How To Calculate Fortnightly Pay From Annual Salary Australia Your gross income is the amount of money you earn before any deductions like tax are taken out SEEK s new pay calculator helps you easily work out your take home pay depending on the salary you re offered for a role The tool also takes into account relevant taxes and superannuation

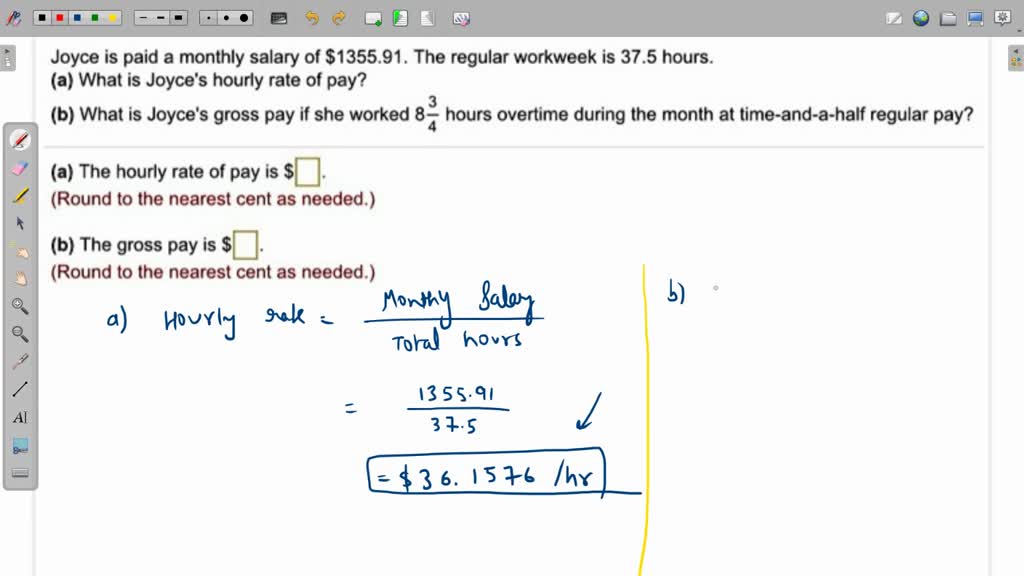

Step 6 Your paycheck For the final step divide your net pay by your pay frequency The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck If you want to calculate your pay after tax with the factual rates at the moment please use 2015 2016 year tab on the calculator Once again if your employer uses ATO tax tables to calculate your pay you will be overpaying 67 in tax if you earn 87 000 per year and getting paid fortnightly

