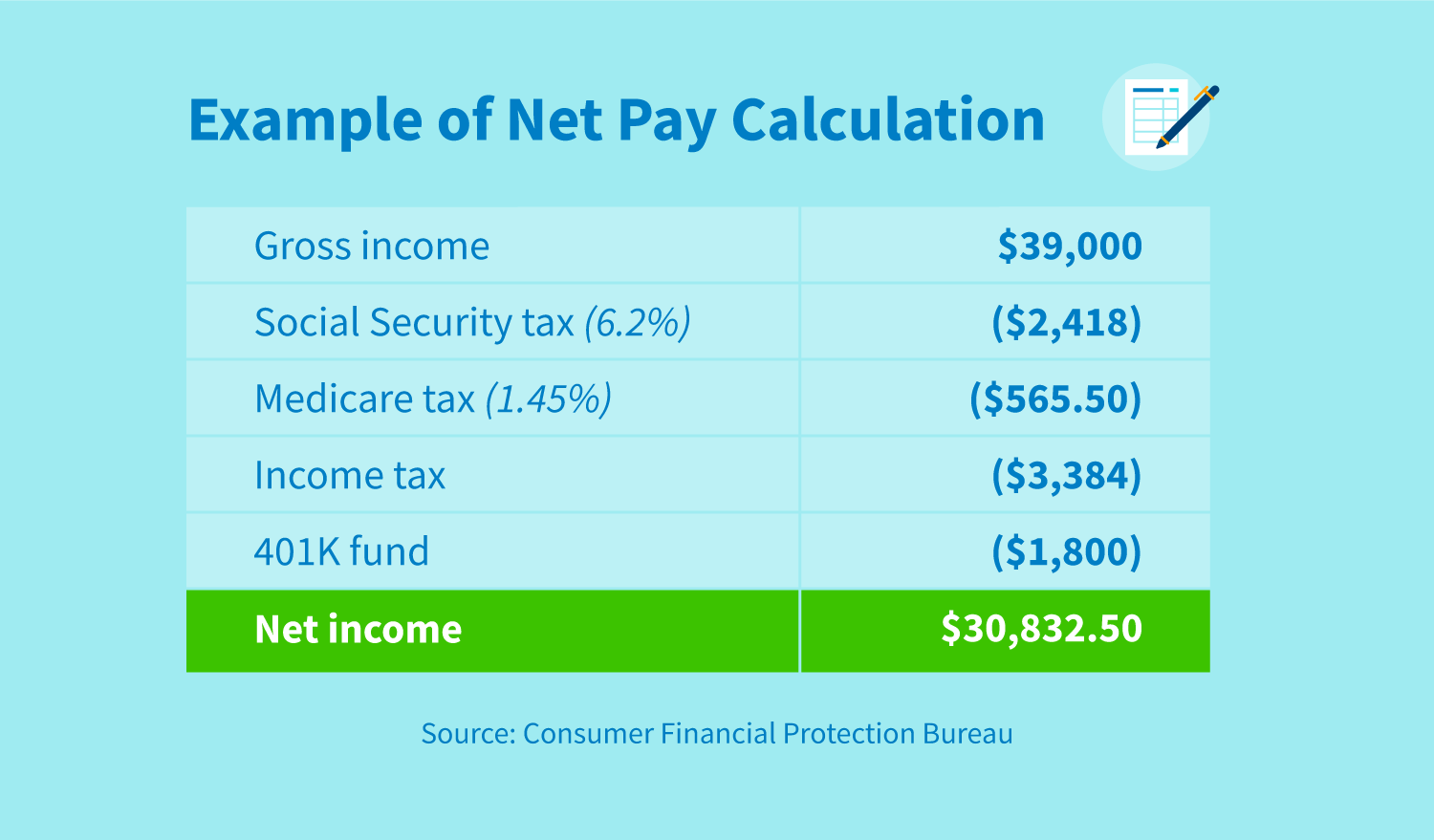

The gross pay method refers to whether the gross pay is an annual amount or a per period amount The annual amount is your gross pay for the whole year Per period amount is your gross pay every payday For example if your annual salary were 52 000 and you are paid weekly your annual amount is 52 000 and your per period amount is 1 000 2 Subtract deductions to find net pay To calculate net pay deduct FICA tax federal state and local income taxes and health insurance from the employee s gross pay Using the formula to calculate net pay determine the employee s net pay Net Pay Gross Pay Deductions

