How To Calculate Biweekly Pay Hourly After Taxes Step 6 Your paycheck For the final step divide your net pay by your pay frequency The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major Biweekly pay hours per pay period hourly wage For example let s calculate your biweekly pay if you work 40 hours per week and earn 20 per hour hours per pay period hours per week 2 80 biweekly pay 80 20 1 600 You ll need to keep in mind that this is your gross income or rather your income before taxes and deductions

How To Calculate Biweekly Pay Hourly After Taxes

How To Calculate Biweekly Pay Hourly After Taxes

https://images.surferseo.art/1c5f85f1-5679-4596-b748-c5d6177bc2e4.png

Biweekly Pay Calendar Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/478/617/478617966/large.png

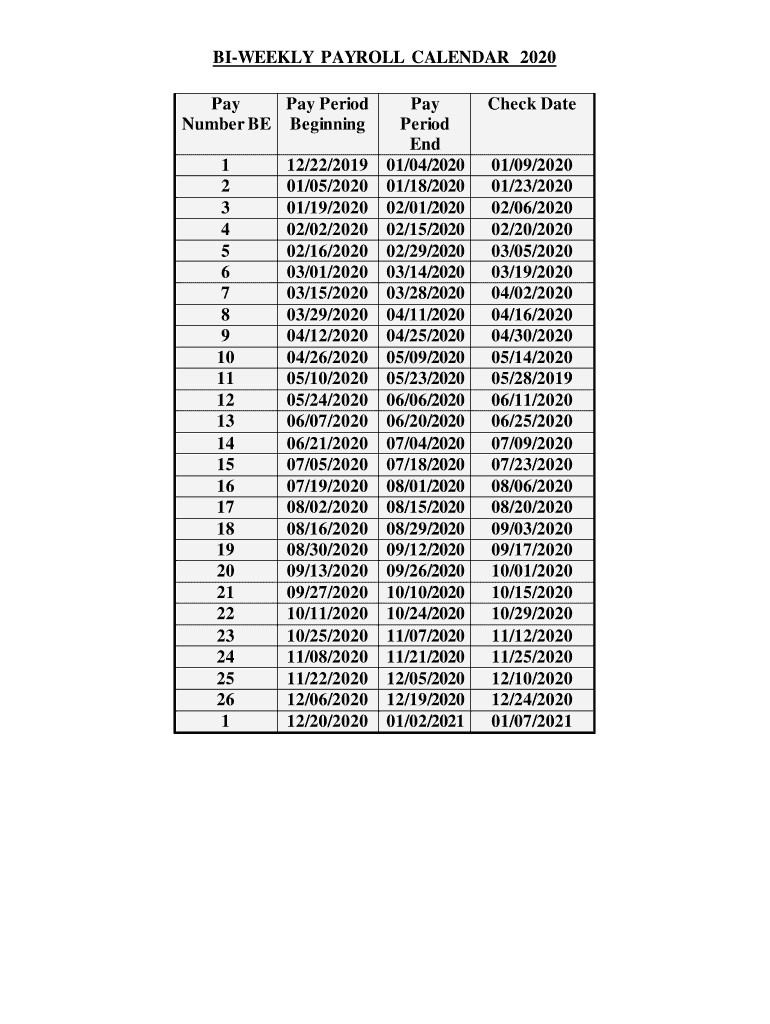

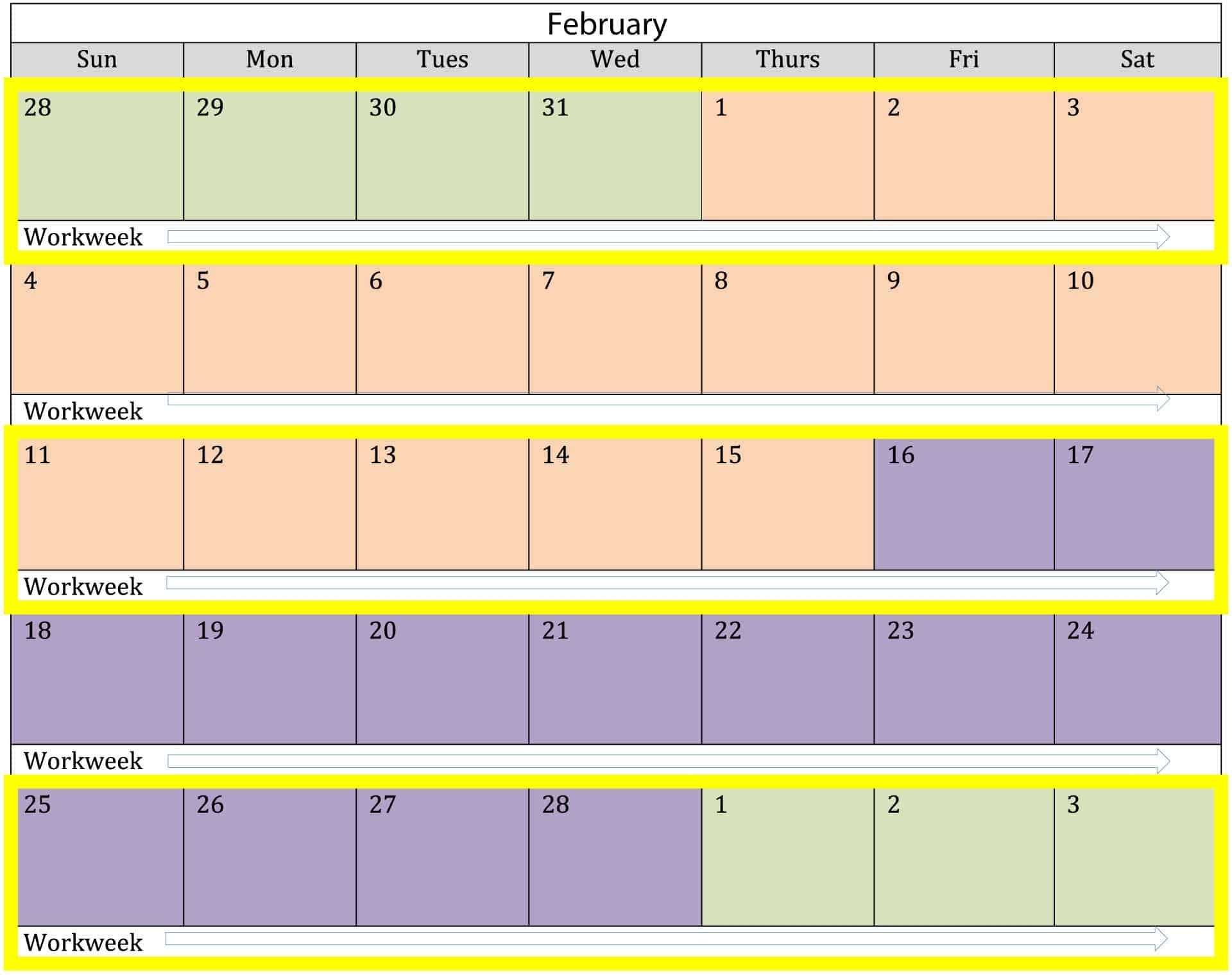

Examples Of 2021 Semi Monthly Payroll Calendar Calendar Template

https://oyungurup.com/wp-content/uploads/2021/01/the-art-of-calculating-overtime-on-a-semi-monthly-pay-schedule-examples-of-2021-semi-monthly-payroll-calendar.jpg

In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you Step 1 Calculate Your Gross Wages The gross wages for the example would be calculated as follows Gross Wages regular hours x regular wage overtime hours x overtime rate 80 x 25 00 5 x 37 50 2 000 187 50 2 187 50 For the purposes of looking up the tax bracket we calculate the annual gross income based on