How To Calculate Fortnightly Pay From Annual Salary Australia

How To Calculate Fortnightly Pay From Annual Salary Australia

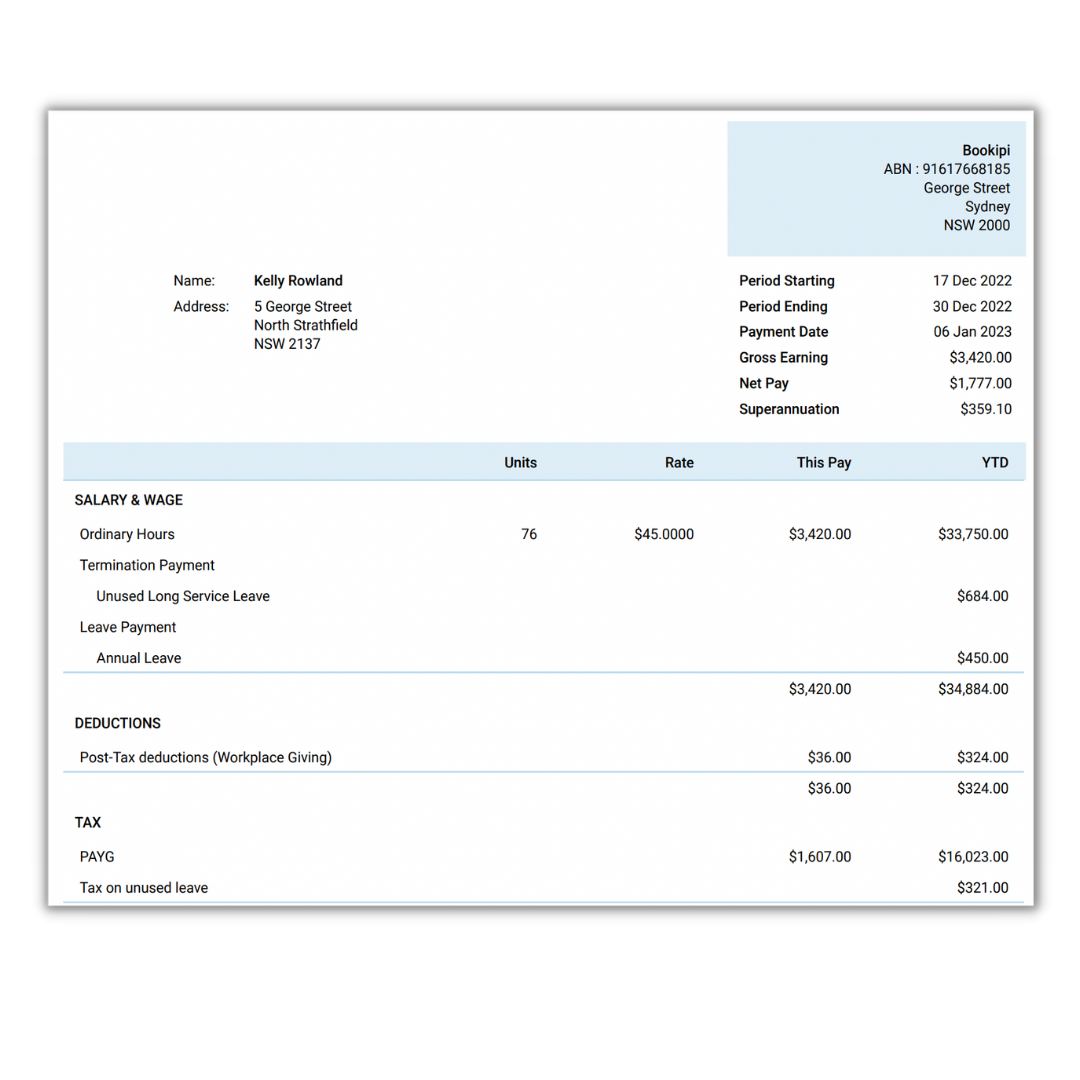

https://payroller.com.au/wp-content/uploads/2023/03/Payslip.png

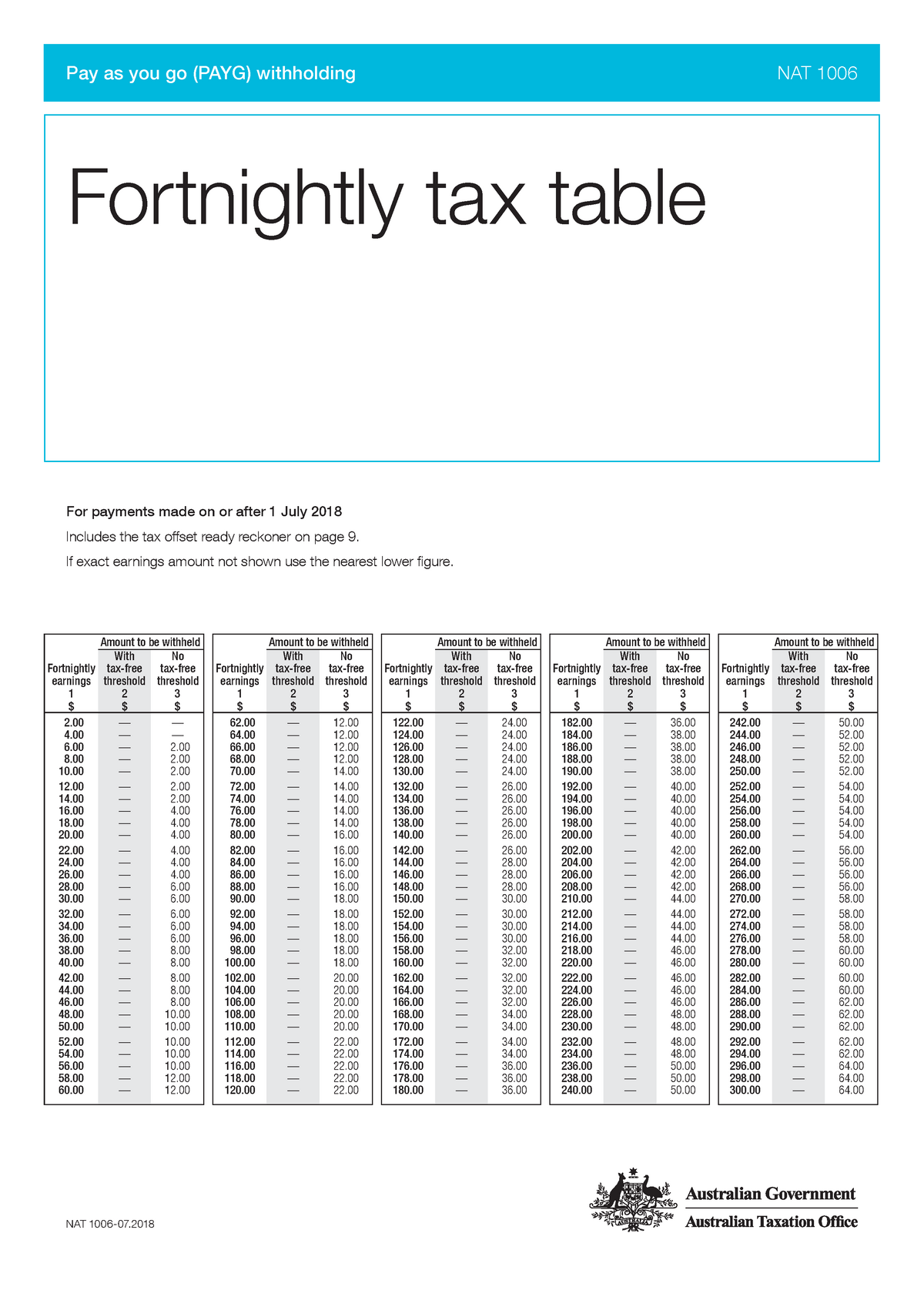

Fortnightly Tax Table From 1 July 2018 NAT 1006 07 Pay As You Go

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4f7c9d76c404c9bf39fc4f9cd2337882/thumb_1200_1697.png

What Is The Activity Rate How To Calculate The Activity Rate InfoComm

https://www.infocomm.ky/wp-content/uploads/2020/09/1600289603.jpeg

Calculate your take home pay using this Pay Calculator updated with ATO PAYG Tax thresholds for 2024 2025 Pay Calculators Australian residents for tax purpose are exempted from tax if annual gross income is less than 18200 For income of more than 18200 tax is levied at different rates amount of money paid by your employer in On 1 July 2023 the super guarantee rate will rise from 10 5 to 11 For salary and wage payments made on or after 1 July 2023 the new superannuation guarantee contribution rate of 11 will apply So double check your payslip and make sure employer is paying you the correct amount of super 2022 2023 2023 2024 2024 2025