More picture related to How To Calculate Gross Salary From Net Pay

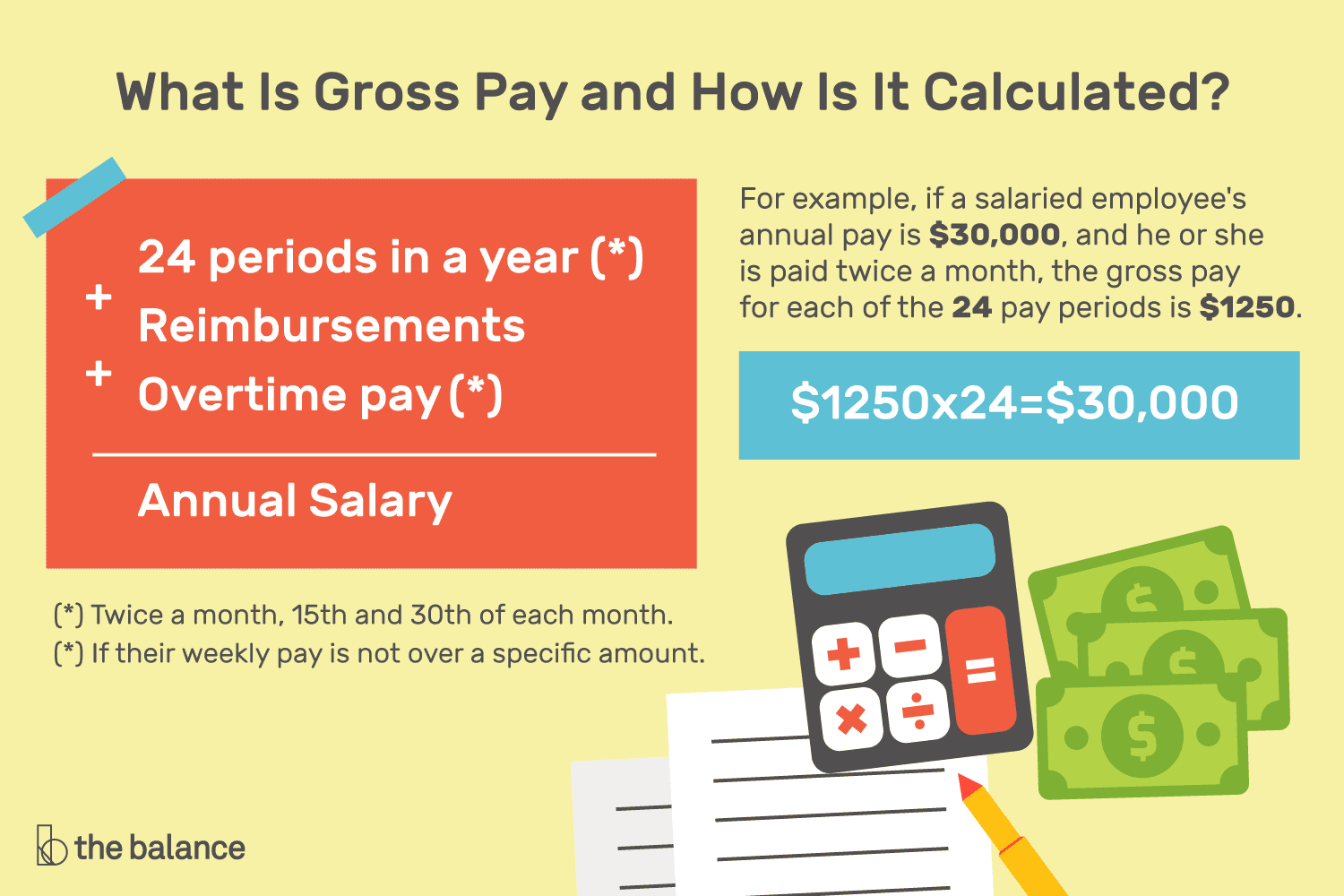

What Is Gross Pay And How Is It Calculated Db excel

https://db-excel.com/wp-content/uploads/2019/09/what-is-gross-pay-and-how-is-it-calculated.png

