How To Calculate Biweekly Mortgage Payments In Excel With the biweekly payment plan you will be paying about 304 367 27 which is 68 655 87 less than the monthly payments option On top of that you will pay off your mortgage almost 5 years earlier with bi weekly payments We haven t even factored in taxes and insurance PMI and other fees If we include all these fees in our calculation the

Let s take a look at the interest payment differences between monthly and biweekly payments of a home mortgage of 200 000 with a 5 45 interest rate and a 30 year term The total interest payment is 206 552 25 after 30 years of the monthly payments whereas the total interest payment is 165 807 86 for borrowers who make biweekly payments How to use a biweekly mortgage payment calculator This tool helps you decide whether it makes sense to accelerate your monthly mortgage payments On the left side of the calculator enter your

How To Calculate Biweekly Mortgage Payments In Excel

How To Calculate Biweekly Mortgage Payments In Excel

https://link.usps.com/wp-content/uploads/2021/12/Paydays_large-story.jpg

Mortgage Fees Calculator KerynSaffron

https://i.pinimg.com/736x/82/59/91/825991aefa41486fbb0d1e0a0232c682--mortgage-payment-calculator-mortgage-calculator.jpg

Next Biweekly Payday From Date Excel Formula Exceljet

https://exceljet.net/sites/default/files/styles/original_with_watermark/public/images/formulas/next biweekly payday from date.png

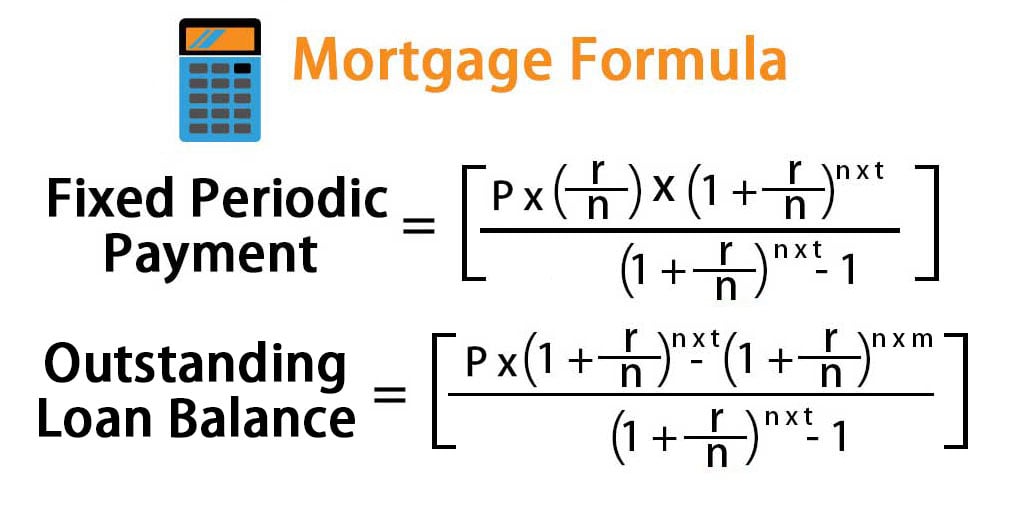

Instead of paying one monthly payment they pay half the payment twice a month How Bi Weekly Payments Work The concept of a twice monthly payment is a bit misleading Bi weekly is not the same as twice a month There are 52 weeks in the year which means that on a biweekly payment plan you would make 26 payments per year Bi Weekly Mortgage Payment Calculator Terms Definitions Bi Weekly Payments Payments that occur once every two weeks Mortgage Loan The charging of real property by a debtor to a creditor as security for a debt Principal Amount The total amount borrowed from the lender Interest The percentage rate charged for borrowing money

Biweekly mortgage calculator is a tool that helps you calculate your mortgage payments on a biweekly basis That means every two weeks The calculator is a simple version of our mortgage calculator which deals with all the questions arising when you are about to buy a house with a mortgage loan This article provides all the information you need to know about how to calculate biweekly Min down payment 3 Guaranteed Rate offers conventional loans with as little as 3 down Check Rate on Guaranteed Rate Veterans United offers VA loans for as little as 0 down If you want to

More picture related to How To Calculate Biweekly Mortgage Payments In Excel

2023 Biweekly Payroll Calendar Template For Small Businesses Hourly Inc

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/63a4b20e2be9e66ce3457fa0_WhatsApp Image 2022-12-21 at 5.08.15 PM.jpeg

Biweekly Payroll Timesheet In 2021 Timesheet Template Templates Multiple

https://i.pinimg.com/originals/e3/c7/85/e3c785dfa7a139945d4563ae1fead1e6.png

27 Zero Down Mortgage Lenders StephenAurthur

https://cdn.educba.com/academy/wp-content/uploads/2019/07/Mortgage-Formula.jpg

We designed this tool in a super simple way follow the following two steps and you will get your results immediately Original schedule Here you can set your original mortgage schedule Mortgage balance Either the remaining balance or in the case of a new loan is the original loan value Interest rate Yearly rate of interest or APR Loan term The remaining or original loan term Loan Amount Select the loan amount Loan Term Select the loan term in years Once you ve selected the items above click the Next button Step 2 Extra Principal Payments Use the slider to select the following value on page 2

This calculator shows you possible savings by using an accelerated bi weekly mortgage payment Bi weekly payments accelerate your mortgage payoff by paying 1 2 of your normal monthly payment every two weeks By the end of each year you will have paid the equivalent of 13 monthly payments instead of 12 This simple technique can shave years off Biweekly Payment Example For a 200 000 loan with 6 interest and a 30 year term here s what you will pay with the default monthly payment Monthly Payment 1 199 10 Total Interest Payment After 30 Years 231 676 38 Total Payment Principal Interest 431 676 38 With a biweekly payment the following is your payment detail

How To Calculate Loan Payments Using The PMT Function In Excel YouTube

https://i.ytimg.com/vi/ifbNN2SoKlk/maxresdefault.jpg

How To Calculate Monthly Mortgage Payment In Excel Using Function Excel Tutorials Excel

https://i.pinimg.com/originals/58/e1/2c/58e12ceccd0ce9e911b29480df411223.jpg

How To Calculate Biweekly Mortgage Payments In Excel - Biweekly mortgage calculator is a tool that helps you calculate your mortgage payments on a biweekly basis That means every two weeks The calculator is a simple version of our mortgage calculator which deals with all the questions arising when you are about to buy a house with a mortgage loan This article provides all the information you need to know about how to calculate biweekly