How To Calculate Annuity In Excel To calculate the payment for an annuity due use 1 for the type argument In the example shown the formula in C11 is PMT C6 C7 C4 C5 1 which returns 7 571 86 as the payment amount Notice the only difference in this formula is type 1 Related formulas Future value of annuity

Calculating annuity in Excel involves using a specific formula to determine the periodic payments required to pay off a loan or to grow an investment at a certain interest rate Understanding the components of the annuity formula is crucial for accurate calculations A Break down the components of the annuity formula Steps First enter the required data as shown in the image below Next double click on cell C8 and enter the following formula PV C7 C6 C5 Then press Enter As a result you will get the amount of investment needed at present for the required future annuity 2 Applying PMT Function

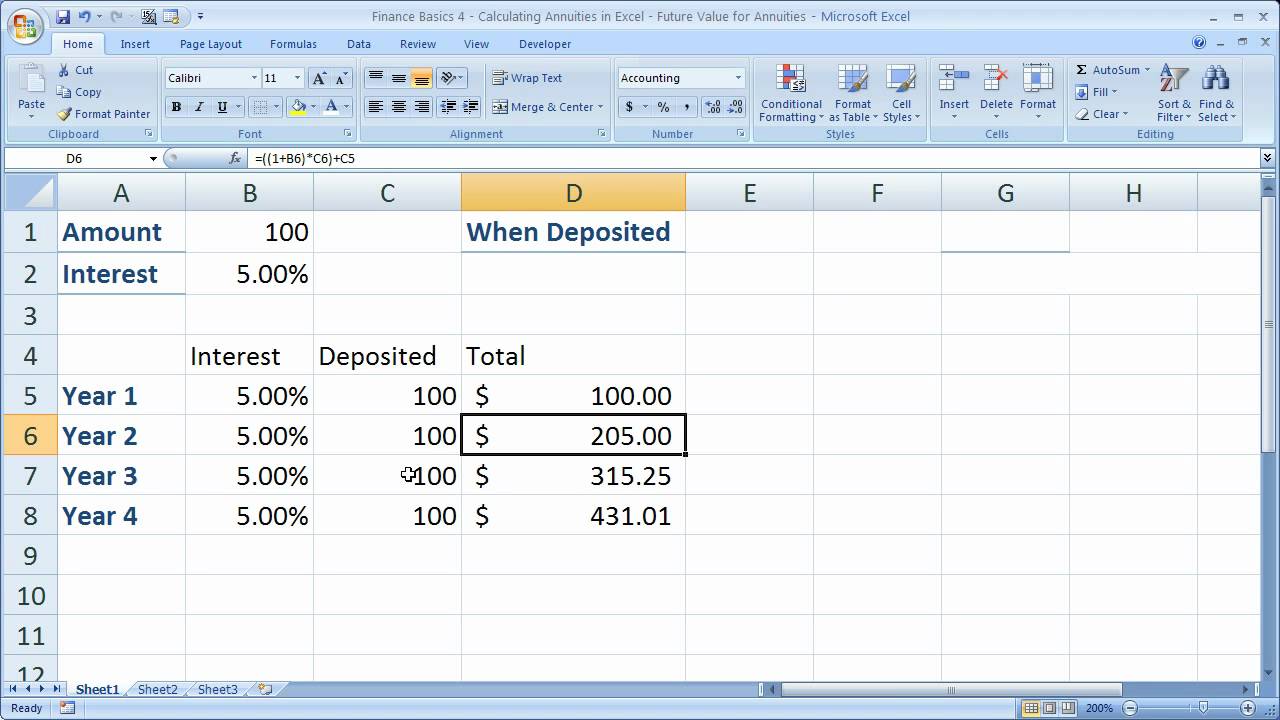

How To Calculate Annuity In Excel

How To Calculate Annuity In Excel

https://i.ytimg.com/vi/DP9wIrnfxf8/maxresdefault.jpg

How To Calculate Annuity In Excel 5 Practical Examples

https://www.exceldemy.com/wp-content/uploads/2022/08/how-to-calculate-annuity-in-excel-3-1-2048x1055.png

How To Calculate Annuity In Excel 5 Practical Examples

https://www.exceldemy.com/wp-content/uploads/2022/08/how-to-calculate-annuity-in-excel-4-1030x516.png

Calculating the present value of an annuity using Microsoft Excel is a fairly straightforward exercise as long as you know a given annuity s interest rate payment amount and duration 1 Insert the PV Present Value function 2 Enter the arguments You need a one time payment of 83 748 46 negative to pay this annuity You ll receive 240 600 positive 144 000 in the future This is another example that money grows over time Note we receive monthly payments so we use 6 12 0 5 for Rate and 20 12 240 for Nper

To get the present value of an annuity you can use the PV function In the example shown the formula in C9 is PV C5 C6 C4 0 0 Generic formula PV rate periods payment 0 0 Explanation The PV function is a financial function that returns the present value of an investment The basic formula for calculating annuity payments is PMT P r 1 r n 1 r n 1 Where PMT the annuity payment P the present value of the annuity r the interest rate per period n the number of periods B Discussing the variables involved in the formula

More picture related to How To Calculate Annuity In Excel

How To Calculate Equivalent Annual Annuity In Excel 2 Examples

https://www.exceldemy.com/wp-content/uploads/2022/08/How-to-Calculate-Equivalent-Annual-Annuity-in-Excel-6-1934x2048.png

Annuity Due Formula Example With Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/12/Annuity-Due-Formula.jpg

Annuity Formula Calculation Examples With Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/06/Annuity-Formula.jpg

Explanation An annuity is a series of equal cash flows spaced equally in time The goal in this example is to have 100 000 at the end of 10 years with an annual payment of 7 500 made at the end of each year What interest rate is required To solve for the interest rate the RATE function is configured like this in cell C9 The basic annuity formula in Excel for present value is PV RATE NPER PMT Let s break it down RATE is the discount rate or interest rate NPER is the number of periods with that discount rate and PMT is the amount of each payment

1 Using NPV Function to Calculate Present Value of Growing Annuity in Excel In our first procedure we will calculate the present value of a growing annuity To do that we will use the NPV function See the below given steps for a better understanding Step 1 Firstly we will determine the stream of payments for calculating the growing annuity Then the negative value of 1 conveys the payment factor Step 2 Now press Enter and cell C5 will show the value of the annuity factor Step 3 Here use the Fill Handle tool and drag it down from cell C5 to C15 Therefore we will get the results of other cells Step 4

How To Calculate Future Value Of Annuity In Excel Haiper

https://i.ytimg.com/vi/KTe5G7HmJl8/maxresdefault.jpg

How To Calculate Deferred Annuity In Excel 2 Quick Methods

https://www.exceldemy.com/wp-content/uploads/2022/08/How-to-Calculate-Deferred-Annuity-in-Excel-6-2048x1460.png

How To Calculate Annuity In Excel - The basic formula for calculating annuity payments is PMT P r 1 r n 1 r n 1 Where PMT the annuity payment P the present value of the annuity r the interest rate per period n the number of periods B Discussing the variables involved in the formula