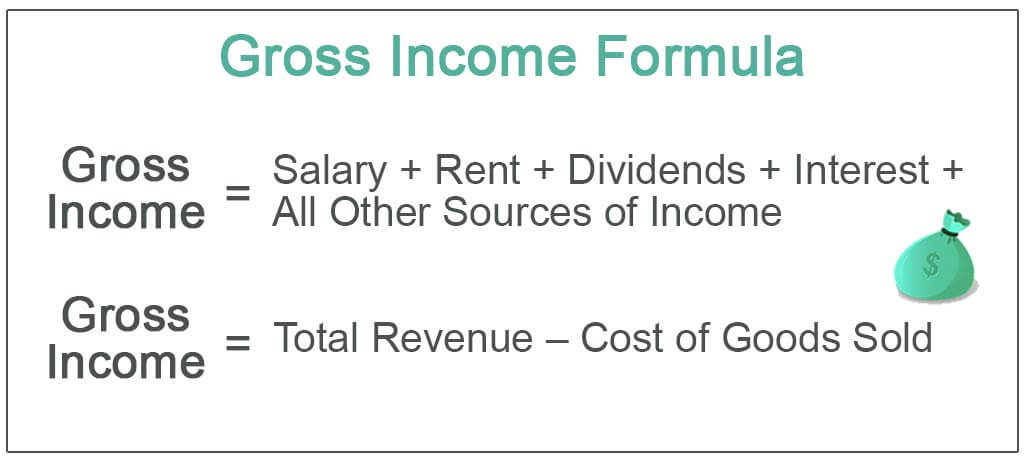

Gross Income Formula Step By Step Calculations

https://www.wallstreetmojo.com/wp-content/uploads/2019/11/Gross-Income-Formula-1.jpg

Gross Compensation Worksheet Turbotax

https://decoalert.com/wp-content/uploads/2021/06/Is-base-salary-the-same-as-gross-pay-1024x576.jpg

What is gross pay Gross pay is the amount of money you receive from your employer before they account for deductions or taxes For example if you earn 50 000 per year your gross pay is 50 000 If you want your monthly gross pay divide this figure by 12 Gross Pay To calculate an employee s gross pay start by identifying the amount owed each pay period Hourly employees multiply the total hours worked by the hourly rate plus overtime and premiums dispersed Salary employees divide the annual salary by the number of pay periods each year This number is the gross pay

The following steps show how to calculate gross pay for hourly wages Determine the actual number of hours worked Multiply the number of hours worked by the hourly wage If there is overtime multiply the number of overtime hours worked by the overtime pay rate Add regular pay and overtime pay together to find the gross pay for that pay period Divide your employee s annual salary by the number of pay periods If you have a salaried employee making 60 000 per year here s how gross pay would look divided by each type of pay period Weekly 60 000 52 1 153 85 per pay period Every two weeks 60 000 26 2 307 69 per pay period

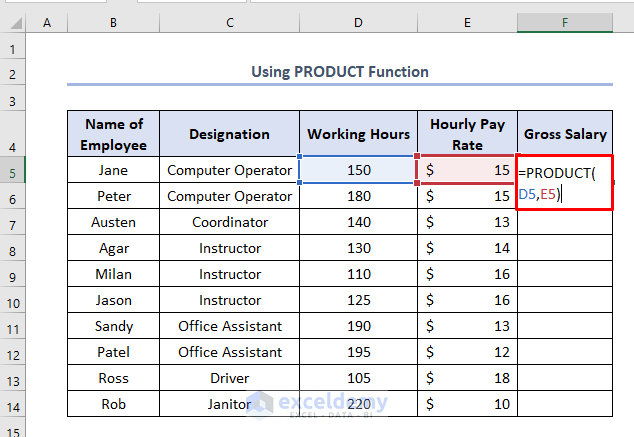

How To Calculate Gross Salary In Excel 3 Useful Methods ExcelDemy

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-gross-salary-2.png

Gross Income Vs Net Income CreditRepair

https://www.creditrepair.com/blog/wp-content/uploads/2020/10/example-of-net-pay-calculation.png

How To Calculate Gross Salary From Net Pay - If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status