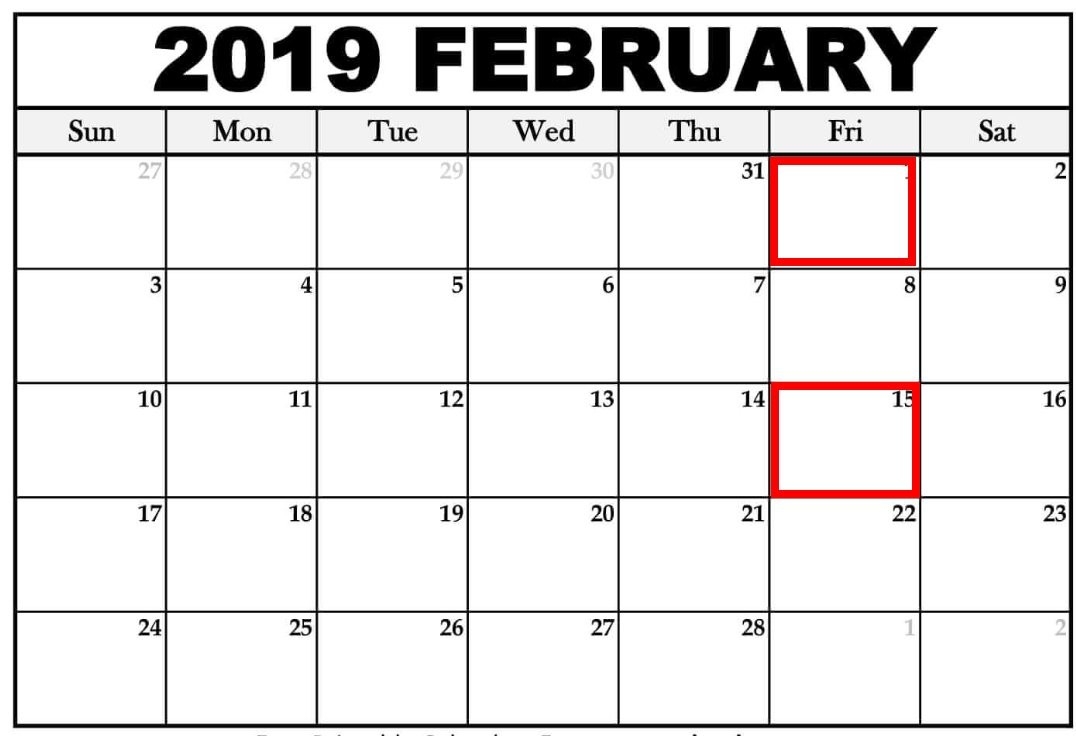

An hourly calculator lets you enter the hours you worked and amount earned per hour and calculate your net pay paycheck amount after taxes Bi weekly is once every other week with 26 payrolls per year or 27 during a leap year like 2024 such as to calculate exact taxes payroll or other financial data Neither these calculators nor To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get

