How To Calculate Gross Earnings From Net Pay To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

The net to gross calculator helps you see how much an amount will be worth after we add or before we deduct a tax look below for an explanation it can be a bit tricky As with all Omni calculators you can input values into the fields in any order and the calculation will still work fine If an individual worked 40 hours in a given period and earned 20 per hour the calculation would be Hours worked in pay period x hourly pay rate gross pay per pay period 40 hours x 20 per hour 800 gross pay per pay period

How To Calculate Gross Earnings From Net Pay

How To Calculate Gross Earnings From Net Pay

https://i.ytimg.com/vi/PaD6N4iwQtU/maxresdefault.jpg

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate

https://i.ytimg.com/vi/ev3JQIvAaPY/maxresdefault.jpg

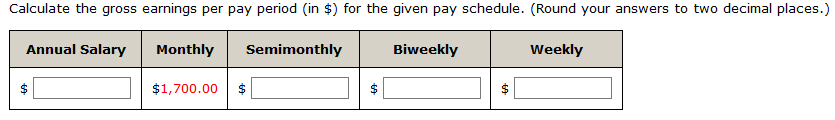

Solved Calculate The Gross Earnings Per Pay Period in Chegg

https://media.cheggcdn.com/media/7be/7beb83fb-306e-4eb7-be6b-bc51e247b253/phpIKQx7y.png

Tool Gross pay calculator Plug in the amount of money you d like to take home each pay period and this calculator will tell you what your before tax earnings need to be Important Note on Calculator The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates Salary Calculator Results If you are living in California and earning a gross annual salary of 72 020 or 6 002 per month the total amount of taxes and contributions that will be deducted from your salary is 16 442 This means that your net income or salary after tax will be 55 578 per year 4 632 per month or 1 069 per week

What is net pay Net pay is a worker s total take home pay or what s left after payroll withholdings and deductions The net pay formula is Gross pay deductions Net pay Some common deductions include income taxes Social Security taxes health insurance and retirement contributions To calculate net from gross you must withhold deductions each pay period There are both tax and non tax deductions And some deductions are mandatory while others are voluntary Taxes are mandatory You may need to withhold the following from an employee s gross pay Federal income tax Social Security tax Medicare tax

More picture related to How To Calculate Gross Earnings From Net Pay

Tema Development Company Rakes In GHS44 Million As Gross Earnings

https://cdn.ghanaweb.com/imagelib/src/Tema_Development_Company1.jpg

Gross Pay Vs Net Pay Definitions And Examples Indeed

https://images.ctfassets.net/pdf29us7flmy/1mWYaSiqsKhd8iV2E5UhXD/bb8f71b867741ce5d170c0c00f09781e/what-is-gross-pay-FINAL-JULY-02.png

Hrpaych hrpaycheck Payroll Services Washington State University

https://s3.wp.wsu.edu/uploads/sites/1383/2016/06/checkstub.gif

Use SmartAsset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes Overview of Federal Taxes Gross earnings for individuals refers to the total income earned prior to the application of any tax deductions or adjustments For public companies gross earnings is an accounting convention

The gross pay method refers to whether the gross pay is an annual amount or a per period amount The annual amount is your gross pay for the whole year Per period amount is your gross pay every payday For example if your annual salary were 52 000 and you are paid weekly your annual amount is 52 000 and your per period amount is 1 000 Gross Pay Calculator Straight Time ST Hours Rate Hr hourly rate of pay Overtime OT OT Hours OT Rate OT rate multiplier 1 5 is time and a half ST Double Time DT DT Hours DT Rate DT rate multiplier 2 is double time ST Round hours to Answer Gross Pay Rate Hr Hours Amount ST OT DT Total How could this calculator be better

Gross Income Vs Net Income Differences And How To Calculate MBO Partners

https://s29814.pcdn.co/wp-content/uploads/2020/06/bill-rate-calculator.jpg.optimal.jpg

Solved Assume Your Gross Pay Per Pay Period Is 4 700 And Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/8d4/8d476c4a-4916-4ec9-8155-009c97c22150/phpRrMOf2.png

How To Calculate Gross Earnings From Net Pay - Salary Calculator Results If you are living in California and earning a gross annual salary of 72 020 or 6 002 per month the total amount of taxes and contributions that will be deducted from your salary is 16 442 This means that your net income or salary after tax will be 55 578 per year 4 632 per month or 1 069 per week