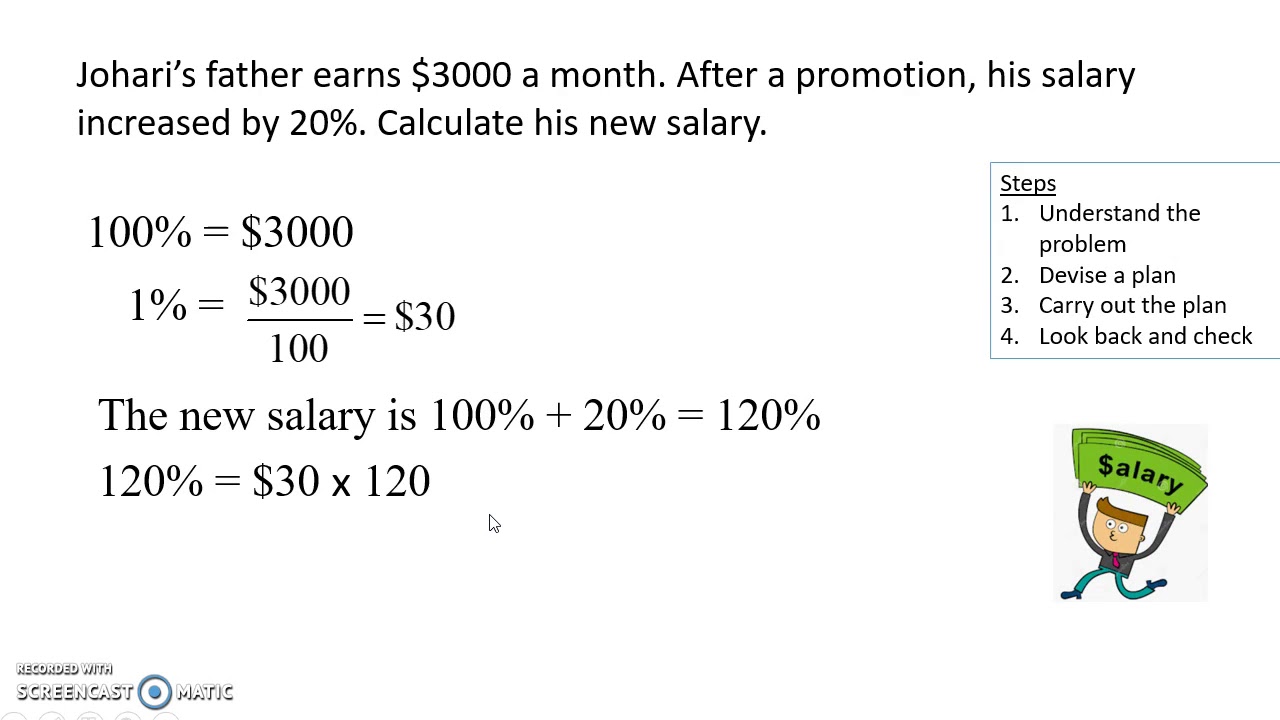

Using our salary calculator we can determine that the average Australian gross salary of 98 218 per year translates to a monthly take home pay of 6 333 On the other hand the median gross salary of 67 600 per year translates to a monthly net income of approximately 4 598 If you work in a major city like Sydney or Melbourne you ll The Money Pay Calculator can be used to calculate taxable income and income tax for previous tax years currently from the 2015 2016 tax year to the most recent tax year 2023 2024 Simply select the appropriate tax year you wish to include from the Pay Calculator menu when entering in your income details Use this pay calculator to work out

More picture related to How To Calculate Fortnightly Pay From Annual Salary Australia

SOLVED Shelley Ltd Pays Its Salaries Fortnightly In Arrears The Next

https://cdn.numerade.com/ask_previews/87480ea6-f918-4672-bbb6-80cbd522d272_large.jpg

Printable Budget Planner For Weekly Fortnightly And Monthly Etsy

https://i.pinimg.com/736x/88/e7/0c/88e70c75710e6b23ac81c6ea06d02a42.jpg

PAYG Withholding Tax Tables A Handy Reference To Keep Tax Store

https://taxstore.com.au/assets/images/menu.jpg

The gross pay estimator will estimate your gross pay the amount you earn before tax from the net pay take home pay you provide for a particular pay period A pay period can be weekly fortnightly or monthly You can use the calculator for income years 2013 14 to 2023 24 The results of this calculator are based on the information you The calculation on the Medicare levy assumes you are single with no dependants 2 There are not other additional levies 3 You are entitled to 250 00 Low Income Tax Offset This calculator is an estimate This calculator now conforms to the Australian Tax Office s Pay As You Go PAYG schedules The latest PAYG rates are available from the ATO

Select a specific Australia tax calculator from the list below to calculate your annual gross salary and net take home pay after deductions for that tax year Calculate your income tax in Australia and salary deduction in Australia to calculate and compare salary after tax for income in Australia in the 2024 tax year Calculate your fortnightly take home pay in 2024 that s your 2024 fortnightly salary after tax with the Fortnightly Australia Salary Calculator A quick and efficient way to compare fortnightly salaries in Australia in 2024 review income tax deductions for fortnightly income in Australia and estimate your 2024 tax returns for your

How To Calculate Percentage Increase Salary Haiper

https://i.ytimg.com/vi/ABPGV3AVa6A/maxresdefault.jpg

How To Calculate Conversion Rate In Retail Haiper

https://i.ytimg.com/vi/9nN8cNaWzfE/maxresdefault.jpg

How To Calculate Fortnightly Pay From Annual Salary Australia - FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024