More picture related to How To Calculate Biweekly Pay Hourly After Taxes

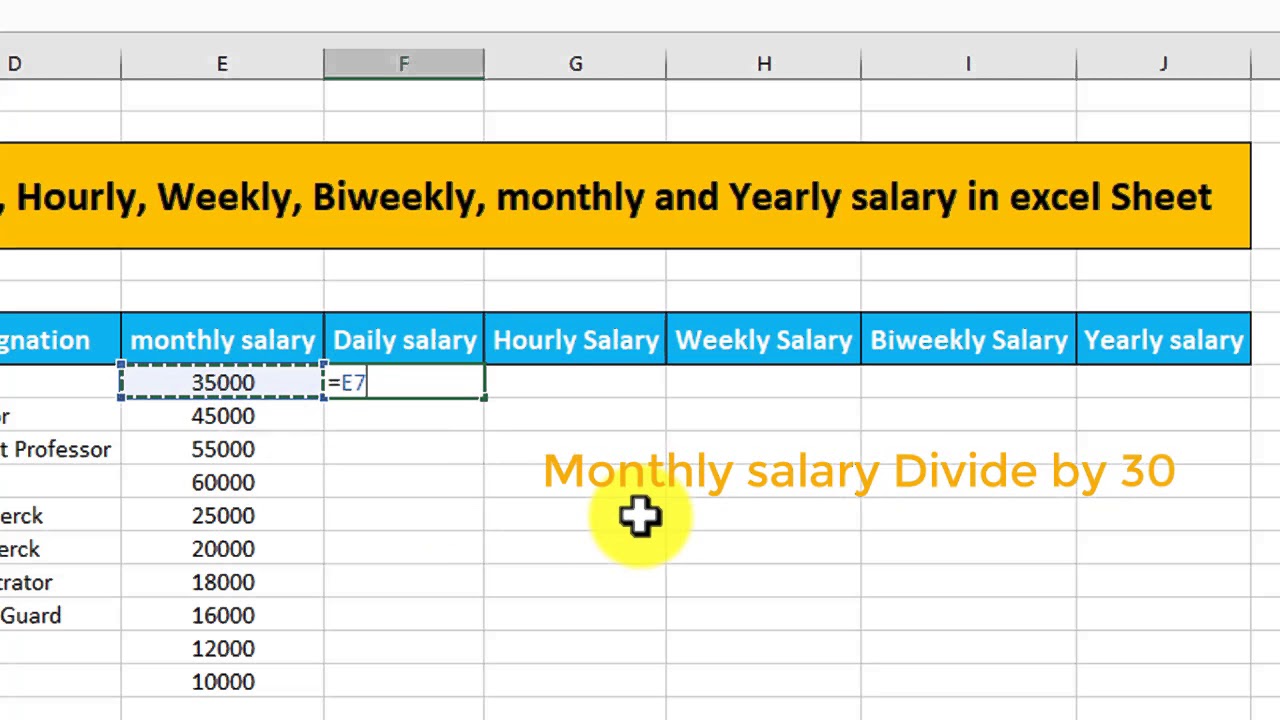

How To Calculate Daily Hourly weekly Biweekly And Yearly Salary

https://i.ytimg.com/vi/pXGxTL-GPjM/maxresdefault.jpg

Convert Biweekly Salary To Annual AadamOgennaya

https://www.easybudgetblog.com/wp-content/uploads/2021/04/60C2965A-FC13-4AFD-93AA-58E63148E51C_1_201_a-1024x767.jpeg

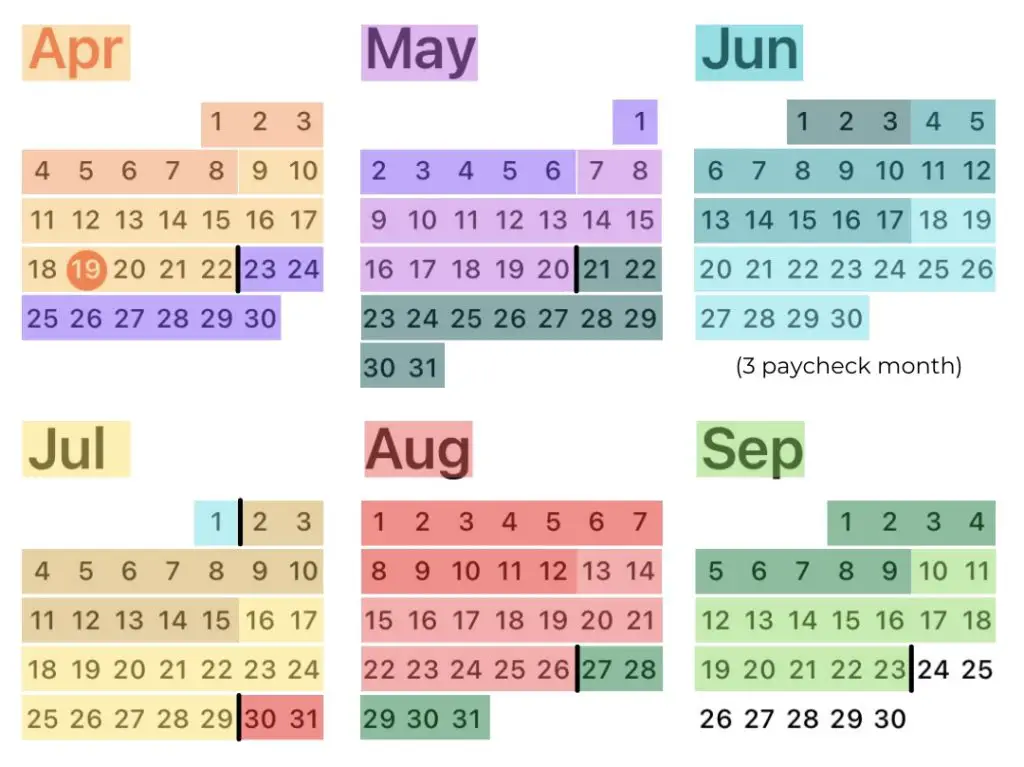

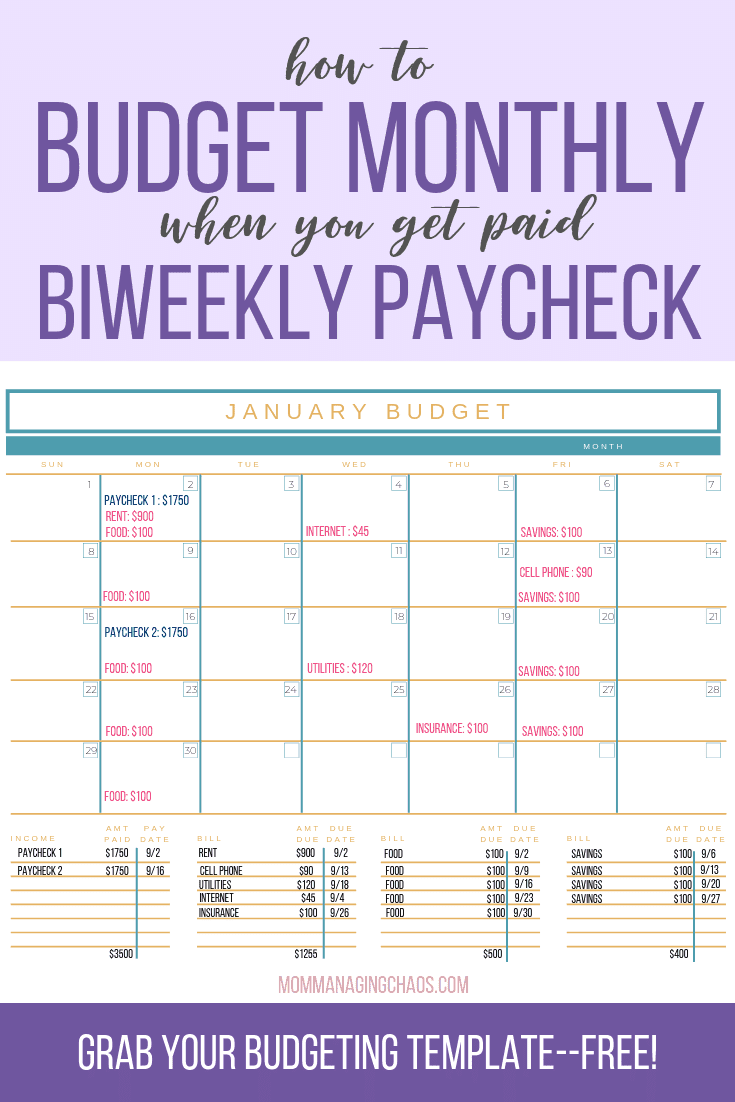

How To Budget BiWeekly Paychecks Paying Monthly Bills

https://mommanagingchaos.com/wp-content/uploads/2018/03/biweekly-budget.png

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Biweekly to hourly Divide your biweekly income by how many hours you typically work in a your typical pay period For example if you work 8 hours a day 5 days a week that is 40 hours per week If you are paid every other week then multiply the 40 by 2 get 80 So if you make 2 000 every other week divide that amout by 80 and you would

How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 Calculate your take home pay after various taxes For United States residents Constantly updated to keep up with the tax year

Bill Payment Calendar By Pay Period Template Calendar Design

https://rancholasvoces.com/wp-content/uploads/2020/05/the-4-minute-guide-to-how-biweekly-pay-works-bill-payment-calendar-by-pay-period.jpg

Paycheck Calculator Mn Hourly

https://i2.wp.com/public.tableau.com/static/images/Wh/Whata100KSalaryLooksLikeAfterTaxesinYourState_autoFit/HowMuchYouTakeHome/1_rss.png

How To Calculate Biweekly Pay Hourly After Taxes - An hourly calculator lets you enter the hours you worked and amount earned per hour and calculate your net pay paycheck amount after taxes Bi weekly is once every other week with 26 payrolls per year or 27 during a leap year like 2024 such as to calculate exact taxes payroll or other financial data Neither these calculators nor